Average Weighted Cost of Capital

What is the Average Weighted Cost of Capital?

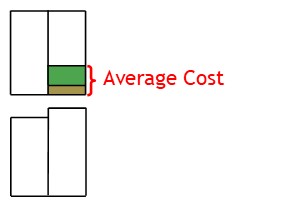

The average weighted cost of capital is the average after tax cost of debt and equity.

How it Works

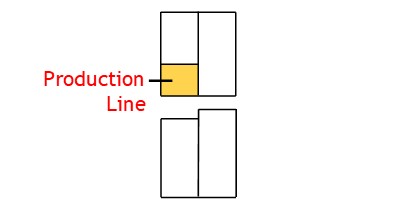

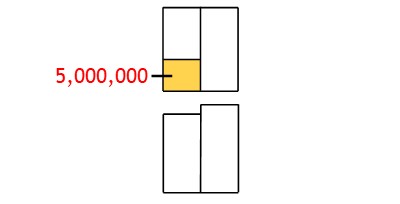

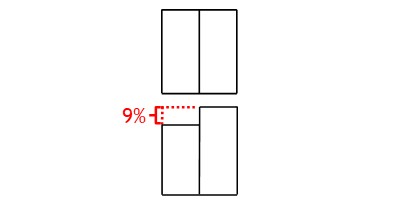

A company may be planning a project.

This project will cost a certain amount to build or install.

Then, once built or installed, it will return a certain amount of profit, each year.

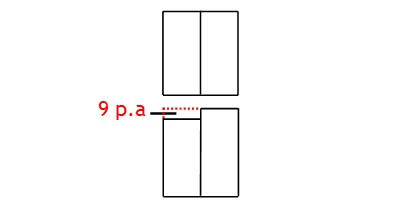

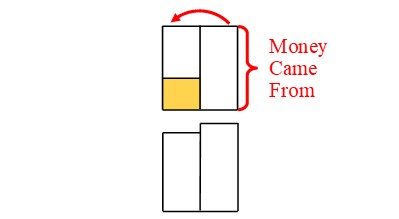

The company will need to fund the project somehow.

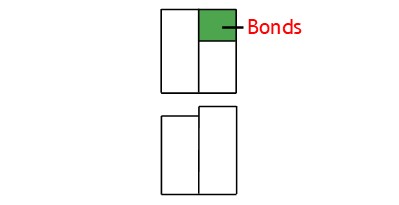

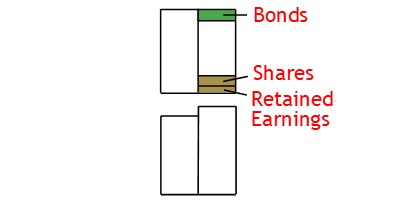

To do this, it may issue debt.

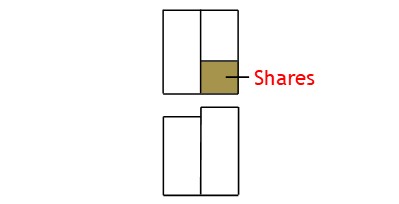

Alternatively, it may issue stock.

It may even fund the investment in part with retained earnings.

Often, though, it will use a mix of these.

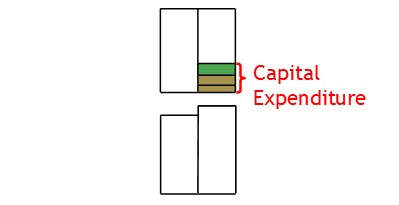

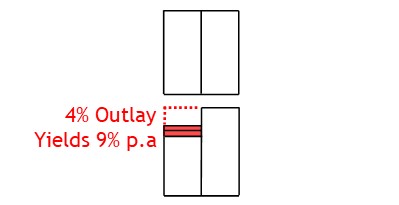

When considering the project, management will determine whether a project is worth the capital expenditure.

To do this, they begin by finding the cost of the capital invested.

Here, they find the weighted average cost of the capital.

Then they compare this to the expected return on investment.

If the return is favorable, they will go ahead with the project.

Calculating Weighted Cost of Capital

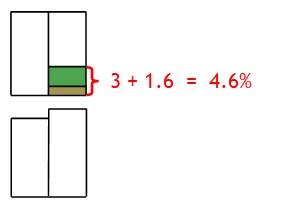

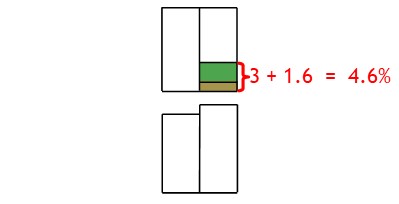

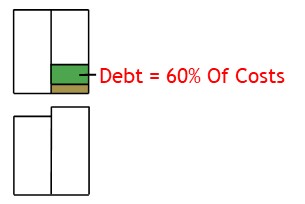

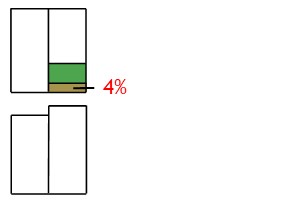

When calculating the average weighted cost of capital, you begin by calculating the cost of the debt portion.

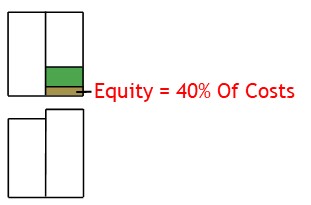

Then calculate the cost of the equity portion.

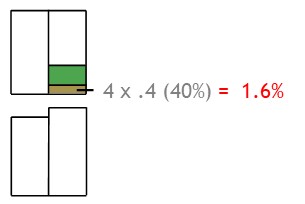

Once calculated, you add the two costings together to arrive at an overall average.

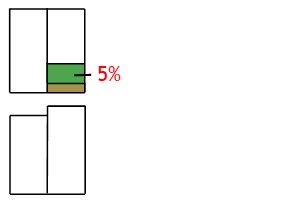

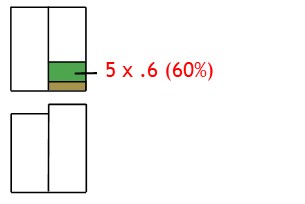

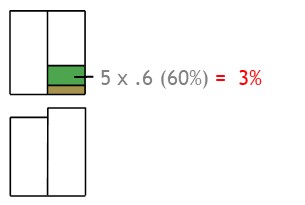

So first, you take the interest rate on the debt.

Then multiply this by the debt portion.

This will show the debt’s portion of total costs.

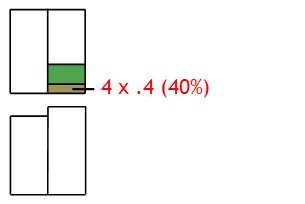

Next, take the dividend cost.

Then multiply this by the equity portion.

This will show the debt’s portion of total costs.

Now add the costs together to arrive at an overall average cost.