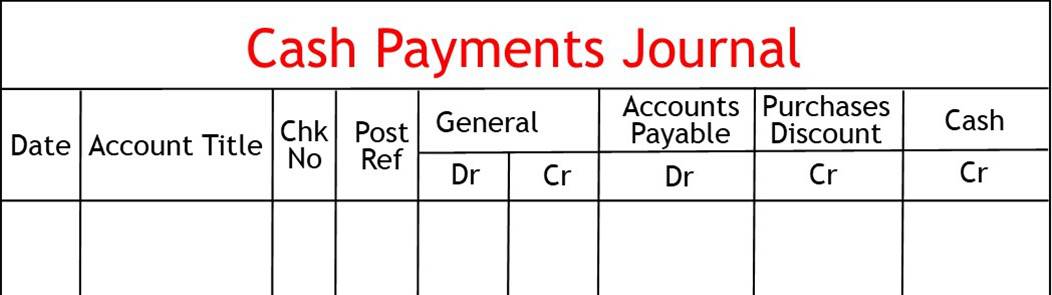

Cash Payments Journal

What is a Cash Payments Journal?

A cash payments journal is used to record any cash payments a business makes.

How it Works

In the days of manual accounting systems, transactions were recorded in journals.

One of those journals was the cash payments journal.

You used this journal whenever the business paid for anything with cash.

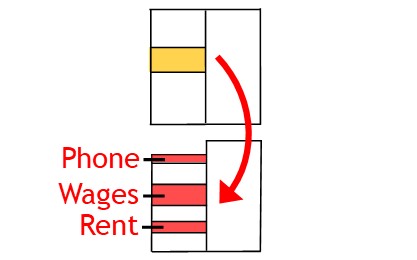

Most of the transactions you recorded were for goods, wages, phone etc.

You also needed to record any payments made to suppliers.

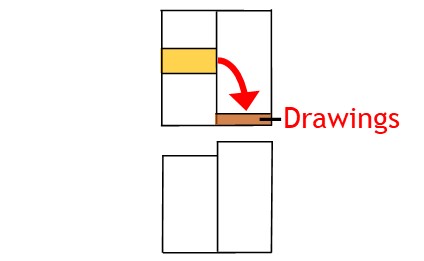

And you needed to record any money the business owner withdrew from the business.

Usually, you needed to update the journal every day throughout the month.

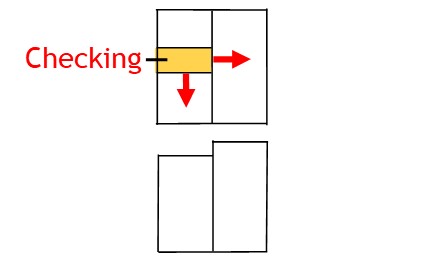

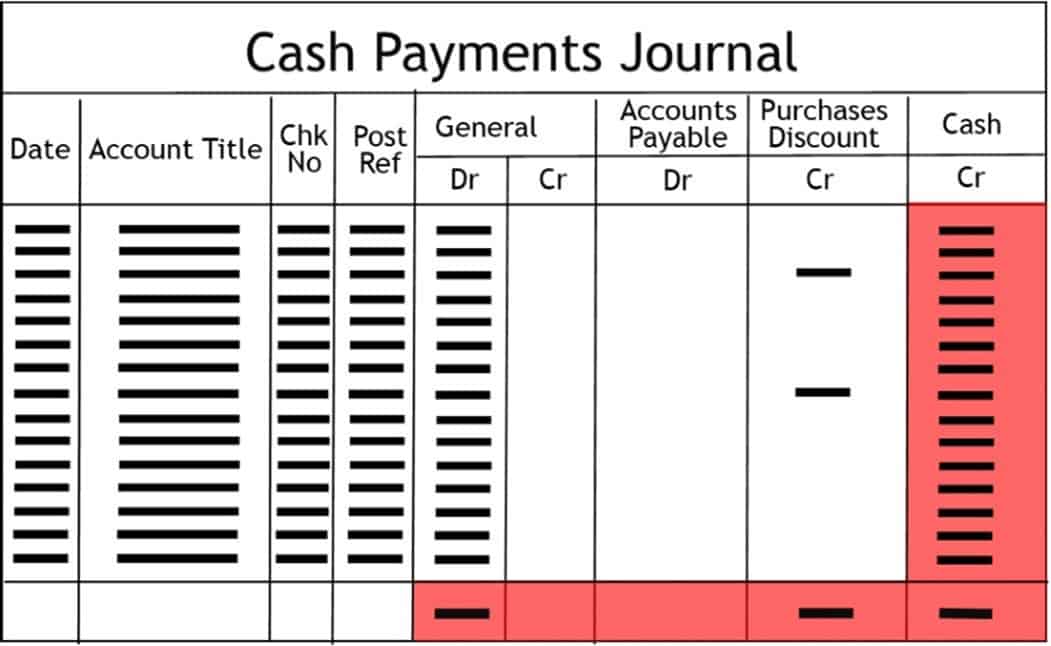

At month end, you totaled its columns.

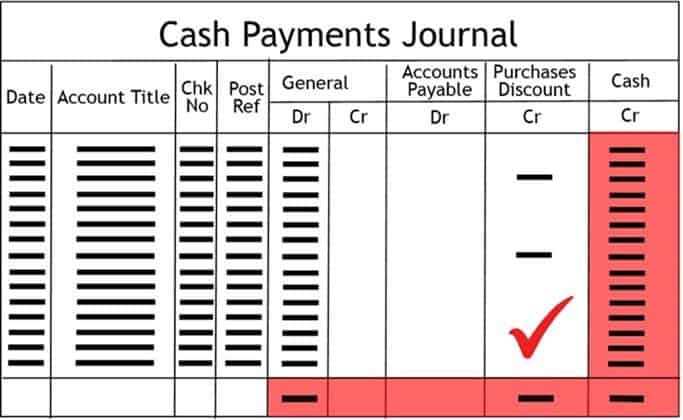

Then you checked them via a process of cross footing.

This is where you check your work by checking that column totals equal row totals.

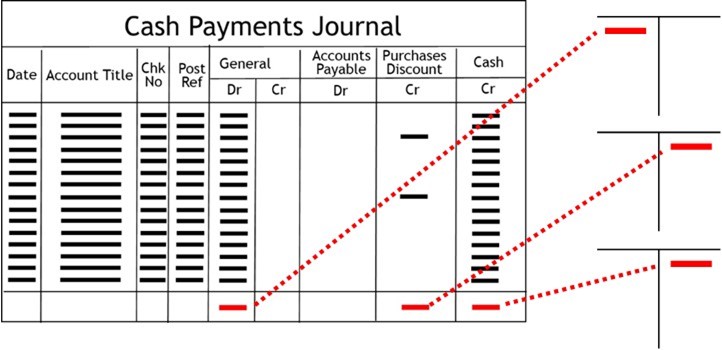

After this, you posted column totals to accounts.

Recording Journal Transactions

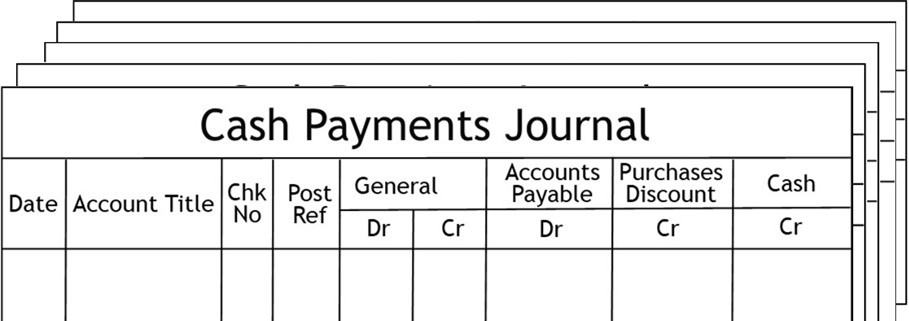

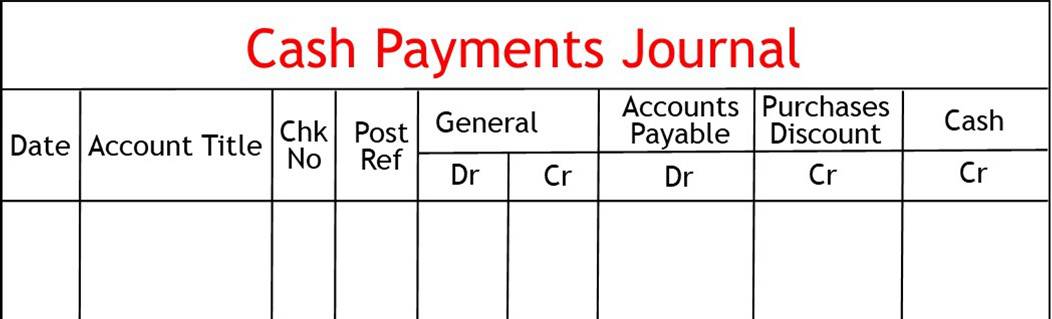

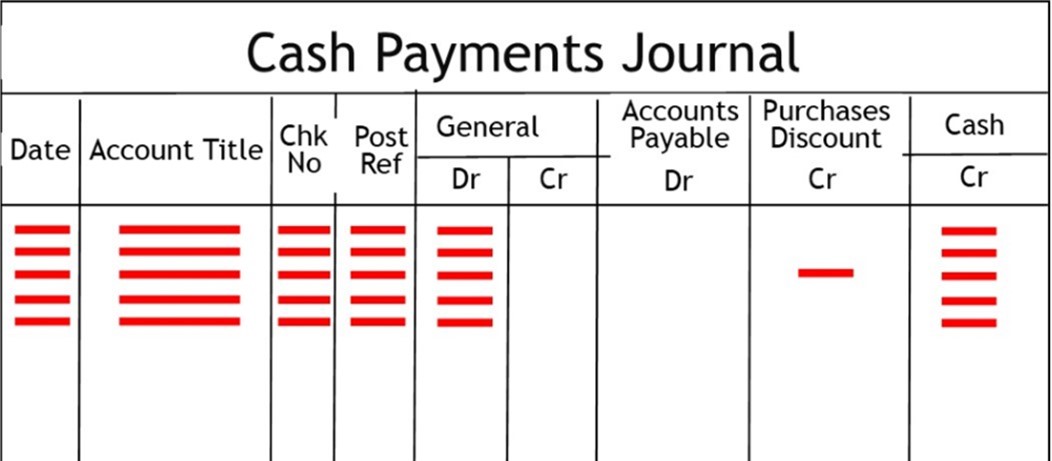

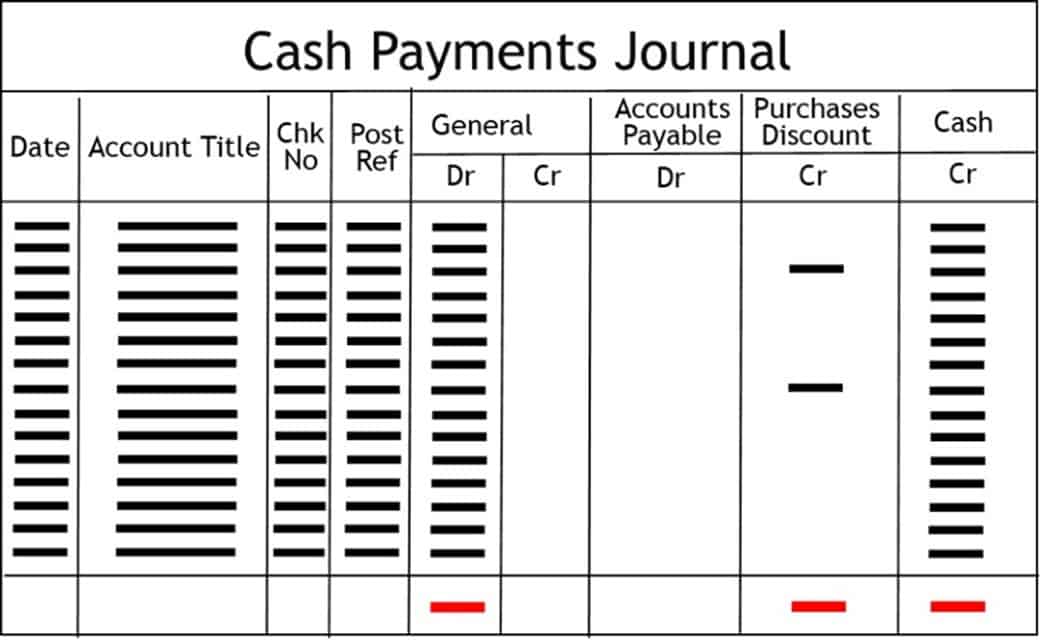

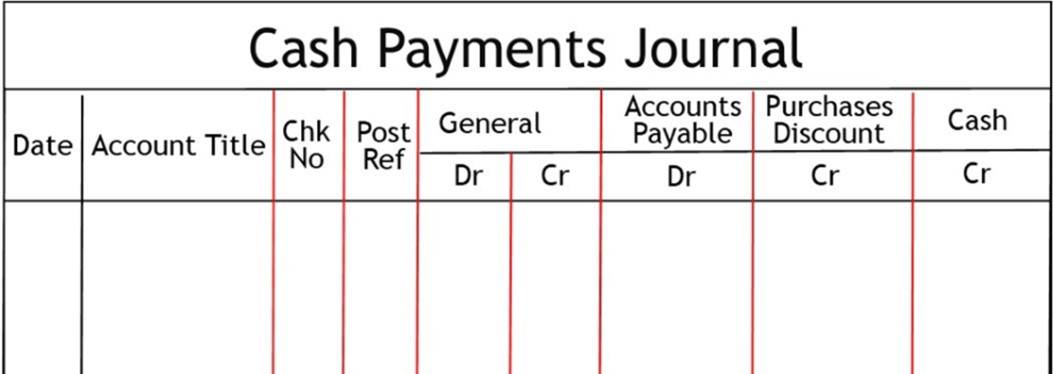

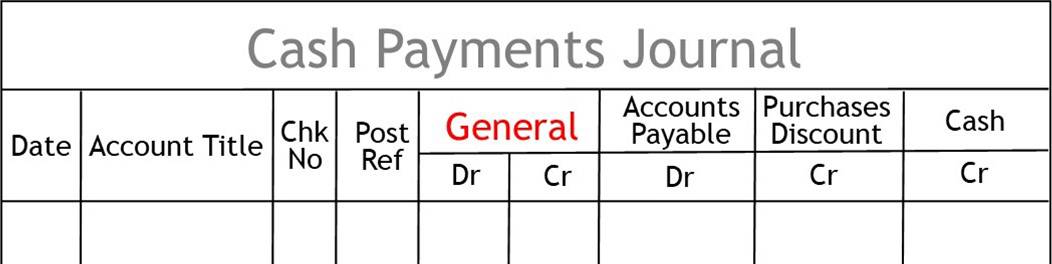

Like all journals, the cash payments journal was in columnar format.

Some cash payment journals had a general column for all payment types.

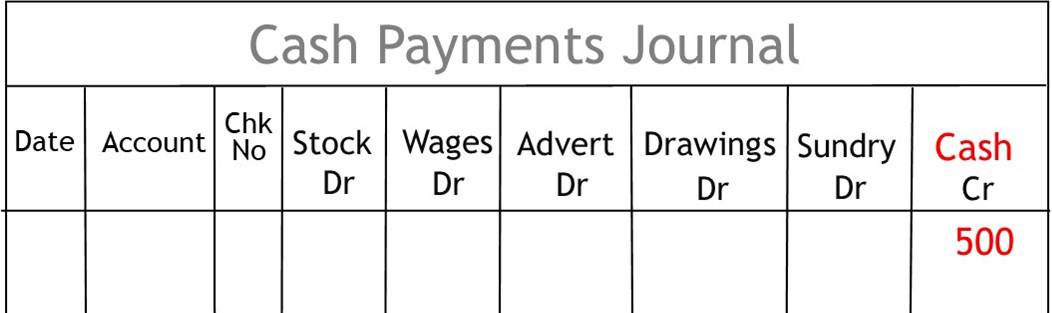

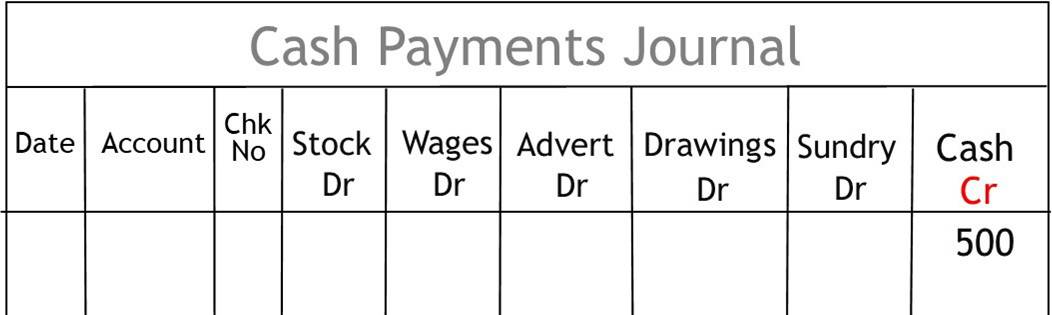

Others had separate columns for each payment type.

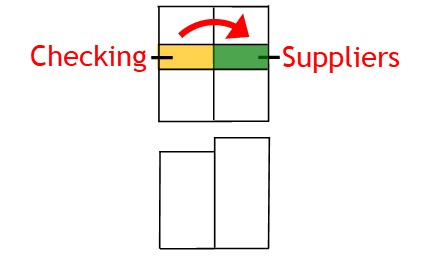

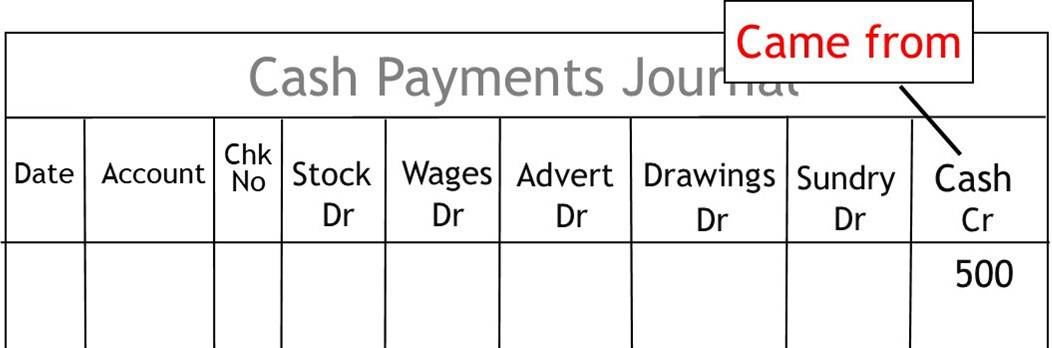

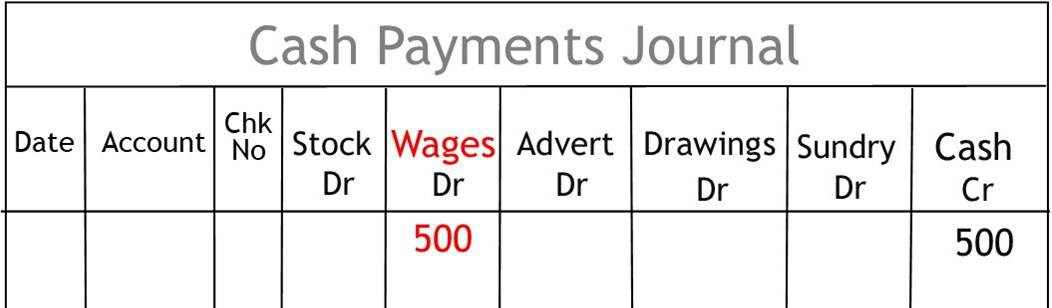

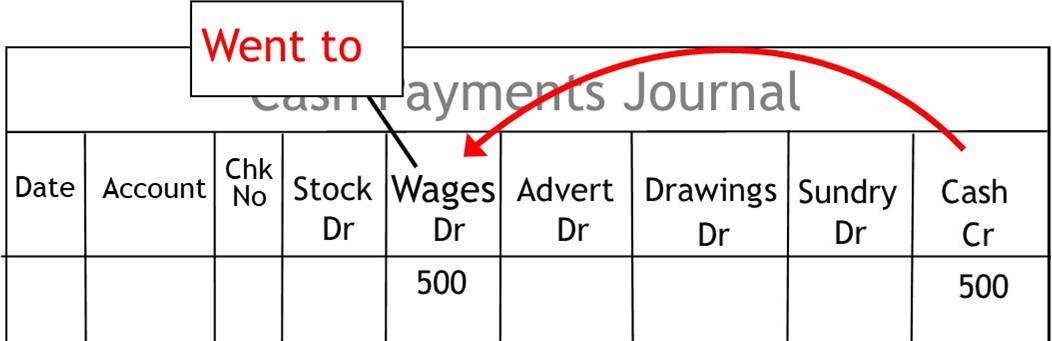

When recording a cash payment, you record the payment amount in the cash column.

The cash column is a credit entry.

This shows money came from the checking account.

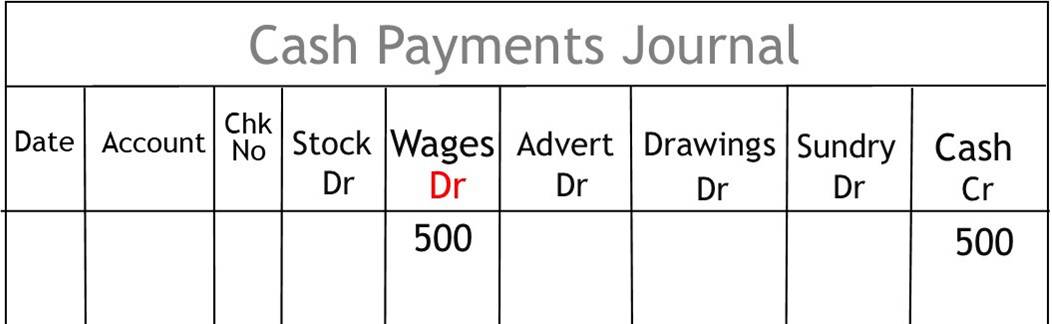

After this, you record the payment in the appropriate payment account.

The payment columns are debits.

This shows where the payment was used or where it went.

© R.J. Hickman 2020