Bond Issue Costs

What are Bond Issue Costs?

When issuing a bond, a corporation will incur issue costs such as preparation costs, distribution costs, and legal costs.

How it Works

A corporation issues a bond when it wants to borrow money.

Doing so involves preparation costs, marketing costs, legal costs etc.

These costs need to be apportioned over the bond’s life.

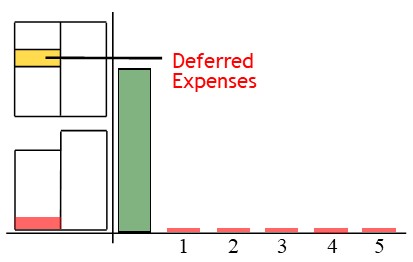

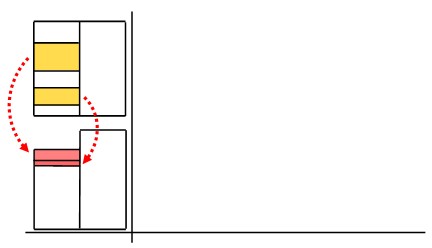

Deferring Issue Costs

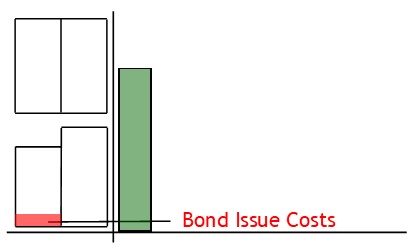

To do this, you begin by deferring the issue costs.

Deferred expenses are those where money has been paid in advance—like prepayments.

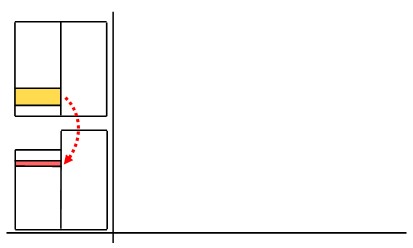

To defer the expense, you show that money for the issue costs came from the bank and went to the deferred issue costs account.

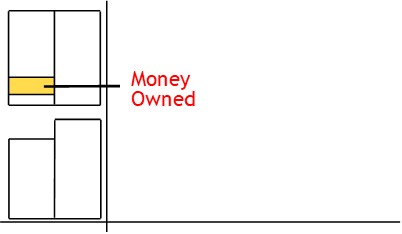

The deferred issue costs account is an asset account.

Like other asset accounts, it shows money owned by the business.

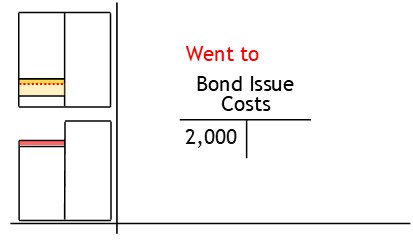

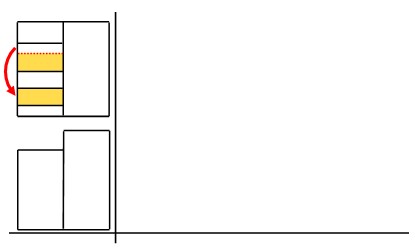

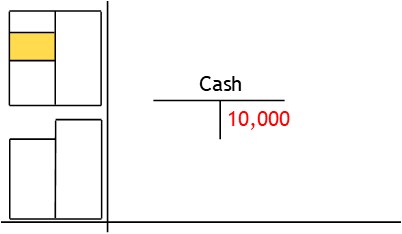

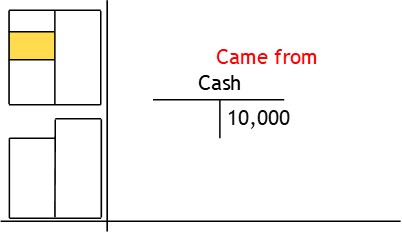

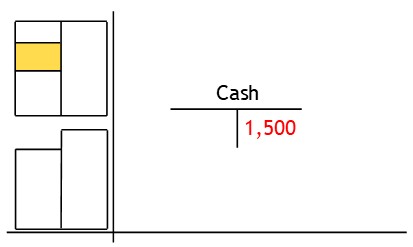

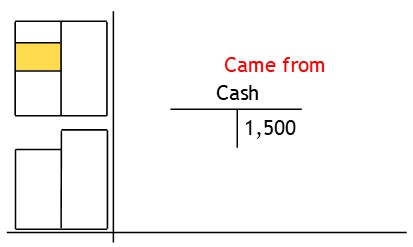

To record the deferral, you credit the cash account.

This shows money came from the bank.

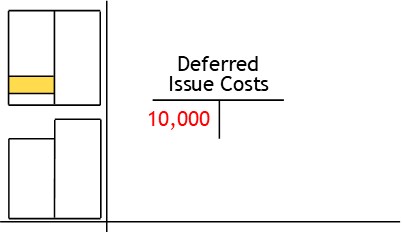

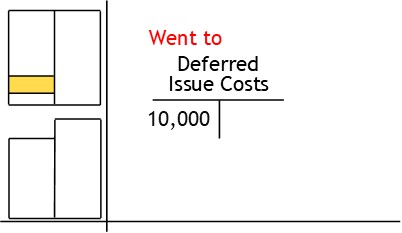

Next, debit the deferred issue costs account.

This shows you have assigned the value to deferred issue costs.

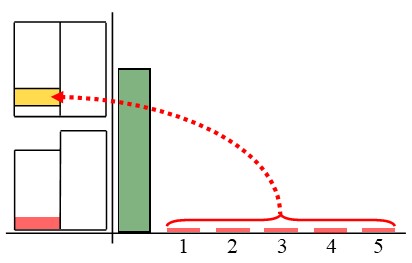

Amortizing Issue Costs

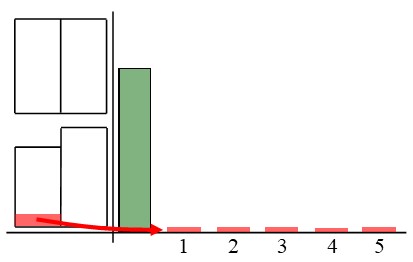

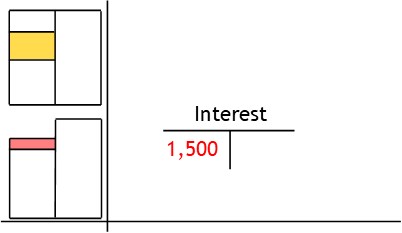

You amortize issue costs as you make interest payments.

When recording interest payments, you credit the cash account.

This shows money came from the bank.

Next, you debit the interest paid account.

This shows the money was used as interest.

At the same time, you need to amortize the bond issue costs.

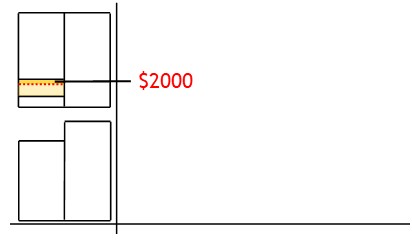

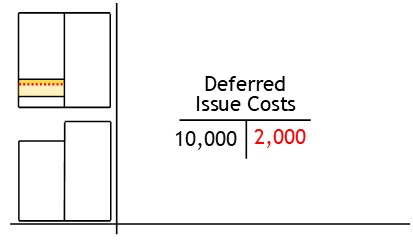

First, you need to calculate how much you should write off.

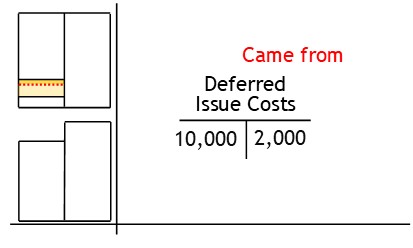

Then you credit the deferred issue costs.

This shows you are taking value from the account.

After that, you debit the bond issue costs expense account.

This shows the value was used as an expense.