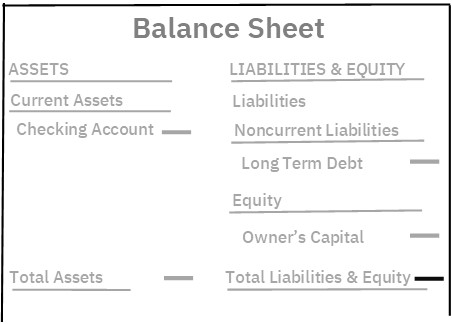

Balance Sheet

Balance Sheet

During an accounting period, a business will generate financial information.

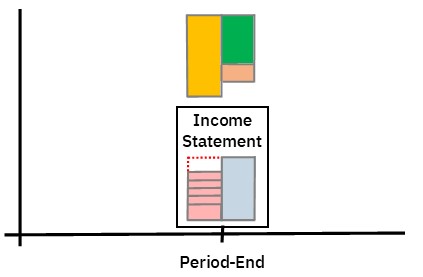

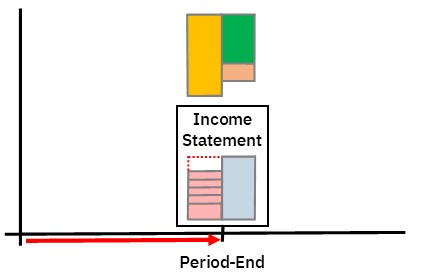

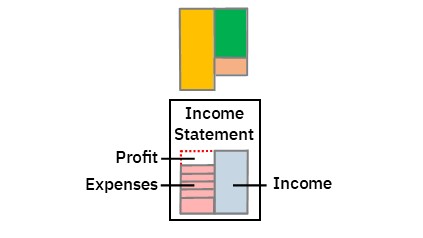

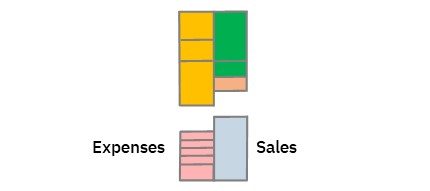

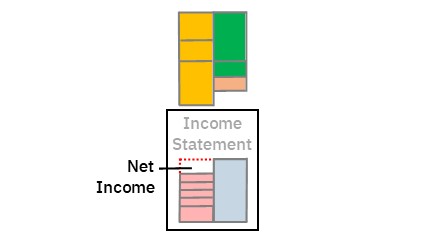

At the period-end, you take this information and prepare an income statement.

The income statement is a report showing how the business performed during the period.

To do this, it shows income, expenses and profit.

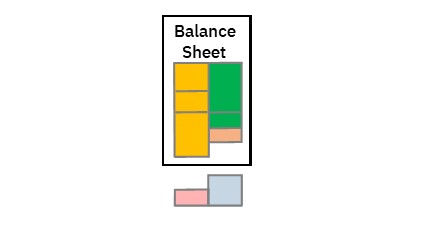

At the same time, you prepare a balance sheet

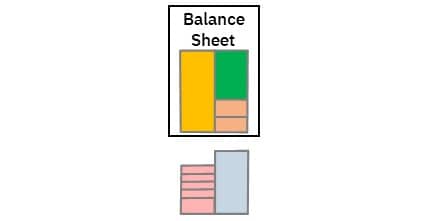

To understand this report, it helps to see how it is formed.

How a Balance Sheet is Formed

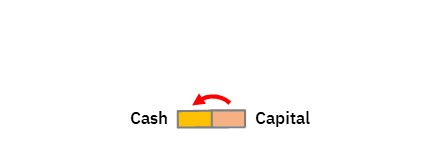

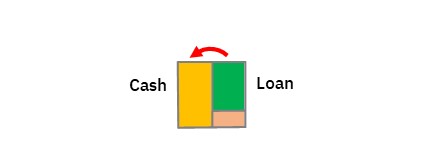

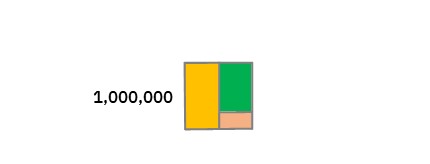

When starting a business, the business owner may invest some of their own capital.

The business owner would deposit this money in the business’s bank account.

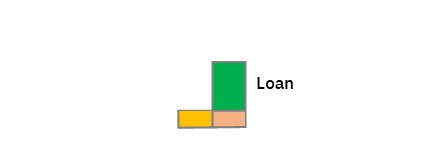

At the same time, the business owner may borrow money from a friend or relative.

The business owner would deposit this money in the bank, as well.

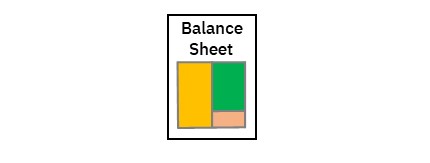

You could create a balance sheet, right here.

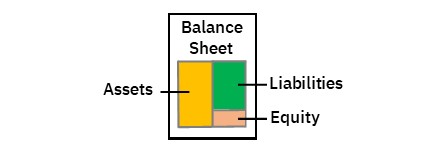

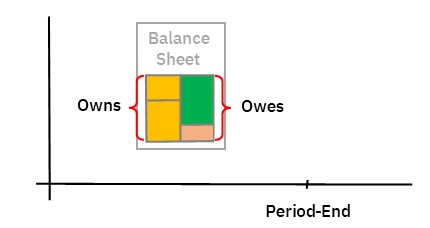

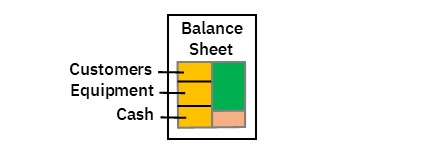

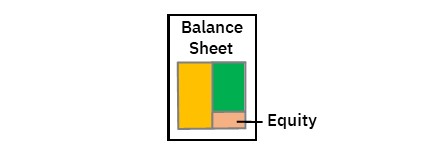

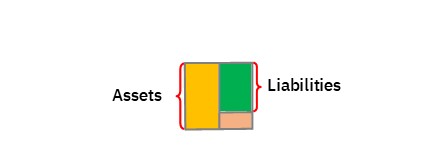

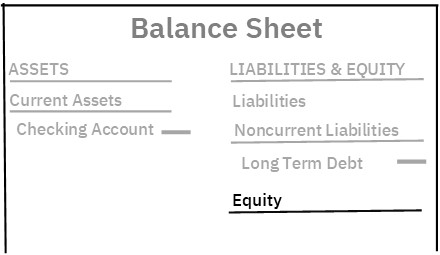

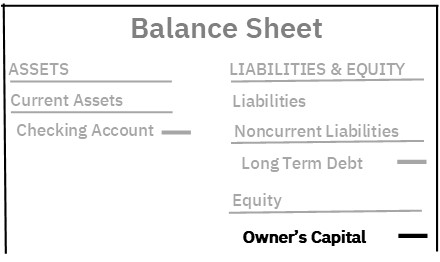

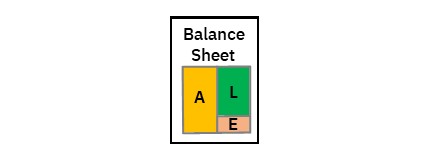

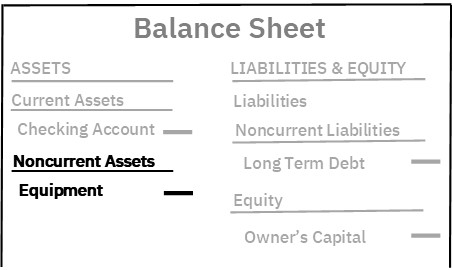

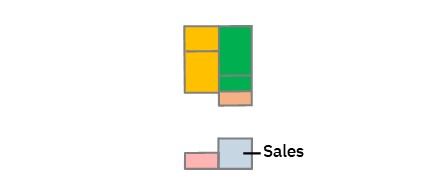

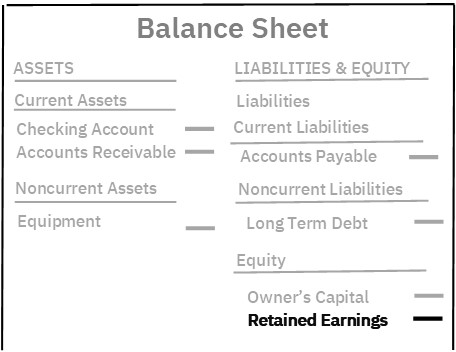

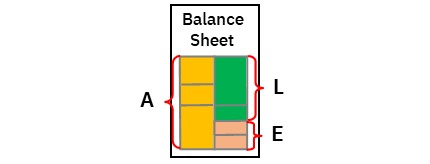

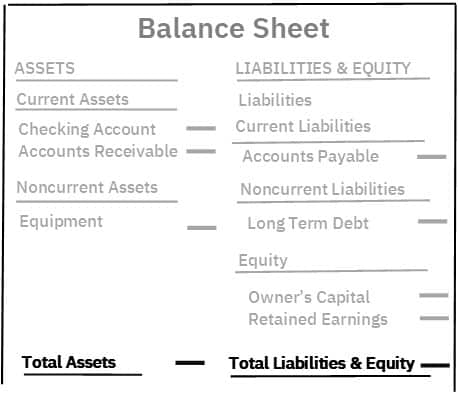

A balance sheet shows a business’s assets, liabilities, and equity.

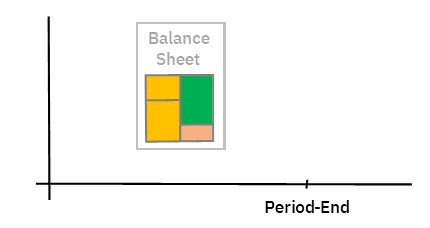

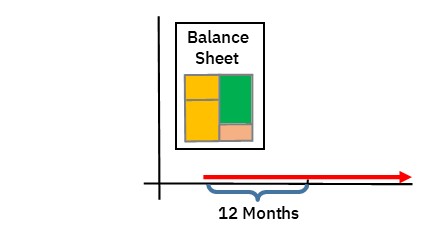

It is usually prepared at period-end, but it can be prepared at any time,

No matter when it is prepared, it will provide a snap shot of what the business owns and what it owes at that point in time.

This is how you track changes in what the business owns or what is owed to it

It also allows you track changes in what is owed to others

This helps you keep track of how much money is now owed to the owner

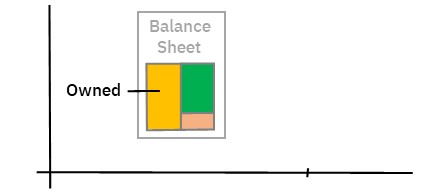

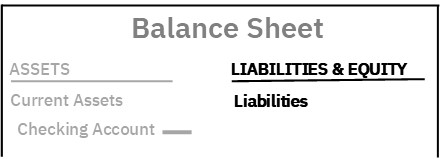

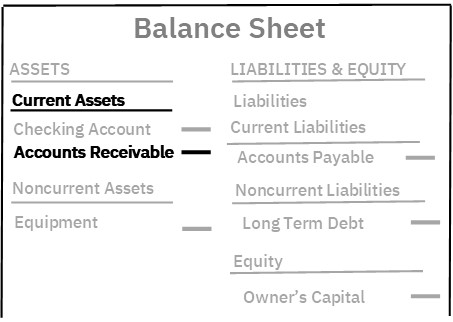

Assets

Assets include cash, things owned, and money owed to the business.

This is the first thing to be shown on a balance sheet.

Cash held at the bank is known as a current asset.

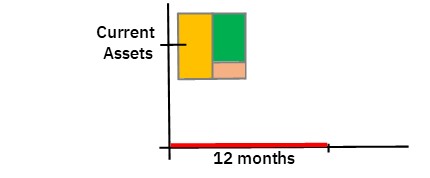

Current assets are either cash or things that can be turned into cash with the coming year.

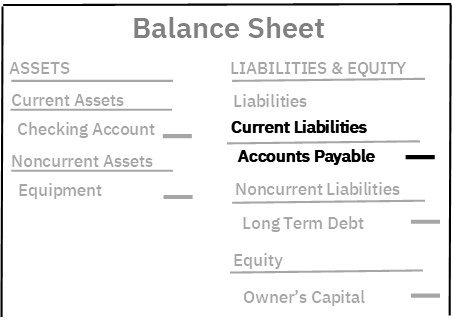

Liabilites

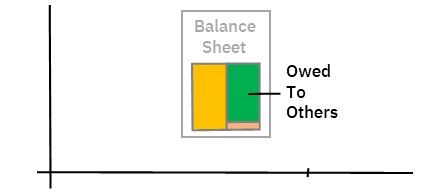

The balance sheet also shows liabilities.

Liabilities show money owed to others, for loans and so on.

On the balance sheet, they are shown in the liabilities & equity section

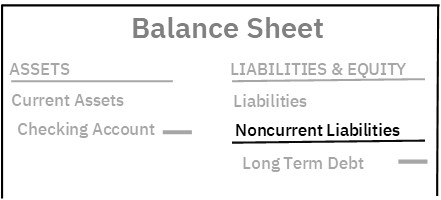

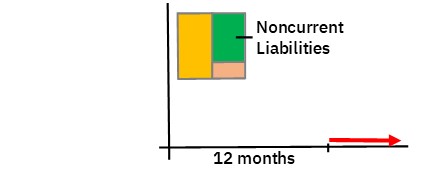

If the loan is a long term loan, you list it as a noncurrent liability.

Noncurrent liabilities are expected to be repaid in a year or more.

Equity

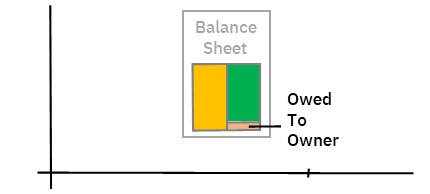

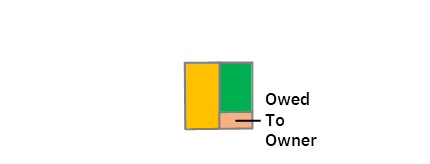

The balance sheet also shows equity.

Equity is the difference between assets & liabilities.

It shows how much money the business owes to its owners or shareholders

Theoretically, the business could cash out its assets.

Then it could use this money to pay back any loans etc.

Any money left over would belong to the owner.

Equity is shown in the equity area of the balance sheet.

You list any capital injections under owner’s capital.

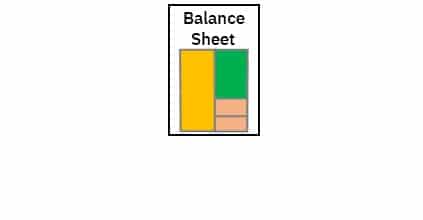

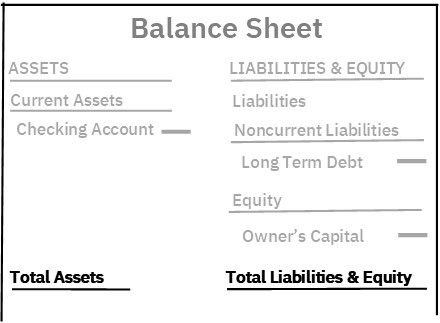

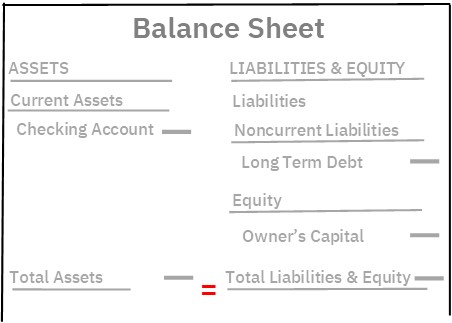

If updated correctly, the balance sheet should balance.

You test for this with the formula Assets = Liabilities + Equity

First, you add up the asset side of the balance sheet.

Then you add up the liabilities & equity side.

If correct, the two sides will be equal.

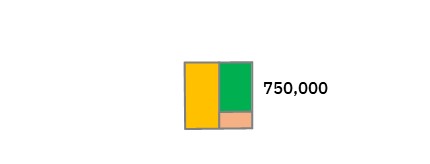

After this, the business owner may use some of the cash to buy equipment.

Once again, you could prepare a balance sheet.

In this case, you would list the equipment as a noncurrent asset.

This is because you expect the equipment to last longer than a year

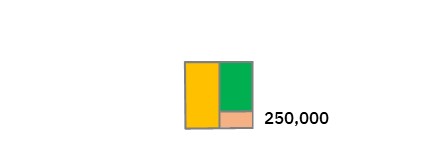

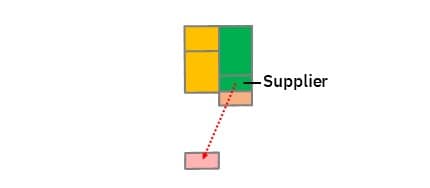

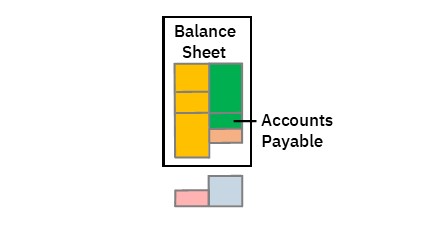

Next, the business may buy goods to sell

If purchased on credit, the goods would come from a supplier.

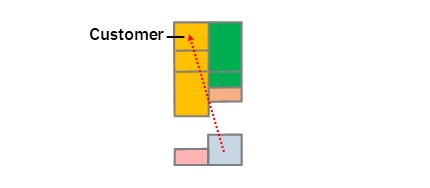

The business may then sell some of these goods.

If sold on credit, you record the sale in the customer’s account.

At this point, you could prepare yet another balance sheet.

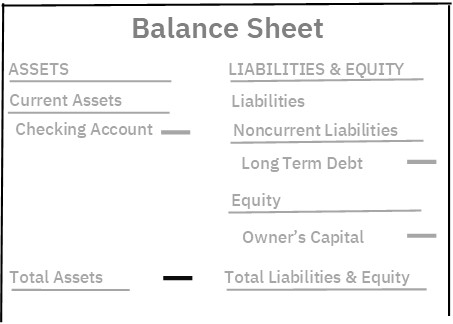

Suppliers are known collectively as accounts payable

You list accounts payable under current liabilities.

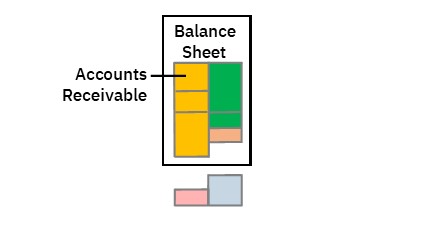

Customers are know as accounts receivable.

You list accounts receivable as a current asset.

After this, the business will add more sales & expenses for the period.

At period-end, you prepare an income statement.

The income statement shows net income or profit for the period.

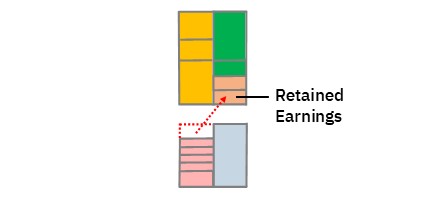

This profit is transferred to retained earnings via income summary.

Retained earnings are shown in the equity section of the balance sheet.

If calculated profit is correct, assets will equal liabilities + equity

This means the balance sheet will balance.

© R.J. Hickman 2020