After-Tax Cost of Debt

What is After-Tax Cost of Debt?

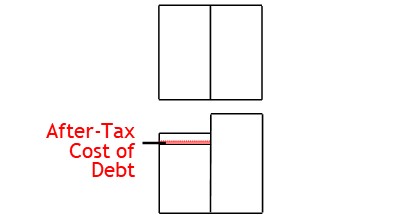

After-tax cost of debt is the tax effective cost of interest on loans or bonds.

How it Works

A company may be considering raising money via a loan or a bond issuance.

This will involve paying interest.

When assessing a loan, though, management look at more than the interest rate alone.

They will also consider the after-tax cost of the debt.

How Income Taxation Effects Debt Cost

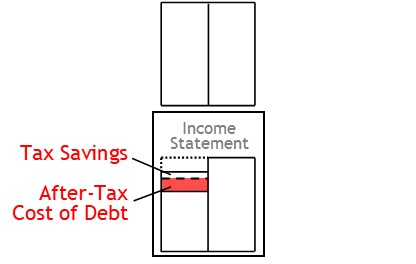

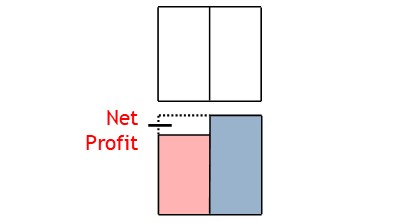

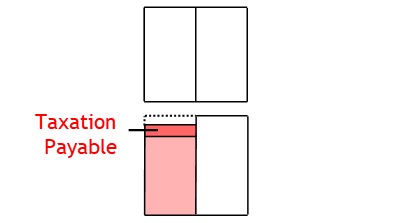

Income tax is based on net profit.

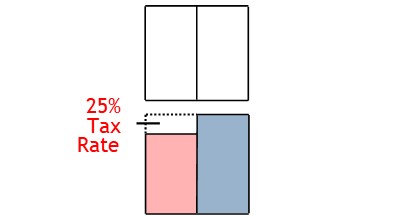

This is calculated at a certain percentage rate.

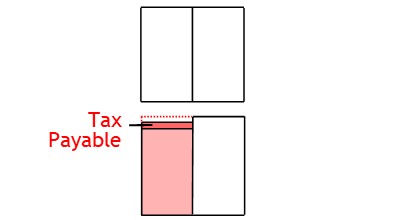

This determines how much income tax the company pays.

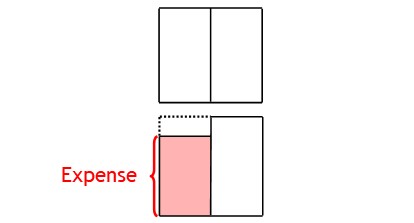

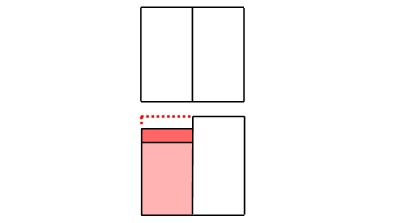

Expenses reduce net profit.

The more expenses a business has the lower it’s net profit.

This, in turn, lowers the amount of income tax payable.

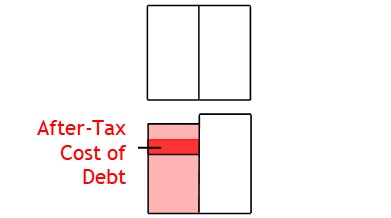

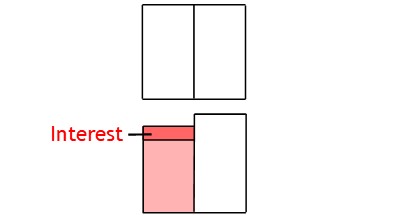

Loan and bond interest is an expense.

Like any expense, interest expense also reduces net profit.

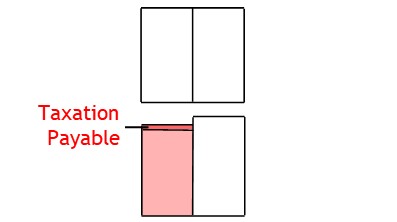

As such, the loan or bond interest reduces the amount of tax payable.

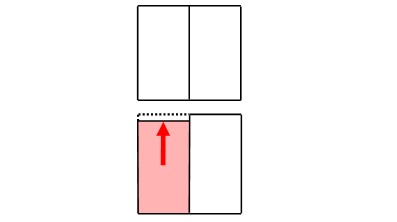

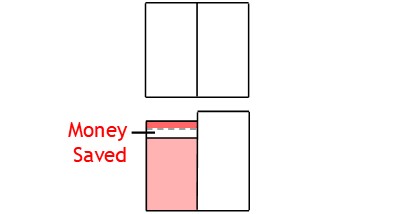

Because of this, the reduction is seen as a saving for the business.

It’s an expense that saves money, but the business does not have to pay for.

This results in a tax effective cost known as the after-tax cost of debt.