Activity Based Costing

What is Activity Based Costing?

With activity based costing, overhead costs are caused by various activities.

How it Works

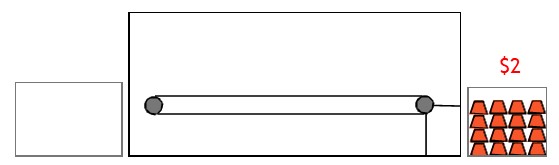

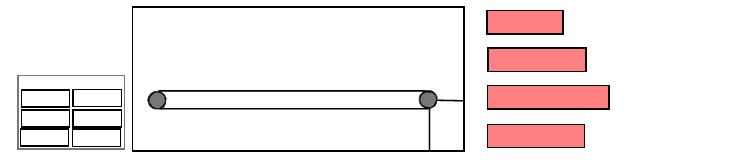

One of the three costs you need to track in manufacturing is manufacturing overheads.

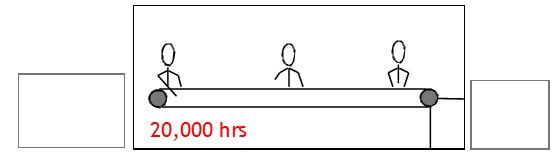

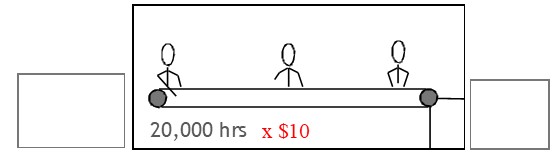

Traditionally, you would use machine hours or labor hours to ascertain these costs.

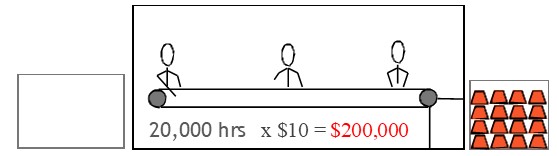

For example, you would estimate total labor hours required to make a batch of goods.

Then you multiply this by the hourly wage rate.

This would show the total labor cost for the batch.

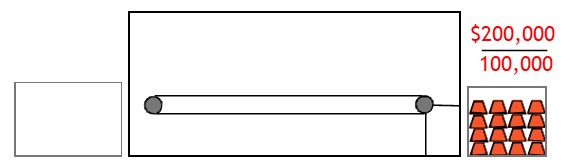

To find the unit cost of those goods, you divide total overhead cost by total units produced.

This gives a cost per unit.

In future costings, you multiply this unit cost by the number of units produced in the batch.

This would show the manufacturing overhead portion of costs for the batch.

Activity Based Costing

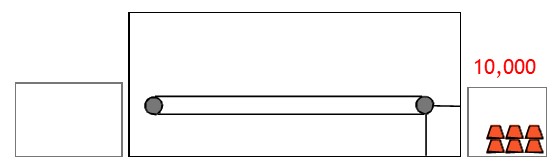

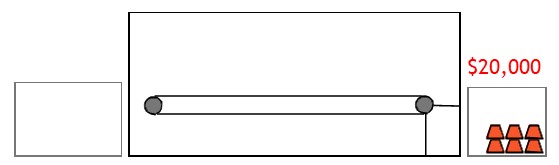

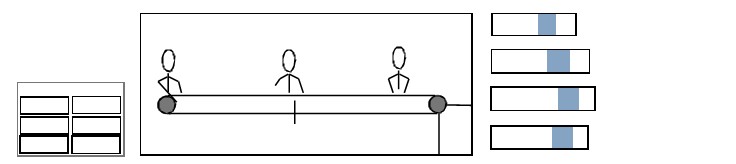

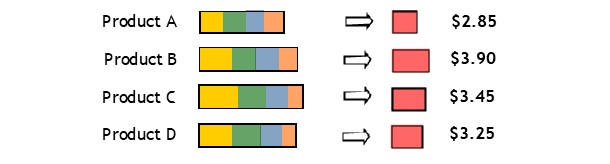

Traditional costing is quick and easy, but a manufacture may make many different products.

With traditional costing, the assumption is that all products use an equal amount of indirect overhead costs.

In reality, though, some products require more overheads than others.

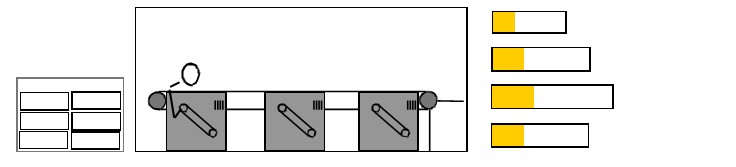

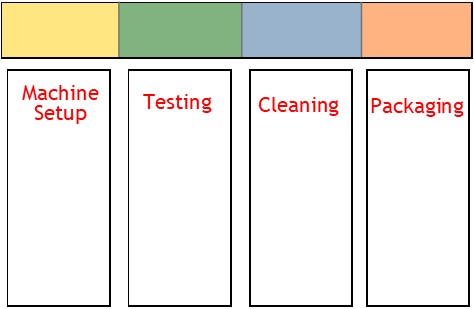

For example, some products may need more time for machine setup.

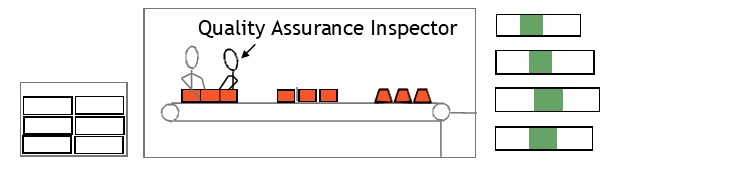

Other products may need more time for inspections.

The time needed for cleaning may also vary.

Even packaging costs can vary from one product to the next.

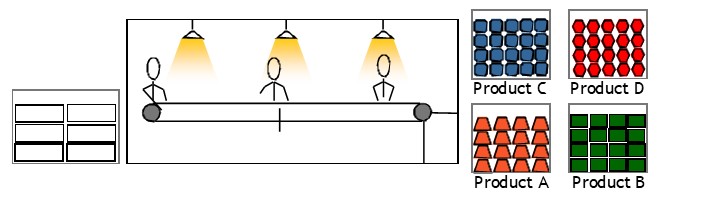

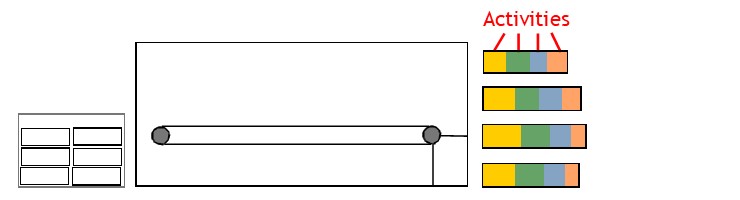

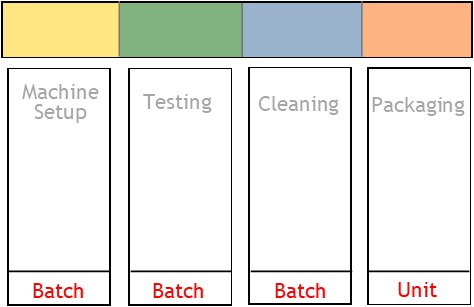

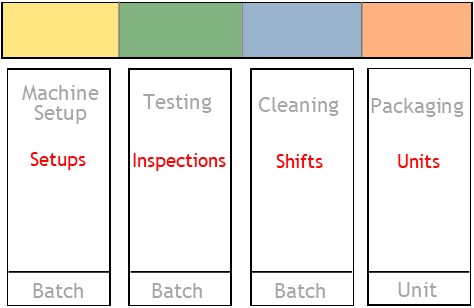

In activity based costing, all of these things are known as activities.

By determining overhead costs based upon these activities, the manufacturer can obtain a more refined unit costing than they can with traditional costing methods.

How activity based costing works — Step by Step

Set Up Activity Information

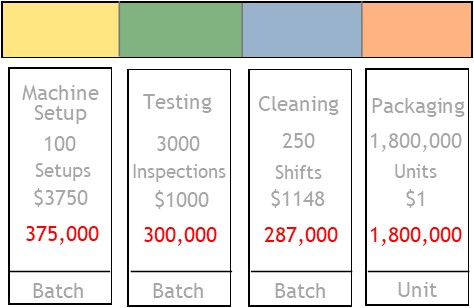

- Identify the activities that are driving costs.

- Classify each activity according to the cost hierarchy—unit level, batch level, product level, or facility level.

- Identify the cost driver of each activity.

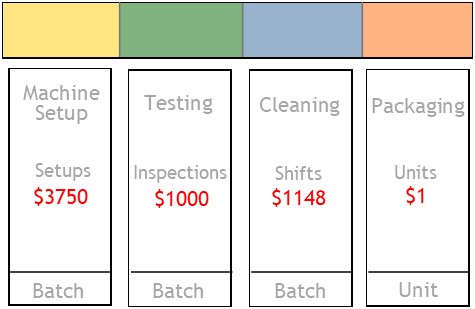

- Calculate the cost driver unit price.

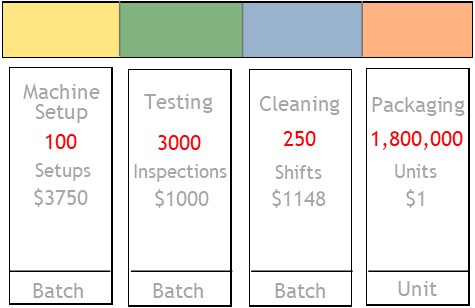

- Estimate the required number of cost driver units.

- From this information, determine the total costs involved in each activity.

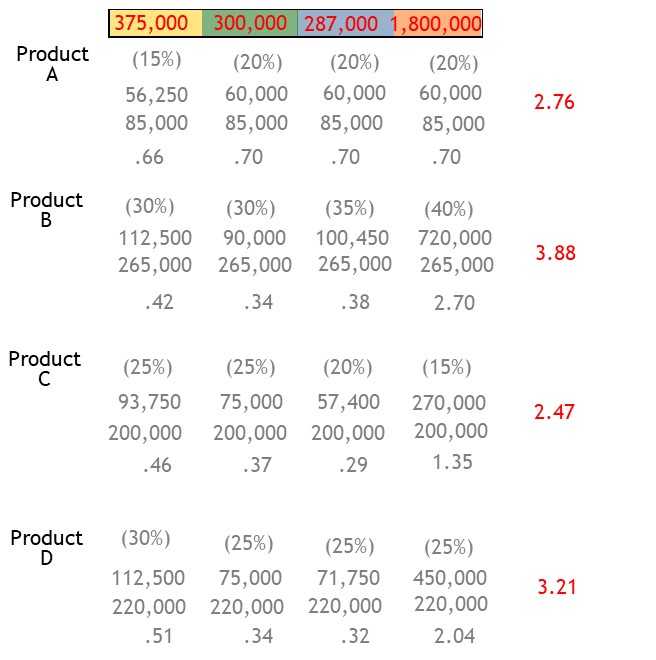

Apply Costs to Products

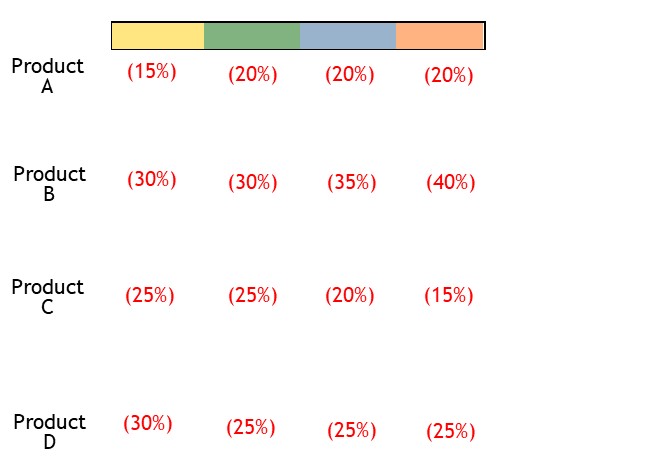

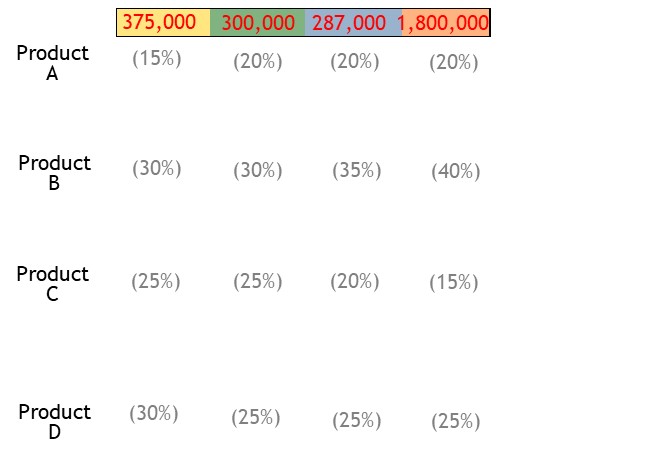

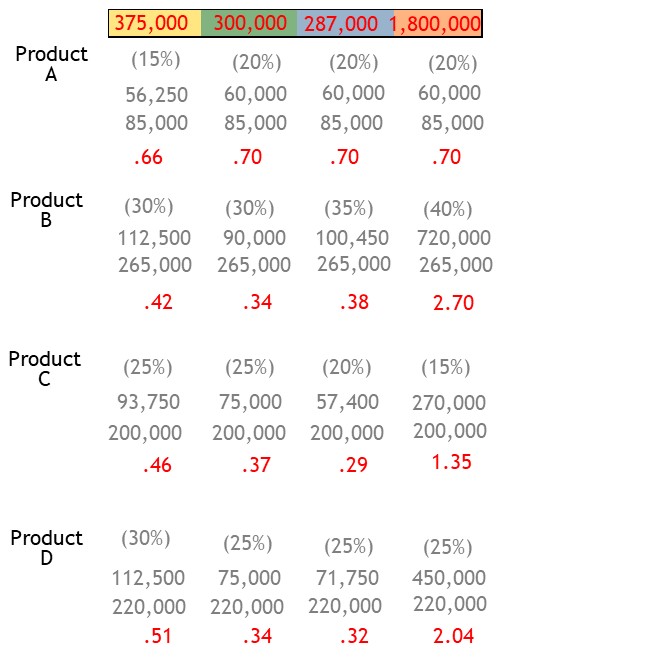

1 Estimate each product’s usage of indirect overhead costs.

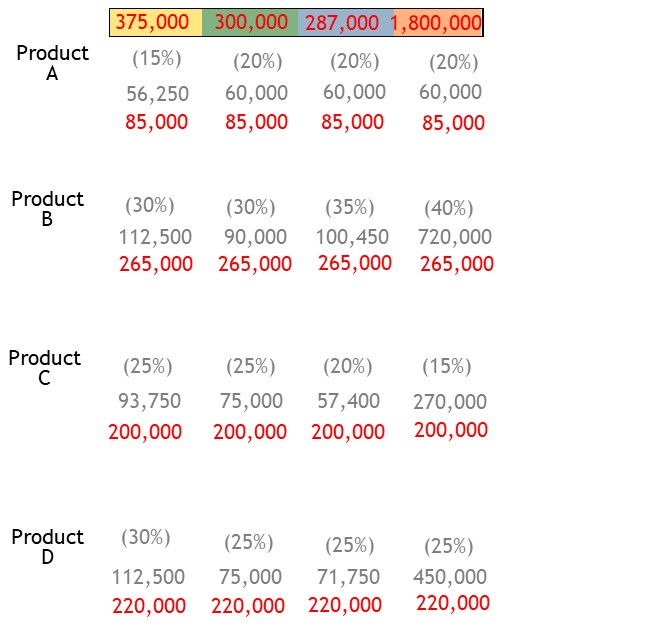

- Take the total costs involved in each activity.

- Then apportion those costs to each product—based on usage.

- Set out the total units to be produced.

- Calculate the cost per unit

- Calculate total indirect overhead costs of each unit produced.