Bond Call Price

What Does Bond Call Price Mean?

A bond call price is an option built into the bond, allowing the issuer to redeem bonds should they reach a certain price.

How it Works

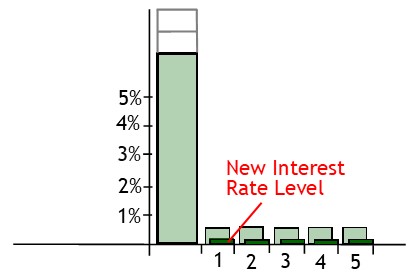

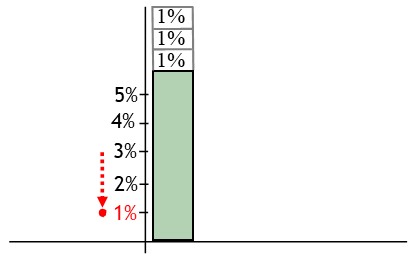

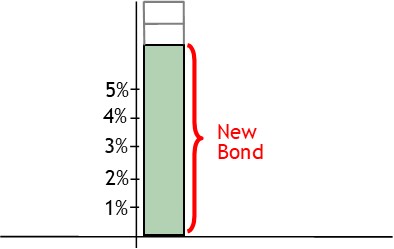

When a corporation issues a bond, it issues the bond around current interest rates.

This means it will pay the current rate of interest each year—over the bond term.

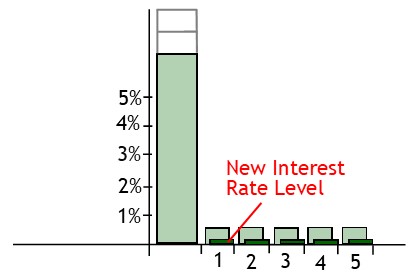

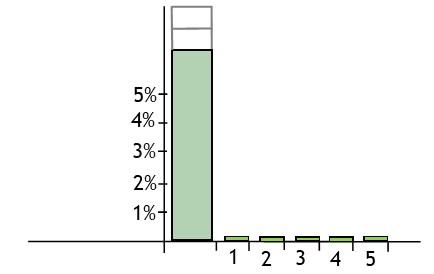

However, interest rates may fall in the next year or so.

This means the issuer can now access lower interest rates.

However, the issuer will be left paying the higher interest rate.

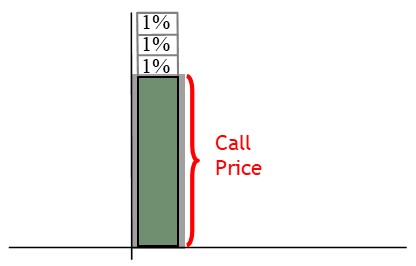

At this point, the issuer could buy back their bond.

Then re-issue the bond.

This way, they could take advantage of the lower interest rate.

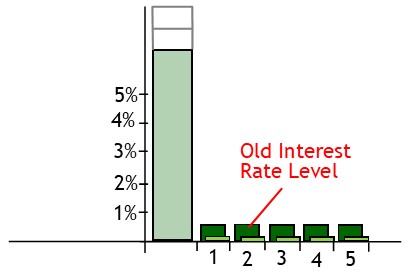

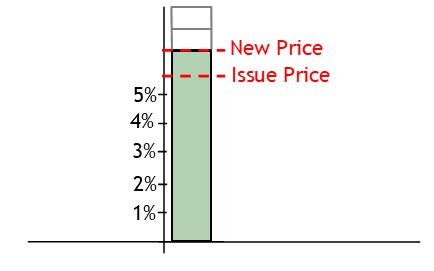

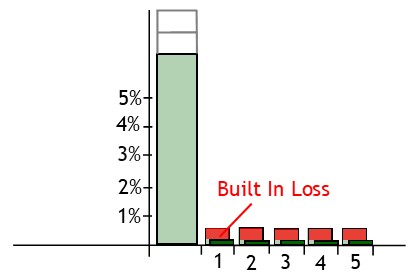

Problem is, the new price will be higher than the issue price.

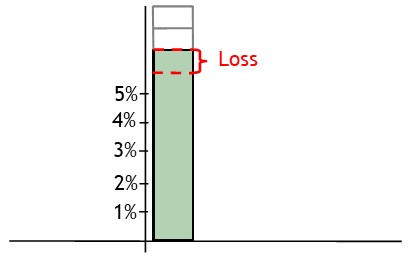

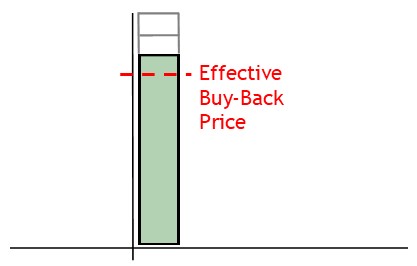

As a result, the issuer will lose money on the deal.

This means that any benefit gained from lower interest rates will be offset by the loss on the buy back.

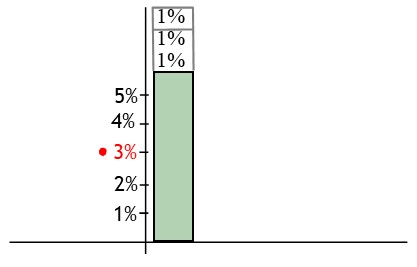

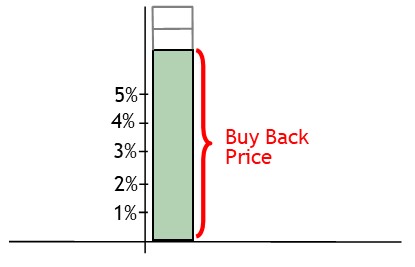

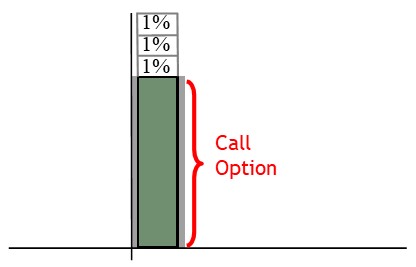

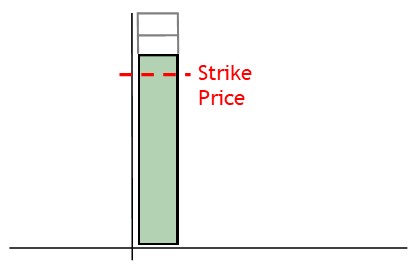

To take advantage of potential falls in interest rates, the issuer can buy a bond call option ahead of time.

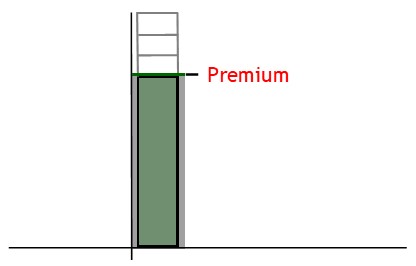

The issuer will need to pay a premium for this option.

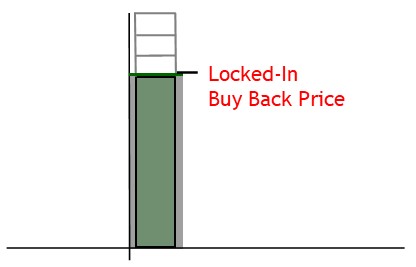

However, the call option will lock in a buy-back price.

Then, if interest rates fall, the bond price will rise.

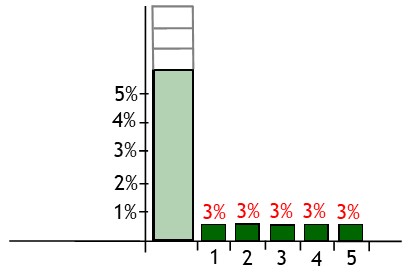

Now, the bond issuer can exercise the call option at the option’s strike price.

This means the issuer won’t lose money on the buy-back.

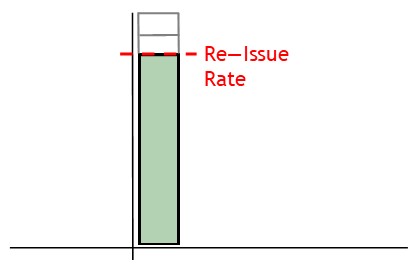

After this, they can re-issue the bond, at a higher price.

At the same time, they can take advantage of lower interest rates.