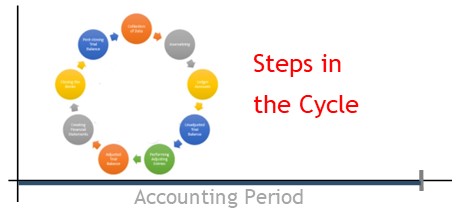

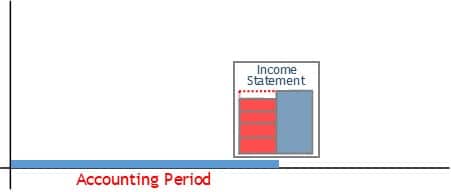

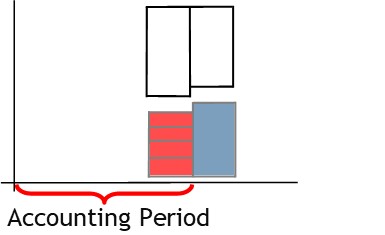

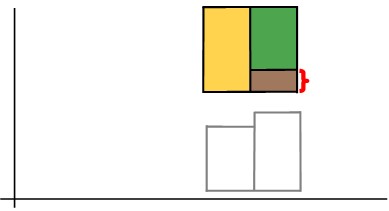

What is the Accounting Cycle?

The accounting cycle is a process that moves from collecting data to summarizing that data in reports—over the course of an accounting period.

How it Works

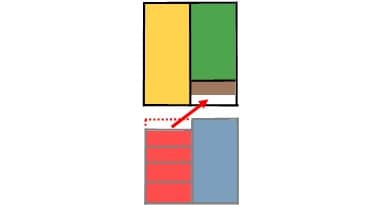

1 Collect, Analyse and Classify Data

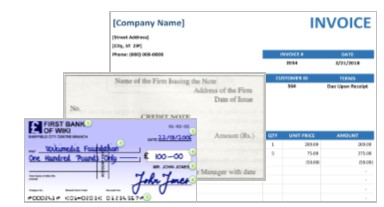

Each day, a business collects many source documents.

These documents include things like invoices, checks, credit notes etc.

Most of them will be for regular day-to-day type transactions, requiring routine processing.

Some, though, will require different processing.

Somebody has to sort through the source documents and classify them.

Regular accounts staff will be able to process most of them.

Others, however, will need to be processed by senior staff or the accountant.

2 Journalize the Transactions

In the days of manual accounting systems, accounts staff recorded the source document information in journals.

Some of these journals were for cash transactions.

Others were for credit transactions.

Still others were for non day-to-day transactions.

These journals were updated each day over the course of the month.

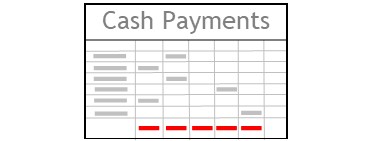

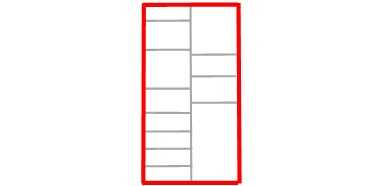

3 Posting from Journals to General Ledger

At month-end, accounts staff would total each journal column.

After this, they would take the total of each journal column.

Then they would post this total to an account.

A business will have many accounts, known collectively as the general ledger.

Once updated, they provide a summary of the journal information.

4 Preparing the Unadjusted Trial Balance.

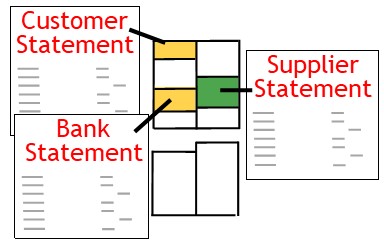

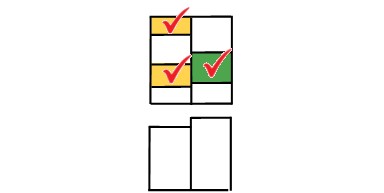

To make sure the accounts were correct, accounts staff checked three control accounts.

They did this by comparing the control accounts to the records of other businesses.

If the records agree, it shows the control accounts are correct.

Theoretically, if the control account is correct, all the other account should be correct, as well.

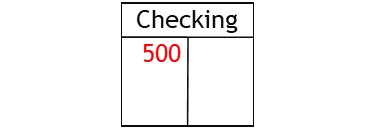

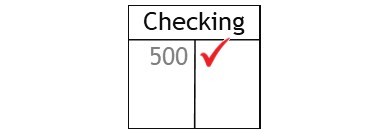

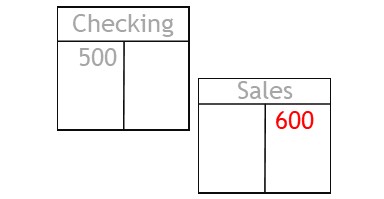

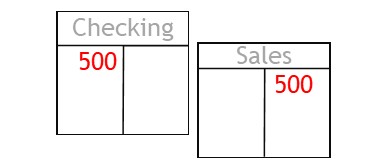

The reason for this is, with the double entry system, you record each transaction with a double entry.

Furthermore, one side of every transaction will appear in a control account.

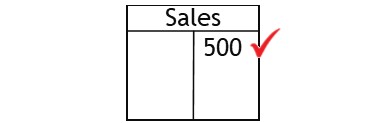

So when you record takings from sales, for example, you show money came from sales.

At the same time, you record a duplicate of that transaction in the control account.

This way, you can check the transaction in the control account.

If correct, it should be correct in the other account, as well.

The problem was, with a manual accounting system, it was very easy to make a mistake while recording the other side of a transaction.

So the control account may have proved correct.

But this was no guarantee the records were fully correct.

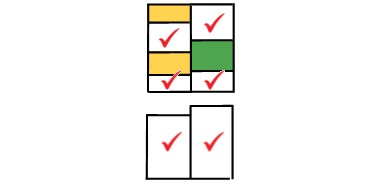

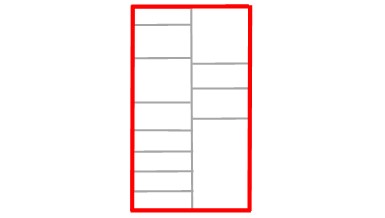

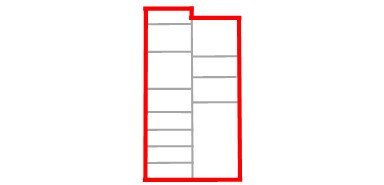

To check for errors like this, accounts staff prepared a trial balance.

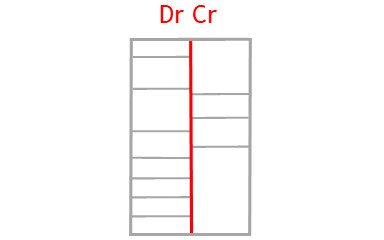

A trial balance is a list of all account balances in the general ledger.

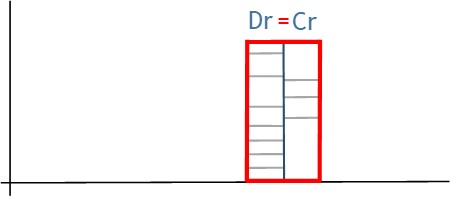

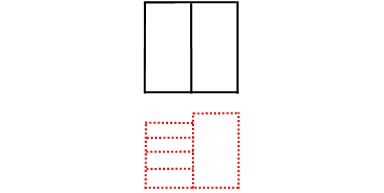

The list is divided into two sides: a credit side and a debit side.

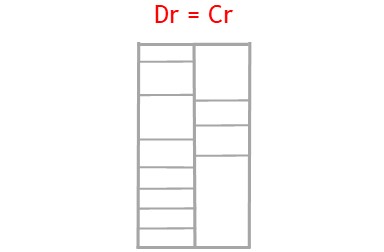

For every credit there should be a corresponding debit.

So total debits should equal total credits.

This being the case, the trial balance would balance.

If there was an error, however, the trial balance wouldn’t balance.

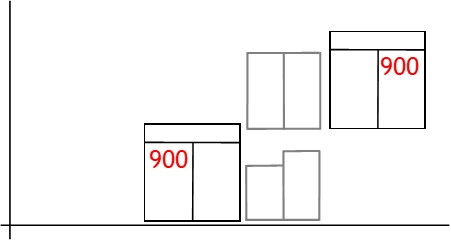

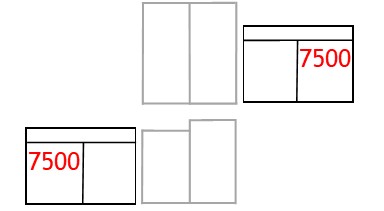

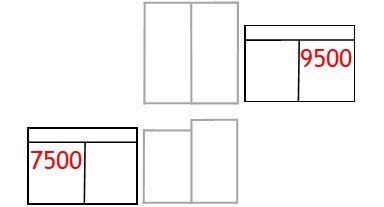

5 Recording Adjusting Entries

At period-end, accounts staff need to prepare financial reports.

Before doing so, though, they may need to make some adjustments.

They do this for reporting accuracy.

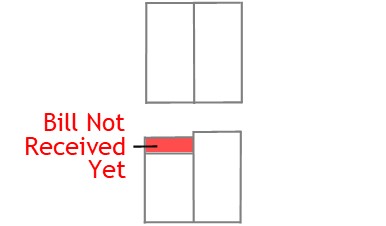

For example, during the period, the business may have incurred telephone expense.

However, the business may be yet to receive the bill for this expense.

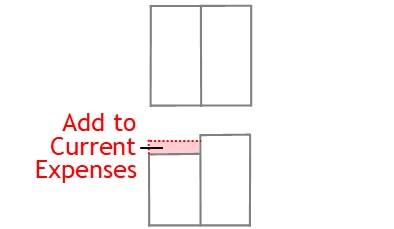

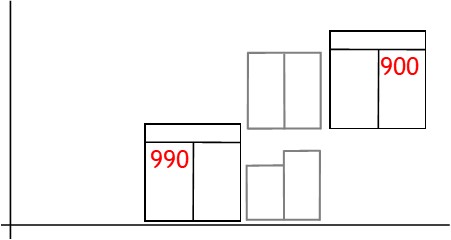

For the current period’s profit to be accurate, you need to make an adjustment.

6 Preparing the Adjusted Trial Balance

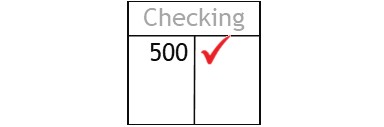

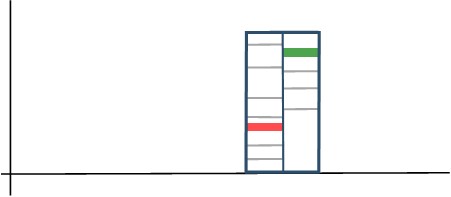

To make a period-end adjustment, you use a double entry.

When doing this, it’s possible to make an error.

To check for errors, accounts staff prepare an adjusted trial balance.

An adjusted trial balance includes the adjustments along with all other account balances.

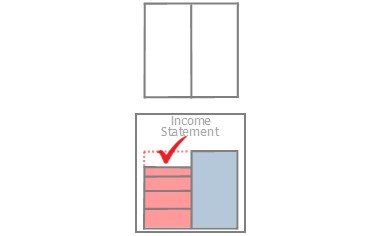

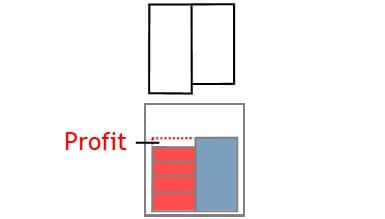

7 Preparing Financial Statements

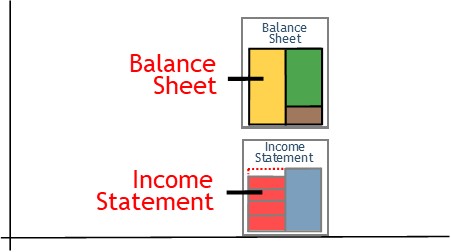

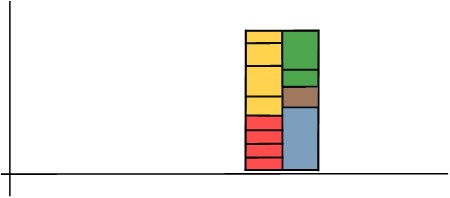

At period-end, accounts staff prepare financial statements.

These reports summarize the information contained in the accounts.

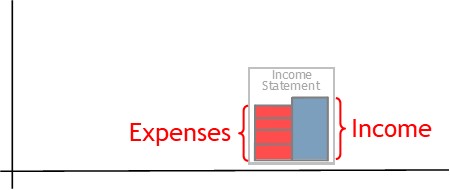

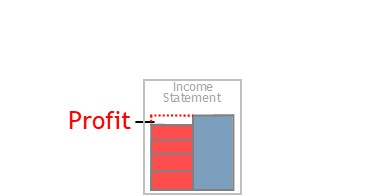

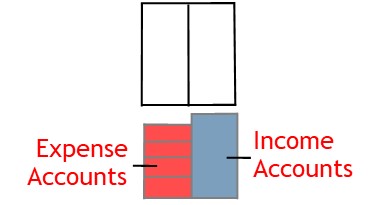

The income statement shows how the business performed during the period.

It does this by setting out income earned and expenses incurred.

The difference shows the period’s profit or loss.

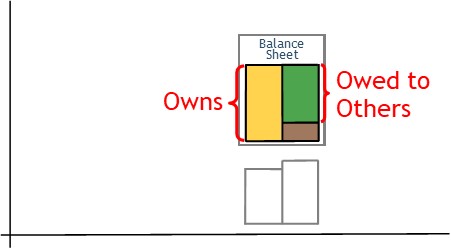

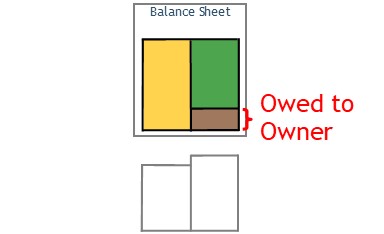

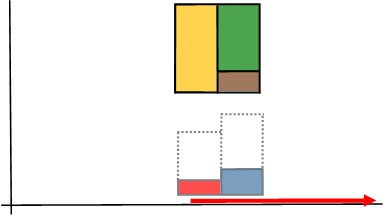

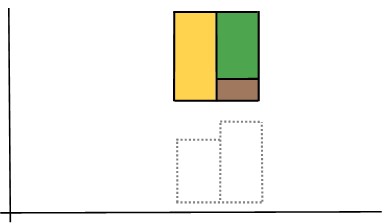

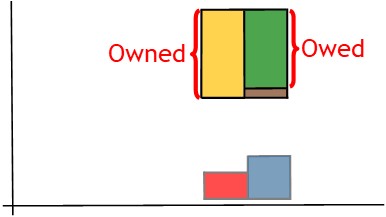

The balance sheet keeps a running tally of what the business owns verses what it owes to others.

The difference shows what the business owes to the owner or shareholders.

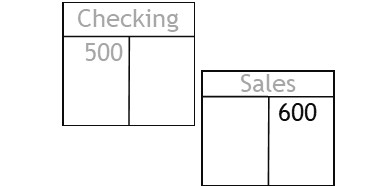

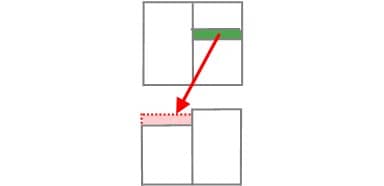

8 Recording Closing Entries

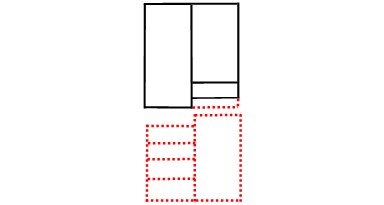

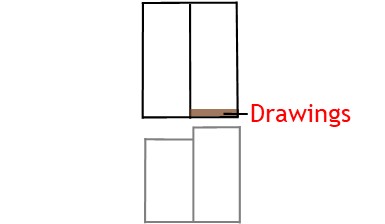

Next, the temporary accounts need to be closed out.

Income and expense accounts are temporary accounts.

So, too, is the owner’s drawings account.

Temporary accounts are used to collect data for the current accounting period, only.

For example, income and expense accounts are only used to determine net profit for the current period.

Once determined, their job is done.

After this, the data they contain is transferred to the permanent accounts.

In the process, they are closed out.

This leaves them empty, ready to start over with next period’s data.

In contrast, the permanent accounts are never closed out.

Their role is to keep a running tally of what is owned verses what is owed.

The greater that difference, the better off the owners are.

9 Preparing a Closing Trial Balance

When making closing entries, you transfer data from one account to another.

In the days of manual accounting systems, you did this via the accounts.

When doing this manually, it was easy to make a mistake.

To check for errors, accounts staff would prepare a closing trial balance.

The closing trial balance contains permanent accounts, only.

This is because the temporary accounts are now closed out.

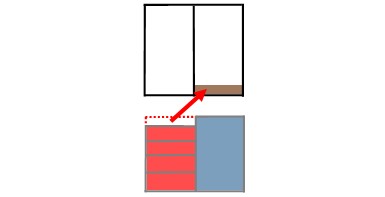

10 Recording Reversing Entries

Typically, adjustments are made to the accounts earlier on in the cycle.

After preparing the reports, these need to be reversed.

Otherwise, the accounts for the following period will be incorrect.