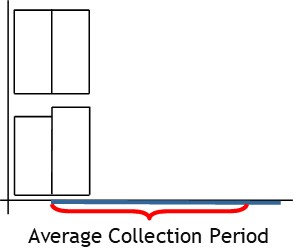

Average Collection Period

What is an Average Collection Period?

The average collection period is the average time it takes for customers to pay what they owe.

How it Works

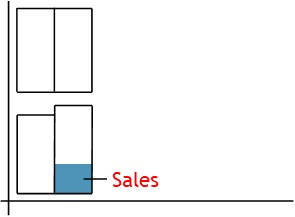

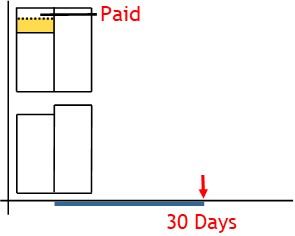

A business will sell goods and services on credit.

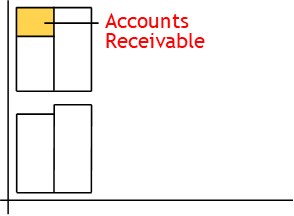

The business will record the debt owed for this in accounts receivable.

By doing this, the business is allowing customers time to pay.

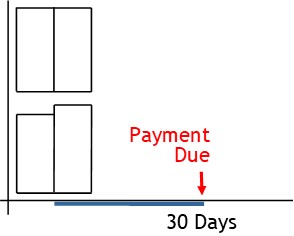

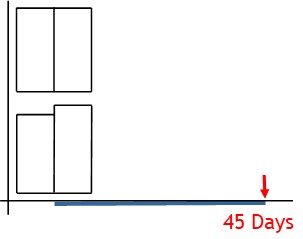

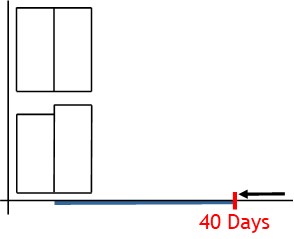

Some customers will pay on time.

Others will take longer.

The sooner all customers pay, the better.

This means the business will have enough money available to meet their financial obligations.

Calculating Average Collection Period

To keep an eye on the situation, management and analysts monitor the average collection period, closely.

Average collection period is the average time it takes to collect customer payments during the period.

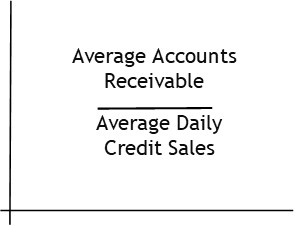

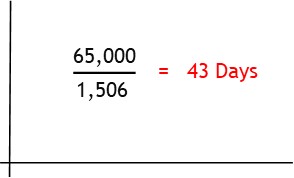

One way to calculate this is to divide average accounts receivable by daily credit sales.

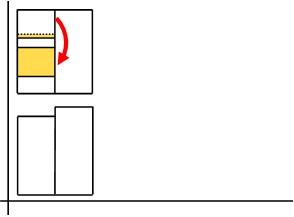

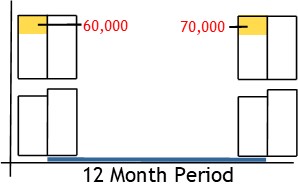

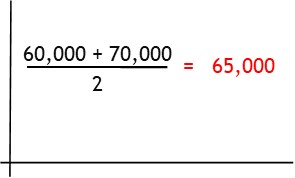

Begin by calculating average accounts receivable.

Add beginning accounts receivable to ending and divide by 2.

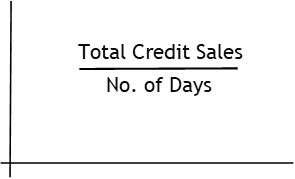

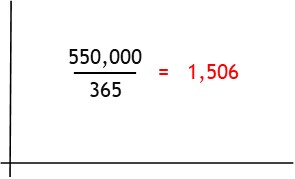

Next, find average daily credit sales for the period.

Here, divide total credit sales by 365.

Now calculate the average collection period.

© R.J. Hickman 2020