Annuity

What is an Annuity?

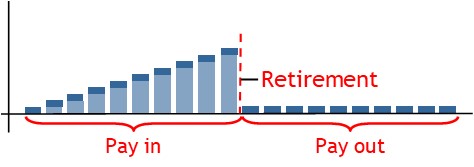

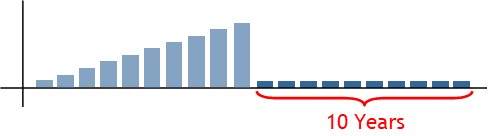

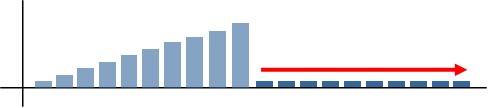

An annuity refers to the payment of regular amounts, such as a pension plan, where a person pays a certain amount in for a set time; then receives back a string of payments.

How it Works

An employee can take out an annuity, such as a defined benefit pension, with an insurance company.

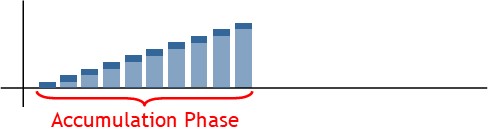

Here, the employee pays a certain amount into the plan on a regular basis.

They continue doing this until a predetermined point in time is reached.

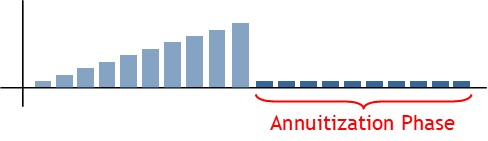

After this, the annuity pays a stream of payments.

It continues doing this until another point of time or situation is reached.

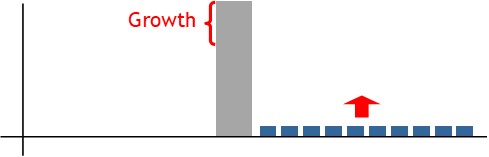

The period where payments are collected is referred to as the accumulation phase..

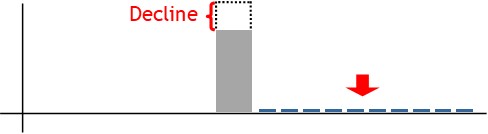

Once payouts begin, it is referred to as the annuitization phase.

Payout Options

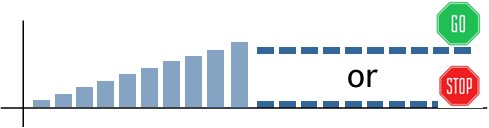

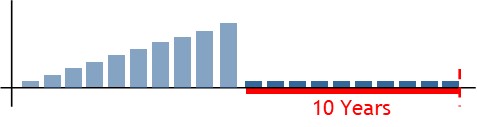

The annuitization phase can be structured in a couple of different ways.

For example, annuities can be arranged so that payments will continue for as long as the annuitant or their spouse is alive.

Alternatively, they can be structured to provide a stream of payments for a fixed period of time.

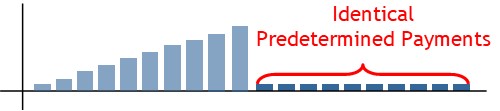

Fixed Annuity

A fixed annuity provides a regular, periodic payment to the annuitant.

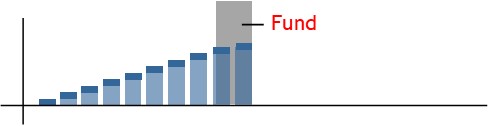

A variable annuity, on-the-other hand, has variable payout options.

Over the years, annuity payments are invested in a fund of some kind—equity, bonds, or property..

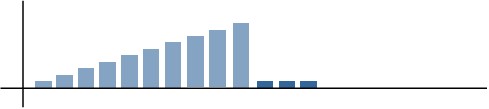

With a variable annuity, if the fund performs well, the payments will be high.

If the fund performs poorly, on-the-other hand, payments will be lower.

© R.J. Hickman 2020