Bank Reconcilation

What is a Bank Reconciliation

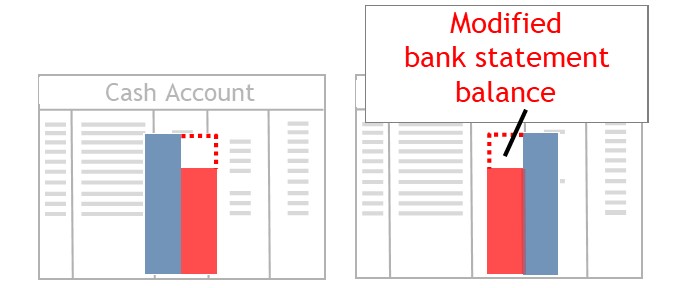

A bank reconciliation modifies the bank statement’s balance so it is compatible with that of your records.

How it Works

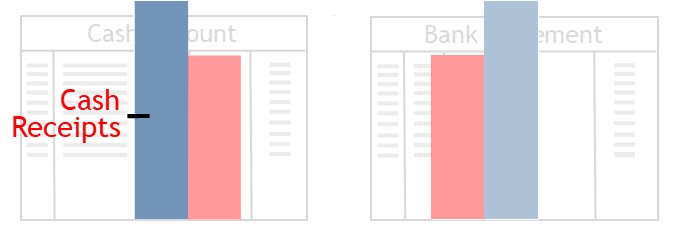

During the month, you record cash transactions in the business’s records.

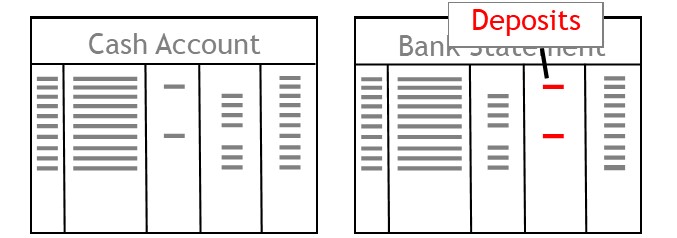

That is, you record cash receipts.

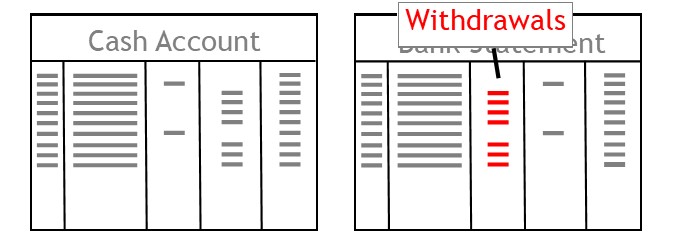

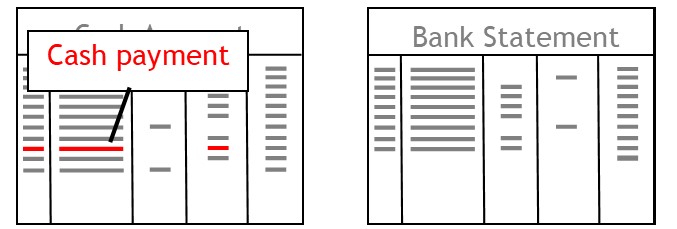

And you record cash payments.

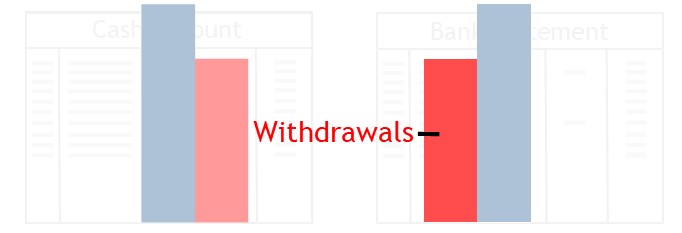

These transactions will also appear in the bank statement.

The cash receipts will appear as deposits.

And the cash payments will appear as withdrawals.

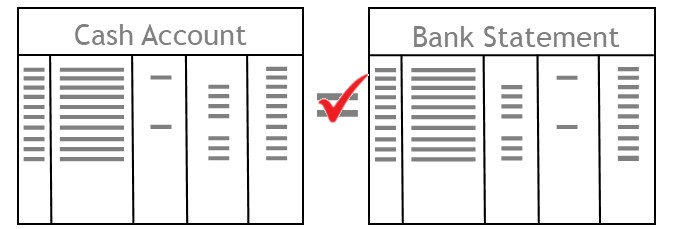

If your record of transactions is correct, they should agree with the bank’s record of them.

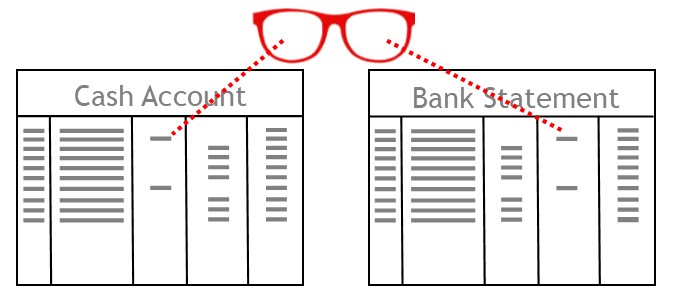

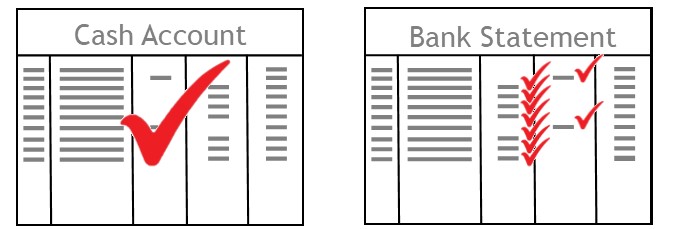

To make sure this is the case, you check the records against one another.

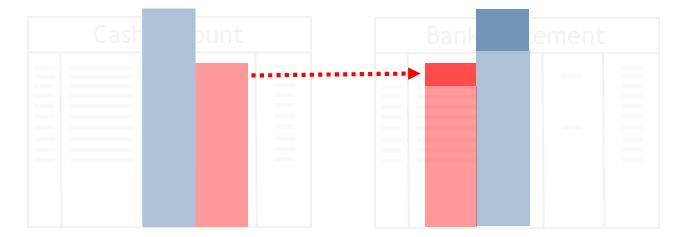

In the days of manual accounting, you did this manually.

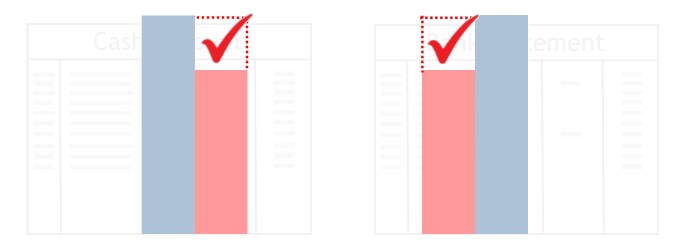

You checked your records against the bank statement — one transaction at a time.

Eventually, you would check all of your transactions.

Theoretically, if each transaction agreed, then your records should be correct.

The problem was it was very easy to make a mistake while checking your records.

You may have ticked something as being correct.

But the transaction was not correct, at all.

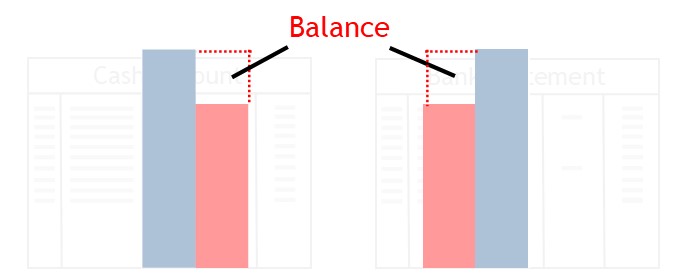

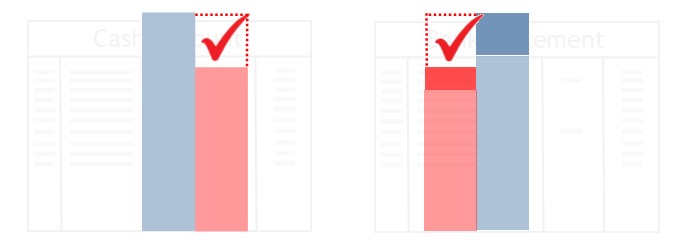

So after checking individual transactions, you need to double check your work.

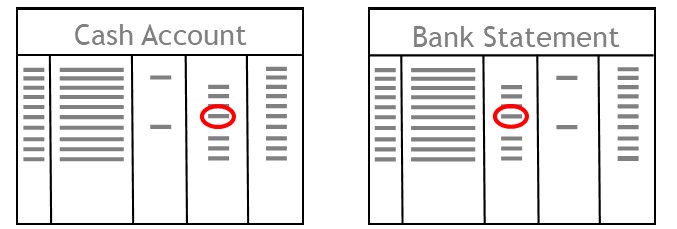

You do this by comparing balances.

If the records are identical, the closing balances should be identical, as well.

More often than not, though, the balances will not agree.

Reasons Balances Don’t Agree

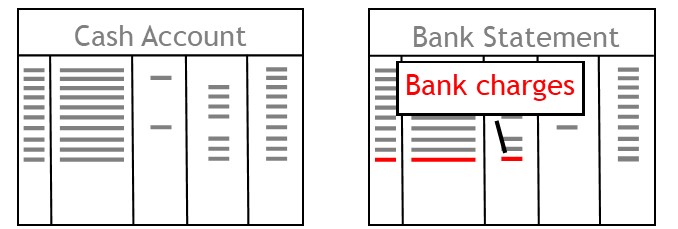

Bank Charges

The bank statement will show a withdrawal for bank charges.

As this is the first you know of them, your records won’t show a corresponding cash payment.

So you need to record bank charges in your records.

Having made the corrections, you compare balances again.

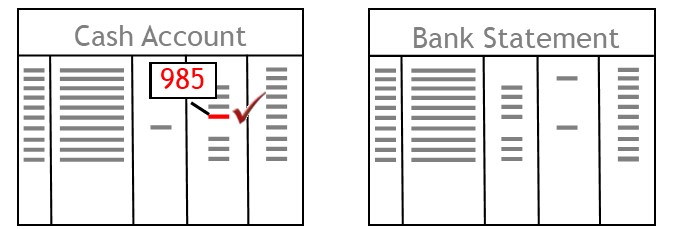

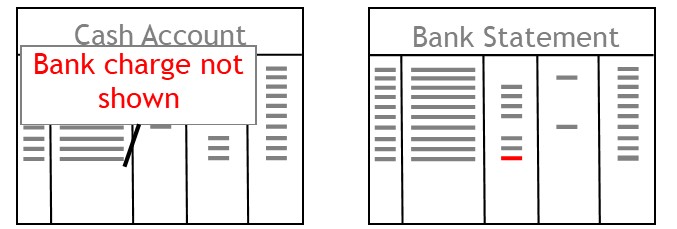

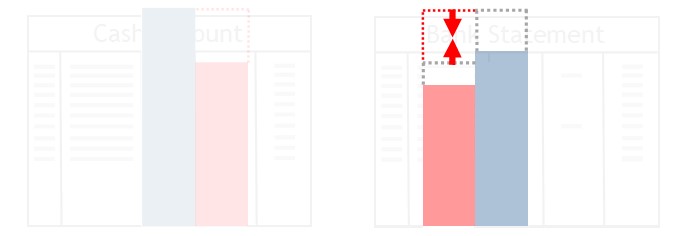

Deposits in Transit

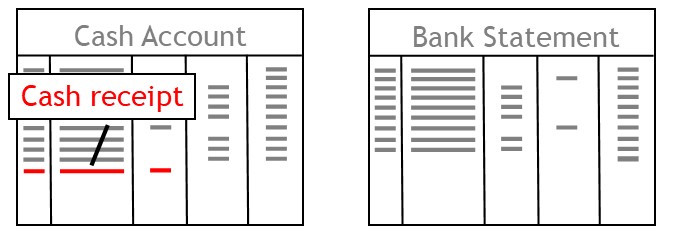

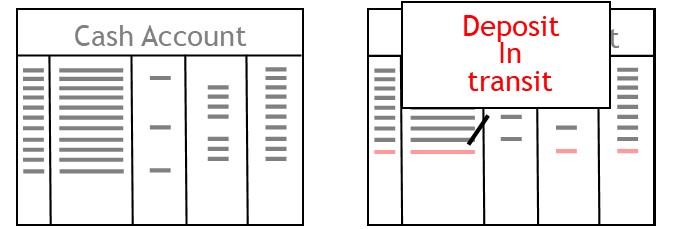

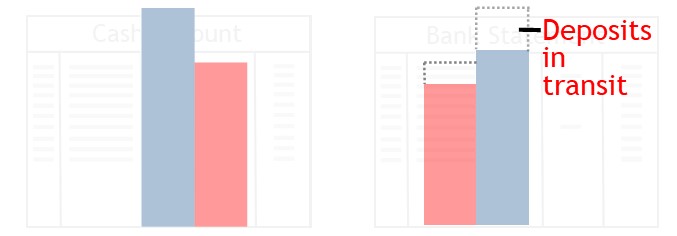

If balances still don’t agree, the reason could be that your records show a cash receipt.

But the bank statement doesn’t show a corresponding deposit.

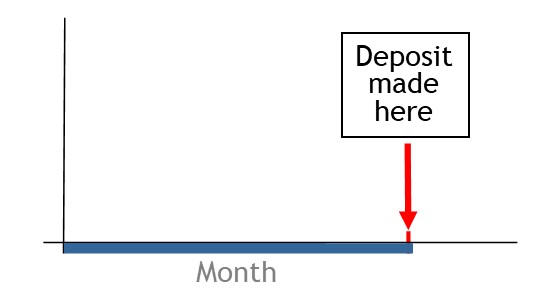

The reason for this was that the business deposited money late in the month.

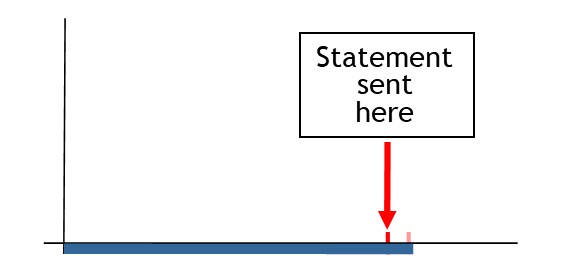

But the bank had already prepared your statement by then.

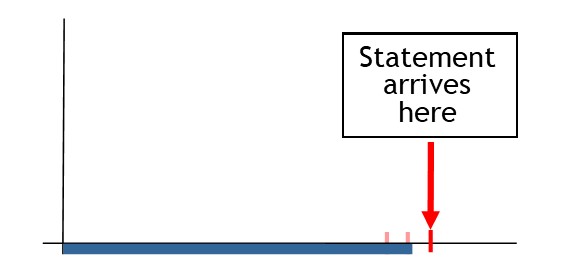

So when your statement arrives, it won’t show the deposit.

In this case, the deposit is known as a deposit outstanding or deposit in transit.

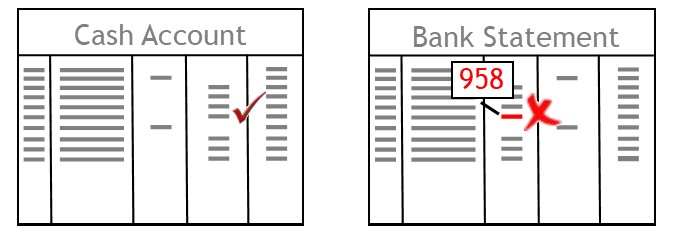

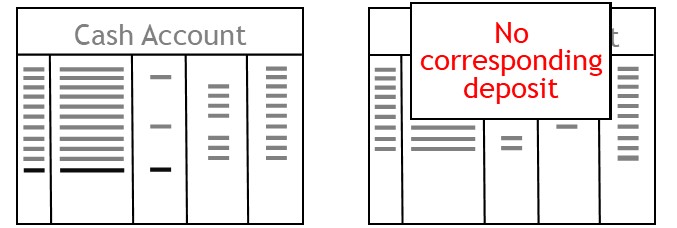

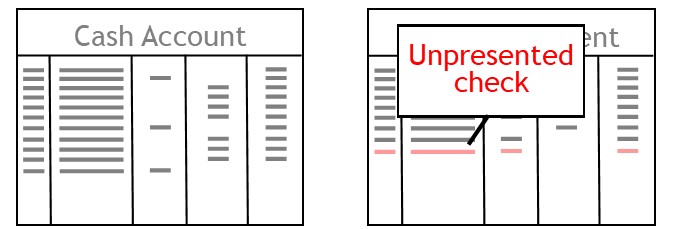

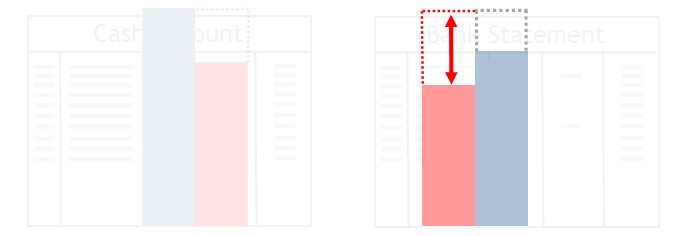

Unpresented Checks

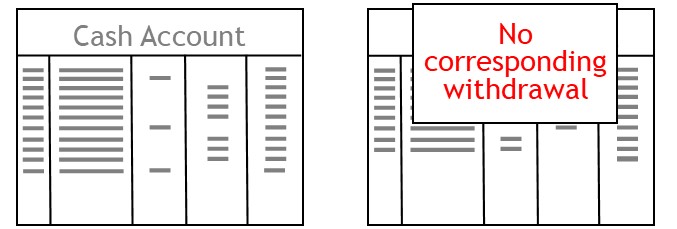

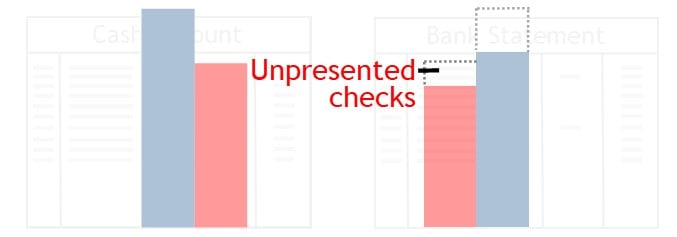

Another reason the balances may not agree is because your records show a cash payment.

But the bank statement doesn’t show a corresponding withdrawal.

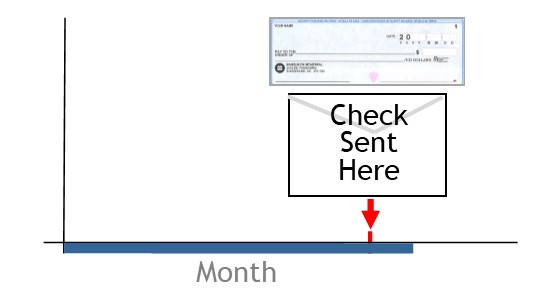

The reason for this is the business paid for something with a check.

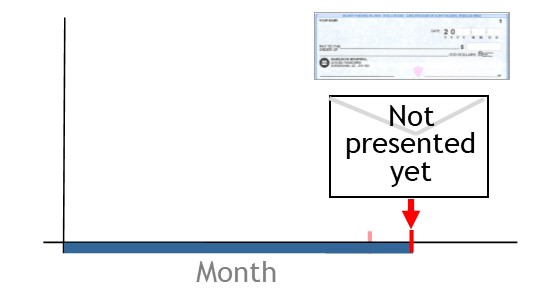

But the check’s recipient is yet to present the check to the bank for payment when the statement was prepared.

In this case, the check is known as an un-presented check.

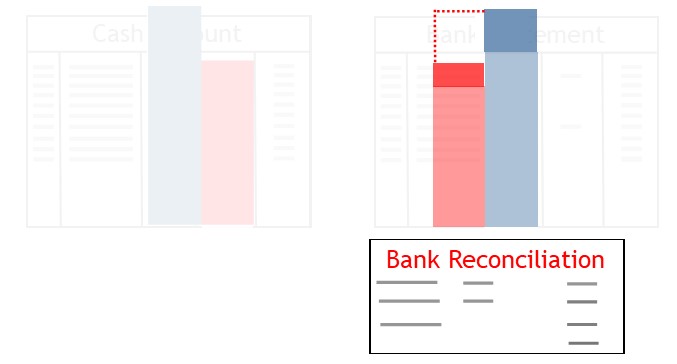

Bank Reconciliation

Recapping – Showing the Process a Different Way

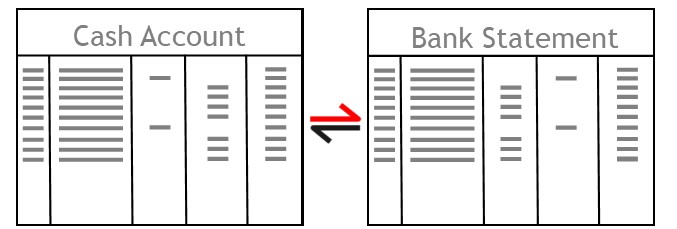

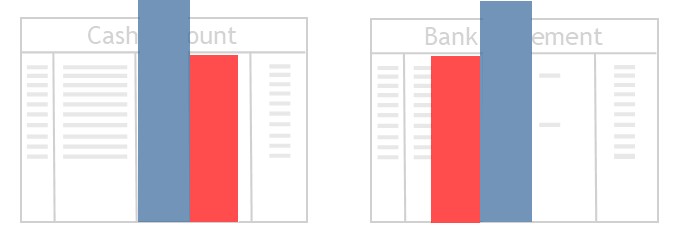

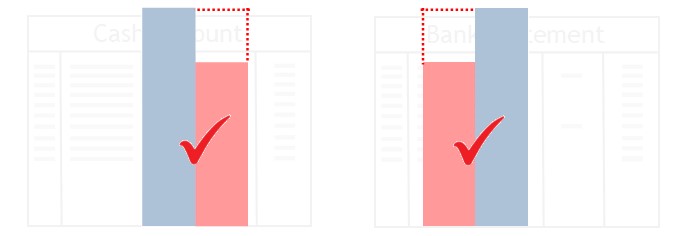

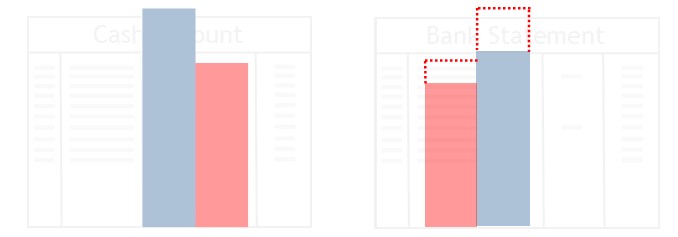

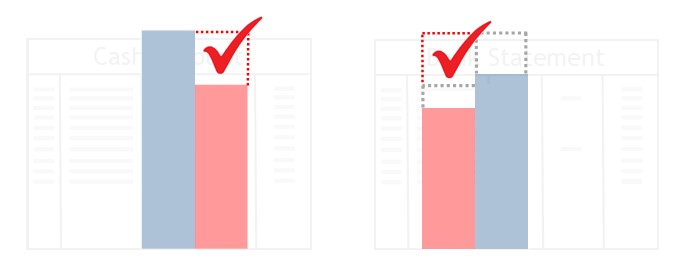

When checking your records, you compare one to the other.

You take your record of cash receipts.

And you check it against the bank’s record of deposits.

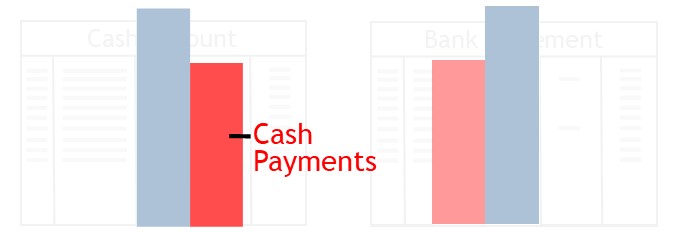

At the same time, you take your record of cash payments.

And you check it against the bank’s record of withdrawals.

After checking transactions, you compare balances.

Here, you are making sure the balances are the same.

If the balances are the same, it shows all the transactions must be the same, as well.

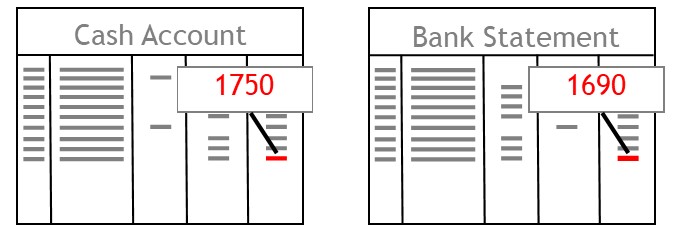

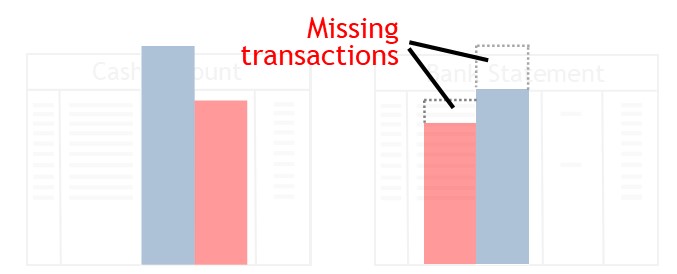

The problem is, the bank statement may not contain all the transactions yours do.

There may be deposits in transit.

Or there may be un-presented checks.

Because it is missing transactions, the bank statement’s balance is incompatible with that of your records.

For the balances to be compatible, the bank statement’s balance needs to include all the transactions shown in your records.

It needs to include all the cash receipts your records show.

And it needs to include all the cash payments your records show.

Only then will the balances of the two records be compatible.

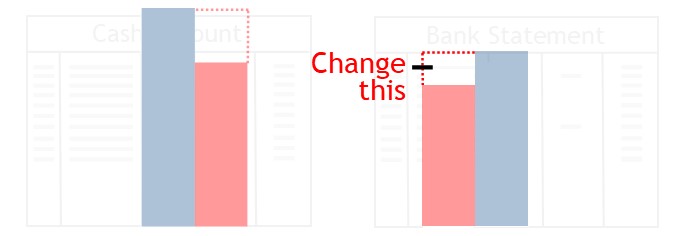

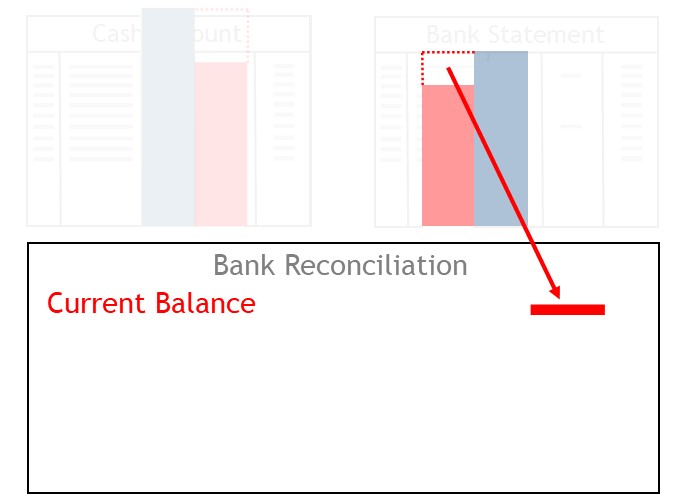

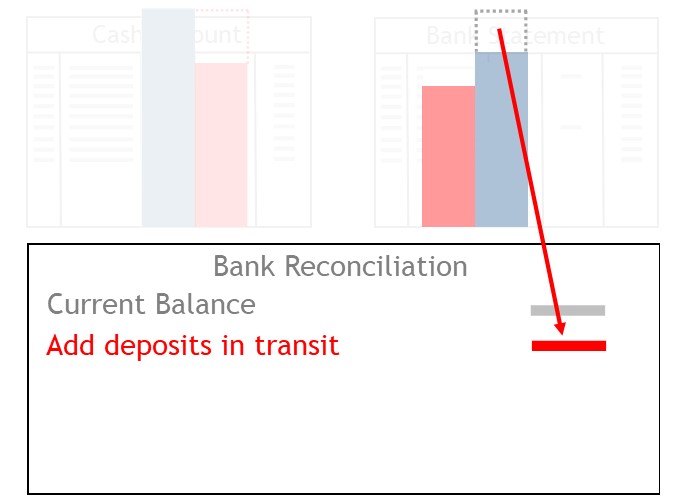

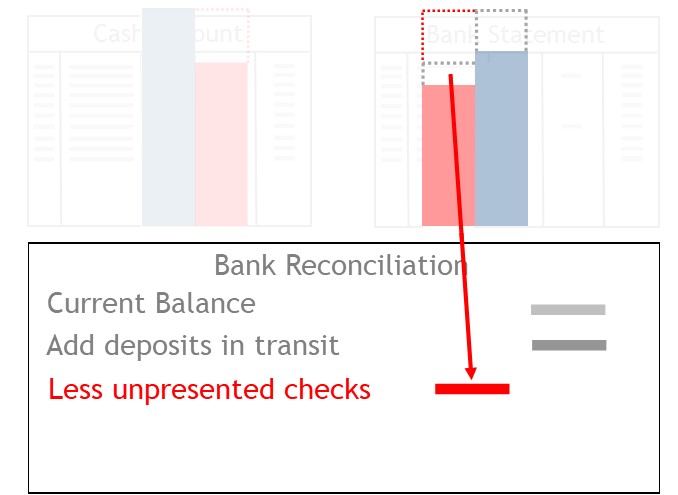

Preparing a Bank Reconciliation

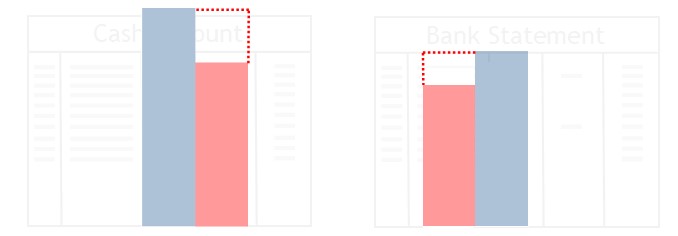

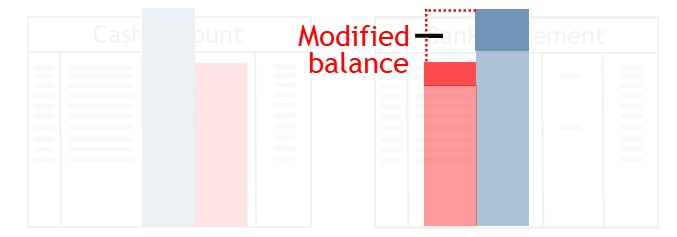

For comparison to be possible, you need to modify the bank statement’s balance.

To do this, you prepare a bank reconciliation.

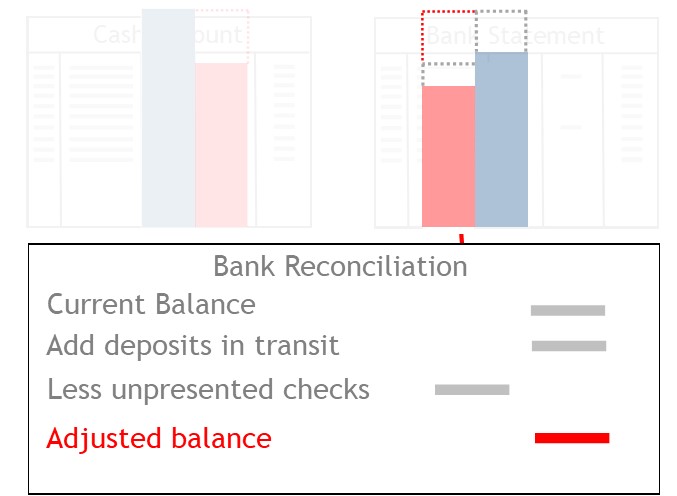

With a bank reconciliation, you modify the bank statement’s existing balance.

So you take the existing balance.

Next, you add any deposits in transit to that balance.

This increases the statement’s balance.

Then you deduct any unpresented checks from the statement’s balance.

This decreases the statement’s balance.

When complete, the reconciliation will show the adjusted balance.

This adjusted balance should be compatible with your records.

© R.J. Hickman 2020