Applied Overheads

Applied Overheads?

Applied overheads are costs that cannot be directly assigned to the cost object.

How it Works

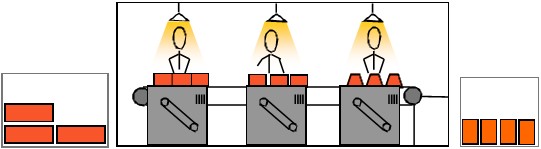

A manufacturer may have a client who is interested in buying a product.

The manufacturer will need to work out a quote for the client.

To do this, the manufacturer will need to estimate the costs involved.

In the end, the quote will include an estimate of the likely material costs.

It will also include direct labor costs.

Finally, it will include manufacturing overheads.

From these estimates, the manufacture will determine a unit cost price.

Based on this, they will come up with a quote.

If the client agrees to the quote, the manufacturer will go ahead and make the product.

Applied Overheads

Applied overheads are costs that are applied to a cost object—as opposed to using actual costs.

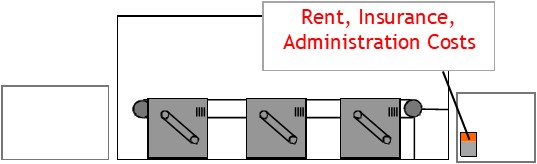

For example, to determine manufacturing overheads, you could calculate the amount of rent, insurance, administration costs etc used in the production of the product.

Problem is, this process requires a large amount of time and resources.

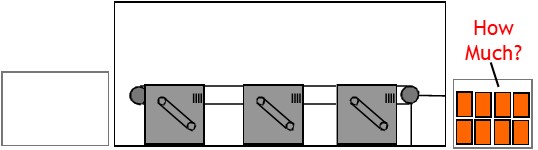

A quicker and easier option is to assign an applied cost.

For example, you could use a cost based on the number of machine hours required to produce the product.

Alternatively, you may base it on the number of employee hours necessary.

Calculating Applied Overheads

Applied overheads are a factory-wide costing, determined from the company’s records.

Once determined—you apply them to future costings as the need arises.

To calculate applied overheads, you find total cost of overheads for the entire factory for a period.

Then you divide this by the total number of machine hours used for the period.

This gives a factory-wide rate for indirect overheads of so much per machine hour used.

Applying Predetermined Overheads

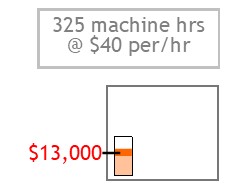

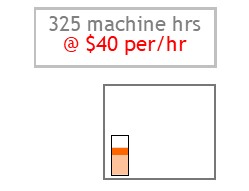

To apply the overheads, you estimate how many machine hours it will take to make the goods.

Then you multiply this by the calculated rate per machine hour.

This will show the total applied overheads for the goods.