Accrual Basis of Accounting

What is the Accrual Basis of Accounting?

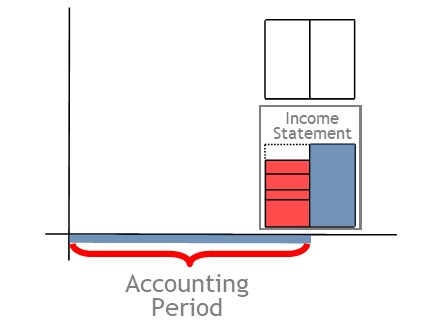

Accrual basis of accounting is a method used for taxation purposes where revenues and expenses are recognized when they are earned or incurred.

How it Works

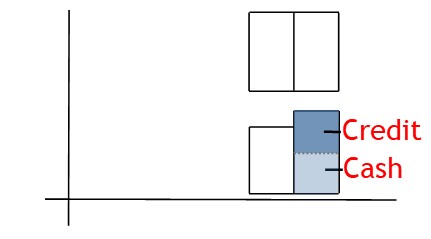

Revenue

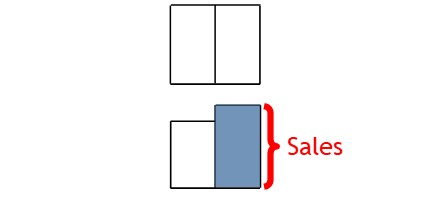

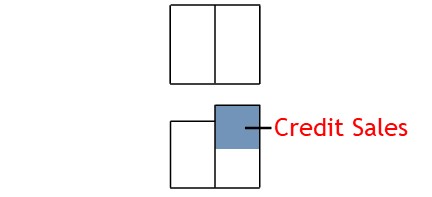

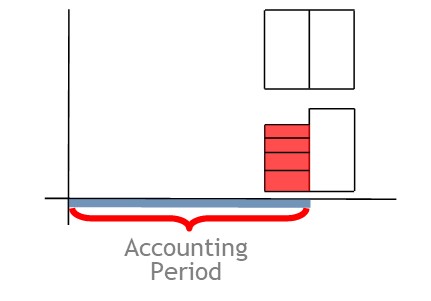

A business will make sales during an accounting period.

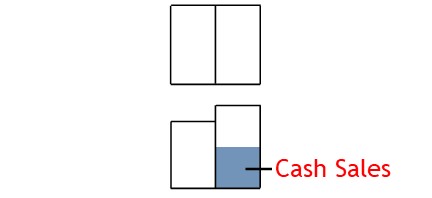

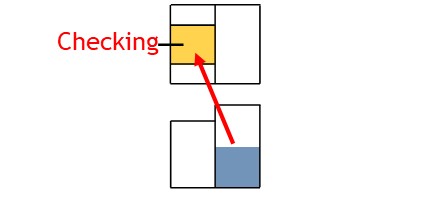

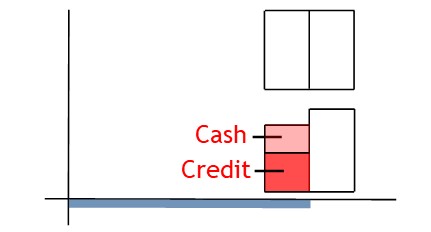

Some of these will be cash sales.

That is, the money from takings will be deposited in the bank, immediately.

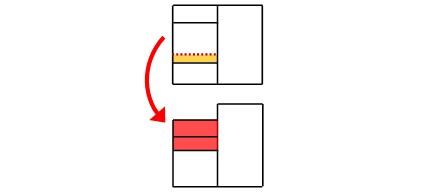

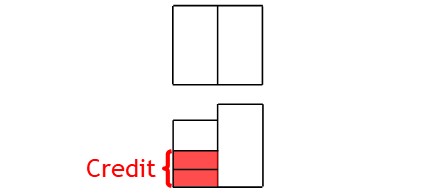

Other sales will be made on a credit basis.

With credit sales, customers are given time to pay.

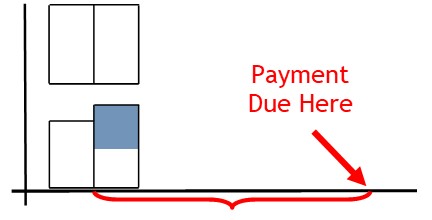

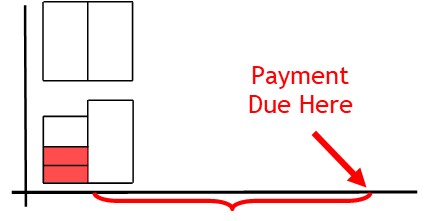

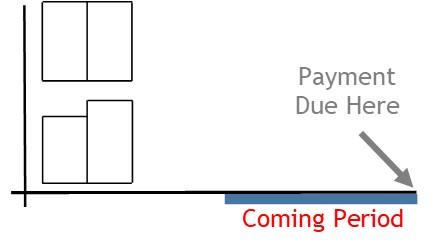

Often, this involves a sale being made in the current accounting period.

But the customer won’t pay until the following accounting period.

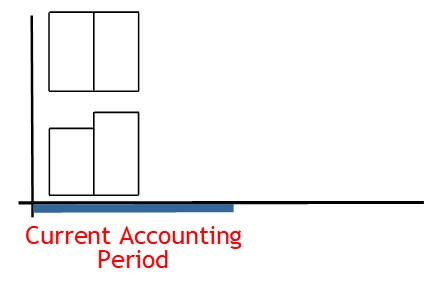

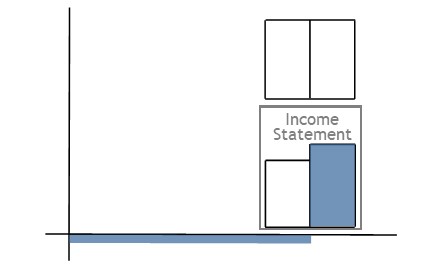

If using the accrual method of accounting, you recognize sales in the period they occur.

This is the case whether the sales are cash sales or sales made on credit.

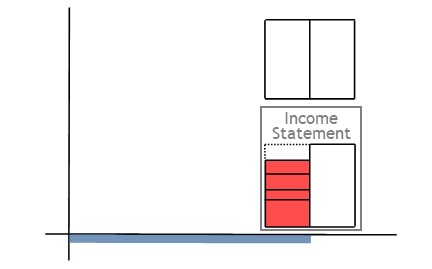

Both will appear in your period-end income statement.

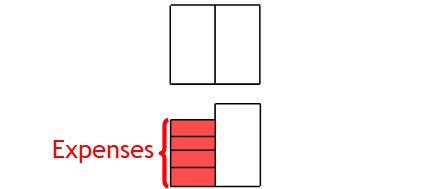

Expenses

The same thing applies to expenses.

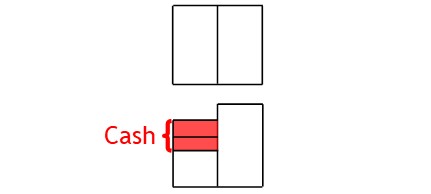

Some will be cash expenses.

That is, the business will take money out of the bank to pay for the expenses straight away.

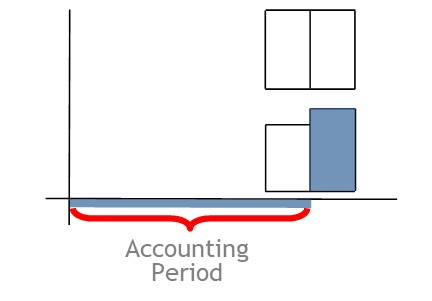

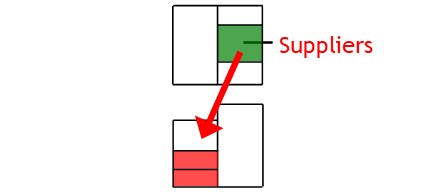

At the same time, the business will also buy other goods and services on a credit basis.

Here, the goods or services come from a supplier.

The supplier allows the business time to pay for the goods or services.

Again, the payment may not fall due until the following accounting period.

With the accrual method of accounting, all expenses are recognized in the period they are incurred.

This applies to both cash expenses and credit expenses.

Both will appear on the month-end report.

© R.J. Hickman 2020