Accelerated Depreciation

What is Accelerated Depreciation

Accelerated depreciation is when depreciation is accelerated in the short term.

How it Works

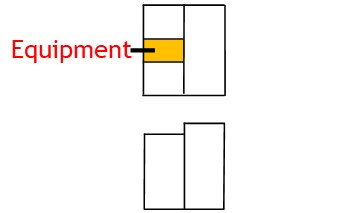

Most businesses own long term assets such as equipment.

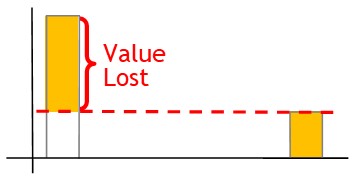

These assets will lose value over time.

This loss of value is known as depreciation.

You need to record each year’s loss of value in a depreciation expense account.

Here, you have a choice of depreciation methods.

Straight Line Method

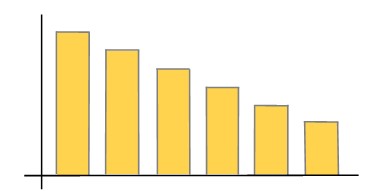

You can use the straight line method of depreciation.

With this method, you base the depreciation rate on the asset’s depreciable value.

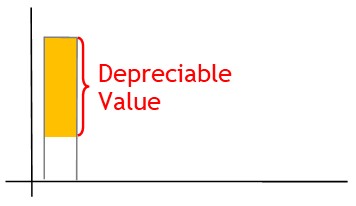

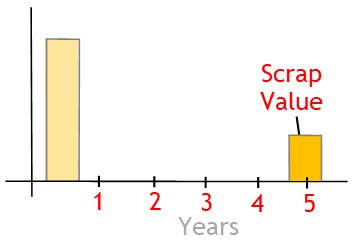

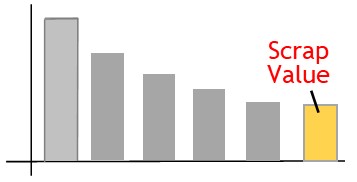

Depreciable value is the difference between the asset’s original value and its scrap or salvage value.

Scrap value is an estimate of what the asset will be worth at the end of its useful life.

The difference will show how much value the asset will lose over its useful life.

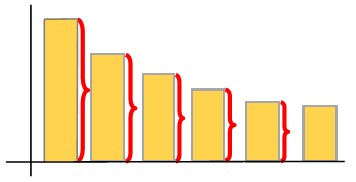

Once calculated, you apply a depreciation rate to the depreciable value.

This then becomes the depreciation amount for each year of the asset’s useful life.

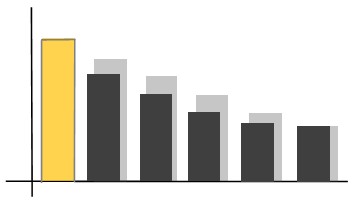

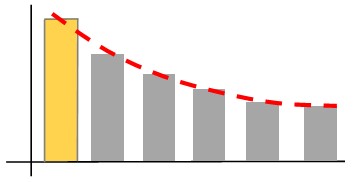

With this method, the asset depreciates by the same amount, year after year.

In other words, the asset’s value goes down in a straight line.

Accelerated Depreciation

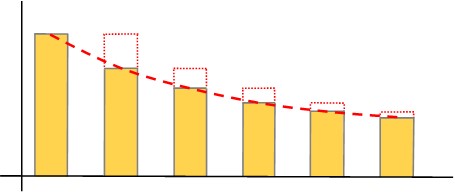

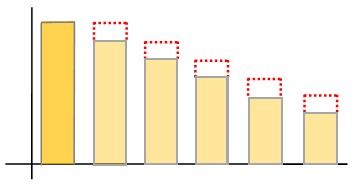

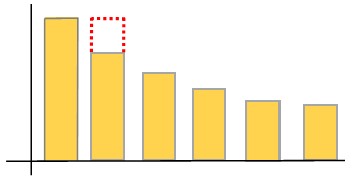

Alternatively, you can use the accelerated depreciation method.

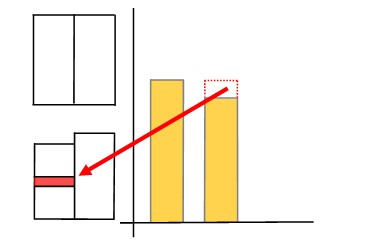

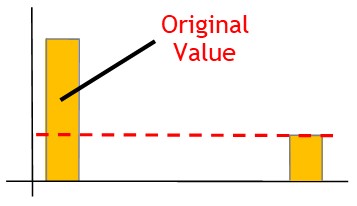

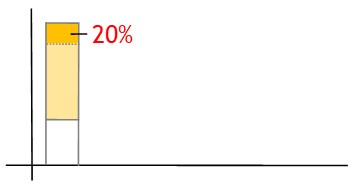

With this method, you take the asset’s full, current book value.

Then you apply a percentage rate to that value.

This will provide the depreciation rate for the first year.

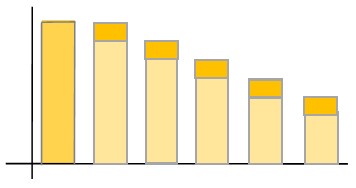

The following year, you take the asset’s reduced book value.

Then you apply the same depreciation rate again.

This will now provide the depreciation rate for that year, as well.

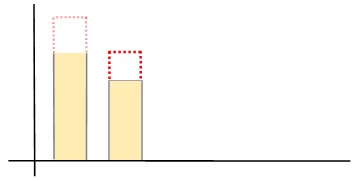

You continue depreciating the asset in this manner until you reduce it to its scrap value.

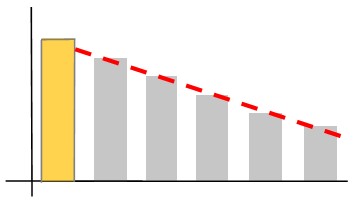

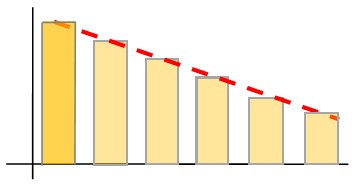

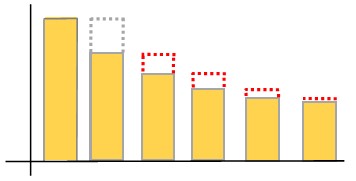

With the accelerated depreciation method, you apply depreciation to an ever decreasing book value.

Because of this, the depreciation rate starts off high.

Then it becomes progressively lower over time.

Regardless of the method used, the asset’s value decreases at the same amount in total, over time.

© R.J. Hickman 2020