Allowance for Doubtful Debts

Introduction

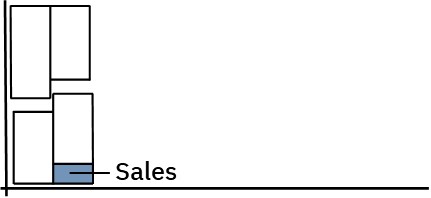

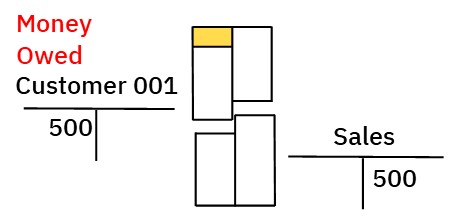

A business may sell goods or services on credit to customers.

This means, the business allows customers time to pay.

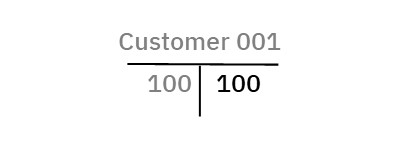

The business needs to keep a record of each sale transaction.

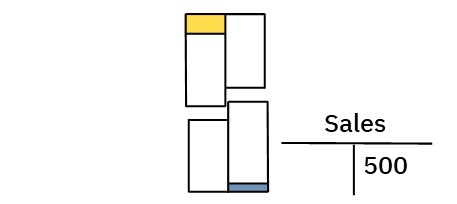

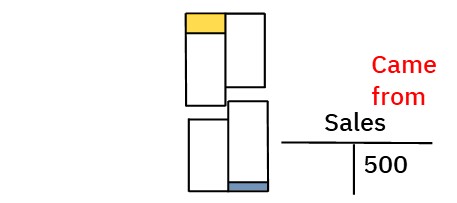

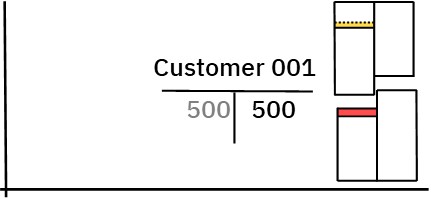

You need to show that a value of goods or services came from sales and the value of those goods or services went to accounts receivable.

Accounts receivable is the collective name for all customer accounts.

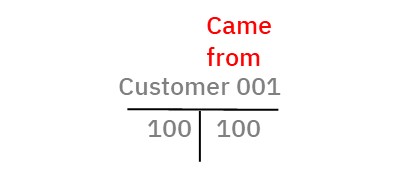

To record each sales transaction, you credit the sales account.

This shows a value of goods or services came from sales.

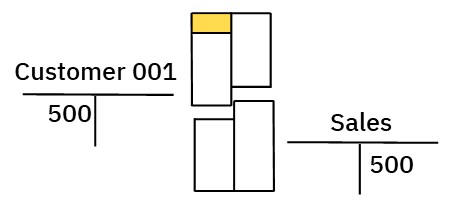

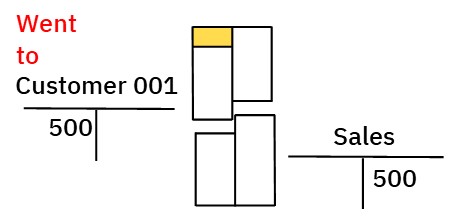

Next, you debit the individual customer’s account.

This shows the value of goods or services went to that particular customer.

The debit entry also shows that the customer owes this money to the business.

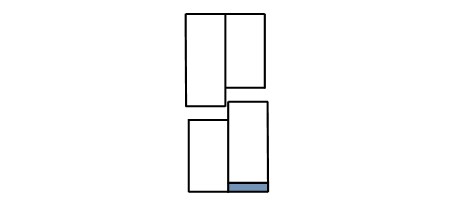

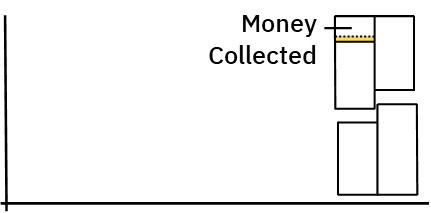

In time, most customers will pay what they owe.

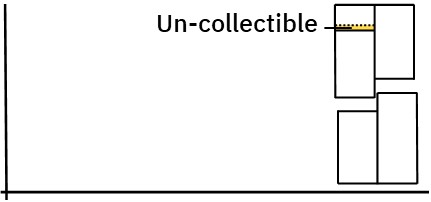

However, some won’t, and the debt will be deemed un-collectible.

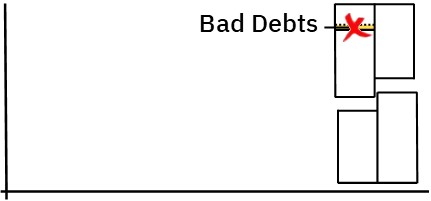

These debts are known as bad debts and need to be written off.

Direct Write Off

One way to deal with bad debts is to wait for customers to default.

Then write the debt off to bad debts expense.

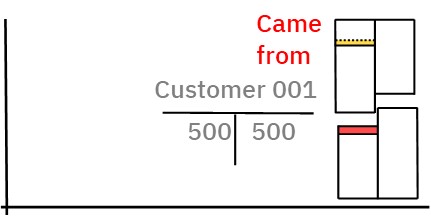

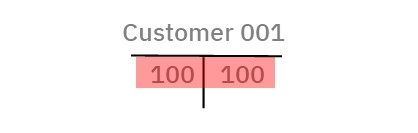

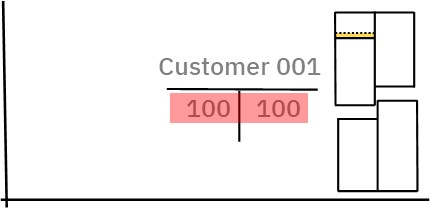

To do this, you credit the customer’s account.

This shows you have taken value from the account

Offsetting the customer’s account this way brings the account’s balance to zero and writes off the debt

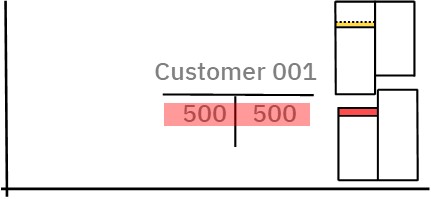

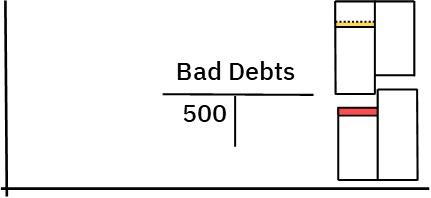

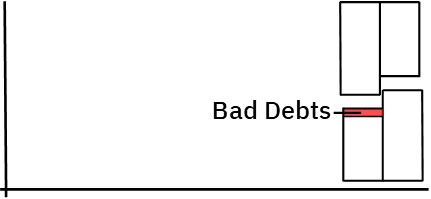

After this, you debit the bad debts expense account

This shows you have assigned the value to bad debts expense

And the debt has now become one of the expenses involved in making sales.

Allowance for Doubtful Debts

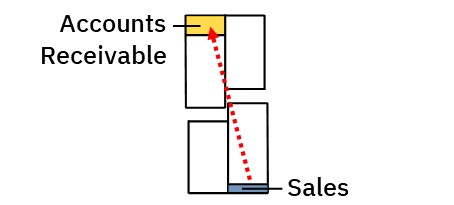

Another way to deal with bad debts is to make an allowance for them, when sales are made.

In other words, you anticipate likely bad debts ahead of time.

The reason you do this is to satisfy the matching principle.

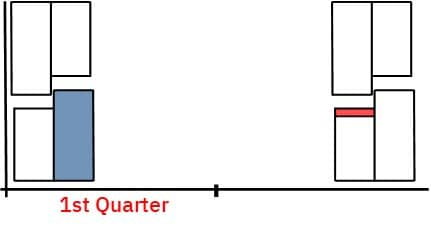

Sales may be made in one accounting period.

But bad debts resulting from these sales may not occur to a later period

In accordance with the matching period, expenses incurred should be recorded in the period revenue was earned.

To do this, you need to estimate likely bad debts

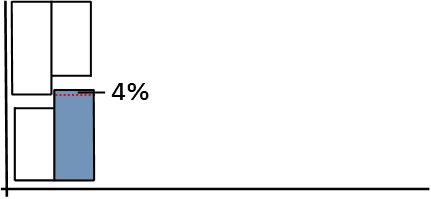

This estimation may be a percentage of sales.

Alternatively, it can be a percentage of accounts receivable.

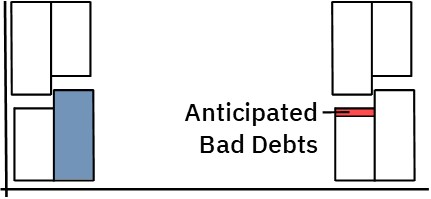

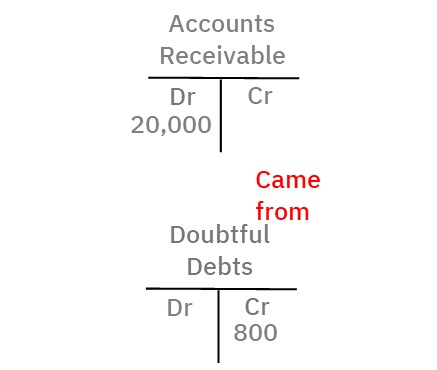

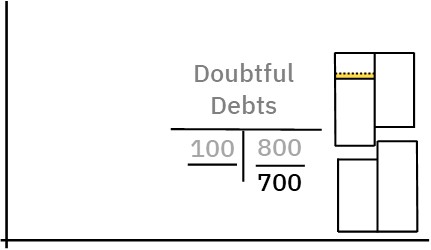

To record likely bad debts, you use an allowance for doubtful debts account.

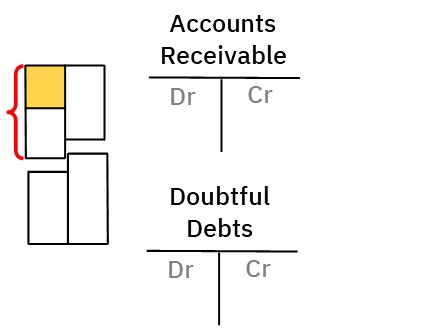

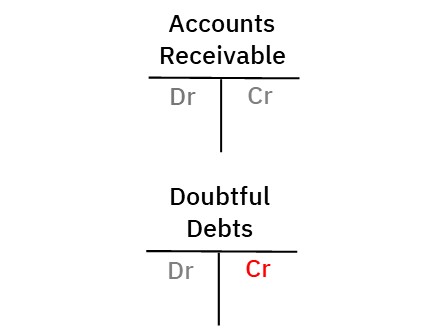

The account is attached to accounts receivable.

It’s an asset account, but its balance isn’t shown on the diagram.

Only accounts receivable is shown.

This is because the doubtful debts account is a contra account.

Most asset accounts, including accounts receivable, balance on the debit side.

To the contrary, doubtful debts balances on the credit side.

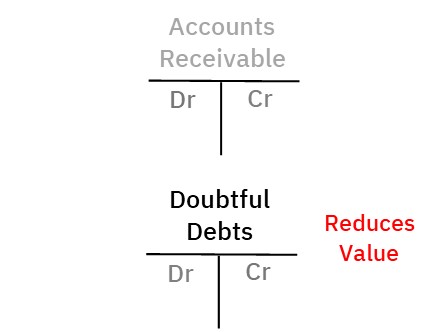

The account is also classified as a valuation account.

This is because any debit entries in doubtful debts will reduce the value of accounts receivable.

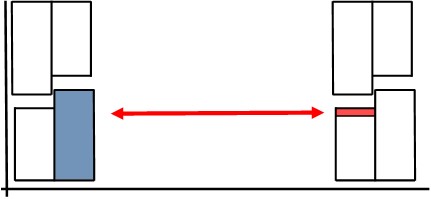

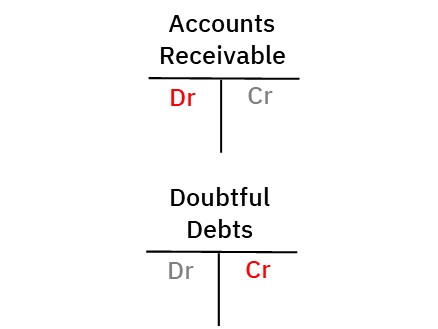

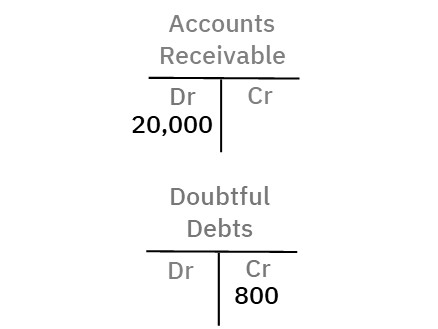

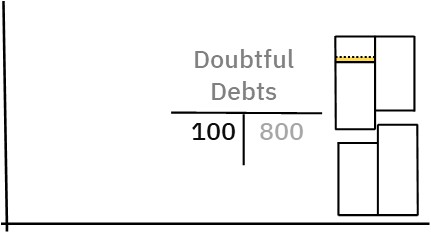

To record doubtful debts, record the estimate in doubtful debts with a credit entry.

This shows you have effectively taken value from accounts receivable.

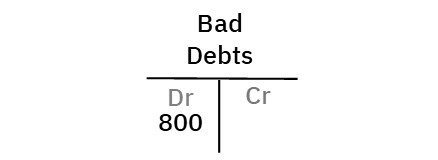

Then you debit bad debts expense

This shows you have assigned the value as an expense.

Once complete, the transaction will show you have effectively taken value from accounts receivable and allocated it to as bad debts

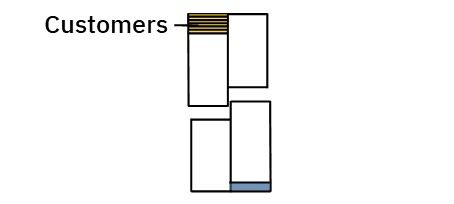

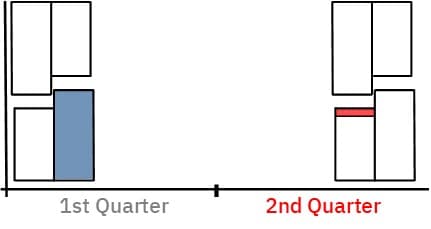

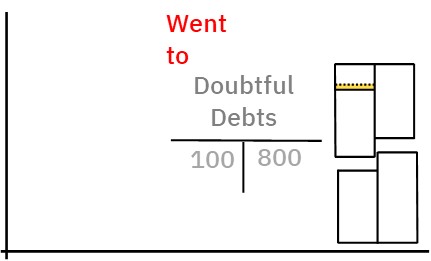

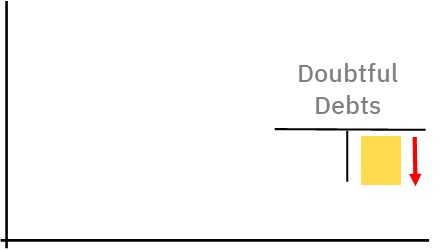

Later, some customers will default on their debt obligation.

When a customer defaults, you credit the customer account.

This shows you are taking value from their account.

It also offsets the debit entry—thereby bringing the account’s balance to zero and writing off the debt.

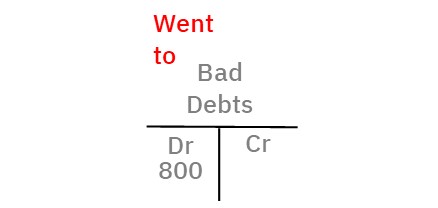

Ordinarily, you would debit bad debts expense at this point.

But you recorded bad debts earlier—when recording doubtful debts.

And the bad debts will have been recognized already—in a previous period.

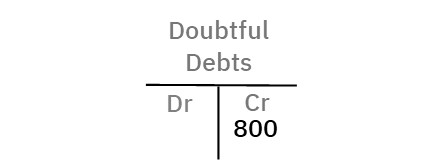

So here, all you need to do is show that the customer’s debt is no longer doubtful—because it has been written off.

To do this, you debit the allowance for doubtful debts account.

This shows you have transferred the customer’s debt to doubtful debts.

Once updated, the doubtful debts balance will show how much debt is still doubtful.

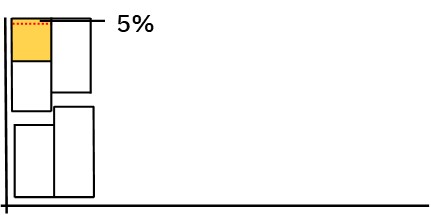

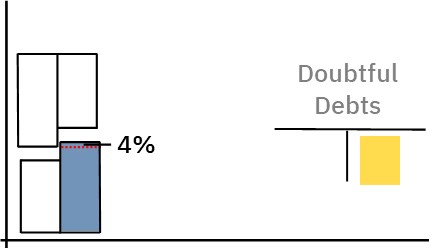

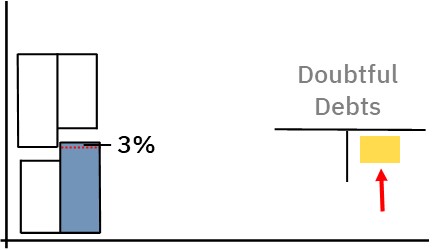

Over time, the balance of your doubtful debts account may steadily rise or fall.

This will happen if your estimate for bad debts is too high or too low.

To bring things into line, you will need to adjust your estimate.

Doing this will result in a more accurate reflection of bad debts expense.

© R.J. Hickman 2021