Assigned Accounts Receivable

What are Assigned Accounts Receivable?

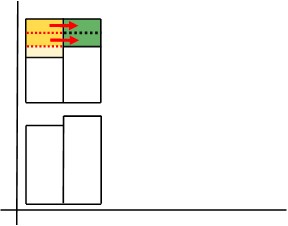

Assigned accounts receivable are accounts receivable that are pledged as collateral for a loan..

How it Works

A business may apply for a loan.

To secure the loan, the lender will usually require a fixed asset as collateral.

Sometimes, though, a business will not have fixed assets.

All they have is accounts receivable.

This is money customers owe to the business.

The lender may deem this to be acceptable collateral.

If so, the lender will set up an arrangement with the business.

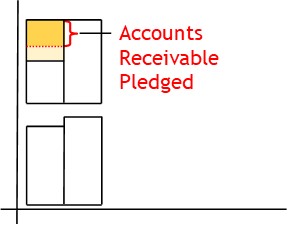

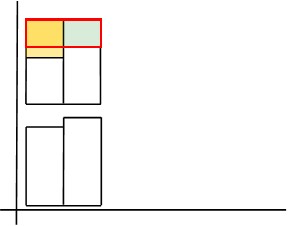

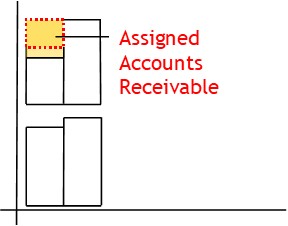

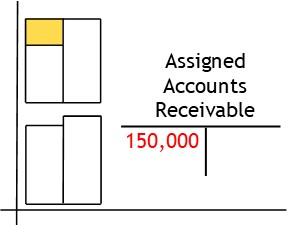

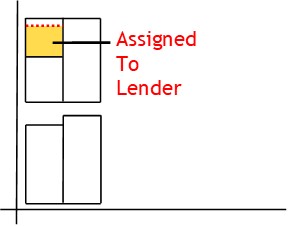

Under the arrangement, the business assigns a portion of the accounts receivable to the lender.

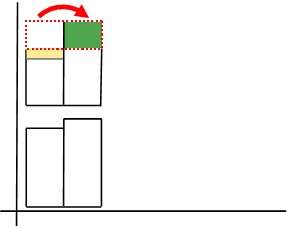

Should the business default on the loan, the lender will then make a claim on that portion of the accounts receivable..

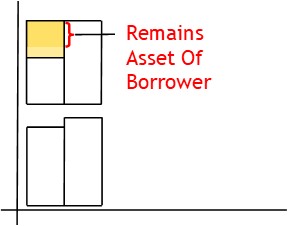

With this arrangement, the assigned accounts receivable aren’t sold or transferred to the lender.

Instead, the agreement simply gives the lender the right to collect the accounts receivable in the event of default.

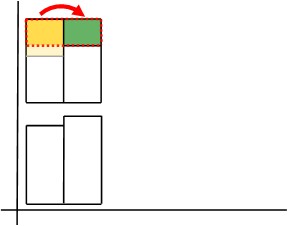

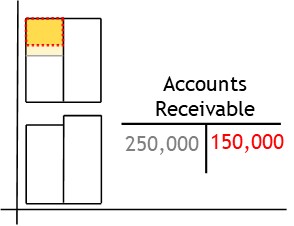

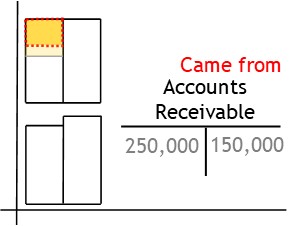

To record assigned accounts receivable, you credit the accounts receivable account.

This shows you are taking value from the account.

After this, you debit the assigned accounts receivable account.

This shows you have assigned the value to that account.

Agreement Types

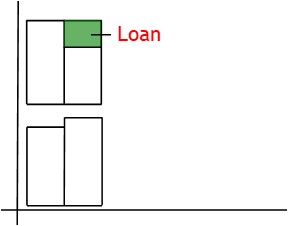

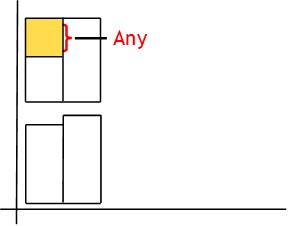

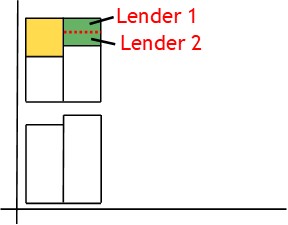

General Assignment

With general assignment, the lender can collect any accounts receivable.

This is suitable where there is one lender, only.

Not all customers will pay the business what they owe.

With general assignment, the lender can collect from other customers.

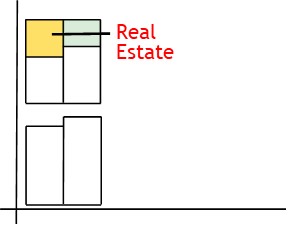

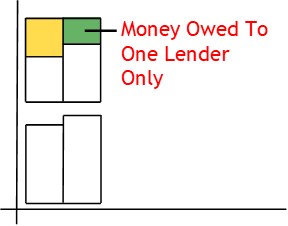

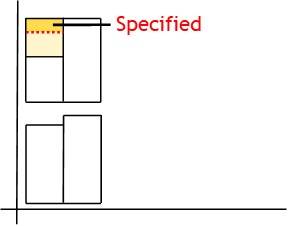

Specific Assignment

With a specific assignment, the lender can collect from specified accounts receivable, only.

This is a better arrangement for multiple lenders.

Lenders know in advance which accounts receivable they can collect—and which ones they can’t.