Cash Over & Short

What is a Cash Over & Short Account?

A cash over and short account is an expense account used to record any variation in petty cash.

How it Works

A business will usually keep a small amount of cash on hand for incidental expenses.

This is known as petty cash.

During the month, office staff will use petty cash for such things as incidental office supplies.

They may also use it to buy a birthday cake for a staff member.

To buy the cake, they take money from petty cash.

As they do this, they record the disbursement on a petty cash voucher.

Then they place the voucher in petty cash.

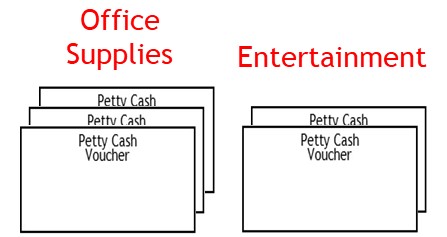

At month-end, you sort the vouchers by purpose (See Petty Cash for more on this)

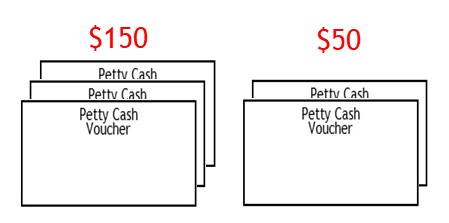

Then you tally the vouchers.

This will show how much money was recorded as being taken out of the petty cash draw.

Next, you tally the money in petty cash.

This will show how much money was actually taken out.

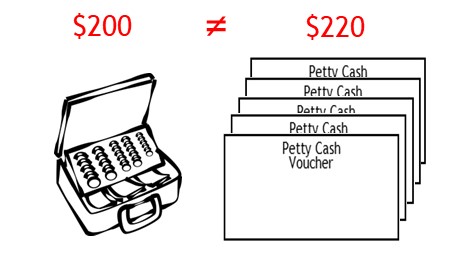

The total of vouchers should equal the total of cash disbursed.

However, there may be a discrepancy.

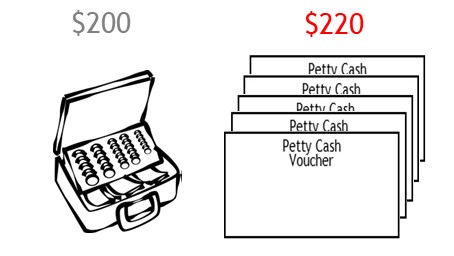

Sometimes, your tallies will indicate more money has come from petty cash than should have.

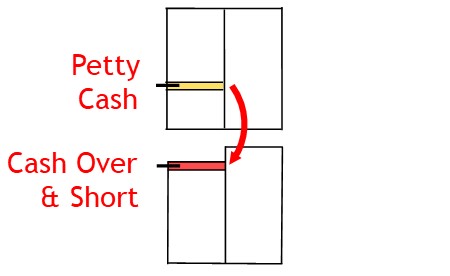

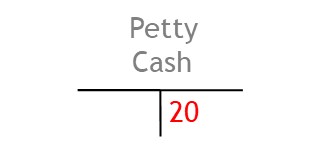

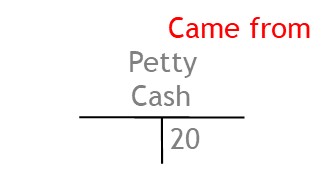

In this case, you have to show that a value has come from petty cash.

And you are allocating this value to the cash over and short account.

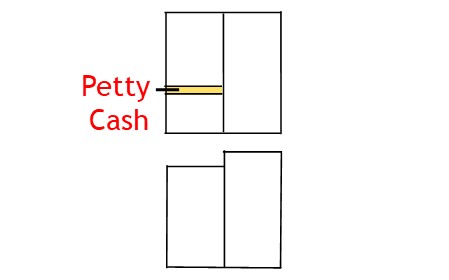

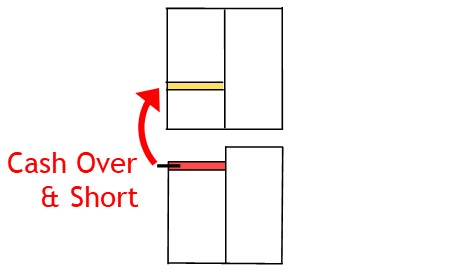

To record the transaction, you credit the petty cash account.

This shows you have taken value from petty cash.

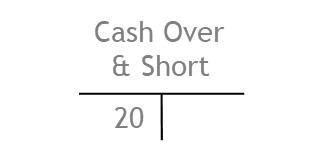

Then you debit the cash over and short account.

This shows you have allocated the value to that account.

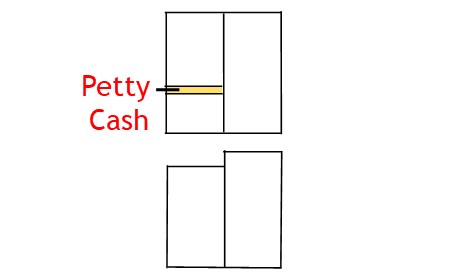

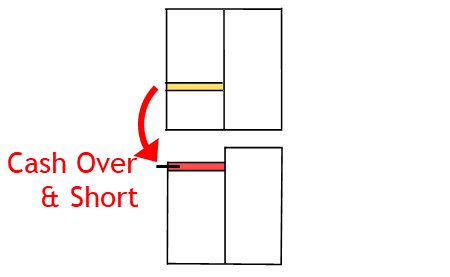

At other times, your tallies will indicate less money has come from petty cash than should have.

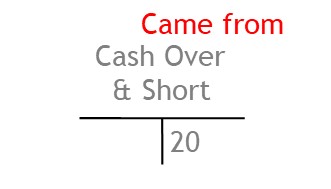

In this case, you have to show that a value has come from cash over and short.

And you are allocating this value back to the petty cash account.

To record the transaction, you credit the cash over and short account.

This shows you are taking value from the account.

After this, you debit the petty cash account.

This shows you are moving value back to petty cash.

© R.J. Hickman 2020