Amorization & Amortization Schedule

What is an Amortization Schedule?

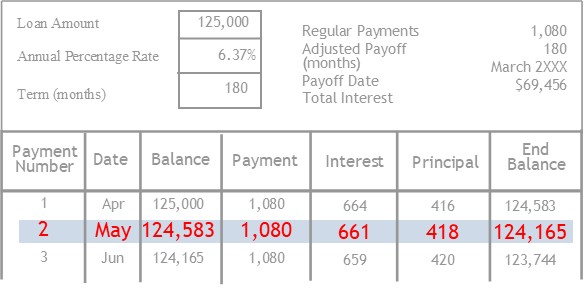

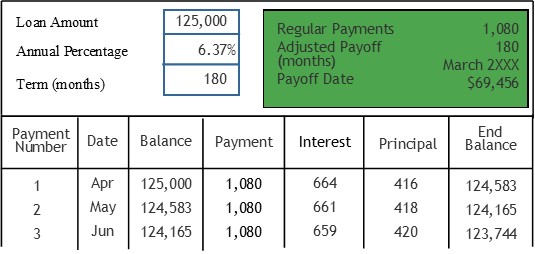

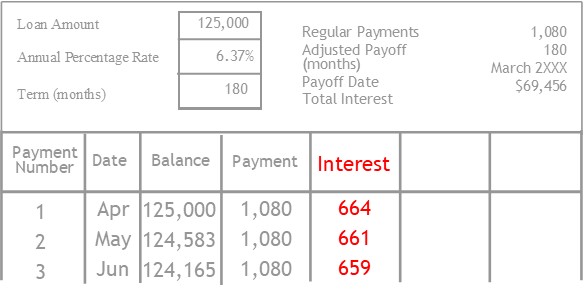

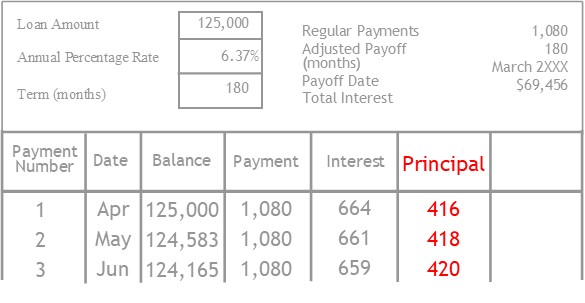

An amortization schedule is a multi-column table laying out the details of a loan.

What is Amortization?

As with depreciation, amortization refers to a loss of value over time.

Depreciation applies to tangible assets such as buildings and machinery.

Tangible assets are those you can see and touch.

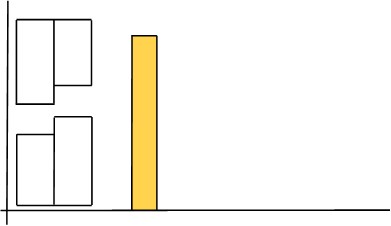

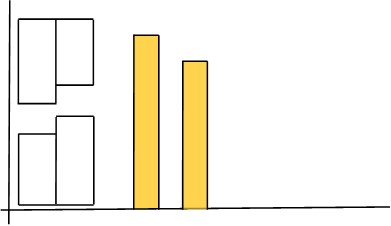

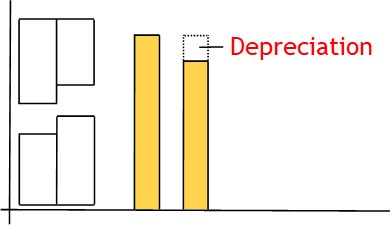

The asset starts off at a certain value—usually cost price.

Then, each year, it loses value.

The loss of value on a tangible asset is known as depreciation.

Amortization refers to intangible things, such as bonds and loans.

For example, a company may take out a loan.

Over time, the company will make principal payments and pay the load down.

The principal payments are a cost to the company.

They are just one of the costs necessary to create revenue each period.

As such, the payment needs to be shown as an expense for the period.

This way, it can be matched against the period’s revenue, thereby satisfying the matching principle of accounting.

Principal and Interest Payments

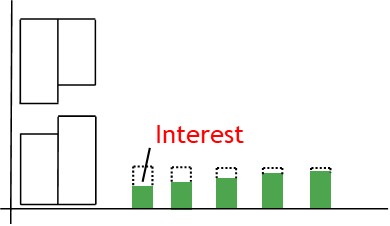

Along with principal payments, you need to record interest on the loan each period.

This way, you can show the total loan costs involved in generating revenue for the period.

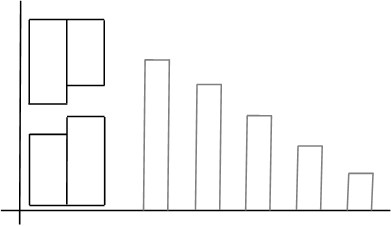

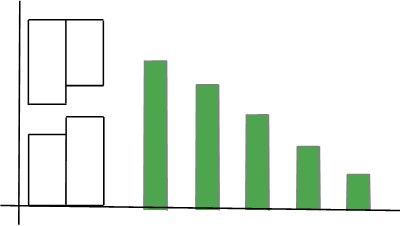

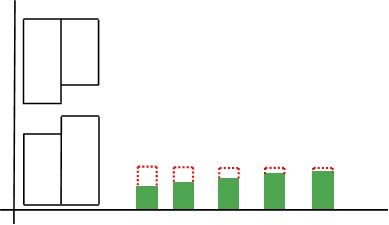

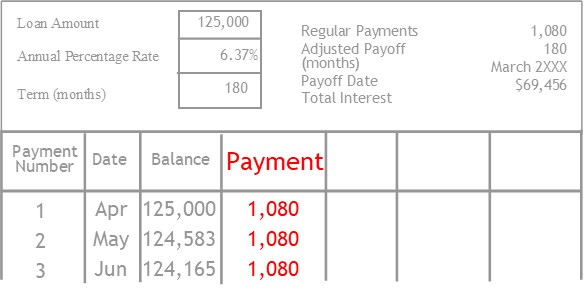

With principal and interest loan payments, the payment amount is the same each period.

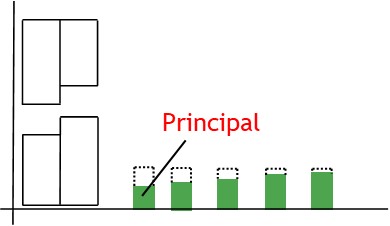

However, the principal and interest components of the payment vary.

The interest component starts off higher—and progressively gets lower.

While the principal component starts off lower—and progressively gets higher.

Amortization Schedule

To simply payments, you set up an amortization schedule when the loan is first taken out.

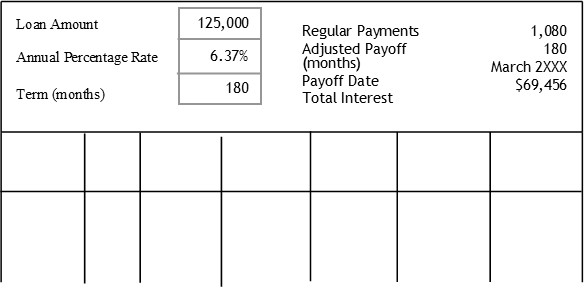

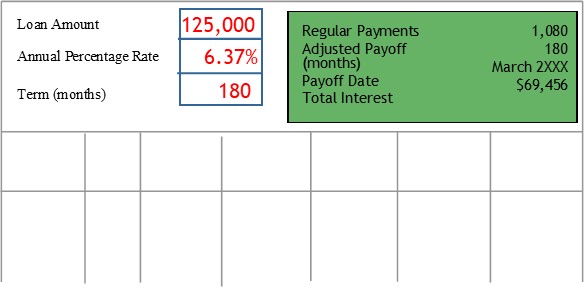

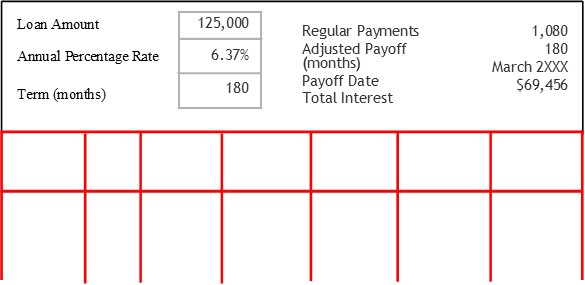

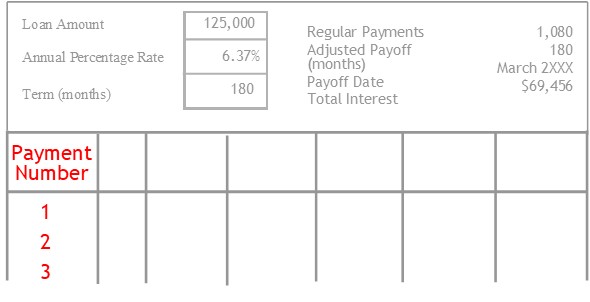

The amortization schedule lays out all the elements of the loan, including loan amount, rate of interest, term, payment amounts, and so on.

It is in a multi-columnar format showing details of each payment.

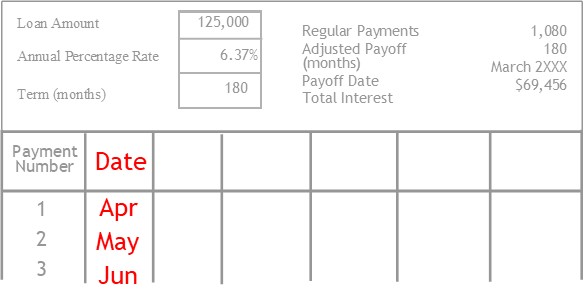

The payment number column shows what payment number the payment is.

The date column shows the date the payment was made.

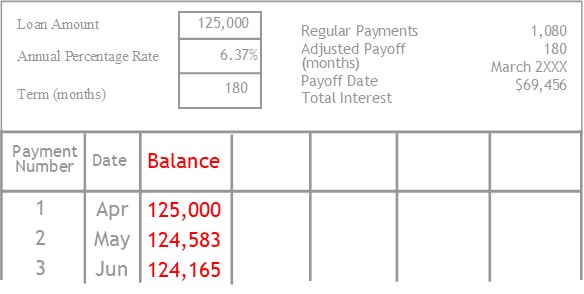

The balance column shows the loan’s balance before the payment was made.

The payment column shows the payment amount.

The interest column shows the interest component of the payment, which decreases over time.

The principal column shows the principal component of the payment, which increases over time.

Finally, the end balance column shows the loan’s balance after the payment is made.

As you come to each payment, you refer to the schedule for the payment details.