Cash Account Seems Back-To-Front

Cash Account Seems Back-to-Front

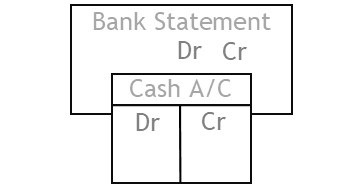

Transactions recorded in the cash account seem back-to-front to the bank’s records.

Why Does It Appear This Way?

At first, the cash account seems the wrong way around.

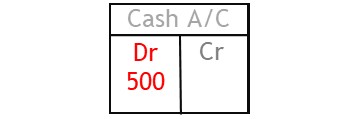

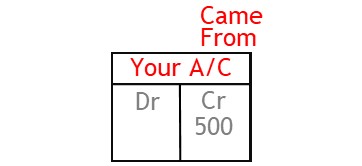

For example, if depositing money into the bank, you record the transaction as a debit.

This seems to imply the business is being penalized for having done a good thing.

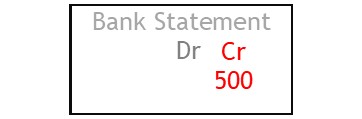

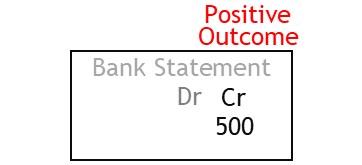

The bank statement seems to make more sense.

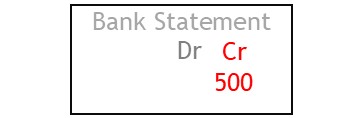

On the statement, the deposit will be shown as a credit.

This seems right because it is showing a “reward” for having deposited money in the bank.

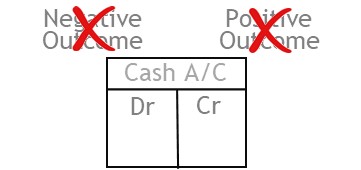

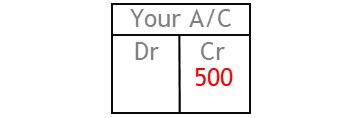

The idea is to not look at debits and credits as positive and negative values.

Instead, see them as a means to show a flow of value.

This way, both the cash account and the bank statement will make more senses.

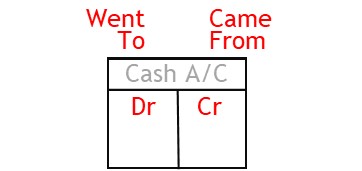

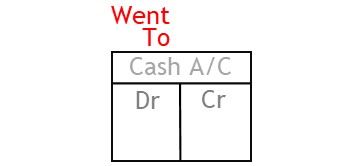

The cash account entry will show that money was deposited in the bank.

At the same time, the bank will update your account at the bank.

Here, the bank will record the transaction with a credit.

This shows money deposited in the bank came from your business.

The month-end bank statement will reflect what happened in your account.

So it will also show the deposit as a credit.

© R.J (Bob) Hickman 2020

So far, you have seen how the double entry accounting system works with cash transactions.

You really should also understand how it works with credit transactions.

Recording Supplier Transactions

Access 100 More Topics

$7.95 Per Month