Bond Sinking Fund

What is a Bond Sinking Fund?

A bond sinking fund is where a corporation regularly buys back a portion of the bonds it has issued.

How it Works

Typical Bond Issue

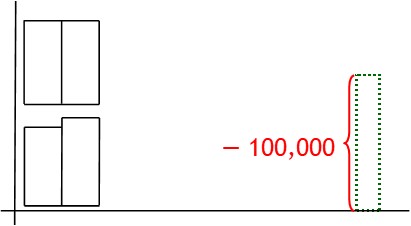

A company may want to embark on a major project.

One way to raise money for this is via a bond issue.

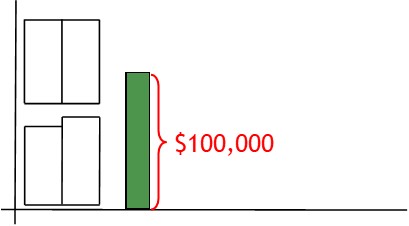

With a bond issue, the corporation sells bonds to investors.

Each bond will have a certain face value.

The investor pays this money to the corporation.

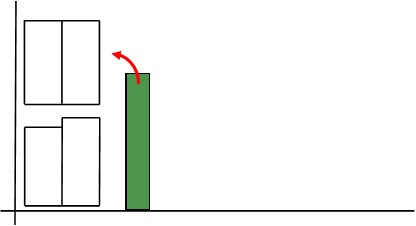

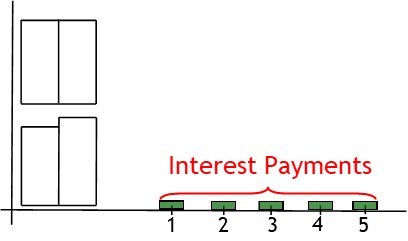

In return, the corporation pays interest to investors over the bond term.

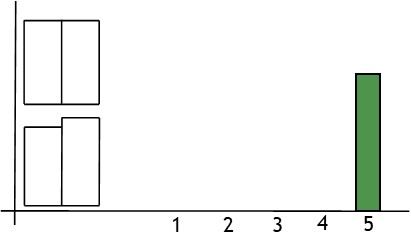

Then, typically, at the end of the bond term, the corporation redeems the bond.

This means they pay the whole of the bond’s face value to the bond holder at maturity.

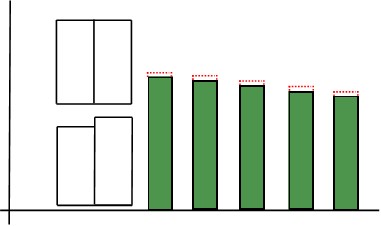

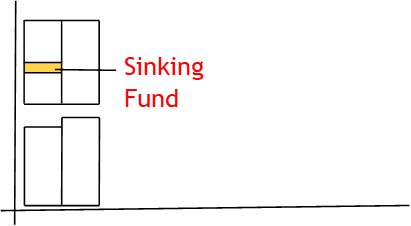

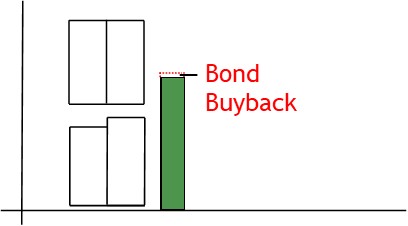

Sinking Fund

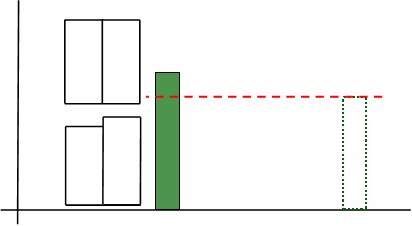

Alternatively, the corporation may use a bond sinking fund.

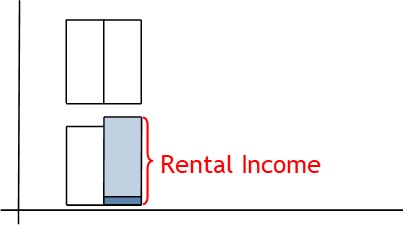

With a sinking fund, the corporation takes money from revenue along the way.

Then they deposit this money in the sinking fund.

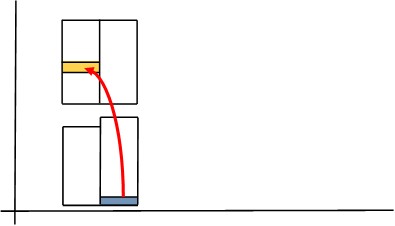

After this, they pass the money onto a trustee.

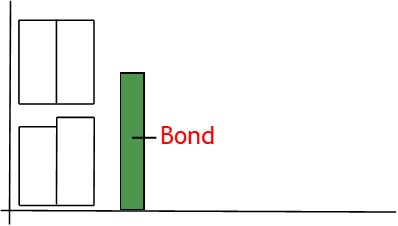

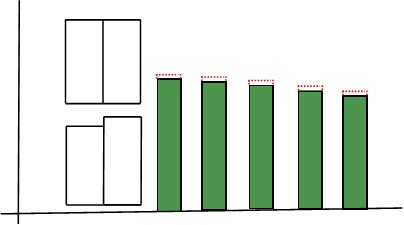

The trustee then uses the money to buy back a portion of the outstanding bonds in the open market

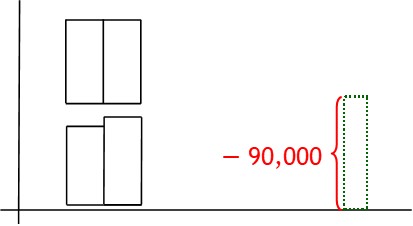

By doing this over and over, the corporation reduces its debt load over time.

As a result, it is easier to redeem the remaining bonds at maturity.

Having a sinking fund attached to the bond makes the bond more attractive to investors.

The reduced repayment burden means there is less risk the corporation will default upon redemption.

© R.J. Hickman 2020