Bank Overdraft

What Does Bank Overdraft Mean?

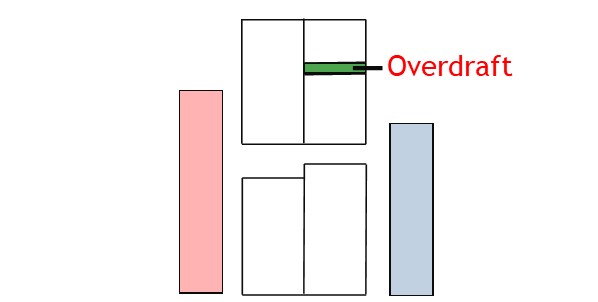

A bank overdraft is when the bank account has a negative balance.

How it Works

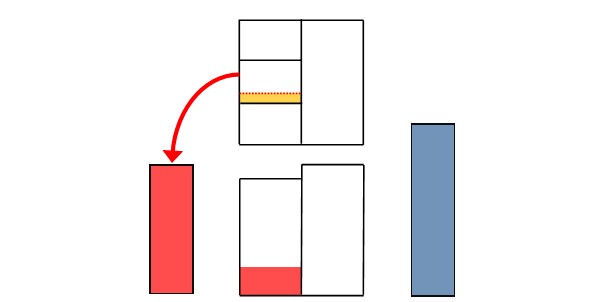

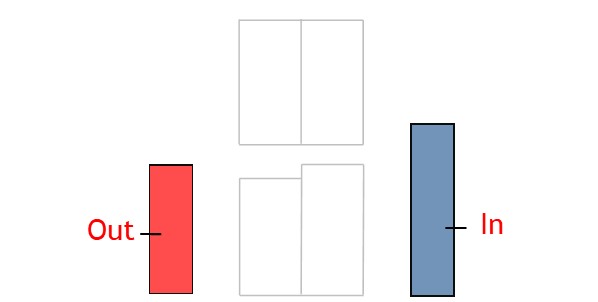

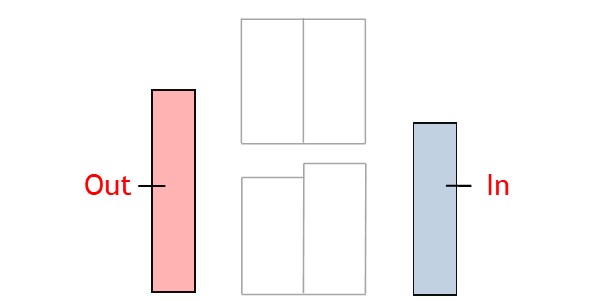

A business will receive cash from sales and customers payments etc.

The business will deposit this money in the bank.

The business will also make cash payments.

Here, the business withdraws money from the bank to pay for expenses.

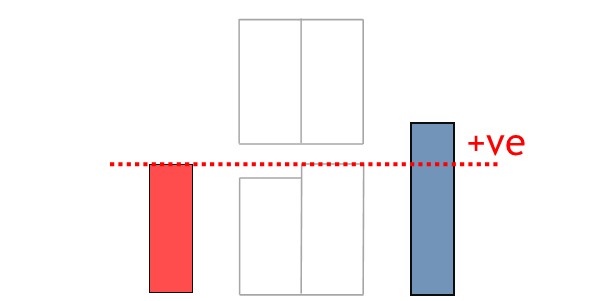

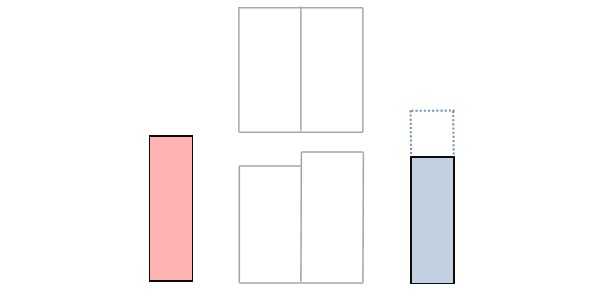

Most of the time, the business will receive more money than it pays out.

This results in a positive balance.

In other words, there are sufficient funds in the checking account to cover expenses and other payments.

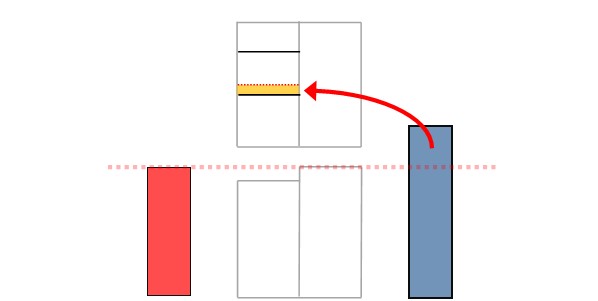

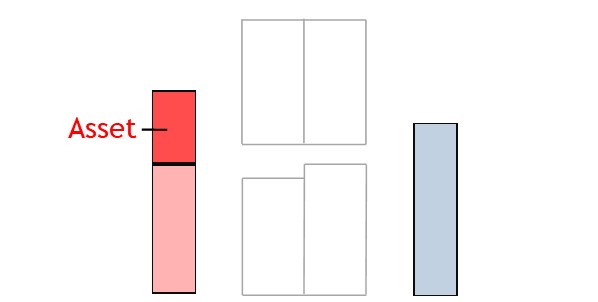

Sometimes, though, a business will acquire a large asset.

Or customers may be slow paying what they owe.

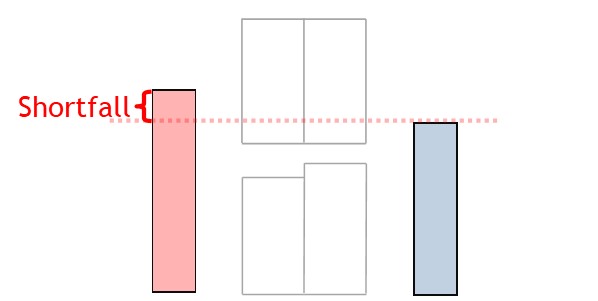

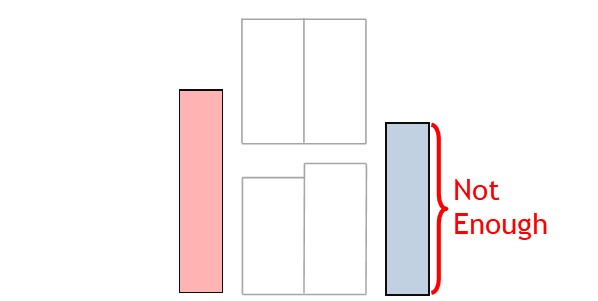

Such things can result in outgoings being more than incomings.

This means withdrawals will be greater than deposits.

The shortfall will result in a negative bank balance.

This is known as being overdrawn.

In other words, the business has insufficient funds in the bank to cover withdrawals.

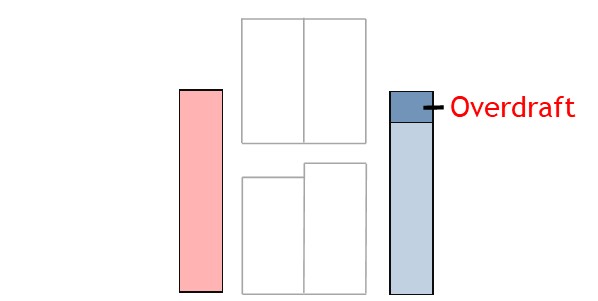

To cover the shortfall, the bank usually offers an overdraft.

This is like a temporary loan.

© R.J. Hickman 2020