Accounts Written Off

What are Accounts Written Off?

Accounts written off are customer accounts that are deemed uncollectible and their balance is allocated to bad debts expense.

How it Works

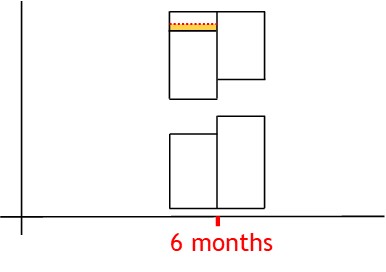

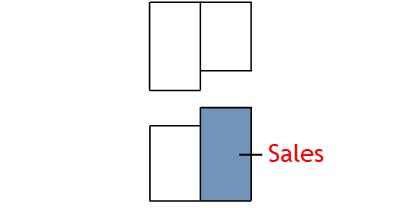

A business may make sales on credit.

The money owed for these sales is recorded in the customer accounts.

In time, most customers will pay for the goods.

Some won’t, though.

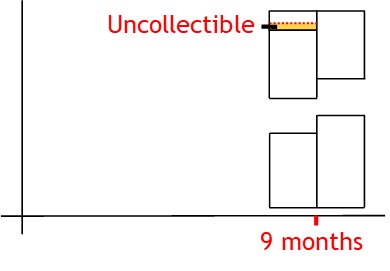

Eventually, these debts will be deemed uncollectible.

Bad debts are inevitable and a business must adopt some system of dealing with them.

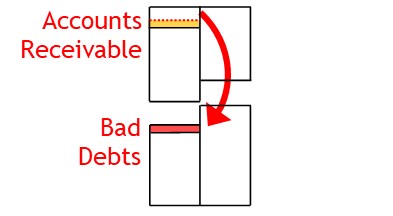

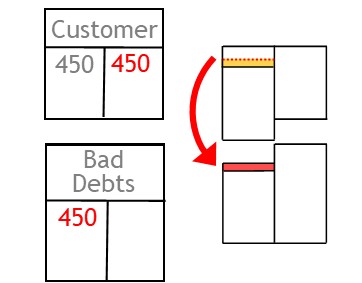

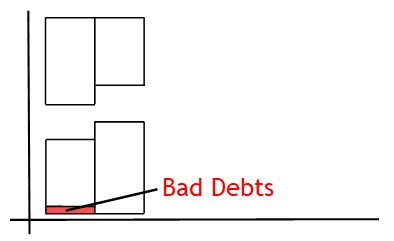

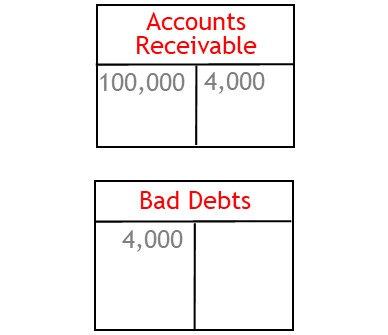

Write off Directly to Bad Debts

One way to write off a bad debt is to wait for the customer to default.

Then write off the bad debt directly to the expense

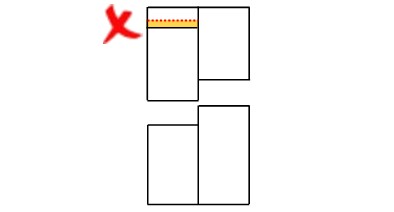

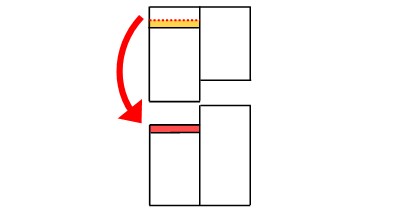

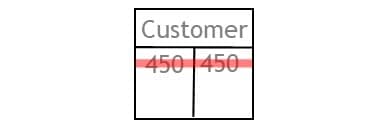

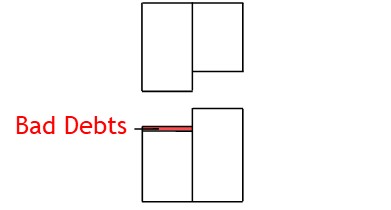

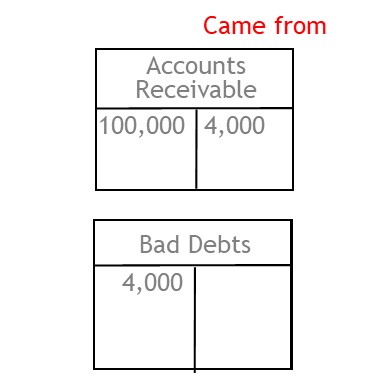

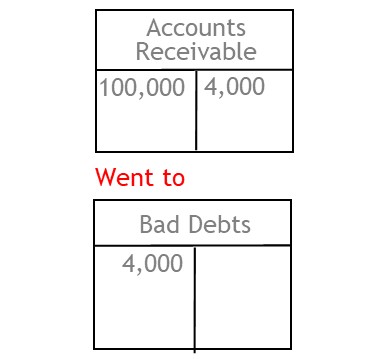

To write off an account, you need to offset the existing balance.

A customer account will have a debit balance.

This is because goods or services went to the customer in the first place.

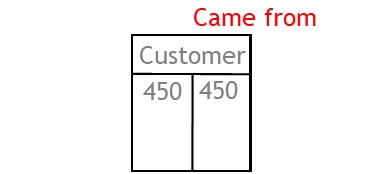

So to write off the customer account, you credit it.

This shows you have taken value from the account.

In the process, the entry offsets the account, effectively closing it.

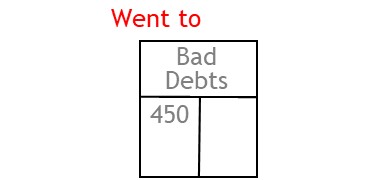

After this, you debit the bad debts expense account.

This shows the value was used as an expense.

When complete, the transaction will show you have taken value from the customer’s account and allocated it to bed debts expense

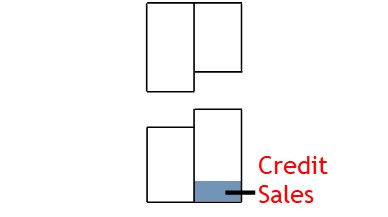

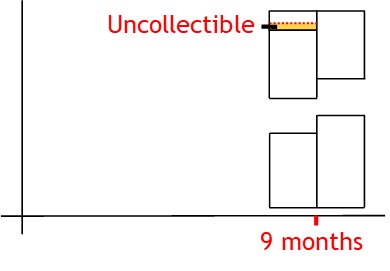

Write it Off Via Doubtful Debts

The other way is to write off bad debts when sales are made.

Here, you assume that some of the sales will become bad debts.

Then you record this amount as an allowance for doubtful debts.

At the same time, you write the amount off as bad debts.

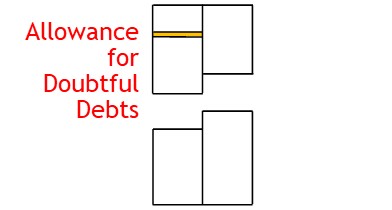

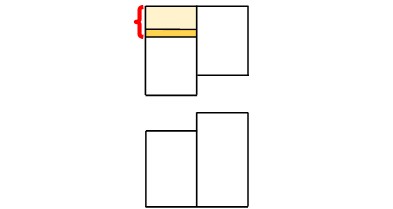

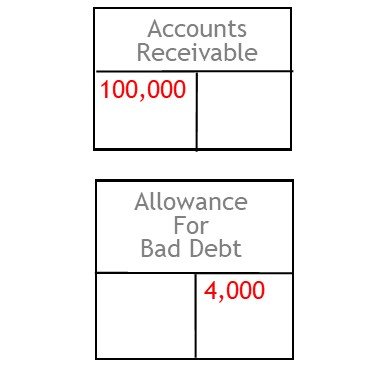

The allowance for doubtful debts account is a separate account attached to accounts receivable.

It is classified as a valuation account.

This is because it reduces the value of accounts receivable.

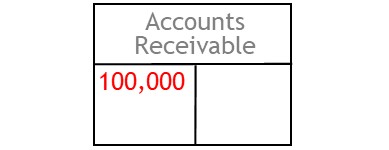

Accounts receivable has a debit balance.

It shows how much money customers owe the business in total.

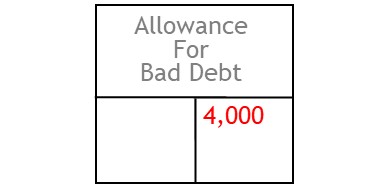

Allowance for bad debts has a credit balance.

It offsets accounts receivable balance.

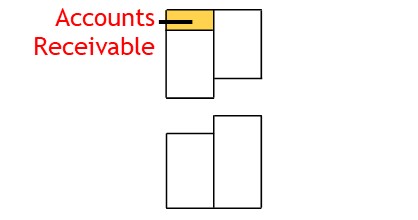

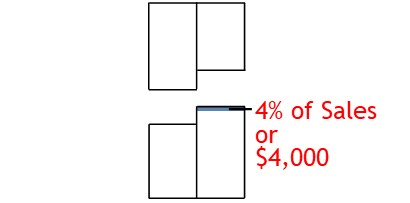

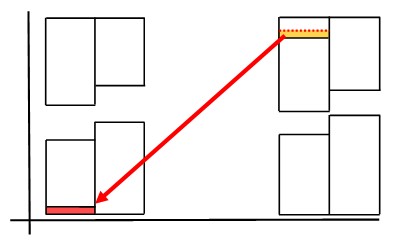

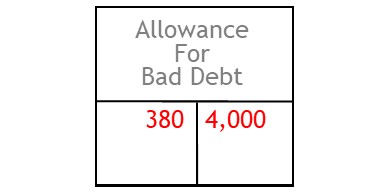

Recording Allowance for Bad Debts

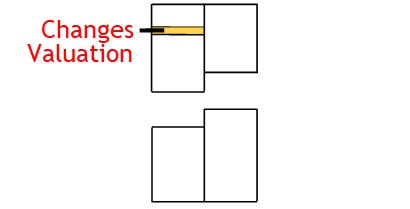

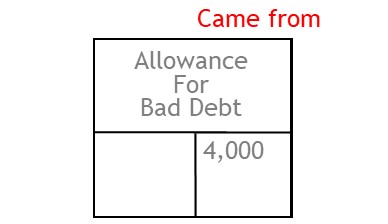

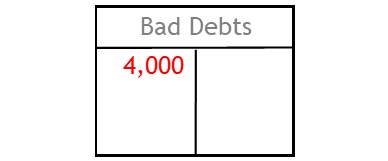

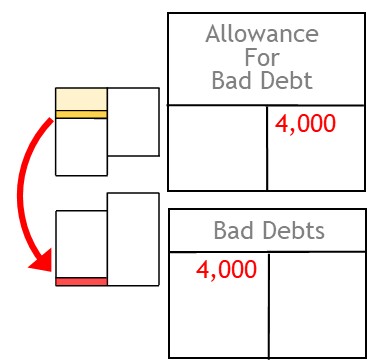

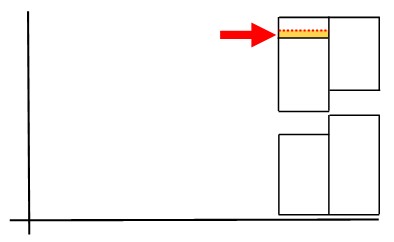

To make a provision for bad debts, you credit the allowance for bad debts account.

This shows you are taking value from accounts receivable.

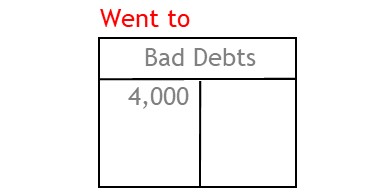

Then you debit the bad debts expense account.

This shows you have allocated the written off value to bad debts.

When complete, the transaction will show you have taken value from accounts receivable and allocated it to bad debts.

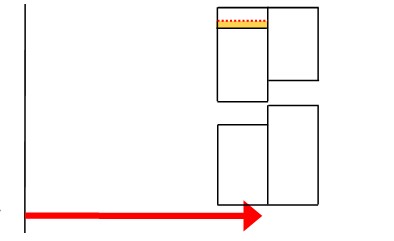

By doing this, you write off the bad debts in advance, at the time the sales are made.

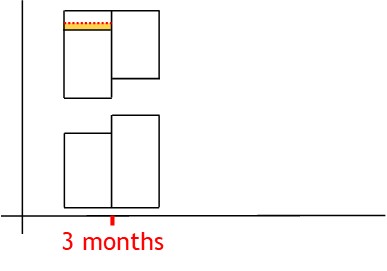

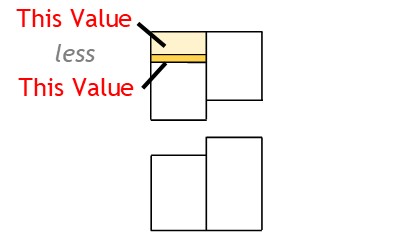

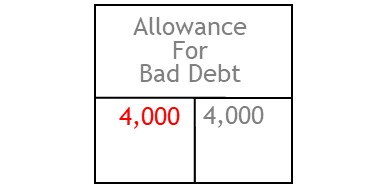

Later on, customers will actually default.

You have already written off the bad debts in advance—when the sales were initially made.

Now, though, you need to update the defaulting customer’s account.

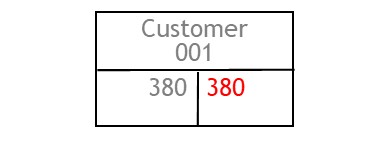

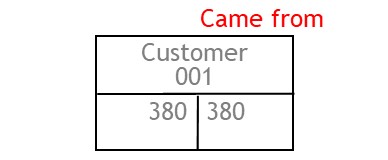

To do so, you credit the customer’s account.

This shows you have taken value from it.

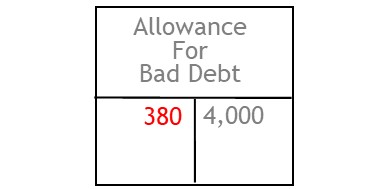

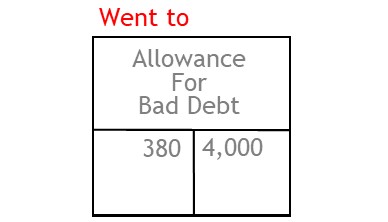

At the same time, you debit the allowance for doubtful debts account.

This shows you have offset a portion of the provision made for bad debts.

By doing this, you will reduce the allowance for bad debts account’s balance.

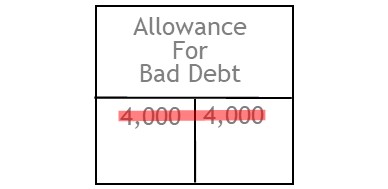

Eventually, this account will contain all bad debts actually written off.

This will bring the account’s balance to zero, effectively closing it.

By offsetting the allowance account, you leave just the other two accounts.

One account will show that value came from accounts receivable.

The other account will show that the value was allocated as bad debts expense.

© R.J. Hickman 2020