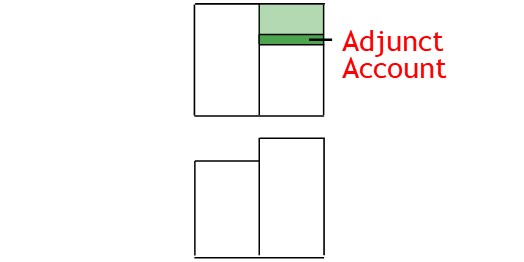

Adjunct Account

What is an Adjunct Account

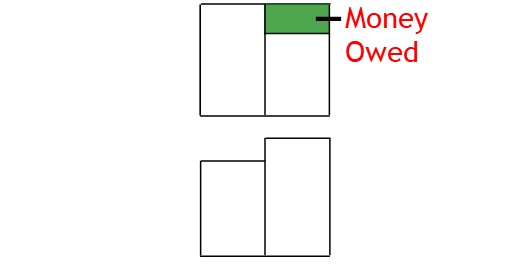

An adjunct account is a valuation account that increases the book value or carrying value of a liability account.

How it Works

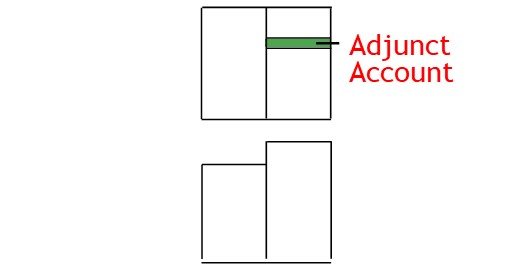

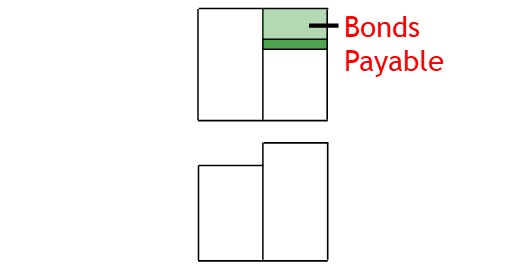

An adjunct account is a liability account.

It is attached to another liability account.

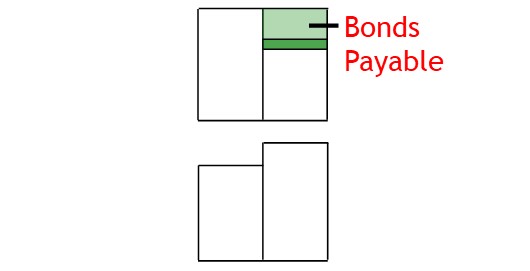

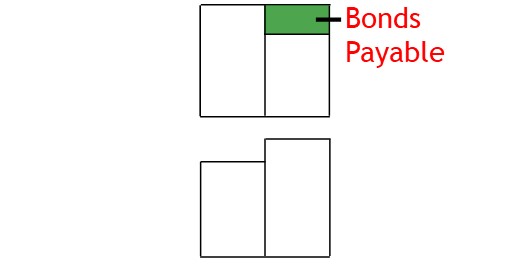

For example, a premium bonds payable is an adjunct account.

It is attached to the bonds payable account.

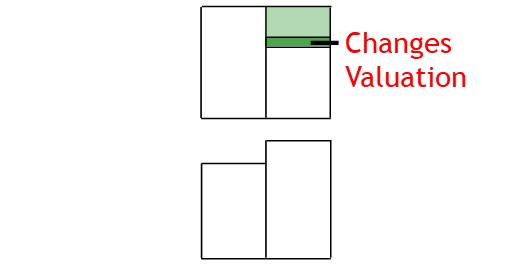

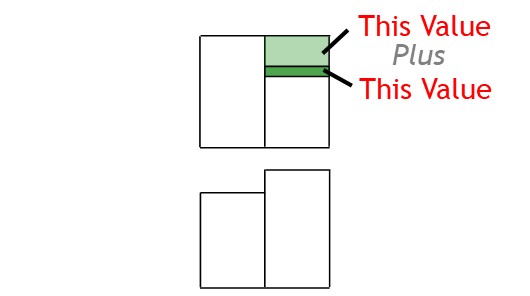

Together, the accounts show how much money came from a bond issue in total.

Bonds payable shows money owed to bond holders and needs to be paid back.

The adjunct account also shows money received, but this money does not have to be paid back.

In doing this, the adjunct account operates as a valuation account.

To see how much came from the bond issue in total, you add the value of the bonds premium account to bonds payable.

How it works in More Depth

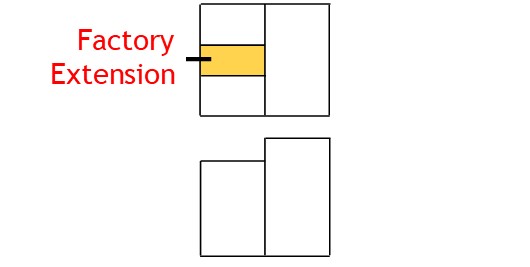

A company may want to buy an asset.

One way to fund this is via a bond issue.

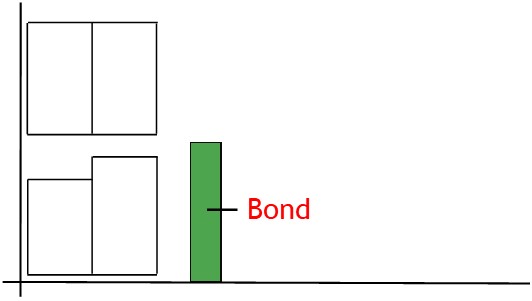

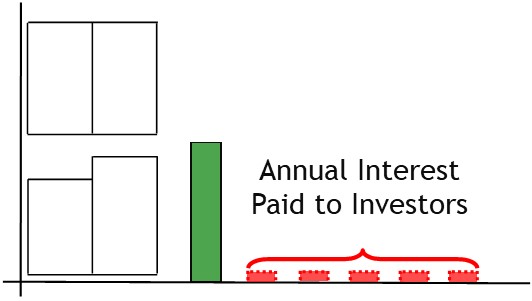

With a bond issue, the company sells bonds to investors.

Investors buy the bonds and pay the money to the issuer.

In return, the issuer pays interest to the bond holder each year.

The money received from investors is recorded as bonds payable.

Bonds payable is a liability account showing money owed to bond holders.

When setting up the issue, the issuer will consider the prevailing interest rates.

Then they will set their own rate of interest around this level.

This rate is known as the coupon rate or stated rate.

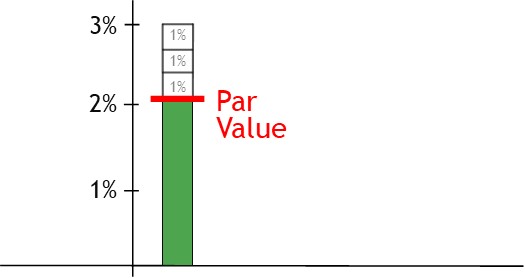

When issuing bonds, the issuer hopes to launch the issue at par value.

This is where the issuer receives the full face value of each bond from investors.

Things don’t always go smoothly with bond issues, though.

There is quite a bit for the issuer to prepare beforehand.

The issuer will need to get approval to issue the bond, print bond certificates, arrange sellers etc.

During this process, it’s not uncommon to encounter administrative problems.

This can delay the bond issue.

During the delay, interest rate markets can become volatile.

If this happens, interest rates can change quite a bit during the delay.

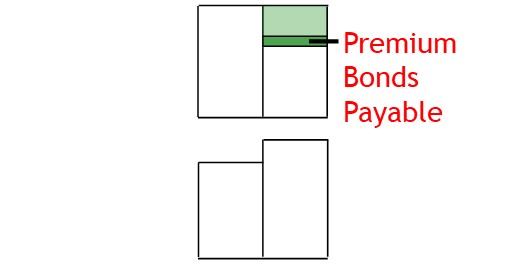

Bond Premium

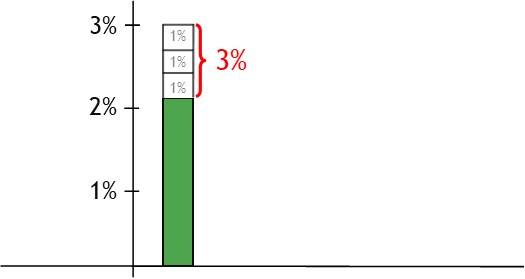

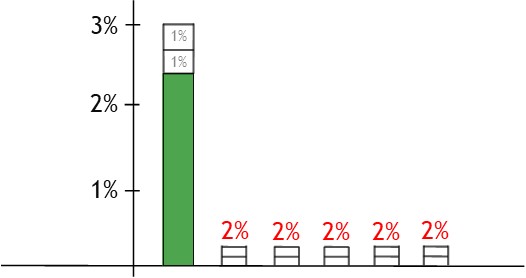

Sometimes, interest rates will fall during a delay in a bond issue.

This will result in a mismatch between the stated rate and prevailing interest rates.

In other words, the issue’s stated rate is higher than it needs to be.

At this rate, the issuer will be paying out too much interest on their bond

Competing bonds will be paying out less interest each year.

So to compensate, the issuer issues their bond at a premium.

This way, investors still receive the stated rate of interest.

However, they will have to pay more than face value for the bond.

For their part, the issuer will still have to pay the higher stated rate.

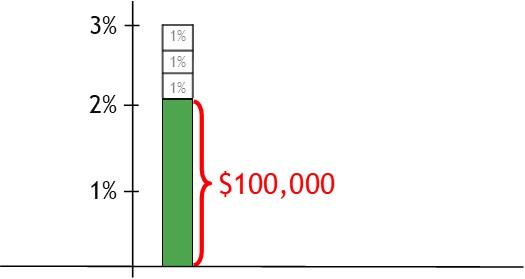

But this will be offset to some extent by the extra money received from the premium.

This saving will effectively result in them paying the prevailing rate of interest.

Recording a Premium Bond Issue

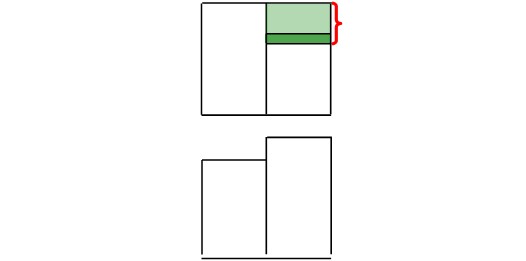

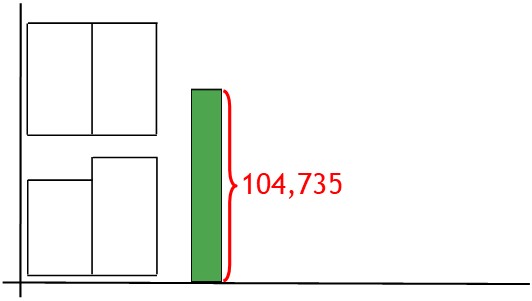

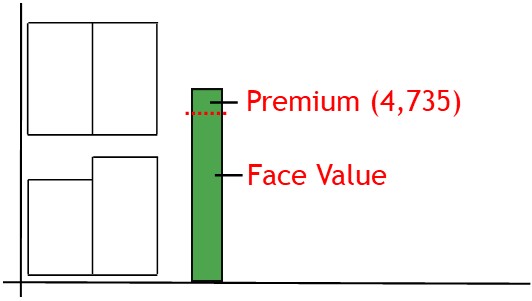

With a premium bond issue, the issuer receives more than each bond’s face value.

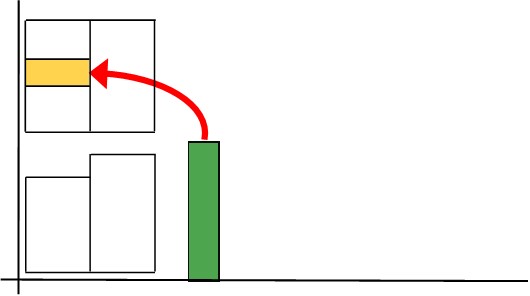

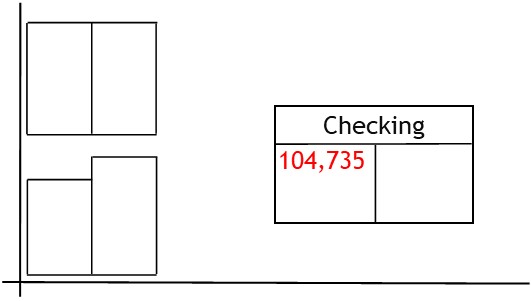

When received, the proceeds from the bond issue are deposited in the bank.

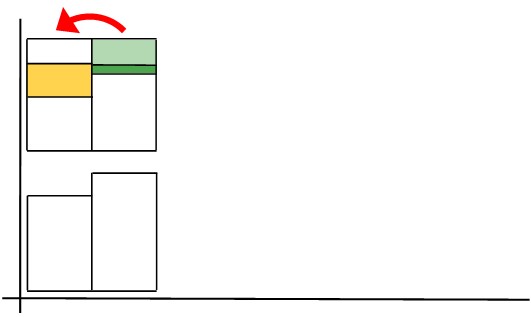

However, to record the issue, you divide it into its component parts.

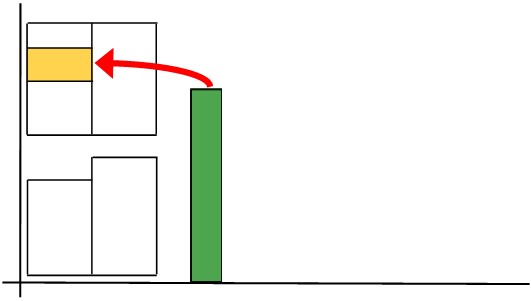

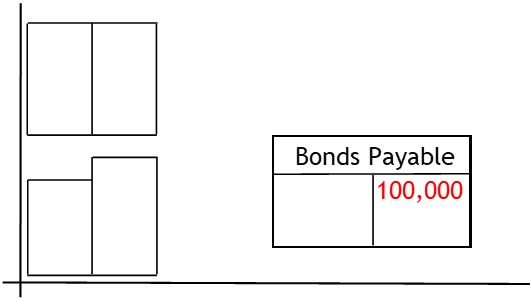

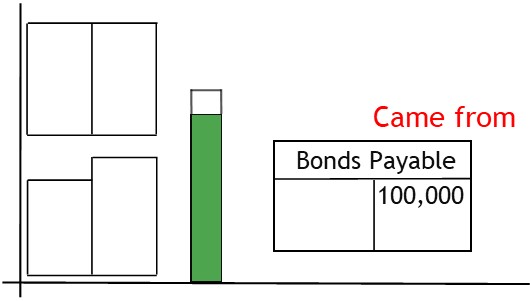

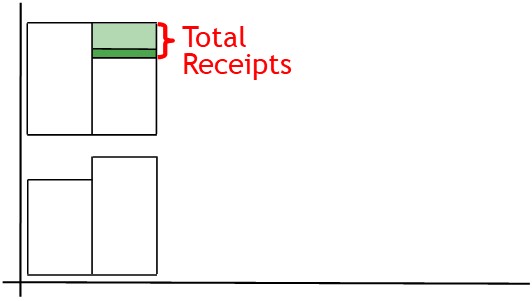

You credit the bonds payable account with the bond’s face value component.

This shows that some money came from the face value part of the bond.

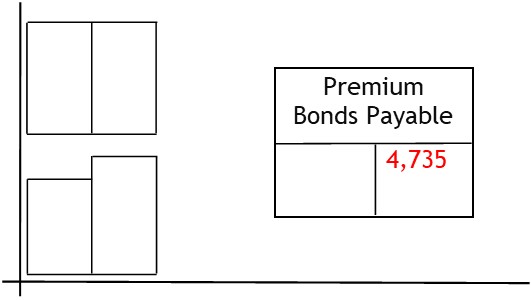

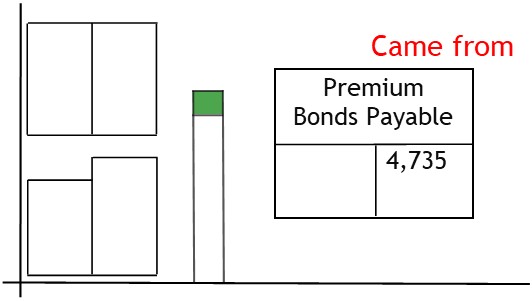

At the same time, you credit the premium bonds payable account.

This shows that some of the money also came from the premium.

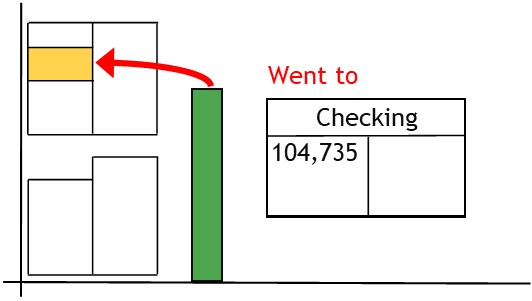

After this, you debit the checking account with the whole amount.

This shows the money went to the bank.

When complete, the transaction shows that money came from a bond and its premium.

And that money went to the bank.

© R.J. Hickman 2020