Adjusting Entries

What are Adjusting Entries?

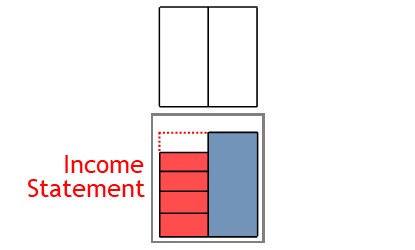

Adjusting entries are adjustments you need to make your accounts at period-end to improve reporting accuracy.

How it Works

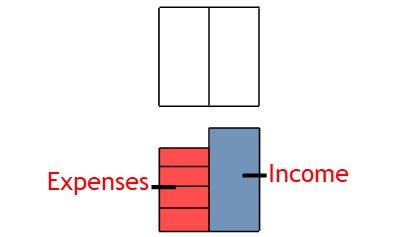

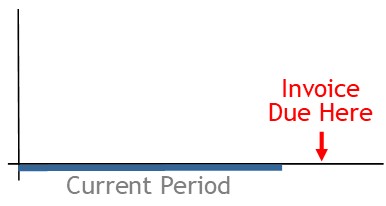

During the accounting period, you record transactions in income and expense accounts.

Then, at period end, you prepare reports.

Before doing this, though, you may need to make some adjustments to your accounts.

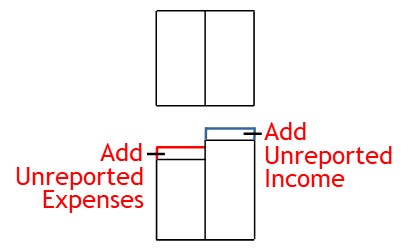

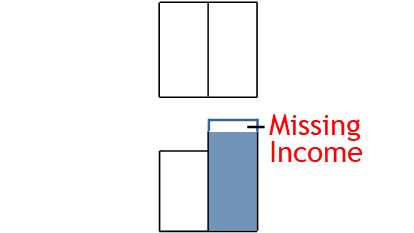

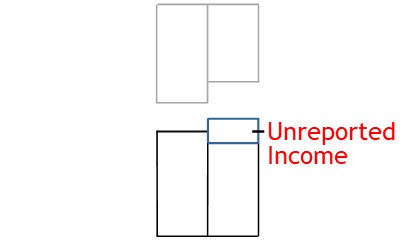

Unreported Income

By period-end, your accounts may be missing income.

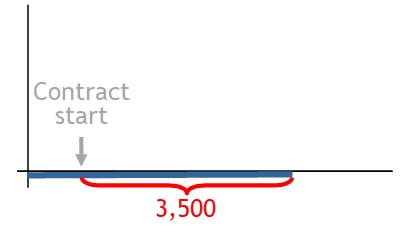

For example, the business may enter a consulting contract with a client during the period.

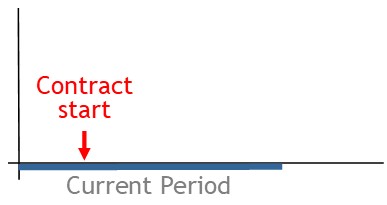

The contract may start during the current period.

But the contract’s first payment milestone falls after period-end.

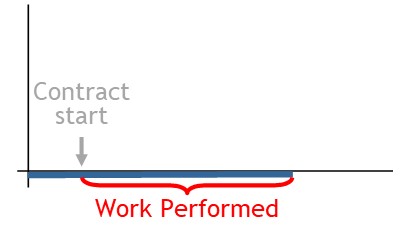

So, by period end, the business will have performed work for the client.

And the income resulting from this work should be shown in the period-end reports.

However, because the business is yet to invoice the client, this income will not appear in the accounts as at period-end.

For reporting accuracy, you need to adjust the accounts.

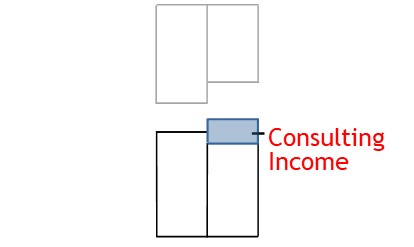

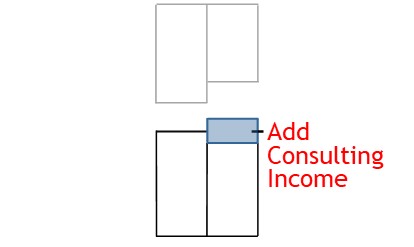

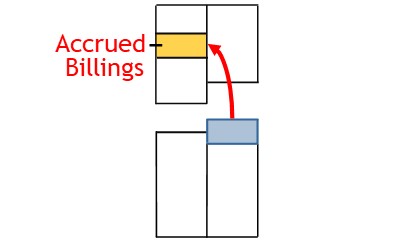

When making this adjustment, you show that value will come from consulting income.

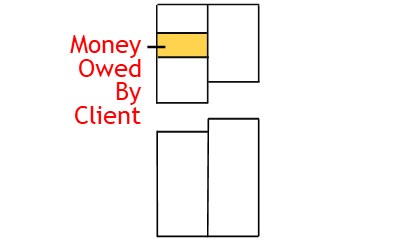

Then you record the amount owed in the accrued billings account.

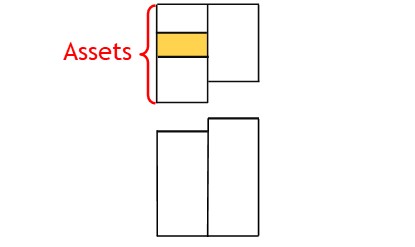

The accrued billings account is an asset account.

Like accounts receivable, it shows money owed to the business by customers.

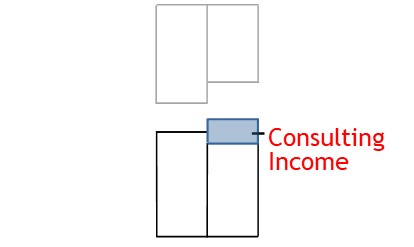

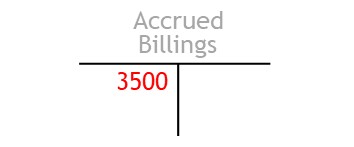

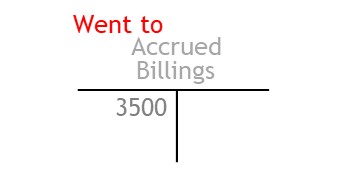

Recording Accrued Income

To make the adjustment, you calculate the amount of consulting income not yet received.

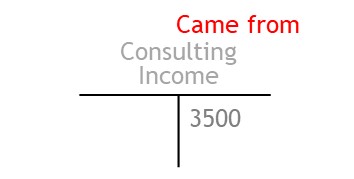

Once calculated, you credit the consulting income account.

This shows that revenue will come from consulting income.

After this, you debit the accrued billings account.

This shows you have recorded the amount owed in accrued billings.

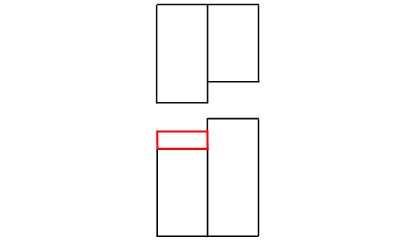

Unreported Expenses

At period-end, the accounts may also be missing expenses.

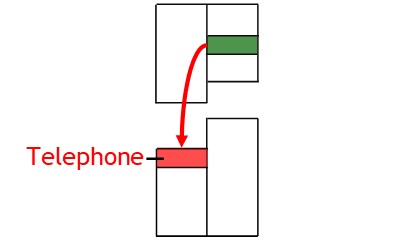

For example, during the period, a business may incur telephone expense.

Often, though, the business will not be invoiced for telephone expense until after period-end.

Because of this, you will have had no reason to record the expense, as at period-end.

For reporting accuracy, your period-end reports should contain any unreported expenses such as telephone expense.

So you need to adjust your records.

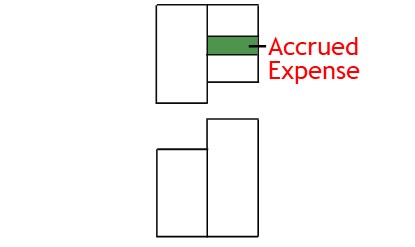

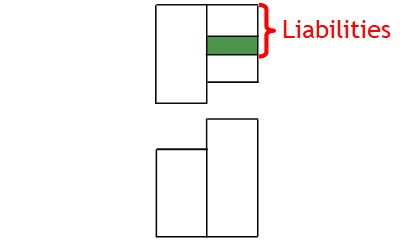

When making this adjustment, you use an account known as an accrued expense account.

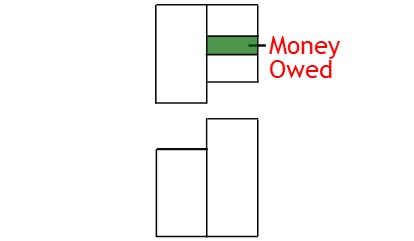

An accrued expense account is a liability account.

Like supplier accounts, it shows money the business owes to others.

After you record the amount likely owed, you allocate the expense to the appropriate expense account.

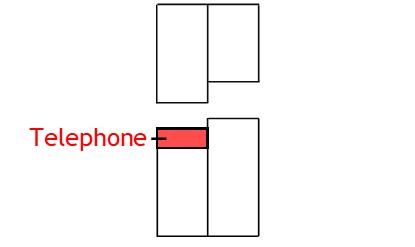

Recording Accrued Expenses

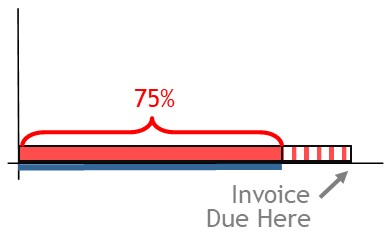

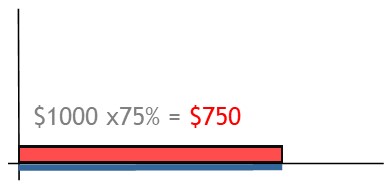

To record the likely expense, you begin by determining the portion of the expense already consumed, as at period-end.

Then you apply this portion to the typical bill to arrive at an estimate of the likely expense.

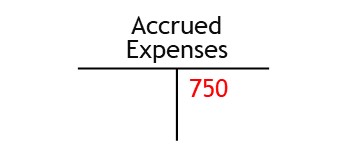

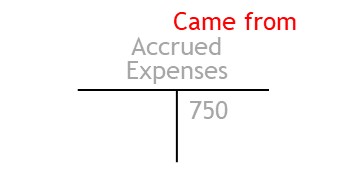

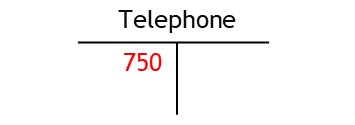

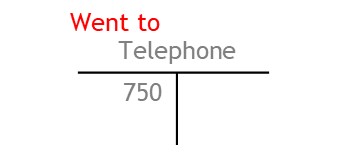

Once estimated, you credit the accrued expense account.

This shows a value of services has come from accrued expenses.

Next, you debit the relevant expense account.

This shows where you are allocating the likely expense.

© R.J. Hickman 2020