Capital Account

Capital Account

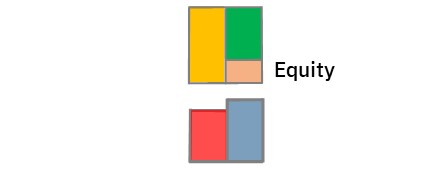

The capital account forms part of owners equity.

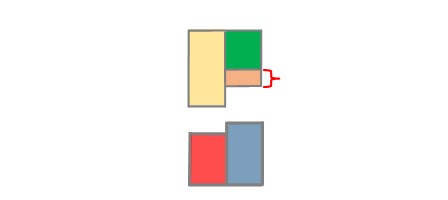

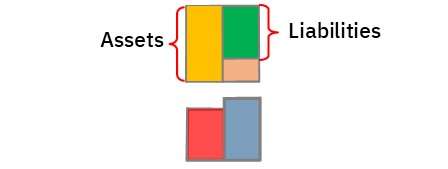

Owner’s equity is the difference between assets and liabilities

It shows how much money is owed to the business’s owners or shareholders

Theoretically, if the business cashed out its assets.

Then used this money to repay loans etc.

The difference would belong to the owner.

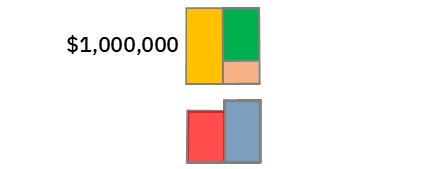

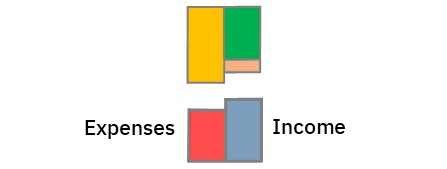

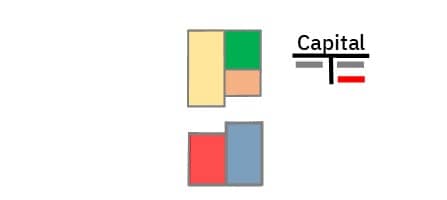

How The Capital Account is Made Up

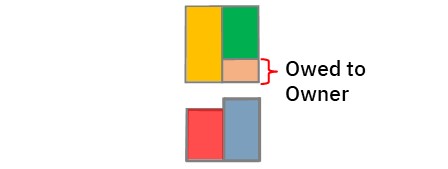

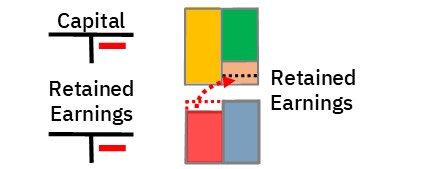

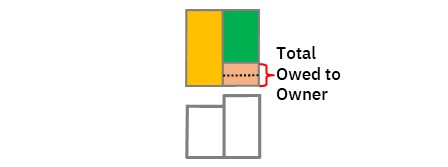

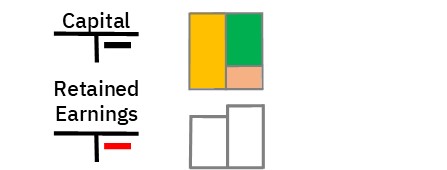

In combination with the retained earnings account, the capital account shows money owed to the owner

It is made up by or influenced by money invested by owners or shareholders

Along with retained earnings resulting from profits made along the way.

Less any withdrawals made by the owners or dividends paid to shareholders..

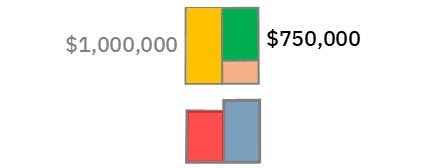

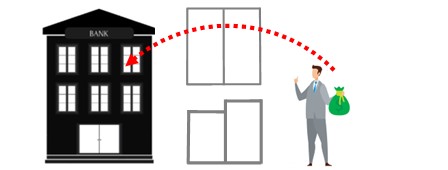

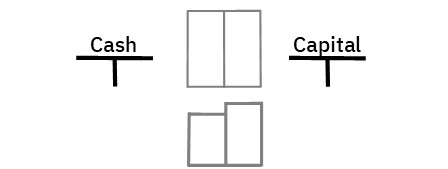

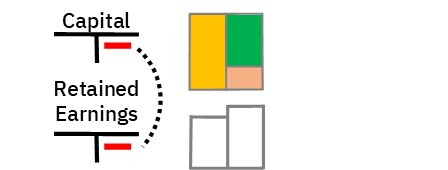

Recording Capital Contributions

To start a business, the business owner may invest some of their own capital.

The business owner would deposit the money in the business’s bank account.

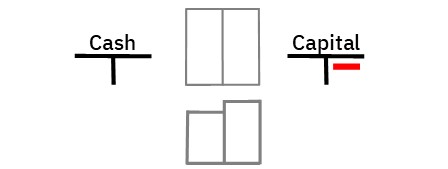

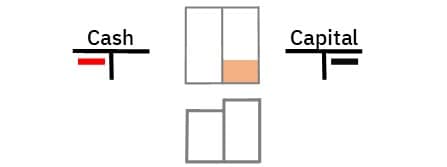

To record the transaction, you use the capital account and the cash account.

You credit the capital account.

This shows the money came from capital.

Then you debit the cash account.

This shows the money was deposited in the bank.

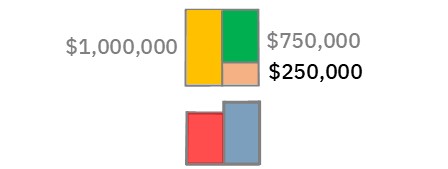

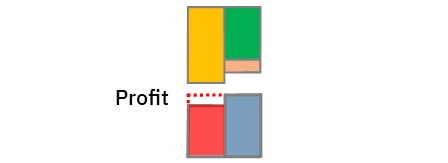

Recording Retained Earnings

Once set up, the business will start trading.

This usually results in a profit.

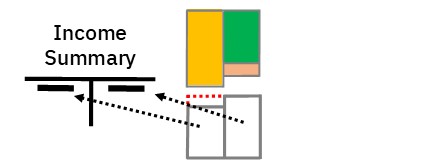

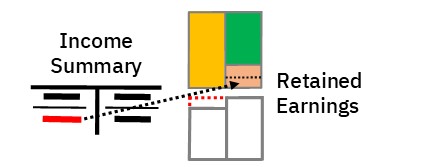

At period-end, the income & expense accounts are closed out to income summary.

The account’s balance will equal the profit or net income for the period.

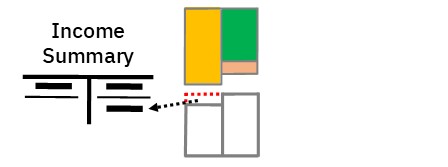

You need to transfer this balance to retained earnings.

Retained earnings is money owed to the owner, as well.

But you don’t transfer it to the capital account at period end.

To do so would imply the business no longer has any retained earnings

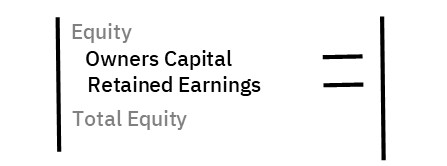

Still, retained earnings impacts on how much money is owed to the owner

To determine this, you need to add retained earnings to the capital’s account’s balance

You can do this easily on the balance sheet, where retained earnings are shown as a line item next to owner’s capital.

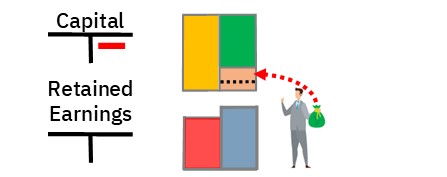

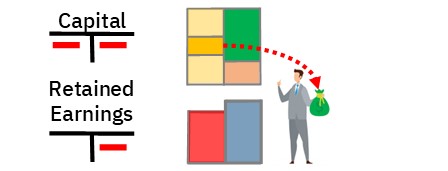

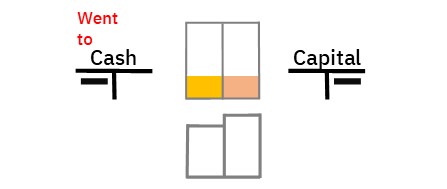

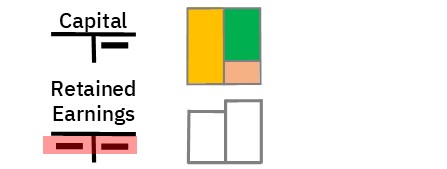

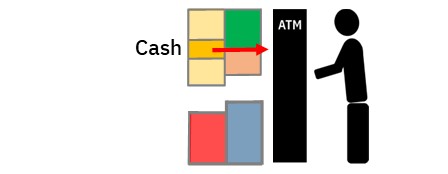

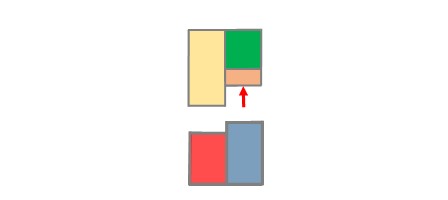

Recording Withdrawals

Periodically, the owner will withdraw money from the bank for personal use.

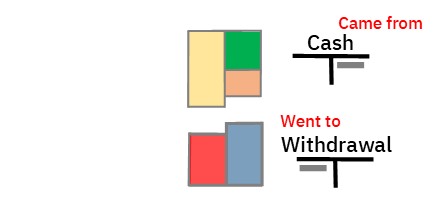

When this happens, you show that money comes from the bank and goes to the owner

To record this transaction, you show that money came from the bank—and went to the owner

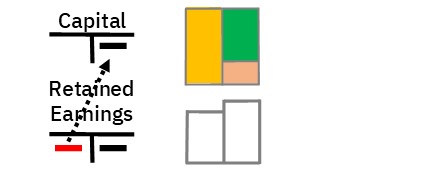

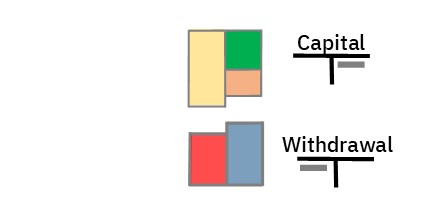

At period-end, you close out the withdrawal account to the capital account

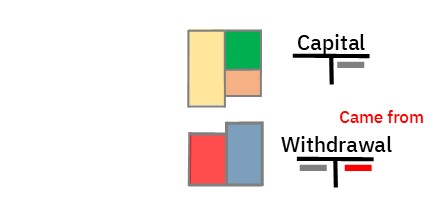

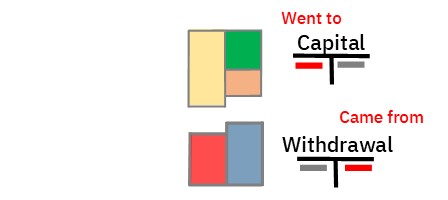

To do this, you credit the withdrawal account to show you have taken value from it.

Then you debit the capital account to show you assigned the value to capital.

The capital account has a credit balance.

So the debit entry will reduce the account’s balance.

This shows the business now owes less to the owner