Accrued Rental Income

What is Accrued Rental Income?

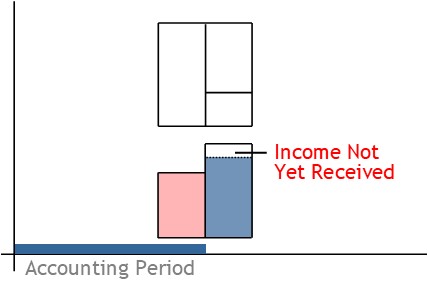

Accrued rent income is rent earned but is yet to be received by period-end.

How it Works

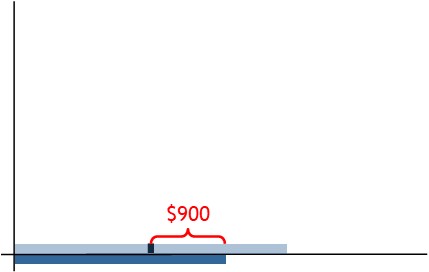

A business may earn income from rent on a weekly, fortnightly, or monthly basis.

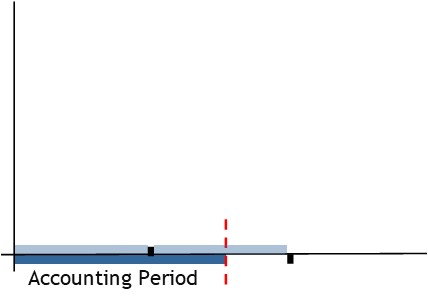

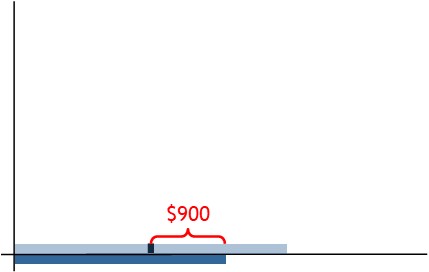

Often, though, an accounting period will end part way through a rental cycle.

When taken, the vacation pay is treated as an expense.

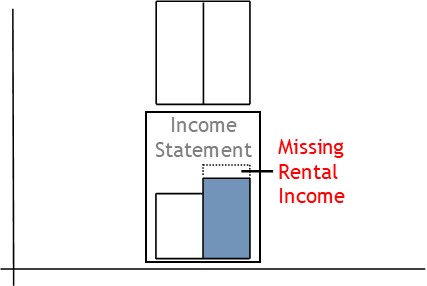

Because of this, your period-end reports will be missing income.

This can be done each pay period, each month, or each quarter.

To accrue vacation pay, you credit the accrued vacation account.

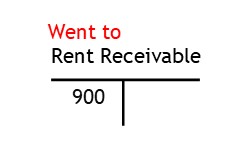

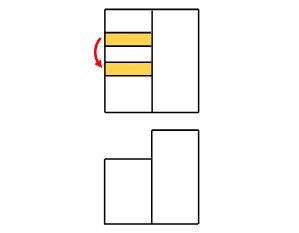

To do this, you begin by calculating the amount of rent not yet received.

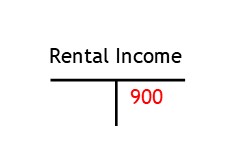

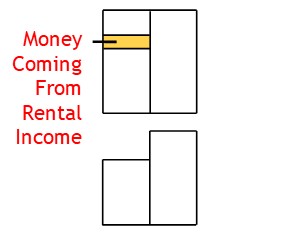

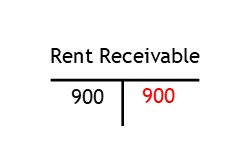

Once calculated, you credit the rental income account.

This shows that income will come from rent.

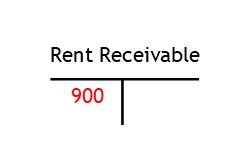

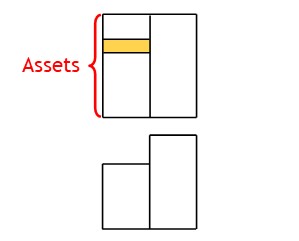

After this, you debit the rent receivable account.

This shows you have sent the value there for the time being.

Eventually, the employee will take their vacation.

Like other asset accounts, this account shows money or value that is owed to the business.

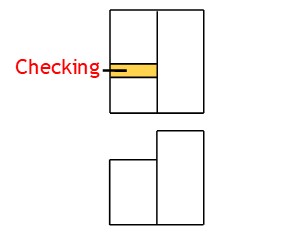

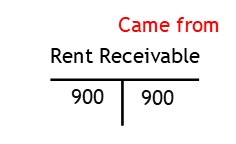

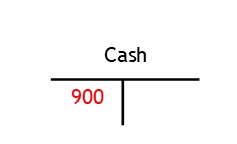

Later, when the rental income is received, the money will be deposited in the bank.

At that time, you will need to show value has come from rent receivable and gone to checking.

To do this, you credit the rent receivable account.

This shows you have taken value from the account.

Then you debit the checking account.

This shows you have sent the value to the checking account.