Closing Entries

What are Closing Entries?

Closing entries are the entries necessary to close out temporary accounts in a manual accounting system.

How it Works

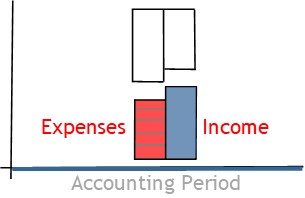

During the period, you record details of income and expenses.

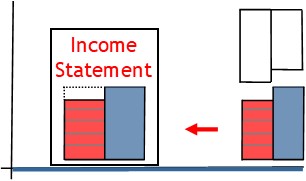

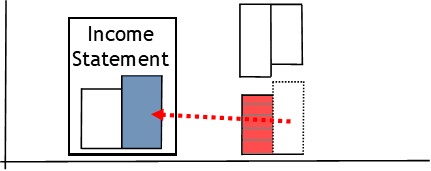

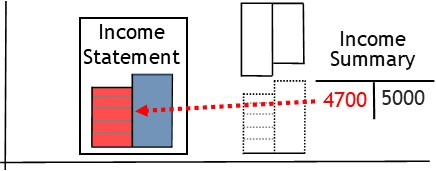

At month-end, you take the information contained in the income and expense accounts.

Then you transfer that information to the income statement.

In the process, you close the income and expense accounts.

Closing Income & Expense Accounts

Income and expense accounts are temporary accounts.

They collect information for the current period, only.

Once the income statement is prepared, their job is done.

So you close them out.

This leaves them empty, ready for next period’s information.

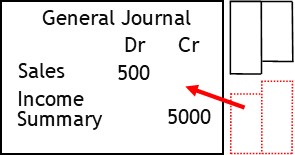

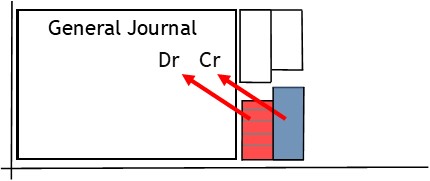

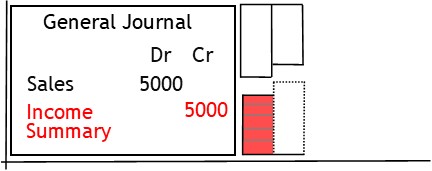

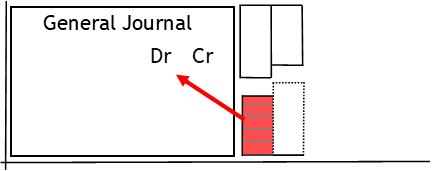

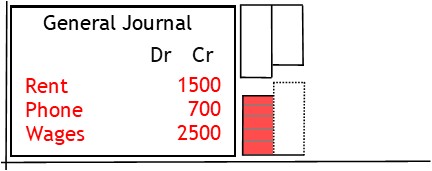

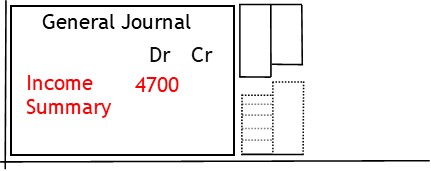

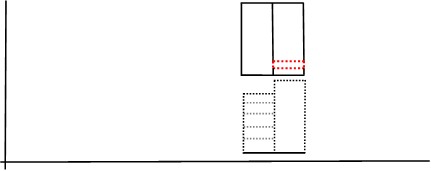

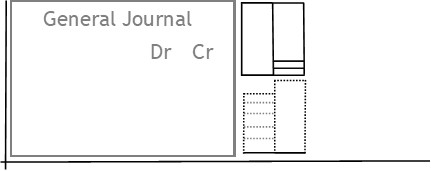

To transfer the information, you use the general journal.

This journal has a debit and a credit column.

You use debits and credits when closing out accounts.

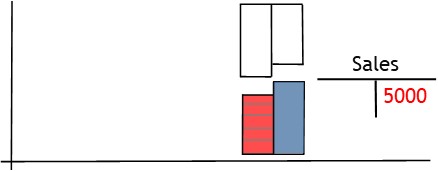

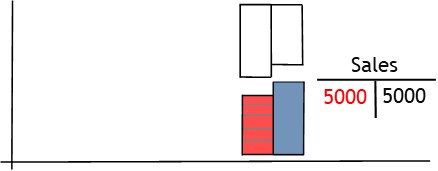

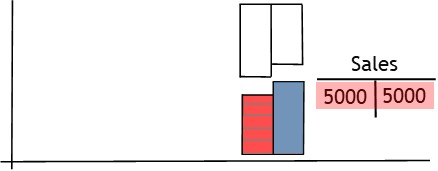

For example, you use them to close out the sales account.

The sales account has a credit balance.

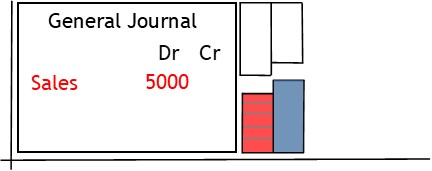

So, to transfer the balance, you record sales in the general journal with a debit entry.

This registers a debit entry in the sales account, itself.

As such, the entry offsets the credit entry currently shown in the sales account.

By bringing the account’s balance to zero, you effectively close out the account.

After this, you credit the income summary account.

This shows the business received money from income.

With this entry, you record income component of the income statement.

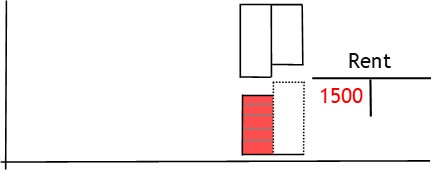

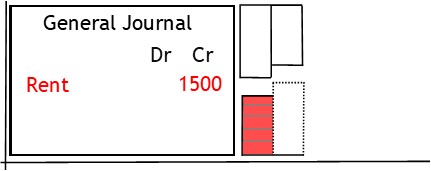

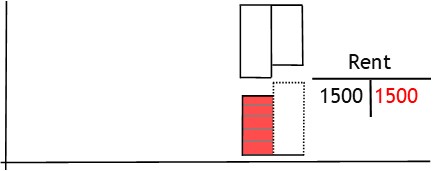

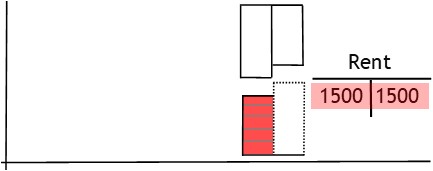

Next, you need to transfer expenses to the income summary account.

Expenses are recorded with a debit balance.

To transfer the balance, you record the expense in the general journal with a credit entry.

This registers a credit entry in the expense account itself.

As with income, the entry offsets the current balance.

You transfer all expenses in the same manner.

By bringing the balance of each and every expense account to zero, you effectively close out all expense accounts.

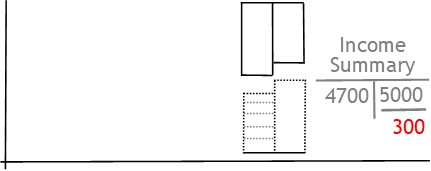

After this, you debit the income summary account with total expenses.

This shows the business used the money for expenses.

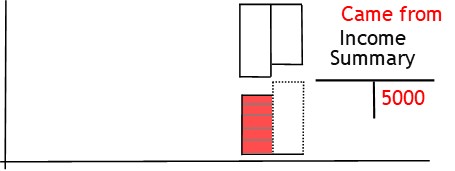

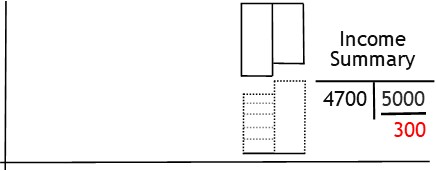

Next, you find the income summary account’s balance.

The income summary account itself is also a temporary account and needs to be closed out, as well.

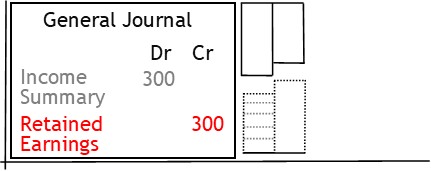

To do this you close it out through the general journal.

The income summary account’s balance shows the period’s profit or loss.

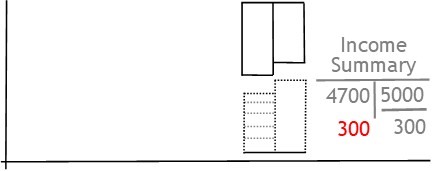

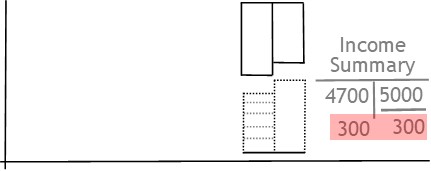

You transfer the profit from the income summary account with a debit entry.

The entry will offset the account’s current balance..

This effectively closes the account.

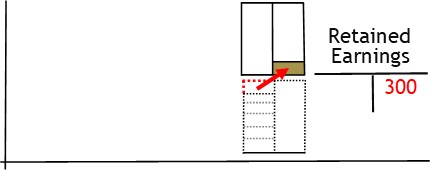

At the same time, you credit retained earnings.

When complete, the transaction will show that profit has been transferred to retained earnings.

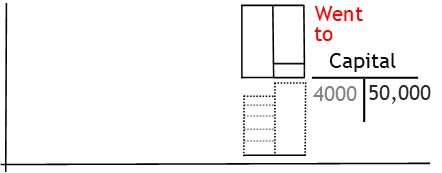

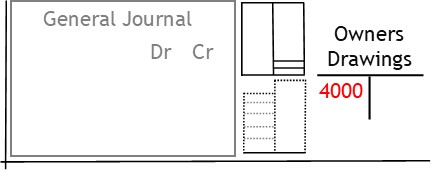

Closing Owners Drawings

Owners drawings is also a temporary account.

The account tracks owners drawings for the current period, only.

So, at period-end, it needs to be closed out as well.

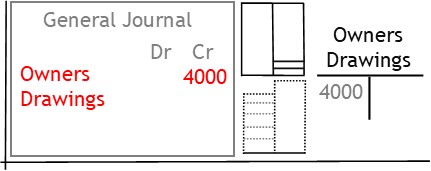

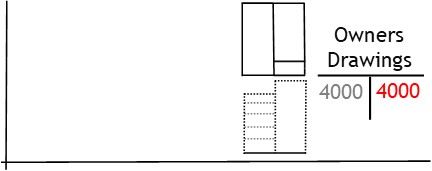

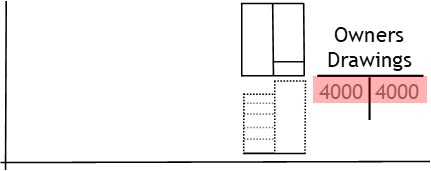

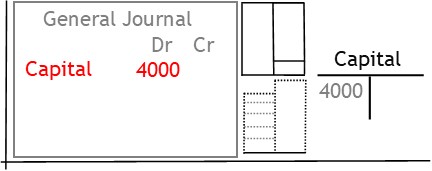

You close owners drawing through the general journal.

Owners drawings has a debit balance.

So, to transfer the balance, you use a credit entry.

The credit entry offsets the account’s current balance.

This closes the account by bringing its balance to zero.

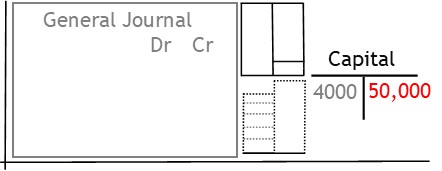

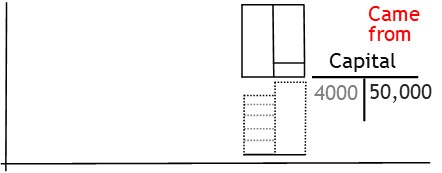

After this, you debit the capital account.

Typically, the capital account has a credit balance.

It shows how much money is owed to the owner—or has come from the owner.

By debiting the account, you are showing that the drawings have gone to the owner.