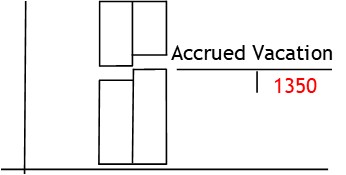

Accrued Vacation

What is Accrued Vacation?

Accrued vacation is vacation pay owed to an employee but is yet to be taken.

How it Works

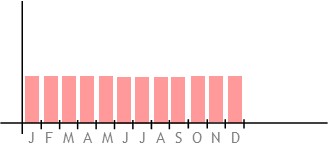

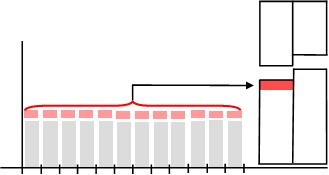

A business will pay its employees wages throughout the year.

On top of this, the business will set aside funds to cover employee vacation pay.

When taken, the vacation pay is treated as an expense.

Until then, though, the vacation pay needs to be accrued.

This can be done each pay period, each month, or each quarter.

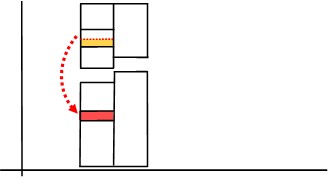

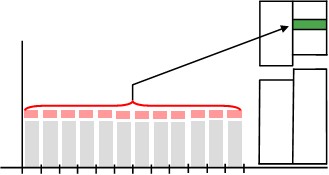

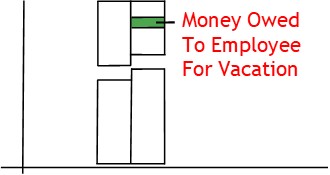

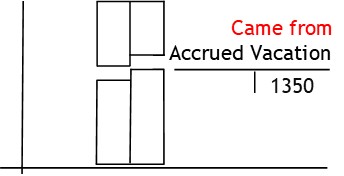

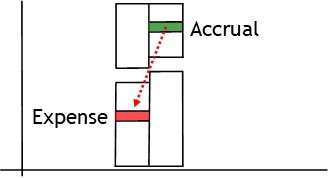

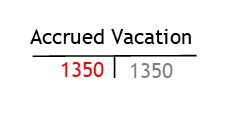

To accrue vacation pay, you credit the accrued vacation account.

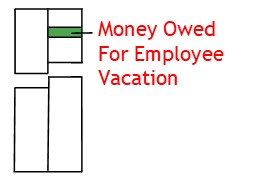

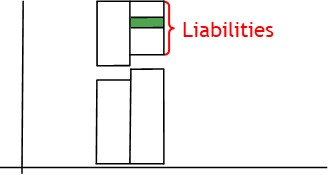

The accrued vacation account is a liability account.

Like all liability accounts, it shows money owed to others.

By crediting the account, you are taking value from the money set aside.

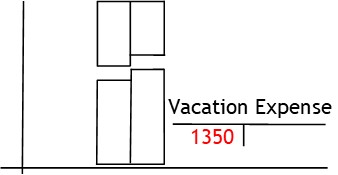

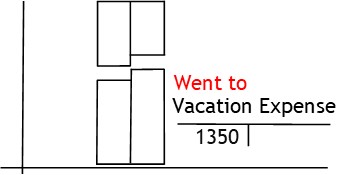

After this, you debit the vacation expense account.

This shows where the value will be used.

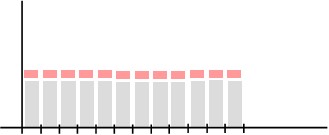

Eventually, the employee will take their vacation.

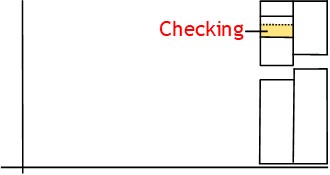

When this happens, you take money from checking account.

Then you give it to the employee.

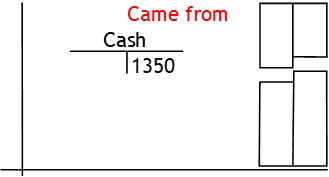

Ordinarily, when the business pays for an expense, you show money came from checking.

Then you show where it was used.

In this case, though, you already recorded the expense, earlier on.

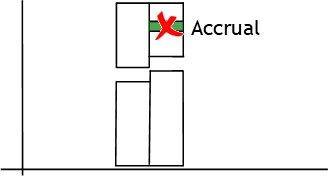

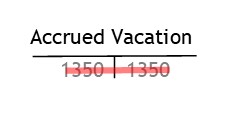

So now, you just need to offset the accrual.

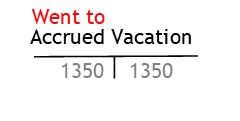

To do this, you credit the checking account.

This shows money came from the checking account.

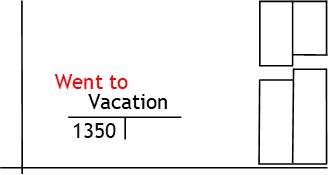

Then you debit the accrued vacation account.

This shows you have sent the value to the accrual account.

By doing this, you offset the amount that was owed.

Once updated, the accounts will show that money came from the bank and was used for vacation expense.