Advance from Customer

What is an Advance from Customer?

An advance from a customer is where a customer pays money to the business before receiving goods or services.

How it Works

Sometimes, a customer will order a product or service.

However, the business may perceive the customer as a credit risk and insist on payment at the time.

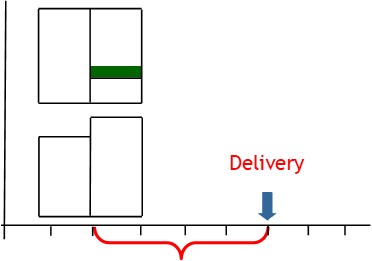

Then the customer takes delivery of the goods or services later.

With this type of transaction, the sale is not recognized until delivery.

Journal Entries

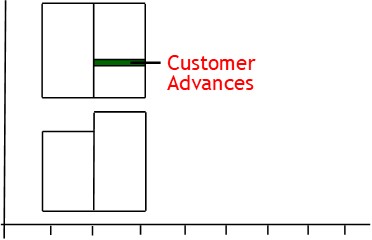

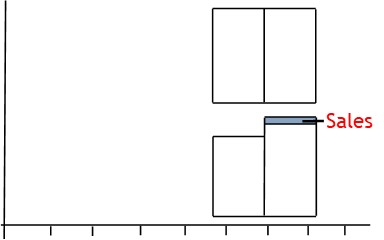

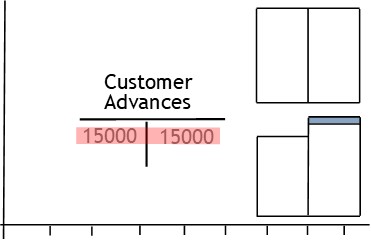

To record a customer advance, you use a customer advances account.

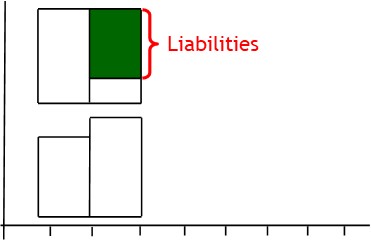

The customer advances account is a liability account.

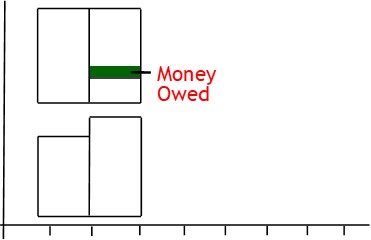

Like other liability accounts, it shows money the business owes.

You show that it is money owed, because technically, until the business ships the product, the money still belongs to the customer.

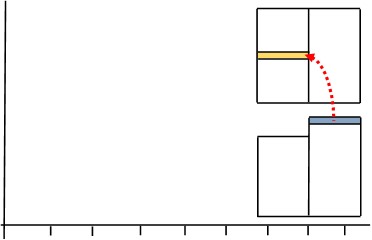

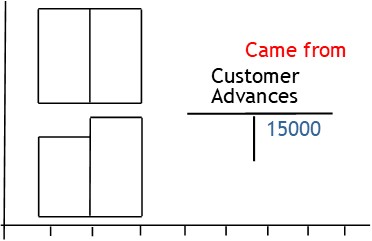

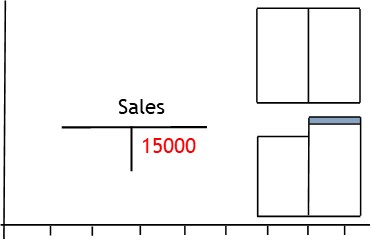

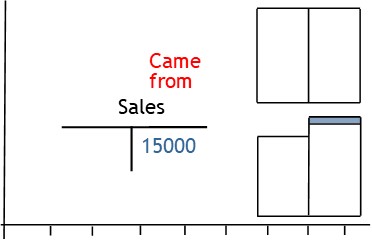

To record the payment, you credit the customer advances account.

This shows the money involved in the transaction has come from customer advances.

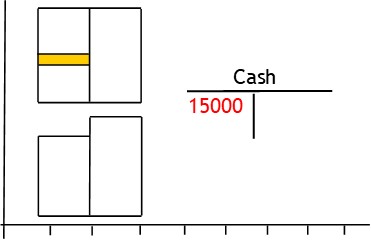

After that, you debit the cash account.

This shows the money was deposited in the bank

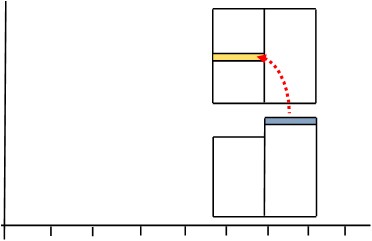

Later on, the business will deliver the product to the customer.

This is when the sale is recognized.

If this was a normal sale, money would come from sales and go to checking..

In this case, though, the money came from customer advances and went to the bank earlier on.

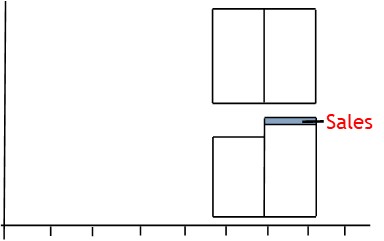

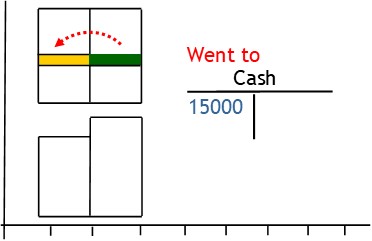

So now all you need to do is offset the customer advances account

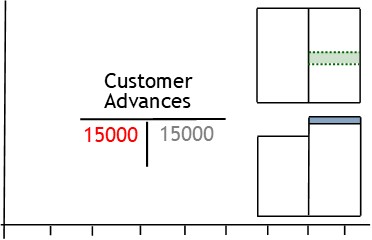

To do this, you credit the sales account as if it was a normal sale.

This shows the value involved has come from sales.

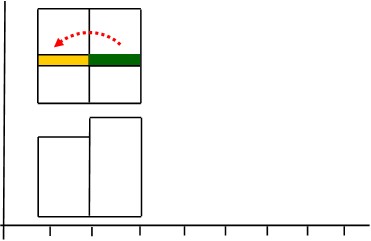

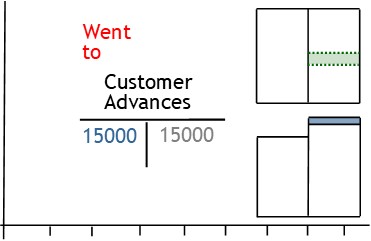

After that, you debit the customer advances account.

This shows you have assigned the value to customer advances.

By debiting the customer advances account, you offset the credit entry made earlier, effectively taking the account out of the mix.

After this, your accounts will show that money was received from sales and went to the bank.