Accumulated Depreciation - Buildings

What is Accumulated Depreciation – Buildings?

The accumulated depreciation for a building is the sum total of a building’s depreciation, to date.

How it Works

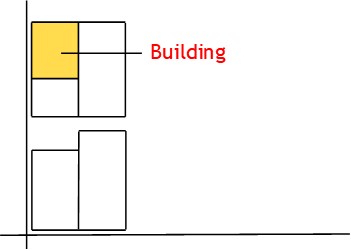

A company may own a building.

When first built, the building will have a certain value.

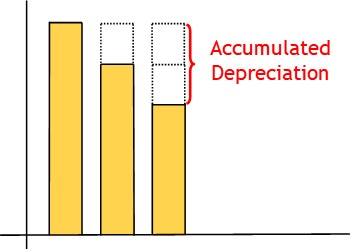

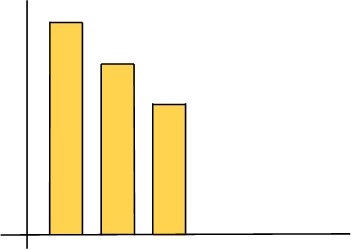

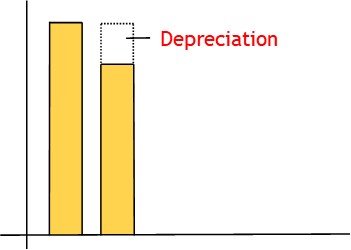

Then each year, the building loses value.

This loss of value is known as depreciation.

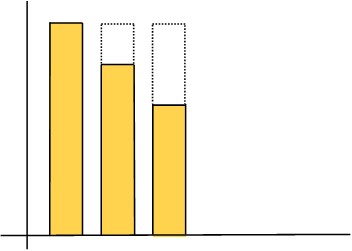

As time goes by, the building loses more and more value.

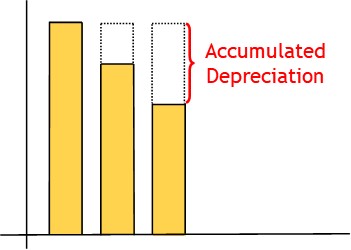

The combined loss of value is known as accumulated depreciation.

Recording Depreciation

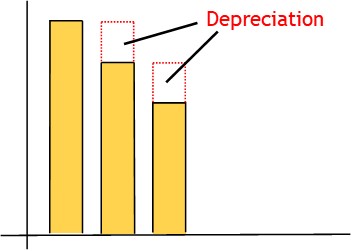

You need to calculate and track the building’s depreciation, one year to the next.

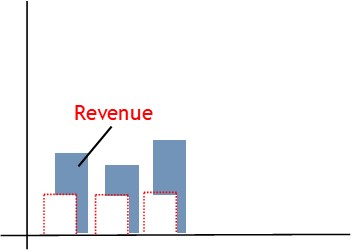

The matching principle of accounting requires that depreciation be matched to revenue in each period.

So your period-end reports need to show this depreciation.

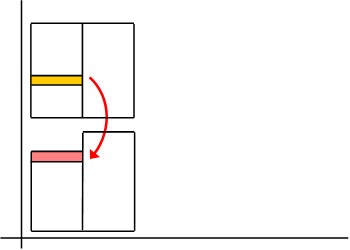

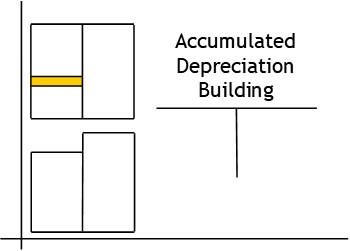

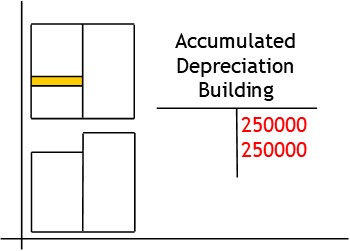

To record depreciation, you use an accumulated depreciation building account.

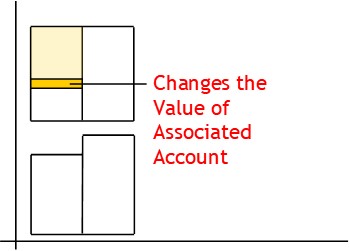

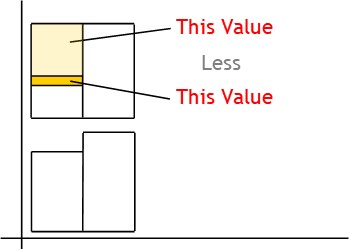

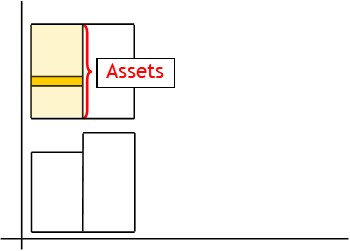

An accumulated depreciation building account is a separate account — attached to the asset account.

The account is a valuation account.

It’s balance reduces that of the building account.

At the same time, it keeps a running tally of the building’s accumulated loss of value.

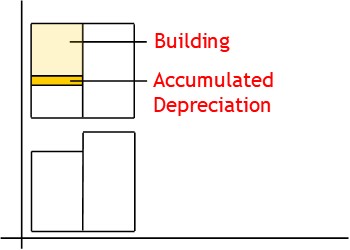

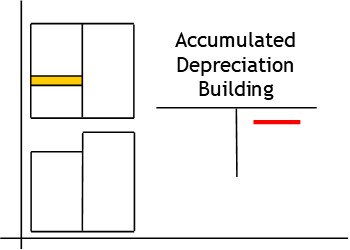

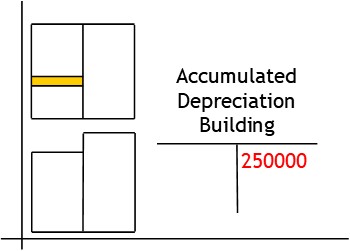

The account is also a contra asset account.

Unlike typical asset accounts, it balances on the credit side.

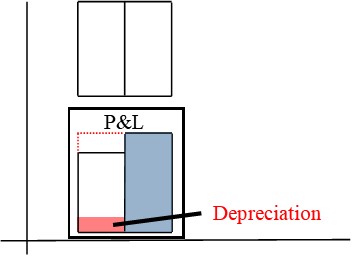

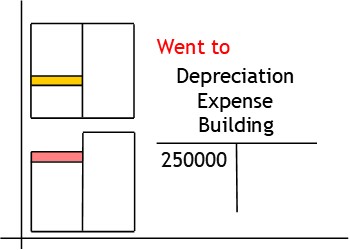

To record depreciation, you credit the accumulated depreciation building account.

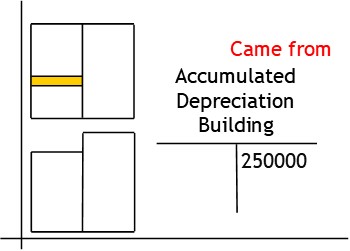

This shows you have taken value from the asset.

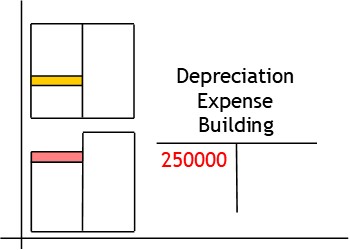

After that, you debit the depreciation expense account.

This shows the value was used as an expense.

When complete, the transaction will show that value has come from the asset and has been used as an expense.