Cash & Cash Equivalents

What Does Cash & Cash Equivalents Means?

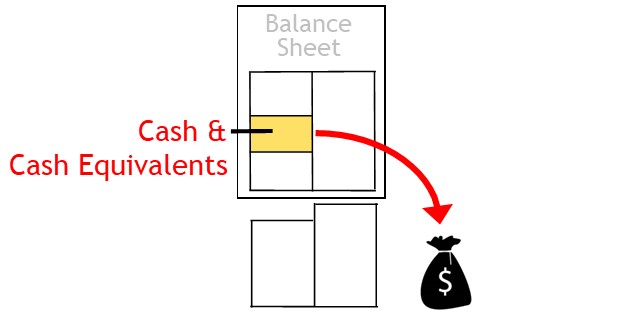

Cash and cash equivalents is a line item on the balance sheet that shows cash and assets that can be turned into cash immediately.

How it Works

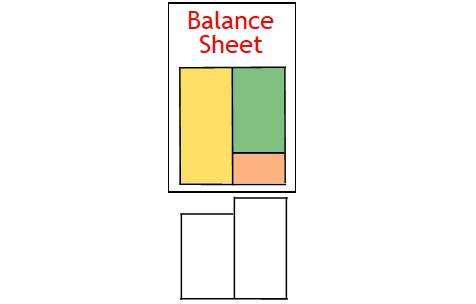

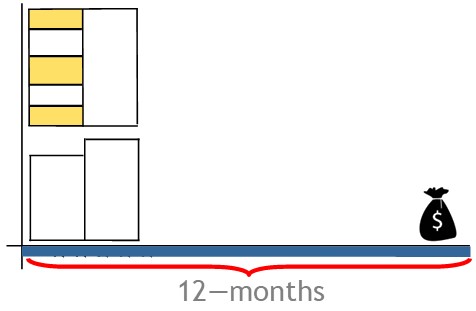

At period-end, the business will prepare a balance sheet.

The balance sheet shows the business’s assets.

Asset accounts show money the business has and things it owns.

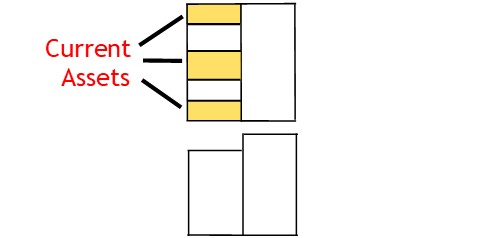

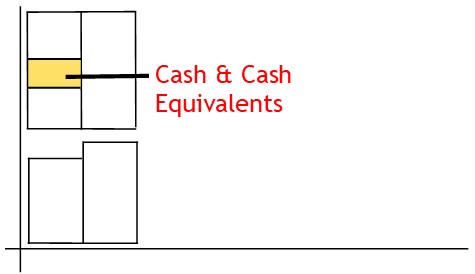

Part of the balance sheet shows current assets.

Current assets are those that can be converted to cash in the coming 12-month period.

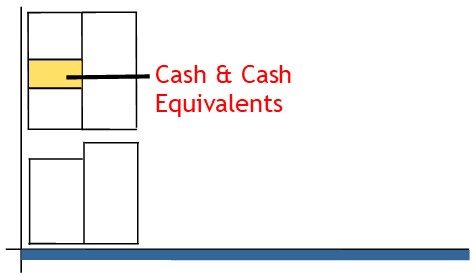

Included in the current assets section is a line item known as cash and cash equivalents.

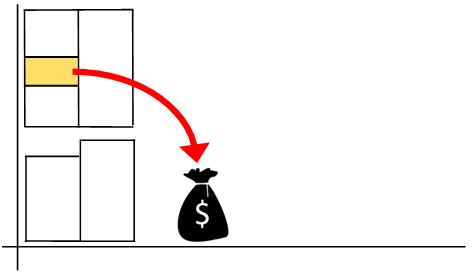

Cash and cash equivalents are those things that can be turned into cash, immediately.

This will include money held in the bank.

It will also include any holdings of foreign currency.

Cash equivalents also include things like commercial paper or treasury bills.

To be considered a cash equivalent, the security needs to have a maturity of less than 3 months.

It also needs to be highly liquid or easily converted to cash.

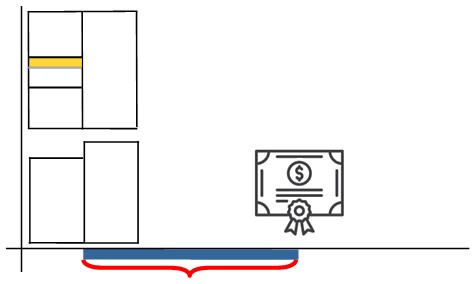

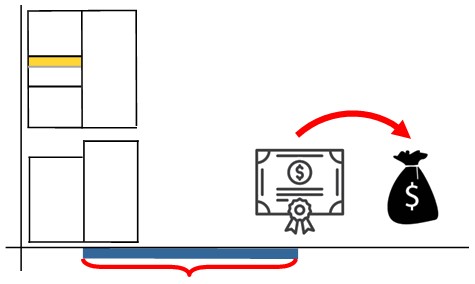

Analysts and management monitor cash and cash equivalents closely.

They compare it to the short term debt obligations.

This shows the company’s ability to pay its bills, quickly.

© R.J. Hickman 2020