Average Accounts Receivable

What is Average Accounts Receivable?

Average accounts receivable is the average of a series of accounts receivable balances.

How it Works

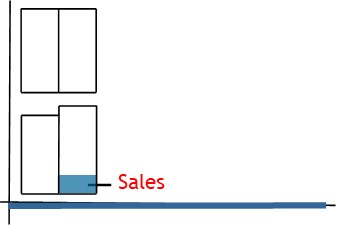

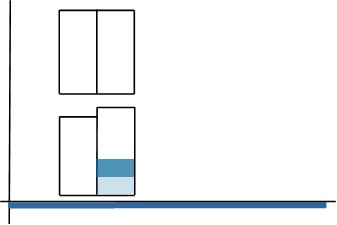

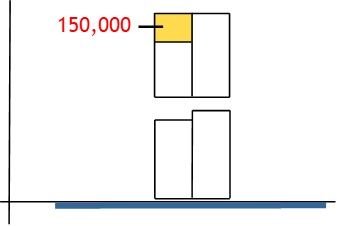

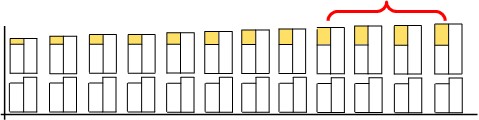

A business will sell goods and services on credit.

They record the debt owed for this in accounts receivable.

In time, some customers will pay what they owe.

At the same time, the business will make more sales on credit.

As before, the debt owed will be recorded in accounts receivable.

This process continually takes place throughout the year.

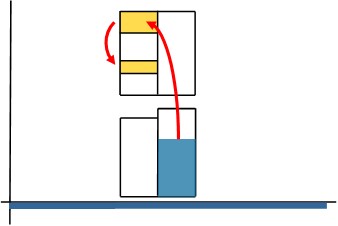

In the process, average accounts receivable will turn over so many times during the year.

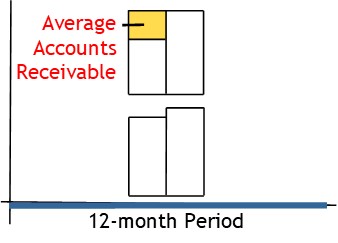

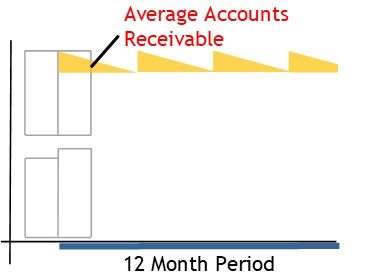

Average accounts receivable is the average amount of accounts receivable a company holds during a 12 month period.

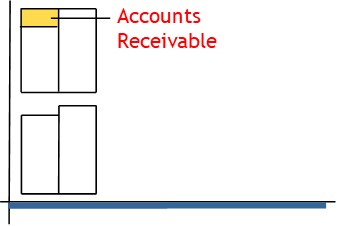

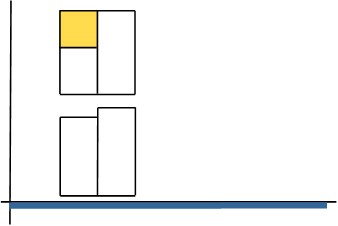

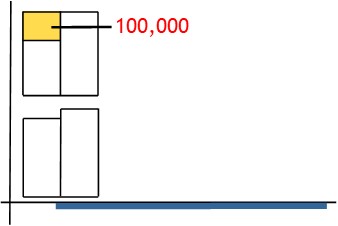

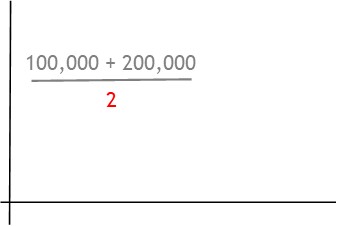

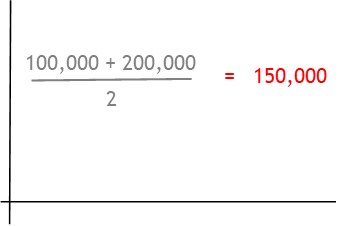

In its simplest form, it is calculated by taking accounts receivable at the beginning of the period.

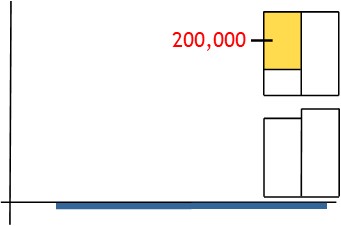

Add to this accounts receivable at the end of the period.

Then divide this total by 2

This will show average inventory for the period.

Different Ways to Calculate Average Accounts Receivable

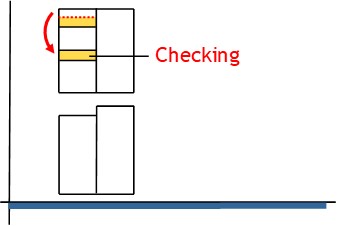

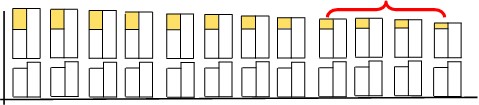

If the business is growing quickly, find the average of balances for the last few month, only.

Do the same if the business is quickly declining.

If the business is highly seasonal, find the average the closing balance of each month in the past 12 months.

© R.J. Hickman 2020