Accounts Receivable Turnover Ratio

What is Accounts Receivable Turnover Ratio?

Accounts receivable turnover ratio is the number of times accounts receivable turnover in the period.

How it Works

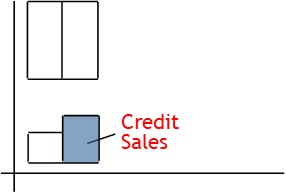

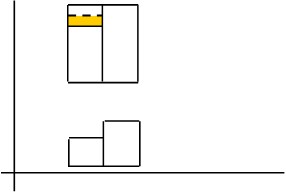

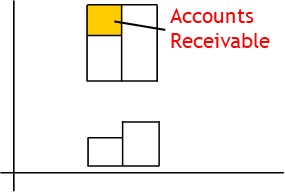

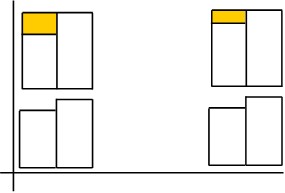

A business will sell goods on credit.

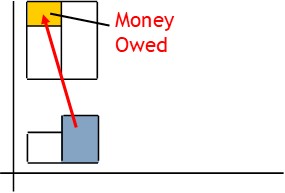

The money owed for these goods is recorded in accounts receivable (customer accounts)

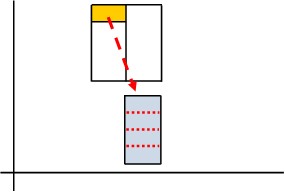

In time, customers will pay some or all of what they owe.

As they do, money will flow into the bank.

This allows the business to buy more stock, pay down debt, advertise more and so on.

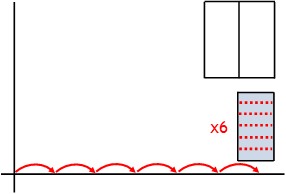

All the while, the business will make further credit sales.

More sales will increase the balance of accounts receivable.

This means even more money will eventually flow into the bank.

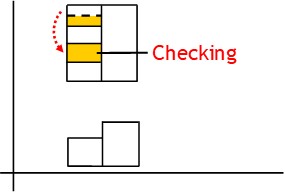

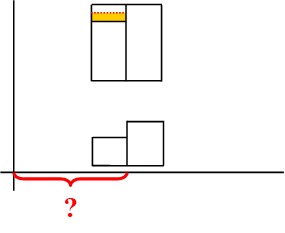

The quicker a business can get customers to pay — the quicker it will have money available.

Management and analysts need to gauge how quickly customers are paying.

To do this, they calculate accounts receivable turnover ratio.

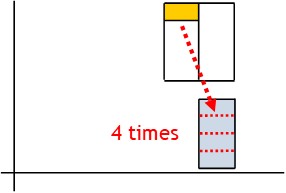

A high ratio indicates average accounts receivable is turned over many times in the year.

This means the business is operating efficiently and achieving maximum profit potential.

A low ratio, on-the-other hand, indicates inefficiencies.

Calculating Accounts Receivable Turnover Ratio.

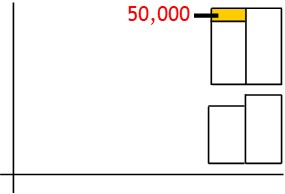

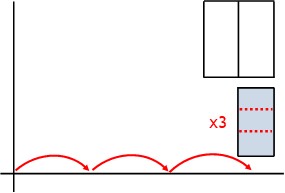

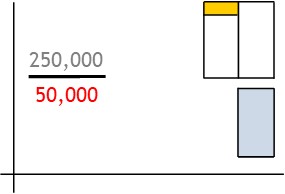

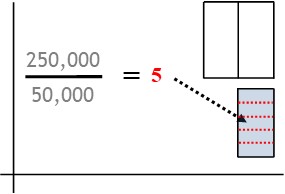

To calculate the ratio, you take net credit sales for the period.

Next, divide this by the average monthly accounts receivable balance.

This will show the number of times accounts receivable turned over.

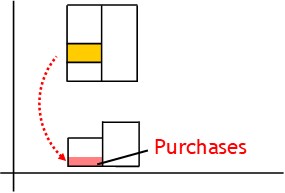

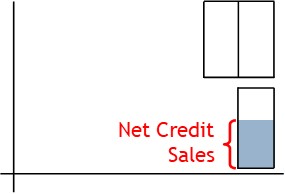

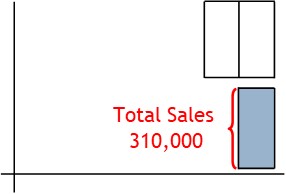

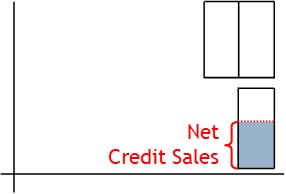

Calculating Net Credit Sales

To calculate the turnover ratio, you need to know net credit sales.

Here, you take total sales for the year.

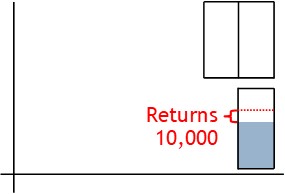

Deduct Cash Sales

Deduct any returns

The remainder equals net credit sales.

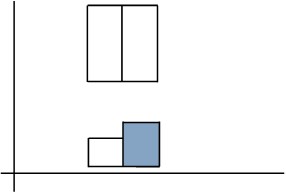

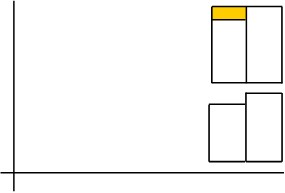

Calculating Average Monthly Accounts Receivable

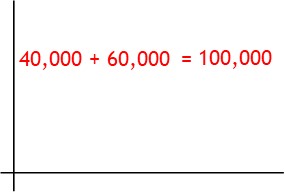

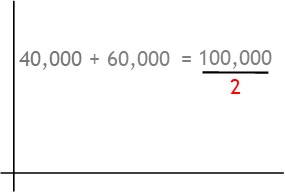

You will also need to calculate average monthly accounts receivable.

A quick way is to find a simple average between beginning accounts receivable to ending accounts receivable.

To do this, you add the two together.

Then divide the total by 2.

The result will show average monthly accounts receivable.