Cash Method of Accounting

What is the Cash Method of Accounting?

Under the cash method of accounting, income and expenses are only recognized when they are actually collected and paid.

How it Works

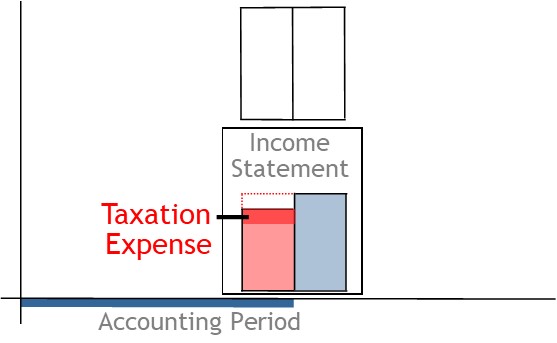

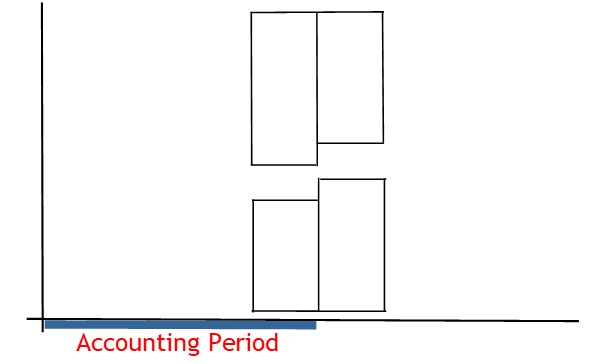

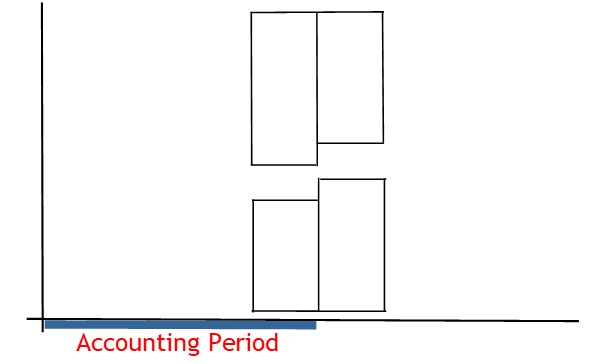

The cash basis of accounting is used to calculate tax at period-end.

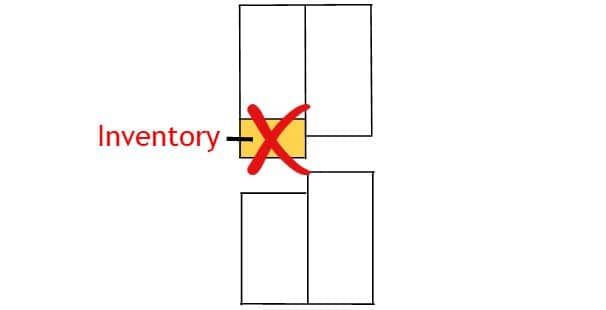

It is mainly used for small service businesses that don’t have inventory.

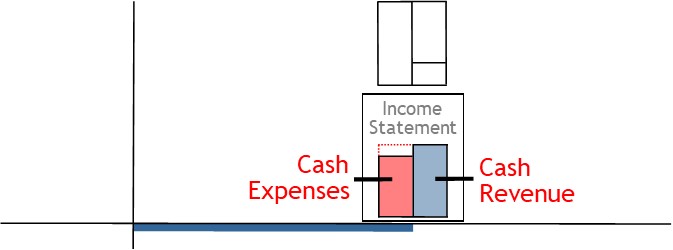

Revenue

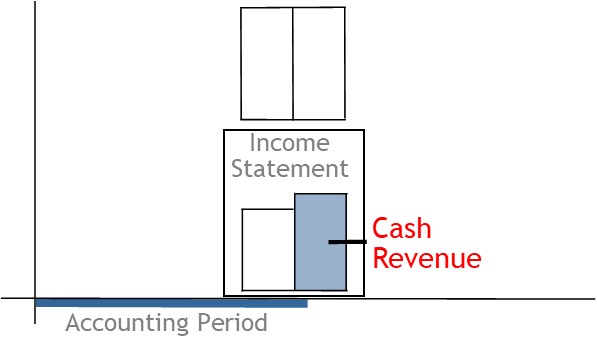

A business will make sales during an accounting period.

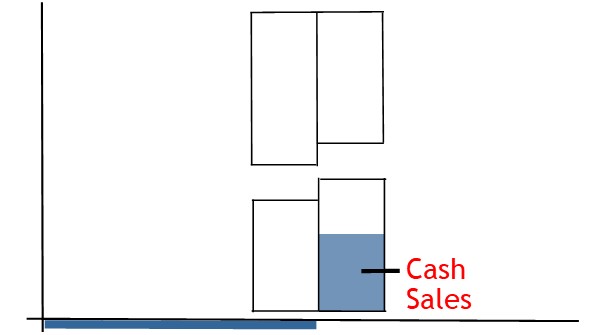

Some of these sales will be made on a cash basis.

In this case, money earned from sales will be deposited in the bank.

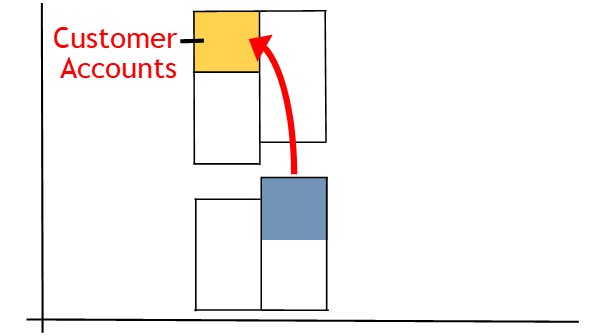

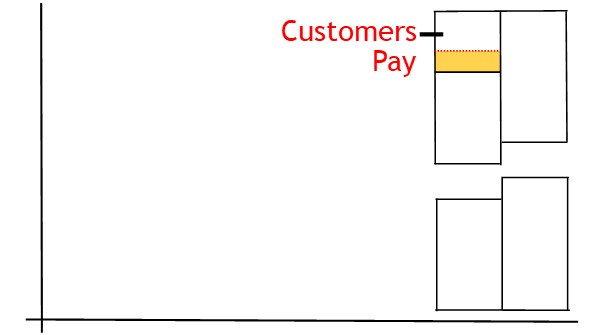

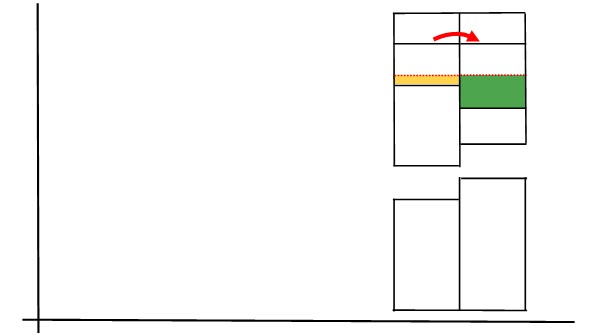

At the same time, the business will make sales on credit.

Here, the money owed from the sales is recorded in customer accounts.

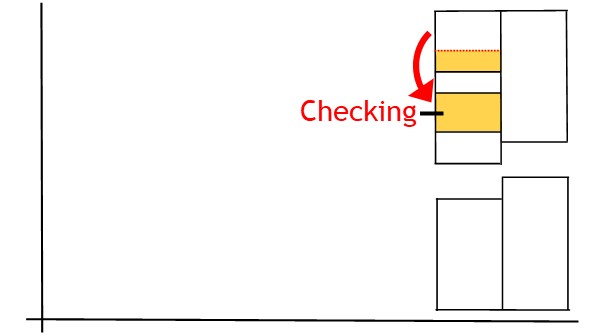

Later on, customers pay what they owe.

This is when the money from credit sales will be deposited in the bank.

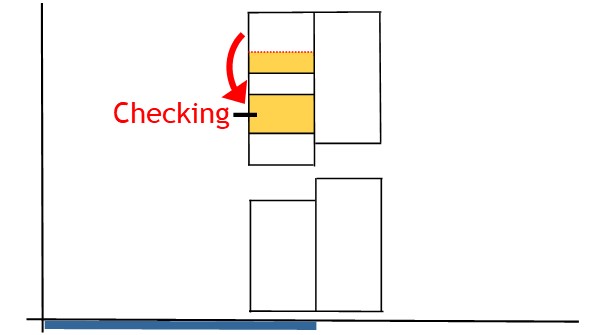

When using the cash basis of accounting, you only recognize revenue where the cash has been received during the accounting period.

So you recognize any money received from the current period’s cash sales.

You also recognize any customer payments made during the current period.

Together, this will show the total of cash revenue during the period.

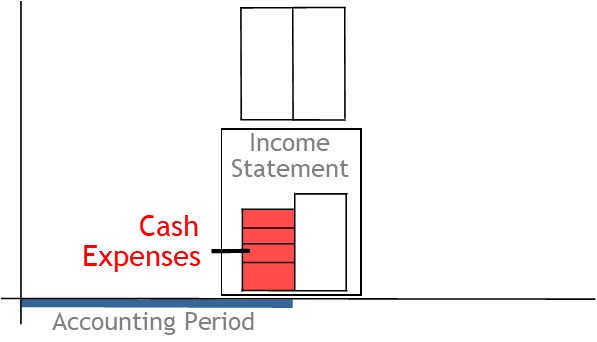

Expenses

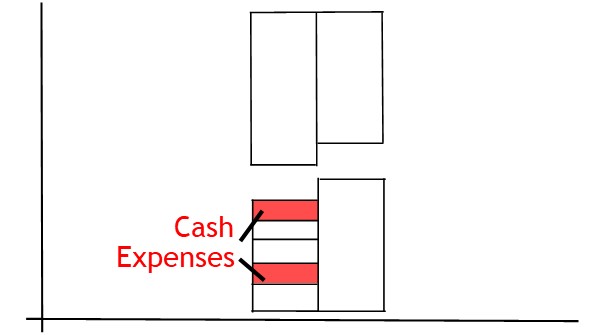

A business will also incur expenses during an accounting period.

The business will pay for some of these expenses now.

That is, they take money out of the bank and use it to pay for expenses.

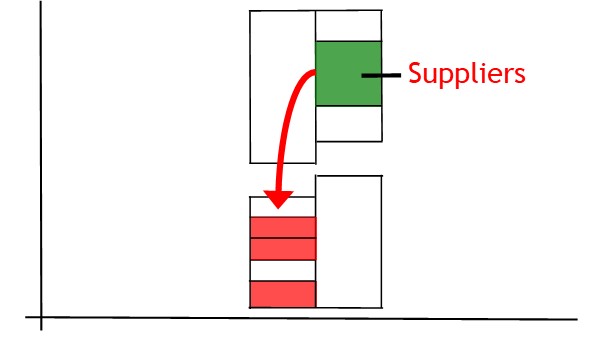

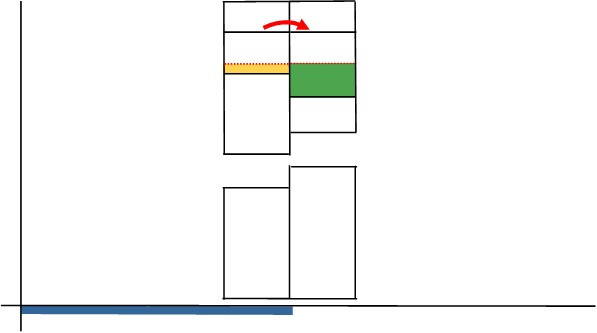

The business will also buy some goods and services on a credit basis.

This means, the goods or services will be provided by suppliers.

Later on, the business will pay the suppliers.

As with revenue, you only recognize cash actually paid during the accounting period.

So you recognize any cash payments made during the period.

You also recognize any payments the business makes to suppliers.

Together, this will show the total of cash paid for expenses during the period.

© R.J. Hickman 2020