Clearing Account

What is a Clearing Account?

A clearing account is a temporary account used when transferring information from one place to another.

How it Works

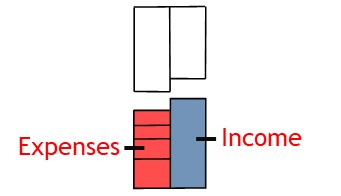

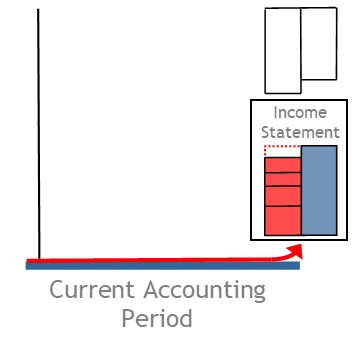

During the accounting period, you record income and expenses.

An income summary account is a clearing account used to clear out the income and expense accounts.

Why Close Out the Accounts

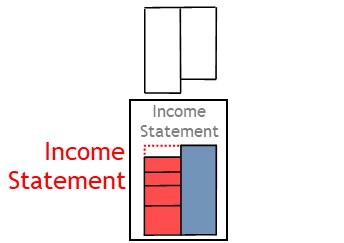

The income statement is a summary of income and expense transactions for the current period, only.

Once the report is complete, the income and expense accounts have done their job.

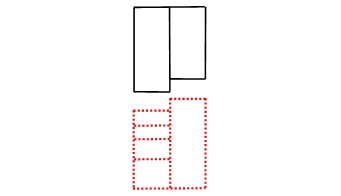

Income and expense accounts are classified as temporary accounts.

So once the report is prepared, they need to be cleared out.

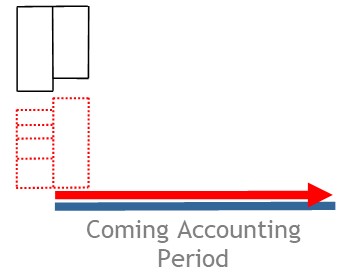

This will leave them empty, ready for the coming period’s income and expenses.

Preparing an Income Summary Account

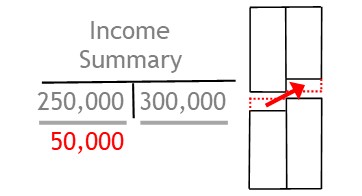

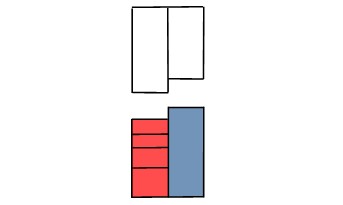

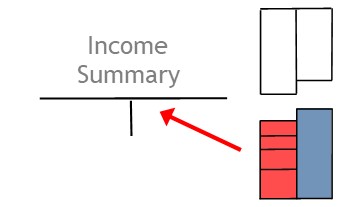

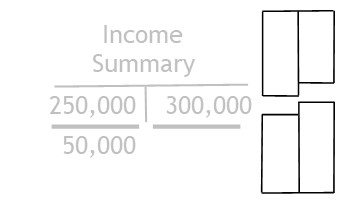

To prepare an income summary account, you transfer information from the income and expense accounts.

First, you transfer expenses to the clearing account.

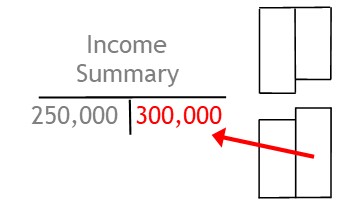

Then you transfer income to the account.

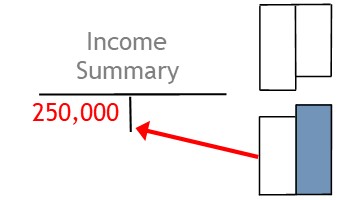

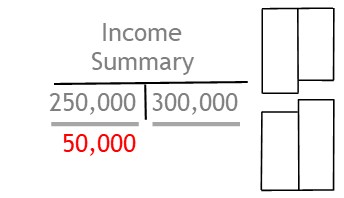

After this, you find the account’s balance, which will show profit or loss for the period.

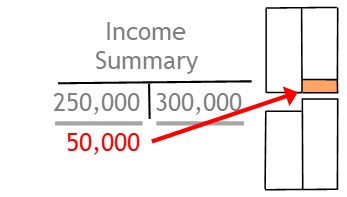

You transfer this profit or loss to retained earnings.

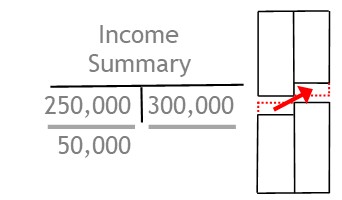

The clearing account is also a temporary account, its only function being to transfer information from one place to another.

So by transferring its balance, you will close out this account, as well.

© R.J. Hickman 2020