Accumulated Deficit

What is Accumulated Deficit?

Accumulated deficit is a negative retained earnings account balance, resulting from continual losses.

How it Works

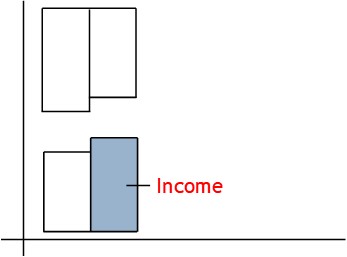

During an accounting period, a business will earn income.

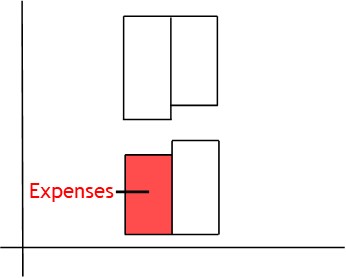

It will also incur expenses.

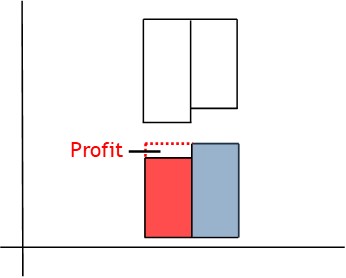

Providing income is greater than expenses, it will make a profit.

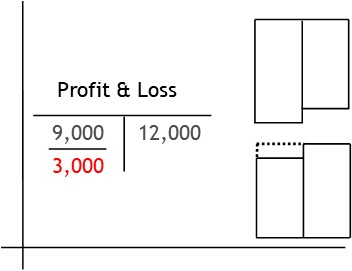

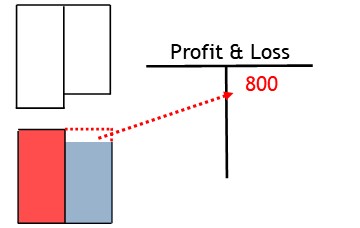

The profit is recorded in the profit and loss account.

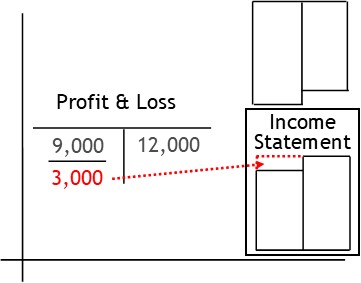

Then it is shown in your period end reports.

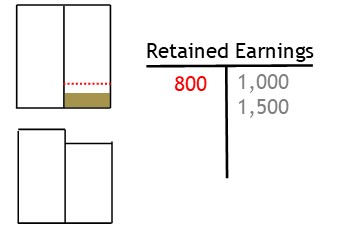

After that, it is transferred to the retained earnings account.

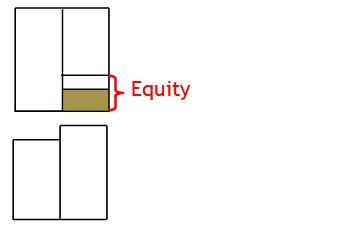

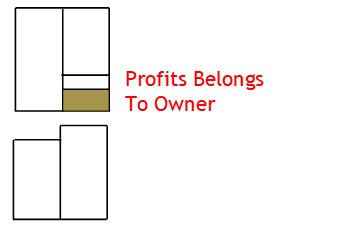

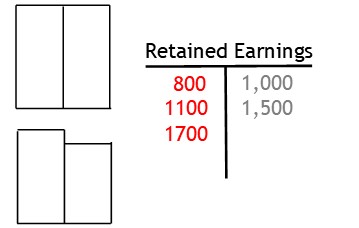

The retained earnings account is an equity account.

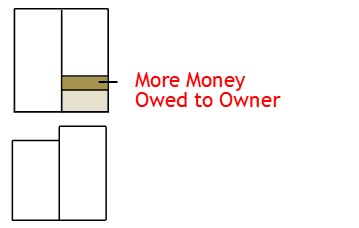

Equity accounts show how much money the business owes to the owner.

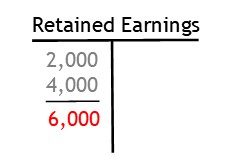

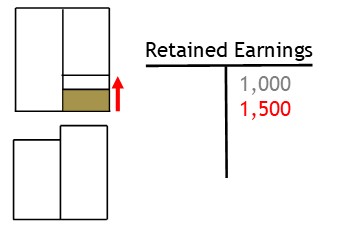

By crediting the retained earnings account, you will increase the account’s balance.

This shows the owner is owed the current profit, as well.

So long as the business continues to make profits, the retained earnings account’s balance will keep growing.

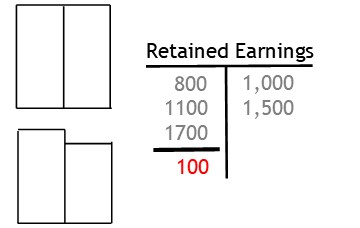

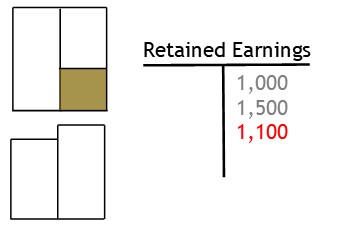

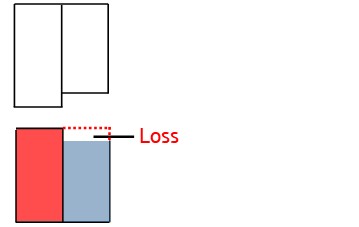

However, a business can also make a loss.

The loss will give the profit and loss account a credit balance.

This means retained earnings will be updated with a debit balance.

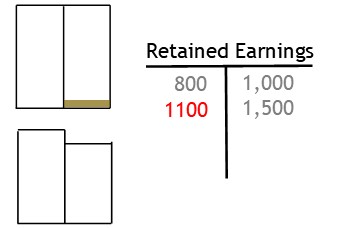

If the business continues to lose money, these losses will accumulate.

Eventually, the account will contain more losses than profits.

At this point, the account’s balance is referred to as accumulated deficit.