Abnormal Spoilage

What is Abnormal Spoilage

Abnormal spoilage is spoilage that should not have happened – was not predicted – and not budgeted for.

How it Works

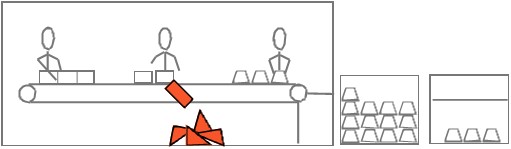

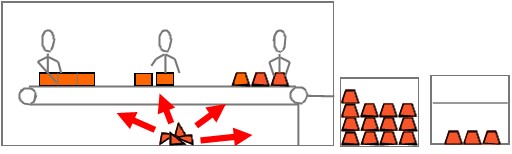

In any manufacturing production process, there is always some form of spoilage.

This may be due to machinery break down or occasional employee error.

Typically, the cost of this spoilage is built into the cost of goods sold.

In other words, the cost of spoilage is spread over all the units eventually sold.

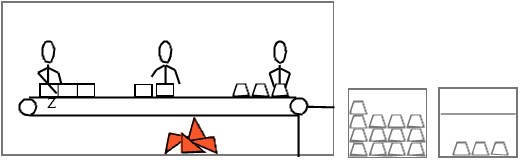

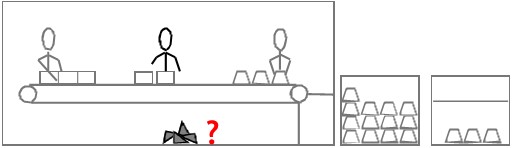

Abnormal spoilage is spoilage you don’t expect in the production process.

It results from such things such as poorly maintained machinery or repeated errors due to poorly trained staff.

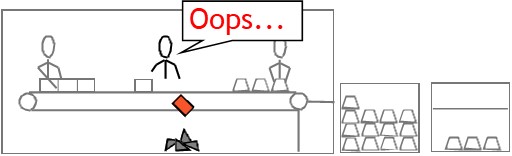

You can’t expect to recover the cost of abnormal spoilage in the eventual sale price of the goods.

So you need to write the cost down.

How to Account for Abnormal Spoilage

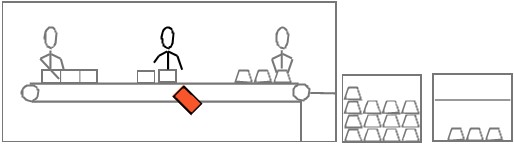

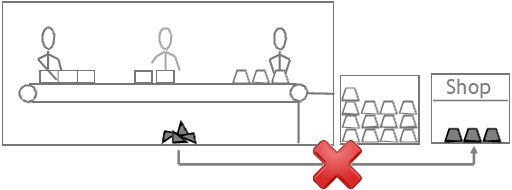

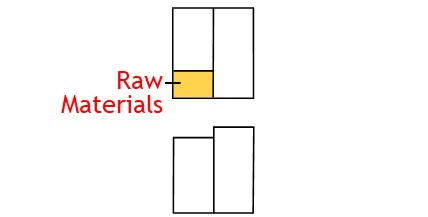

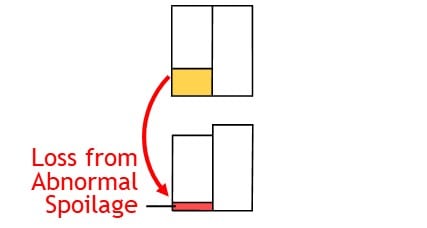

To record abnormal spoilage, you take value from the asset account.

And allocate it to an expense account known as loss from abnormal spoilage.

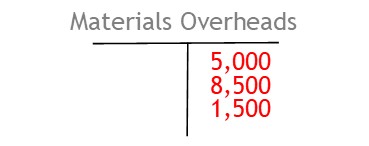

You do this via an account known as a materials overhead account

This is an account used to track costs associated with purchasing, storing, handling, and delivery of raw materials.

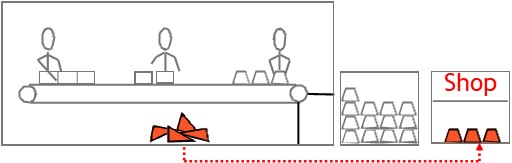

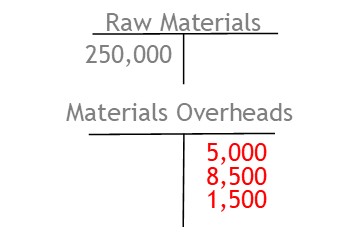

In other words, the value of raw materials will be recorded in the raw materials account.

Then, any associated costs will be shown as offsetting entries in the materials overheads account.

To record abnormal spoilage, you credit the materials overheads account.

This shows you have taken value from the raw materials account.

At the same time, you debit the loss from abnormal spoilage account.

This shows you have allocated the value to loss from abnormal spoilage.

© R.J. Hickman 2020