Accrued Income

What is Accrued Income?

Accrued income is income the business has earned but is yet to receive, as at period-end.

How it Works

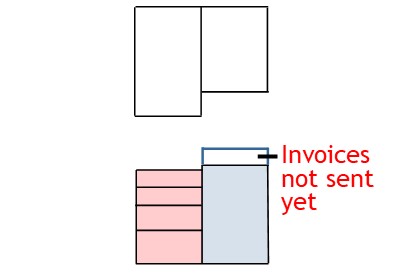

The business may have done work for clients during the period.

Income from this work should be shown in the period-end reports.

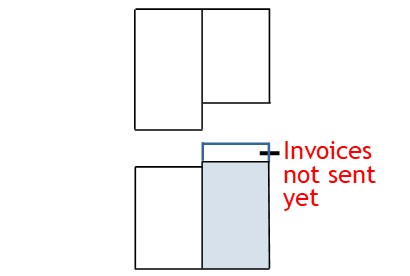

But as at period–end, the business may not yet have invoiced their clients for some of the work done.

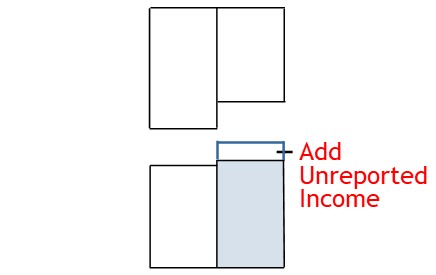

For the period-end report to be correct, you need to add the unreported income.

When doing this, you will use an accrued income account.

How to Account for Accrued Income

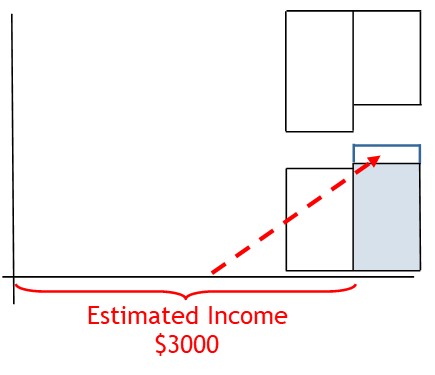

To record accrued income, you begin by estimating it.

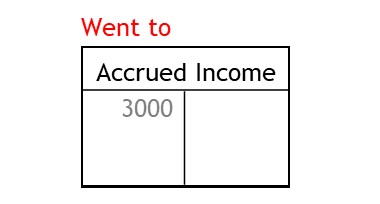

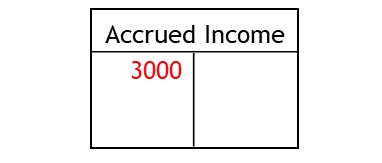

Then you record this estimate in an accrued income account.

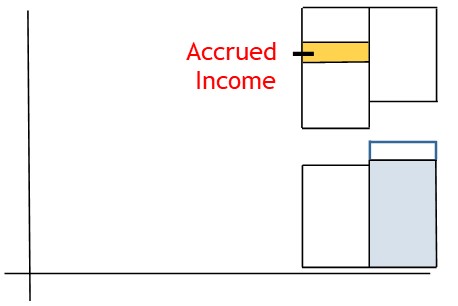

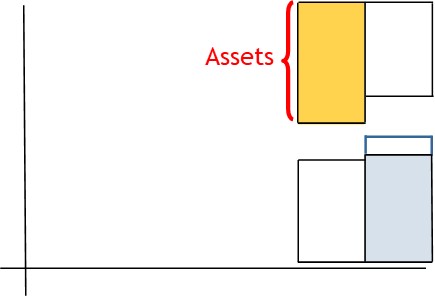

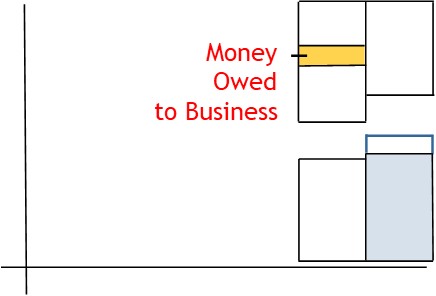

The accrued income account is an asset account.

In this case, the asset account shows money owed to the business.

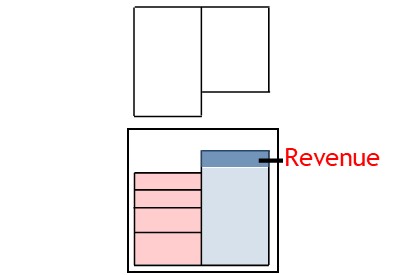

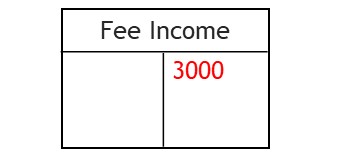

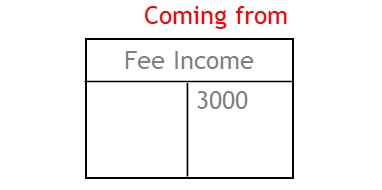

To record the accrual, you credit the income account.

This shows the value will come from fee income

Then you debit the accrued income account.

This shows the value owed has been recorded in the accrued income account.