Balance Sheet Accounts

What are Balance Sheet Accounts?

A balance sheet account is an account found in the balance sheet area of the accounts.

How it Works

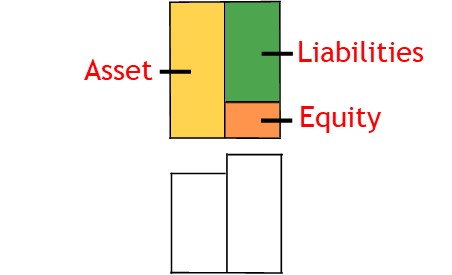

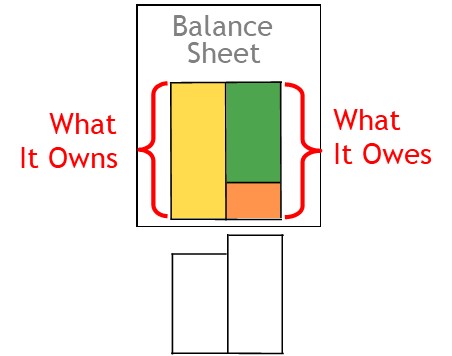

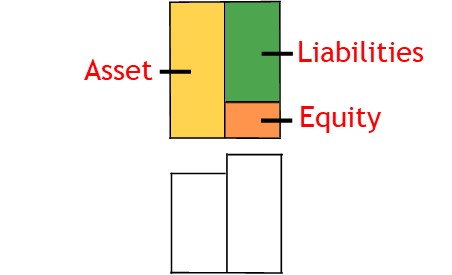

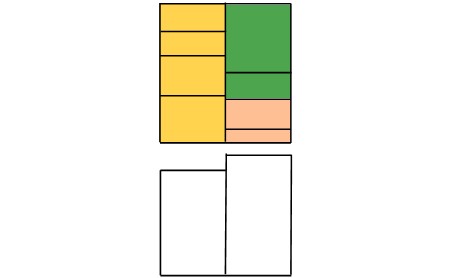

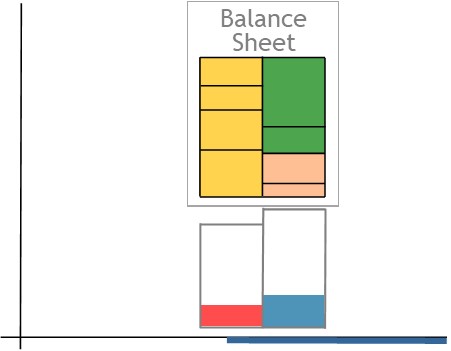

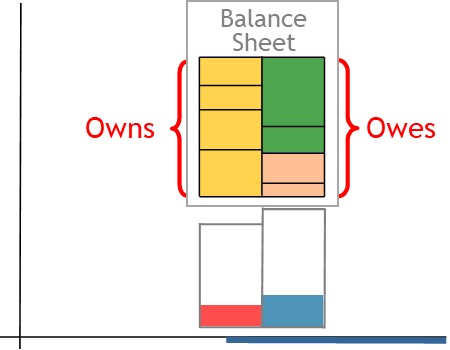

The balance sheet shows what a business owns verses what it owes.

To do this, the balance sheet has three classes of account.

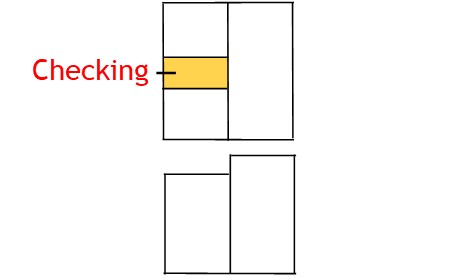

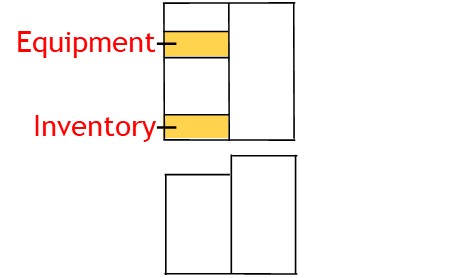

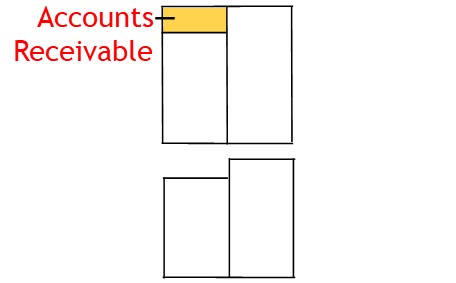

Asset Accounts

Asset accounts show things the business owns.

This includes money the business holds in the bank.

It also includes tangible assets like equipment and inventory.

Asset accounts also show money owed to the business by customers.

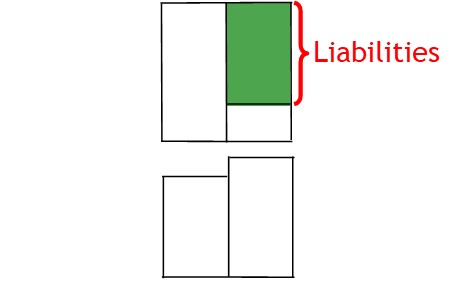

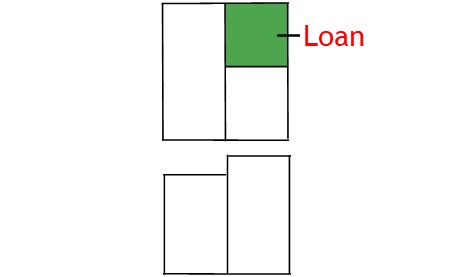

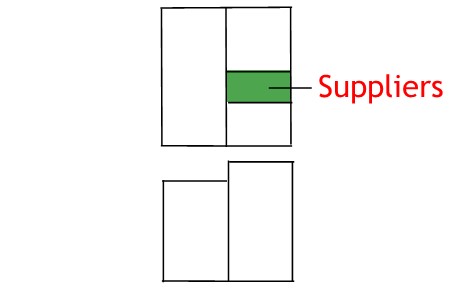

Liability Accounts

Liability accounts show money owed to others.

For example, a loan account shows money owed to a lender.

Supplier’s accounts show money owed to suppliers.

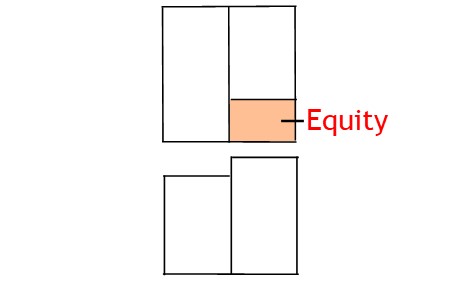

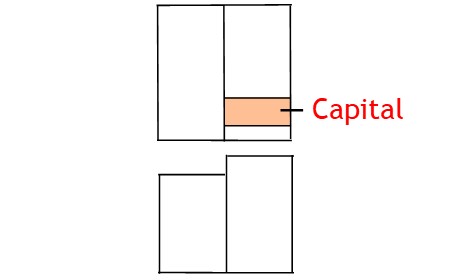

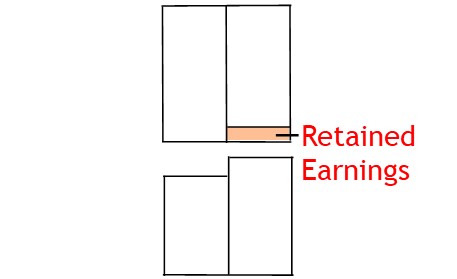

Equity

Equity accounts show money owed to the owner and shareholders.

For example, the capital account shows capital the owner and/or shareholders have invested in the company.

The retained earnings account shows profit the company has acquired over time.

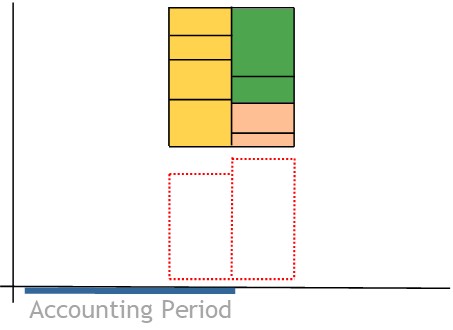

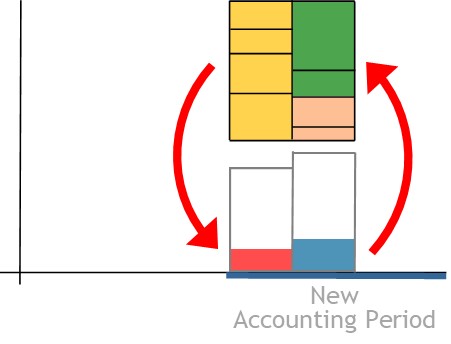

Asset Accounts are Permanent Accounts

The accounts that make up the balance sheet are classified as permanent or real accounts.

Unlike income statement accounts, they are not closed out at the end of the accounting period.

Instead, they are continually updated with transactions in following accounting periods.

This way, a balance sheet can be prepared at any time.

It provides a snap shot of what the business owns versus what it owes at that time.

© R.J. Hickman 2020