Accrued Expenses

What are Accrued Expenses?

An accrued expense is an expense the business has incurred but is yet to be invoiced for, as at period-end.

How it Works

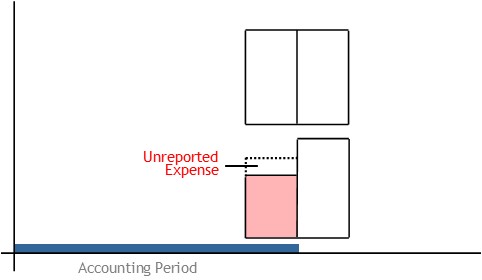

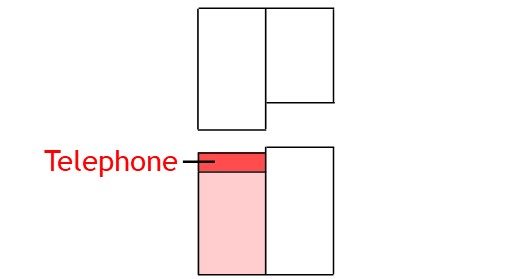

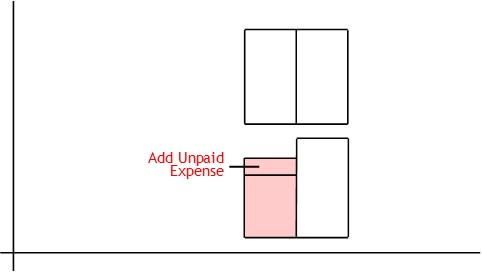

A business may incur and expense during an accounting period.

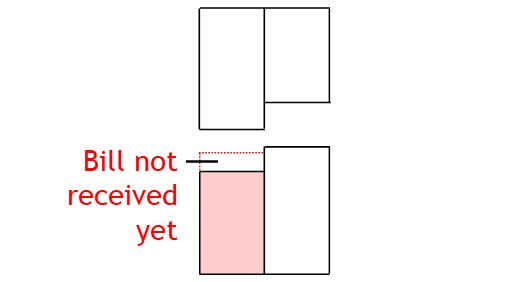

Often, though, it is yet to be invoiced by period-end.

To be accurate, your period-end reports should contain all expenses.

So, at period-end, you need to adjust your accounts.

Accounting for Accrued Expenses

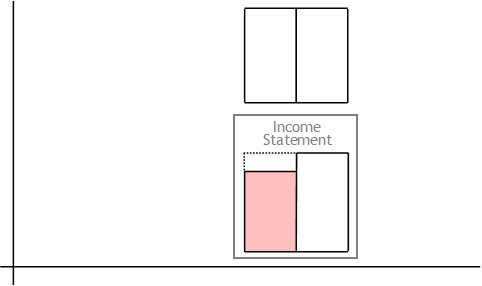

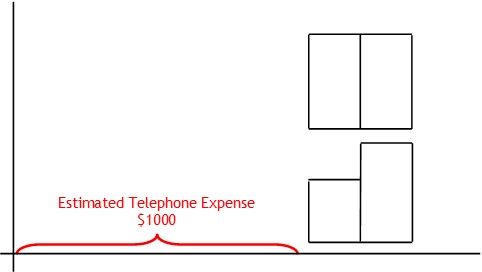

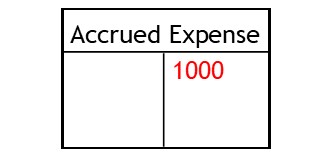

When recording an accrued expense, you begin by estimating it.

Then you record this estimate in an accrued expense account.

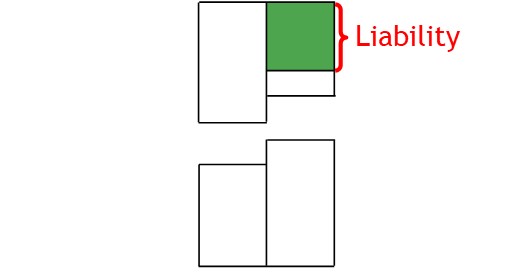

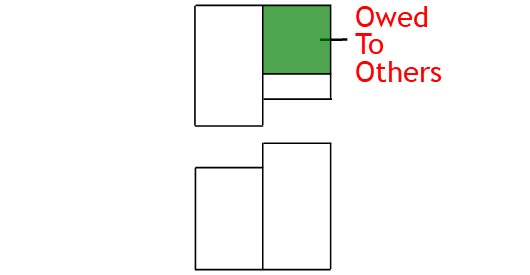

An accrued expense account is a liability account.

Like all liability accounts, it shows money the business owes to others.

After this, you record this value as an expense.

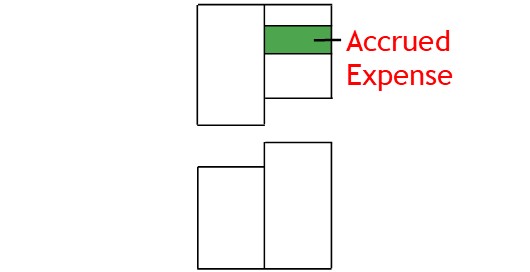

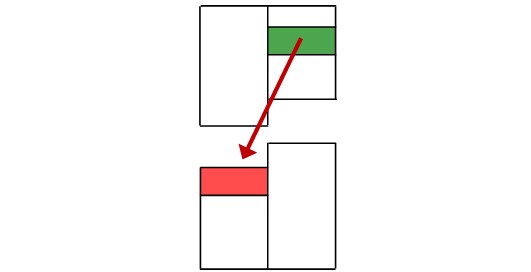

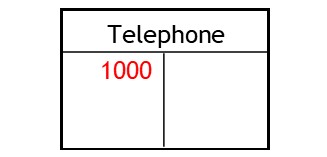

To record the accrual, you credit the accrual account.

This shows value came from accruals.

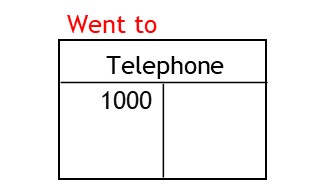

Then you debit the relevant expense account.

This shows the value will be used as an expense.

© R.J. Hickman 2020