Actual Costing

What is Actual Costing?

Actual costing refers to the process of using actual costs to calculate cost of inventory.

How it Works

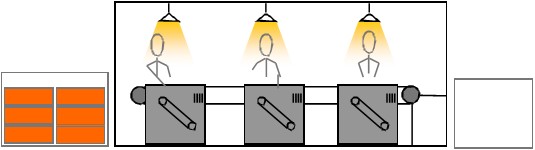

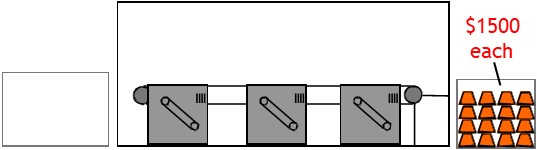

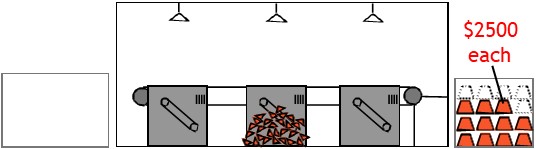

A manufacturer may have a client who is interested in buying a certain amount of a product.

The manufacturer will need to determine a selling price for these goods.

To do this, the manufacturer will set out a budget.

This will include an estimate for likely material costs.

It will estimate likely direct labor costs.

Finally, it will include overhead costs such as utility costs, administration, and machine setup & maintenance.

From all of these estimated costs, the manufacture will determine a unit cost price.

Based on this, it will set a selling price.

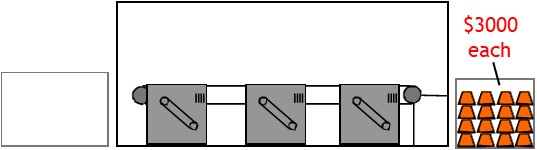

If the client agrees to the price, the manufacturer will go ahead and make the product.

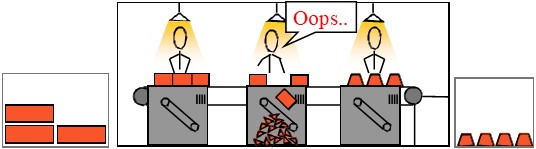

Problem is things don’t always go according to plan.

This means the eventual cost price could be quite different to the budgeted price.

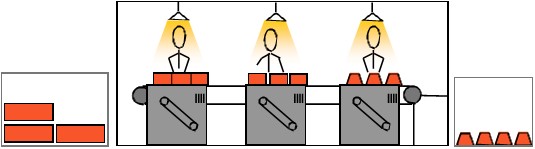

To review performance, the manufacturer may require an actual costing.

Here, it needs to find the actual cost of inputs.

Then the manufacturer compare this to the budgeting revenue outcome.

This way, it can amend their pricing and processes to get a better result next time.

Calculating Actual Costs

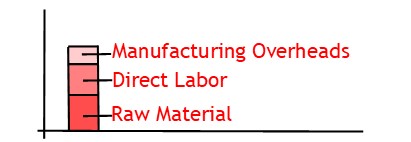

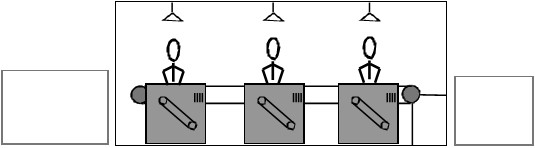

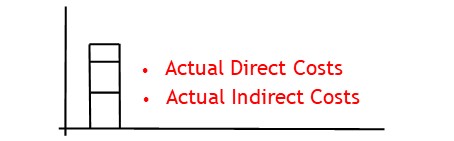

To calculate actual costs, the manufacturer will break the costs down into actual direct costs and actual indirect costs.

Calculating Actual Direct Costs

Actual direct costs relate to direct material and direct labor costs

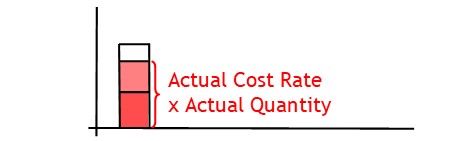

To calculate actual direct costs, you multiply the actual cost rate by the actual quantity used.

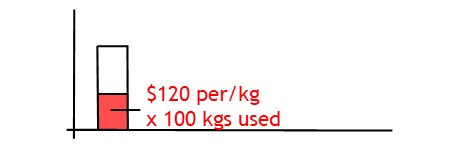

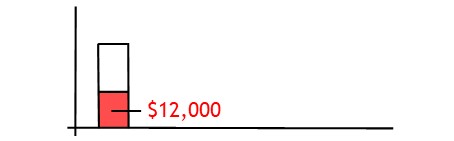

For example, you would apply this formula to direct materials.

Here, you multiply a unit cost of materials by the amount of materials used in the manufacturing process.

This gives a value for that component of costs.

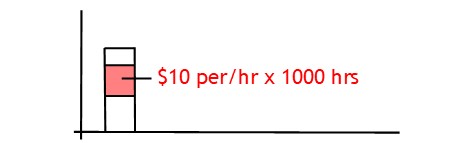

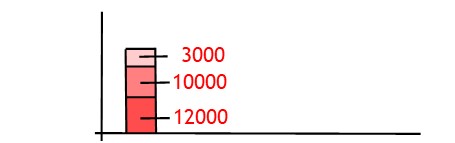

It works the same way with direct labor.

You take employee pay rate per hour and multiply it by the number of hours needed to produce the goods.

As with direct materials, the formula provides a value for the labor component, as well.

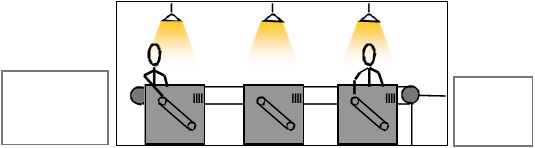

Calculating Actual Indirect Costs

Actual indirect costs relates to manufacturing overheads.

Calculating them works differently to calculating direct costs.

Manufacturers use a formula to calculate these costs, as well.

Allocated indirect cost rates are an estimation based on something like machine hours required to produce goods.

They are a factory-wide costing, determined in a previous accounting period.

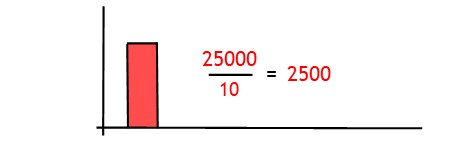

To calculate them, you find total cost of overheads for the entire factory for a period.

Then you divide this by the total number of machine hours used for the period.

This gives a factory-wide rate for indirect overheads of so much per machine hour used.

Manufactures take this amount and apply it to the product being costed.

This provides an amount for actual indirect costs.

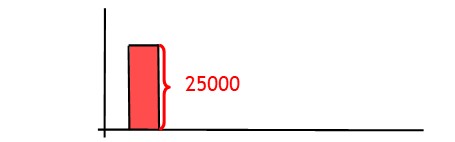

After this, they add all costs.

This provides a total for actual costs.

Finally, you divide this total by total number of units produced to show the cost per unit.