Allowance to Reduce Inventory to LCM

What is Allowance to Reduce Inventory to LCM?

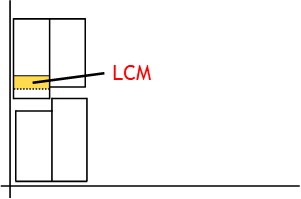

A valuation account used to decrease the value of depreciated inventory on the balance sheet.

How it Works

A business will buy inventory.

This inventory may lose value over time, due to changes in market price or obsolescence.

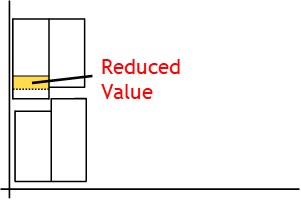

To satisfy the principle of prudence or conservatism, you need to reduce your record of the inventory’s value.

The reduced value is determined by a valuation method known as lower of cost or market.

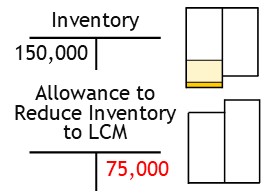

Once determined, you record the value in the allowance to reduce inventory to LCM account.

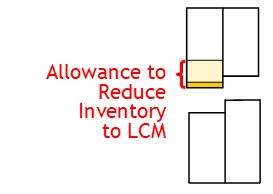

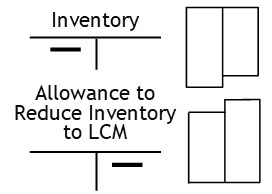

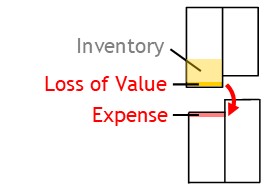

This account is a separate account attached to the inventory account.

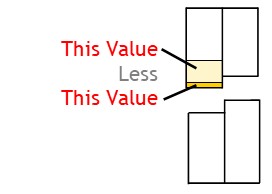

When updated, its balance will reduce that of the inventory account.

As such, it is classified as a valuation account..

The account is also classified as a contra asset account.

Most asset accounts balance on the debit side.

However, the allowance to reduce inventory to LCM account balances on the credit side.

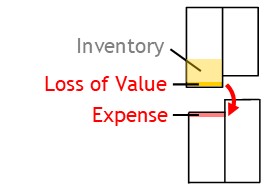

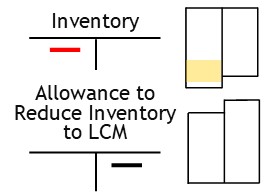

When recording the transaction, you credit the contra account.

This shows you are effectively taking value from the inventory account.

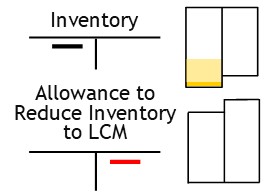

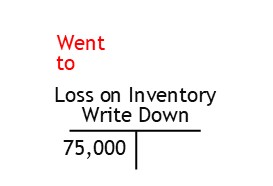

After this, you debit the loss an inventory write down account.

This shows the value was designated as an expense.

Once updated, the accounts will show that inventory has lost value and that loss of value is designated as an expense.

© R.J. Hickman 2020