Advances to Employees

What are Advances to Employees?

An advance to an employee is when a business pays an employee in advance.

How it Works

Sometimes, an employee will ask for an advance on their wage or salary.

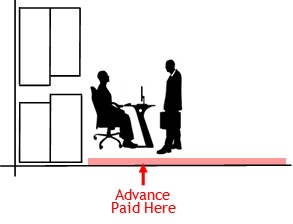

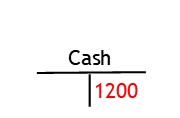

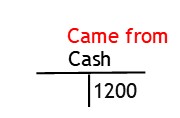

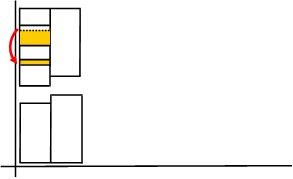

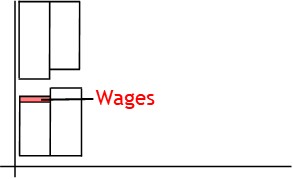

To record the advance, you credit the cash account.

This shows the money came from the bank.

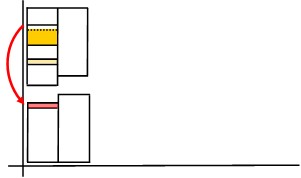

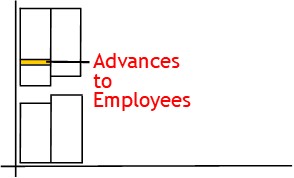

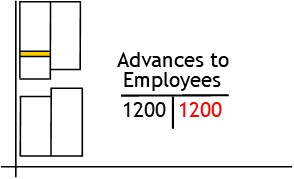

After this, you debit the advances to employees account.

This shows the money went to an employee.

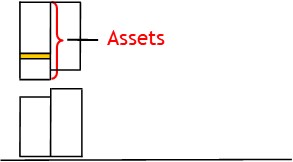

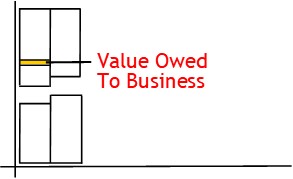

The advances to employees account is an asset account.

Asset accounts show what the business owns or what is owed to the business.

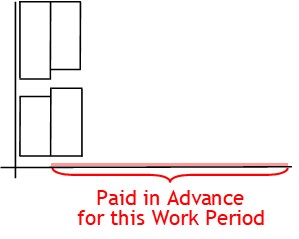

The employee is yet to perform the work for which they have been paid.

So, for the time being, the account shows they owe this value to the business.

At this stage, your accounts will show that money came from the bank and went to employee advances.

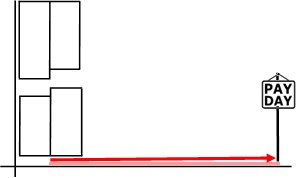

Come pay day, you will need to update the accounts again.

By now, the employee has performed the work.

So you need to record the expense.

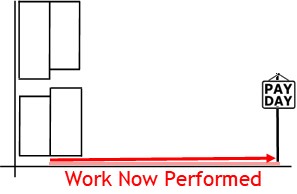

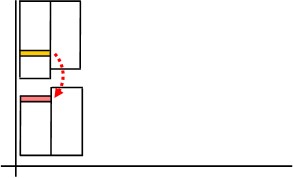

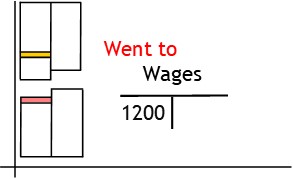

To do this, you transfer the value shown in the employee advances account to the wages expense

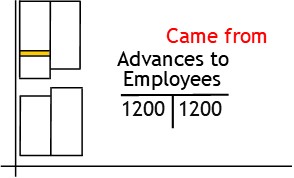

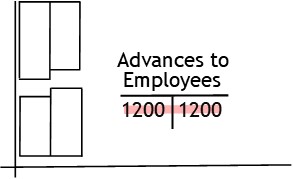

Here, you credit the advances to employees account.

This shows you are taking value from the account.

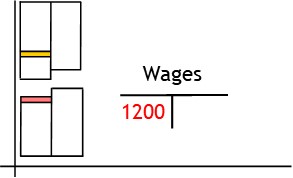

After this, you debit the wages expense account.

This shows that the value has been used as wages expense.

By doing this, you offset the credit entry shown in the employee advances account.

With the offset, your accounts now show that money came from the bank and went to wages.