Consignment

What Is a Consignment?

Consignment is when the owner of goods sends them to another party to sell them.

How it Works

A manufacturer may produce goods.

It may then sell these goods themselves.

Alternatively, the manufacturer may sell the goods it produced on consignment through another party.

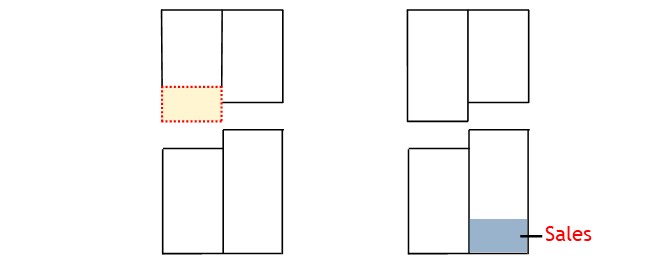

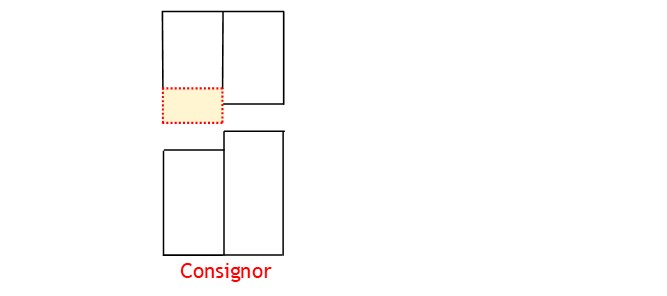

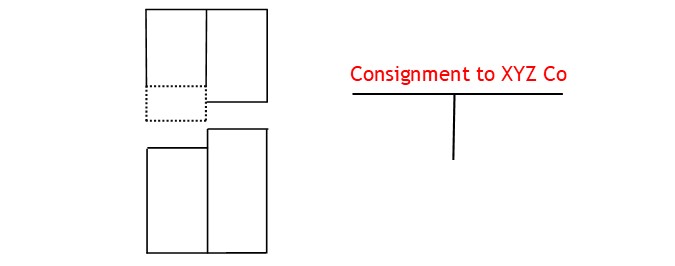

In this relationship, the owner of the goods is known as the consignor.

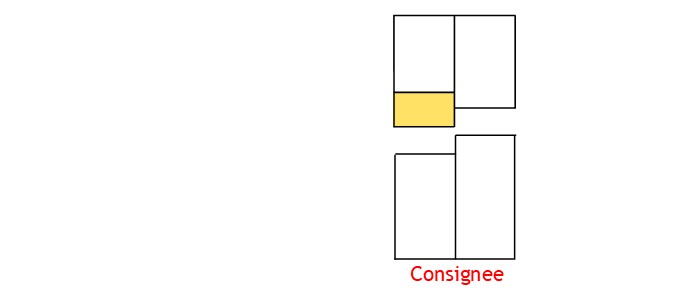

The other party who sells the goods is known as the consignee.

Prior to shipment, the parties will arrange a sale price for the goods.

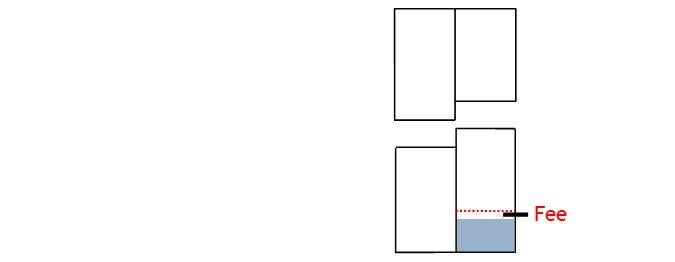

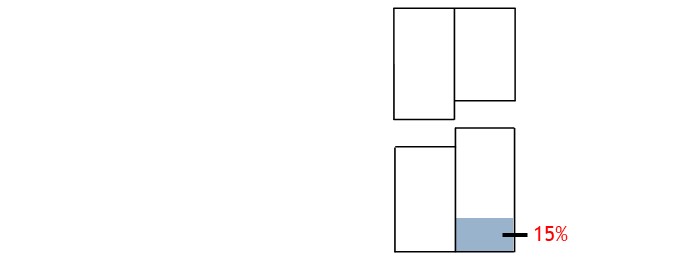

At the same time, they will negotiate the consignee’s fee for selling the goods.

Typically, this will be a percentage of the sale price.

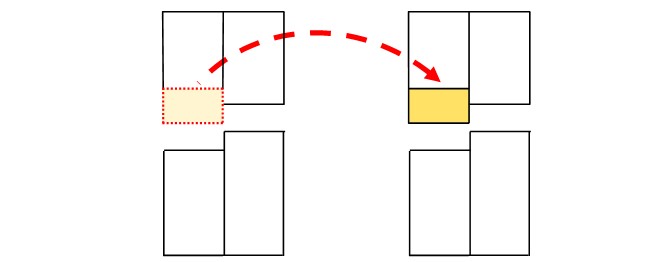

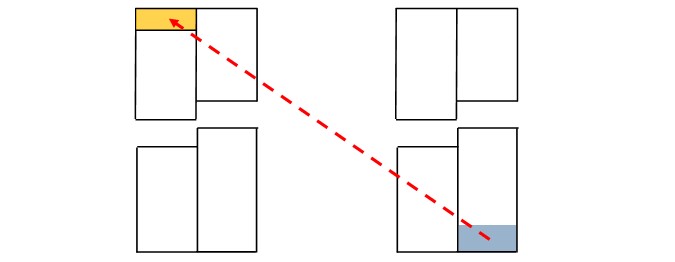

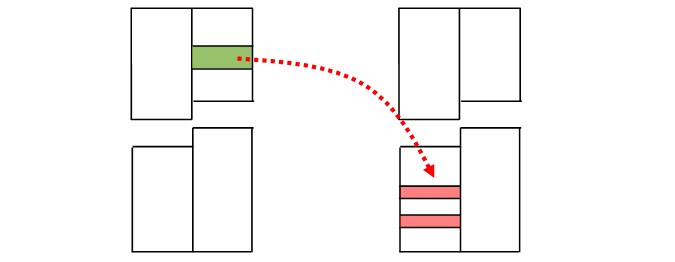

With arrangements in place, the consignor will ship the goods to the consignee.

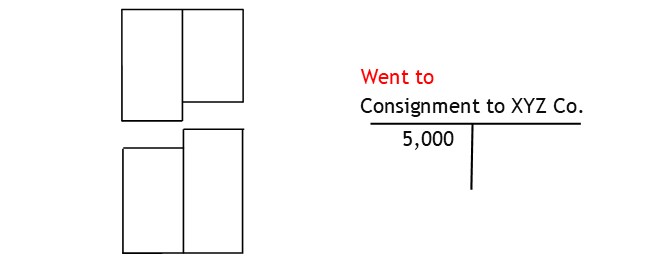

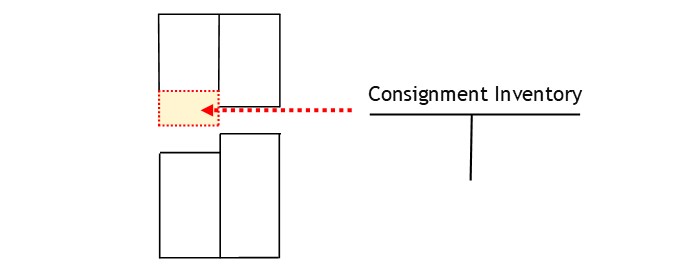

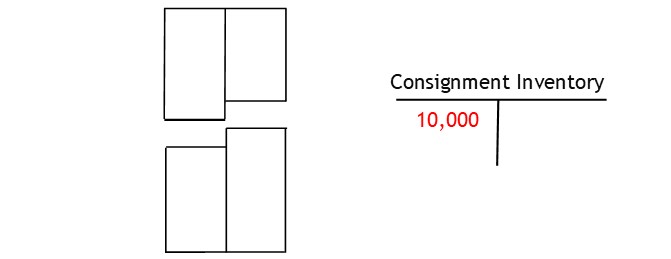

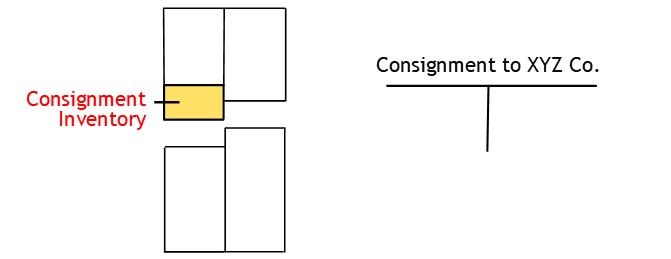

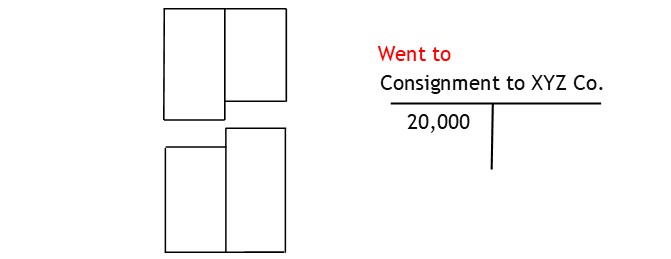

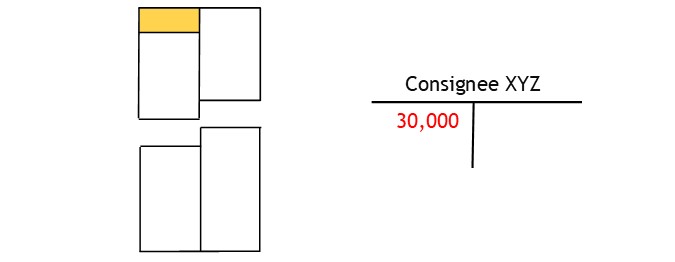

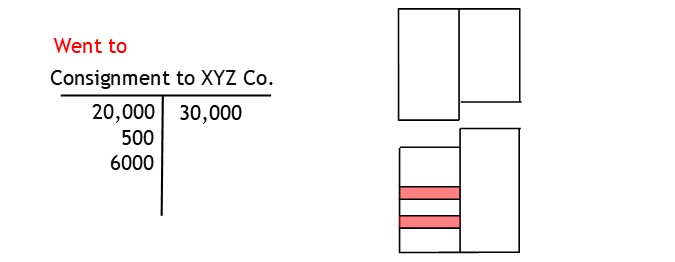

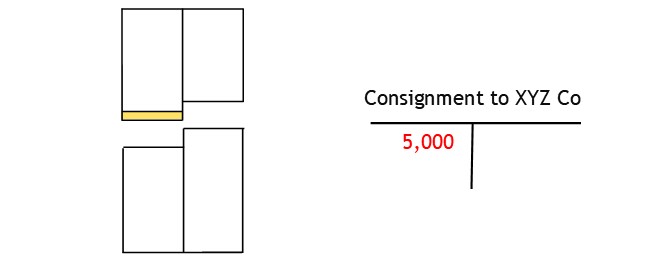

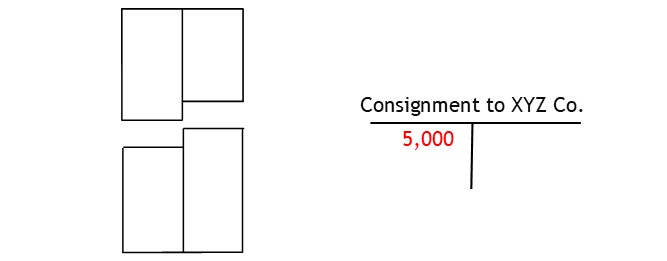

When the goods are shipped, the consignor needs to set up a consignment account.

This is an account used to show stock or goods removed from general inventory and used for consignment.

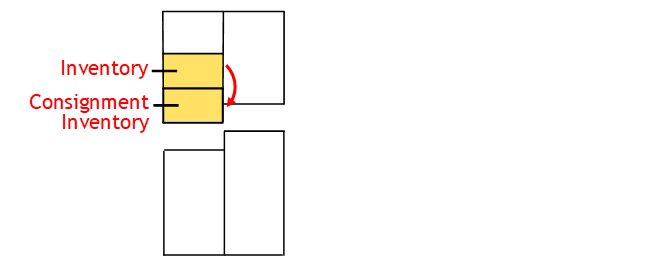

At the same time, you set up a consignment account.

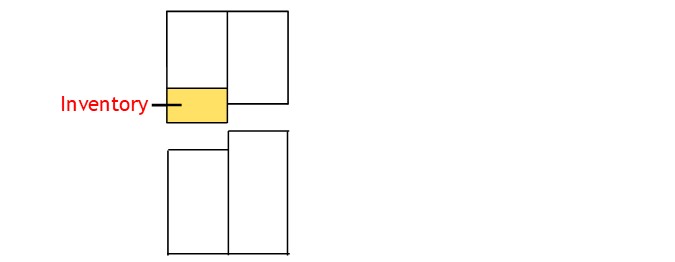

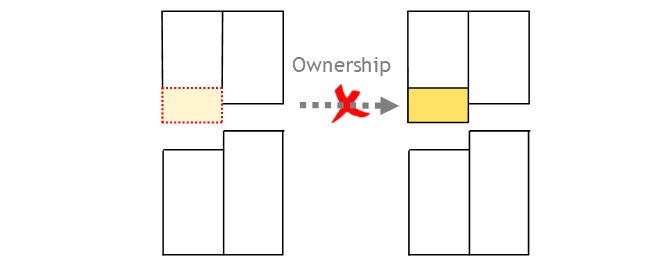

With consignments, ownership of inventory does not change hands.

So the goods on consignment remain a part of the consignor’s inventory.

As such, you need to keep track of this inventory through the consignment process.

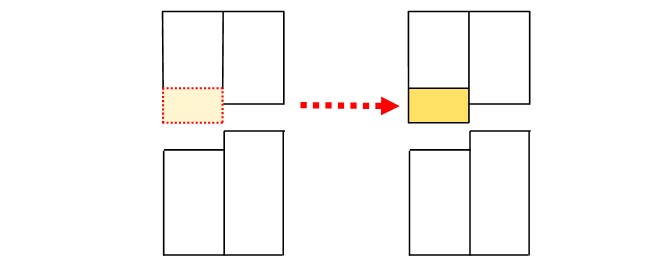

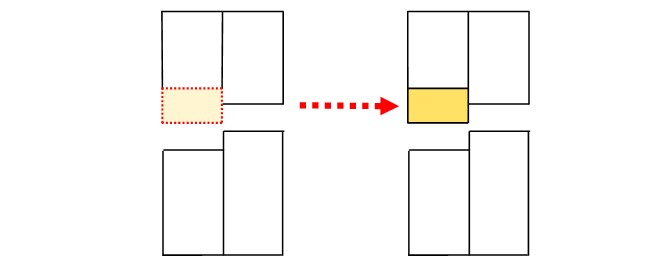

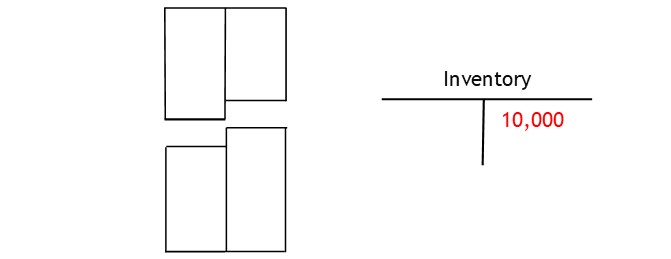

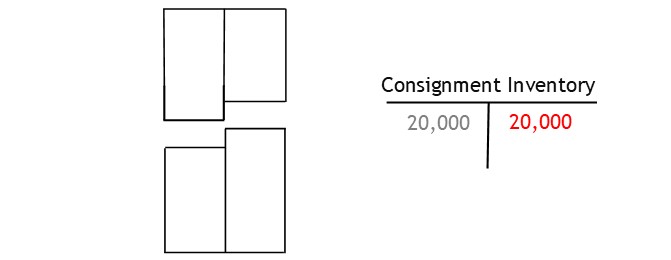

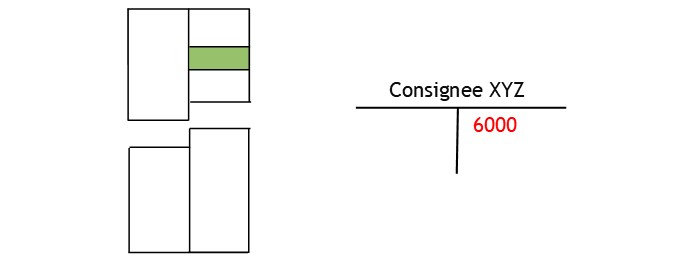

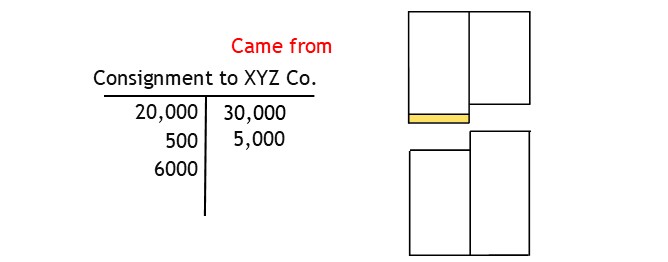

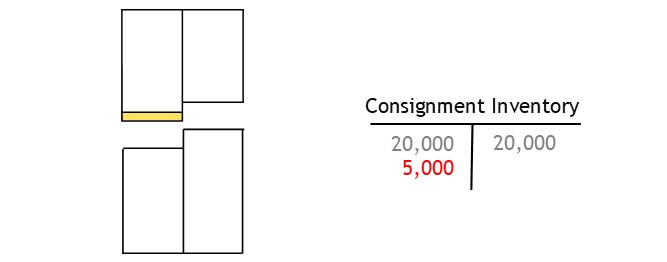

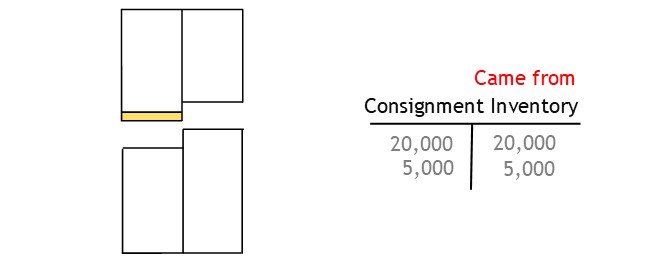

First, you need to show where the consignment inventory came from.

To do this, you credit the inventory account.

This shows you have taken value from the inventory account.

Then you debit the consignment inventory account.

This shows you have transferred the value to the consignment inventory account.

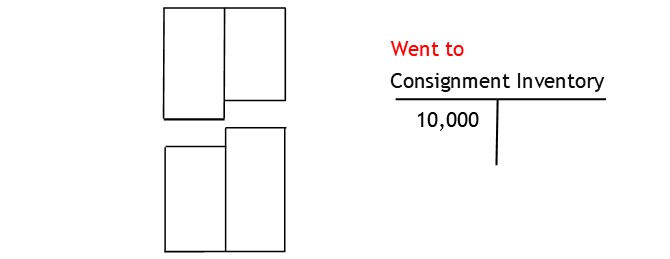

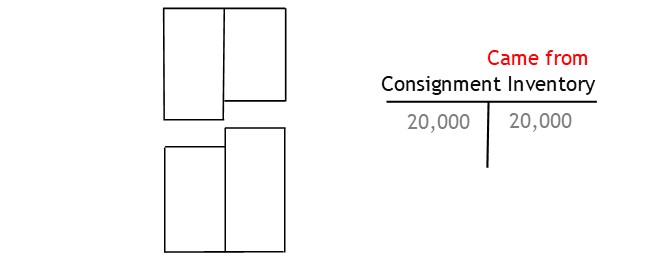

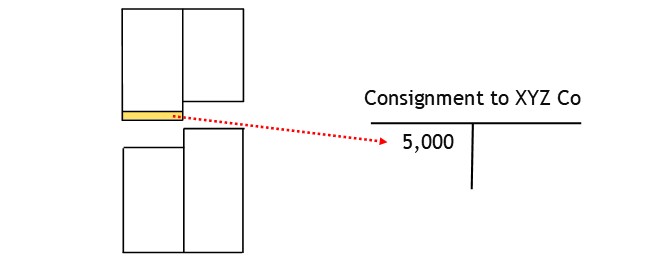

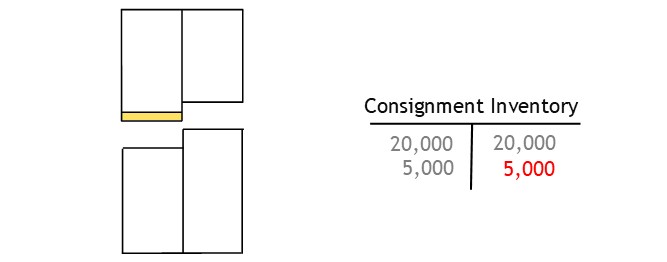

After this, you need to update the consignment account.

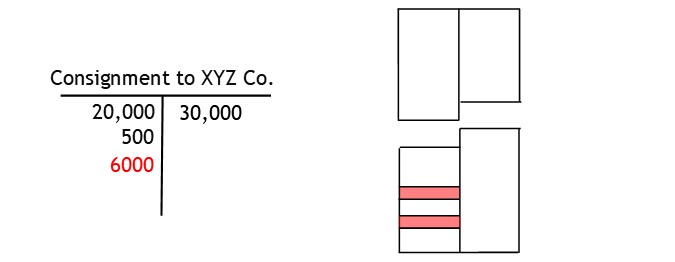

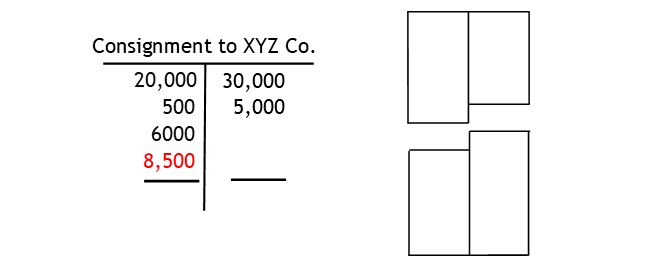

When complete, the consignment account is like a combined trading account and profit & loss account.

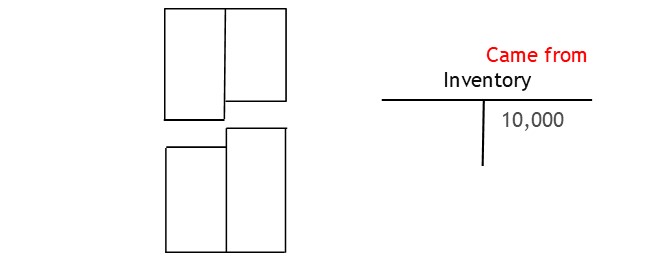

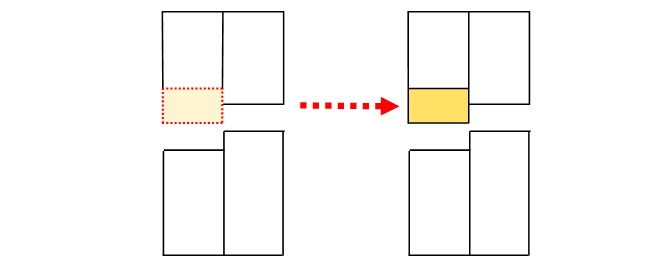

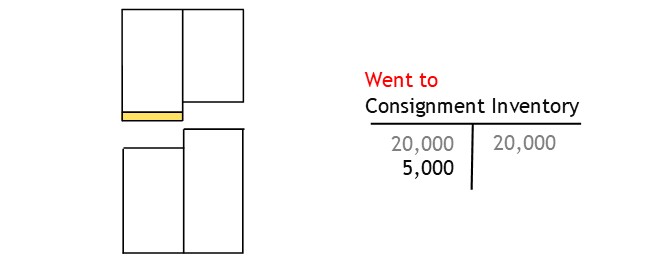

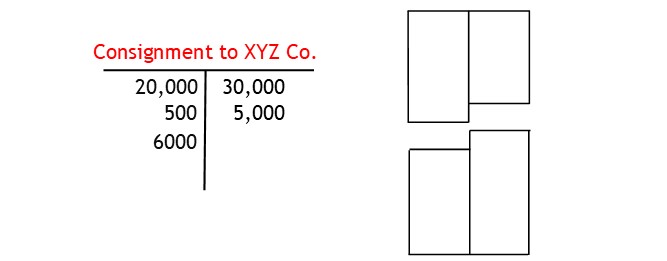

To update the account, you begin by recording inventory information.

Here, you credit the consignment inventory account.

This shows you are taking value from the inventory account.

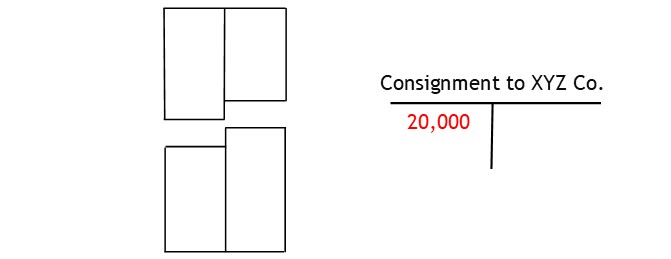

Next, you debit the consignment account.

This shows you have assigned the value to the consignment account.

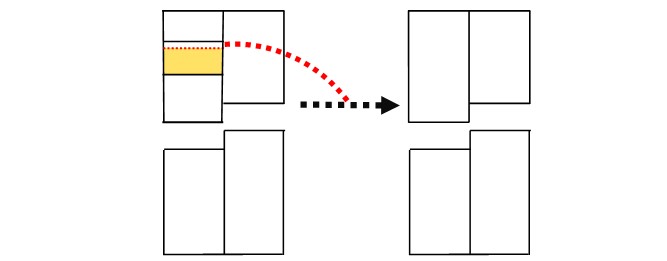

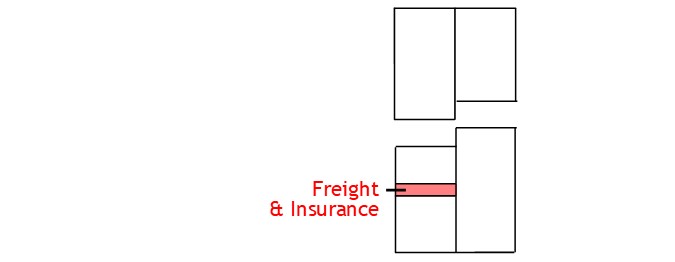

There will also be freight & insurance costs involved with shipping the product.

The money for these expenses will come from the bank.

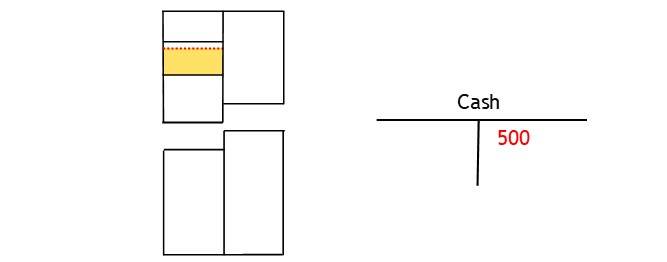

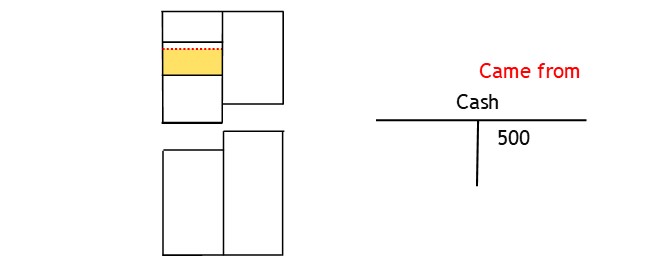

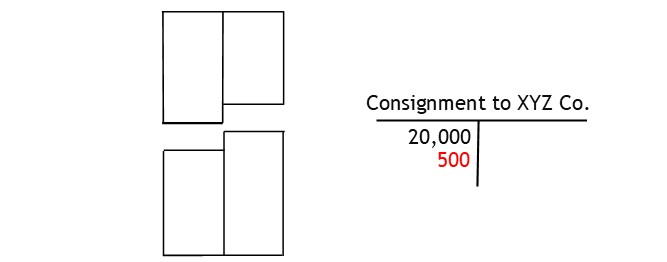

To record the expenses, you credit the cash account.

This shows money came from the bank.

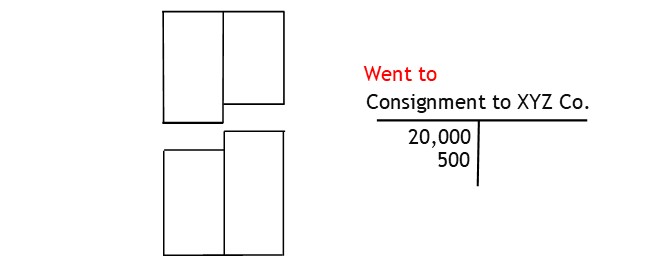

Then you debit the consignment account.

This shows you have assigned the expense to the consignment account.

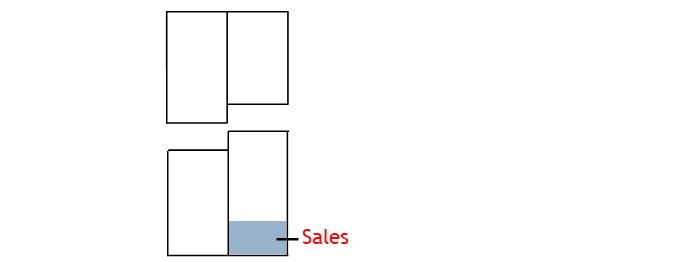

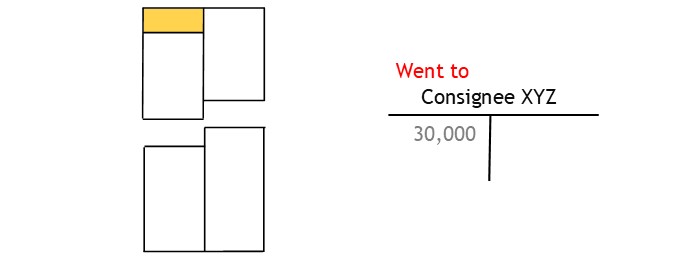

In time, the consignee will sell some of the consignment.

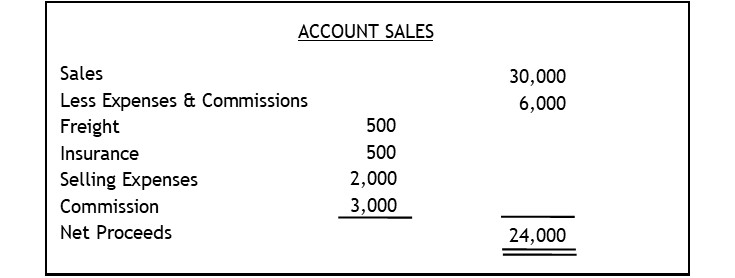

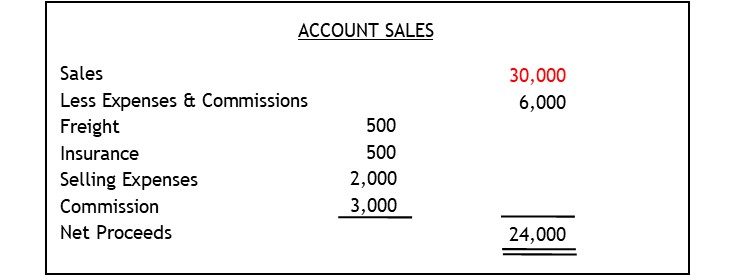

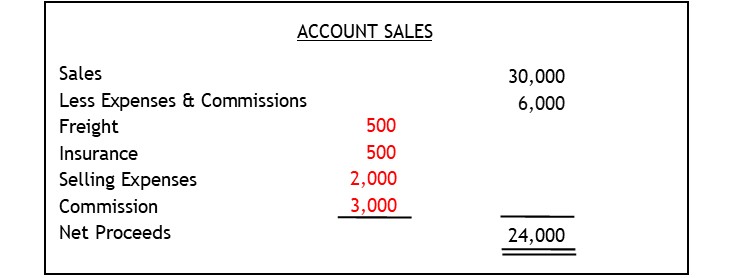

Usually, the consignee will notify the consignor of sales via an account sales.

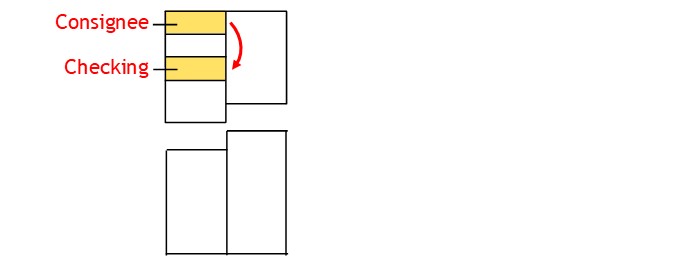

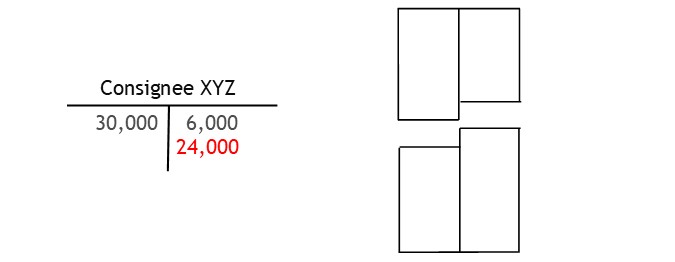

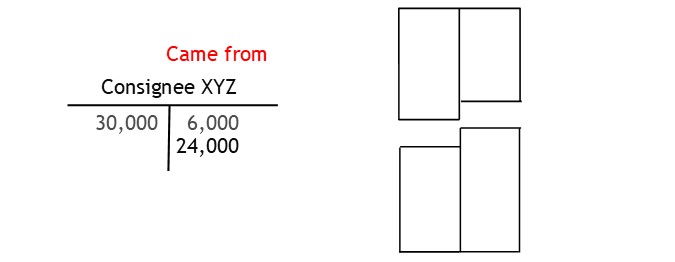

To record the sales information, you need to set up a personal account for the consignee.

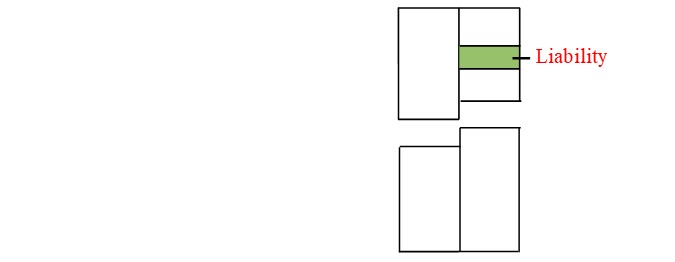

This account is more or less an asset and a liability account, all in one.

Any sales will make the consignee a debtor to the consignor.

This is because the consignee owes the consignor money for the sales.

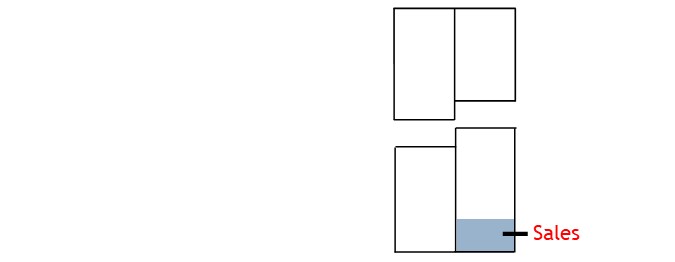

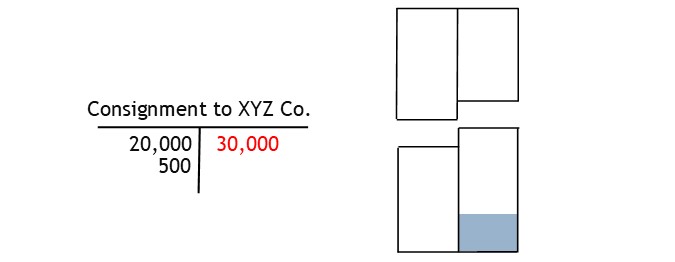

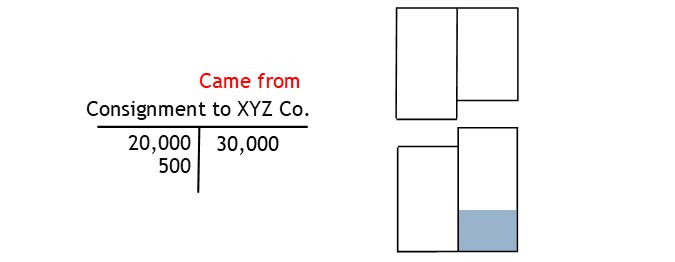

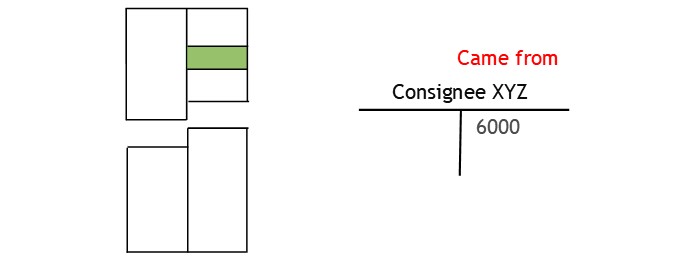

You find the sales amount from the account sales.

To record the sales, you credit the consignment account.

This shows that the money will come from the consignment.

Then you debit the consignee’s personal account.

This shows you have recorded the debt owed.

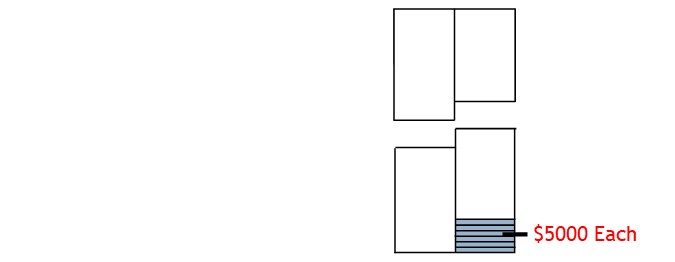

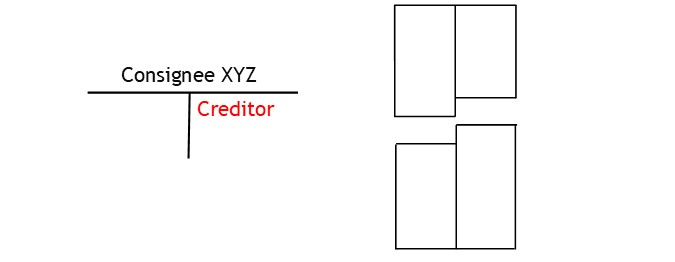

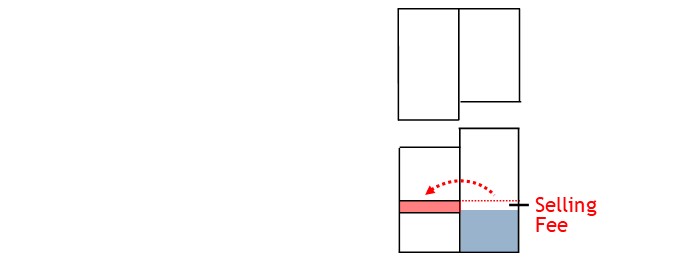

The consignee is also a creditor to the consignor.

When it sells goods to customers, it may have to ship the goods to them.

If so, they will also pay freight and insurance.

The consignee has also performed a selling service for which it is to be remunerated.

All of these costs are shown on the account sales.

As the consignee is owed money for these costs, you treat the consignee as a creditor.

When recording the costs, you need to show that value or money came from the creditor and were used for expenses.

So to record the costs, you credit the consignee’s account.

This shows that the money and value came from the consignee.

Then you debit the consignment account.

This shows the money and value were used as consignment expenses.

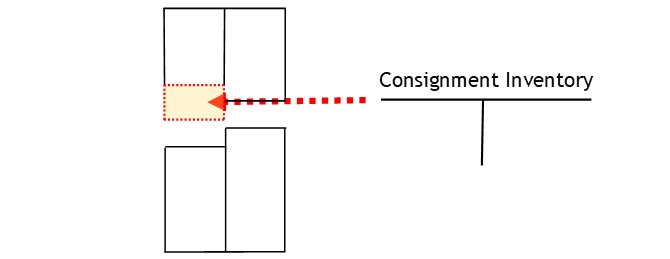

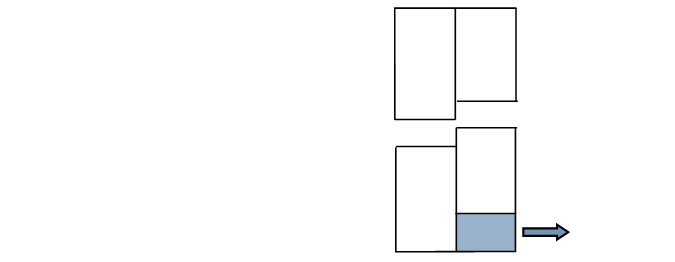

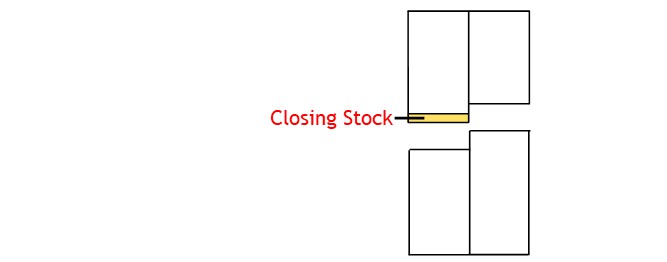

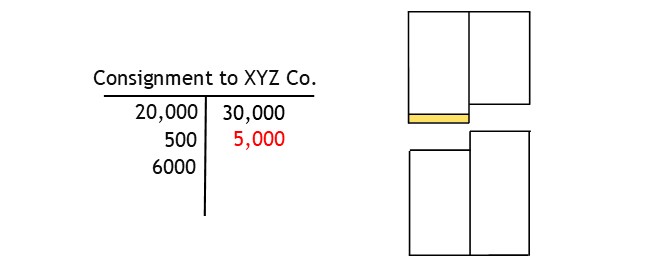

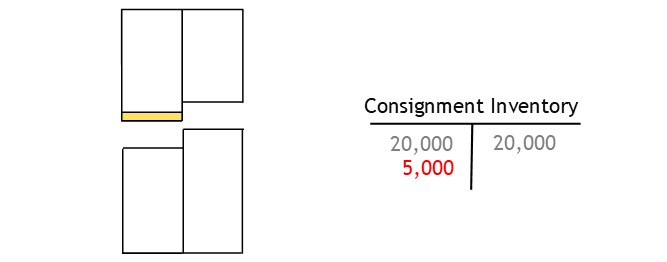

At period—end, the consignee may still have some inventory on hand.

For reporting accuracy, you need to move the closing stock value back to your records.

To do this, you credit the consignment account.

This shows you have taken value from that account.

Next, you debit the consignment inventory account.

This shows you have transferred the closing inventory value back to the consignment inventory account.

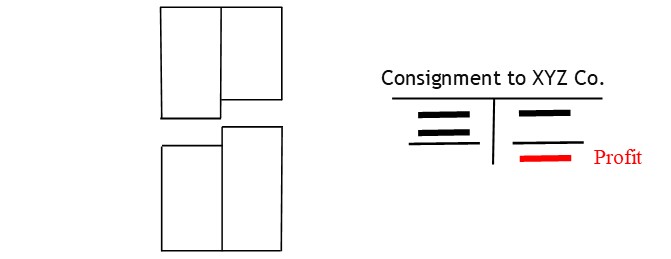

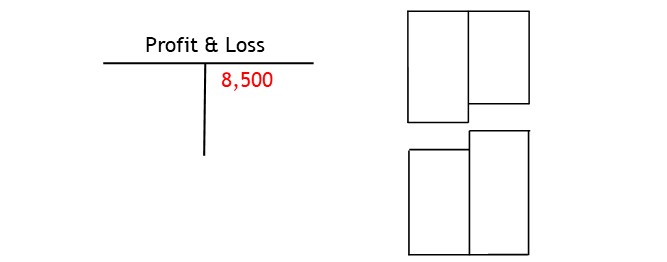

The consignment account now contains all the information necessary to calculate profit/loss on the consignment

To do this, all you need do is find the account’s balance.

After this, you transfer the profit to the profit & loss account.

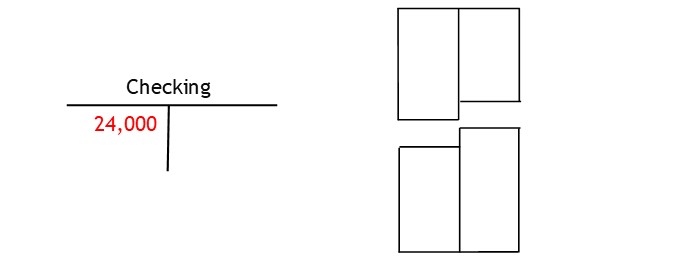

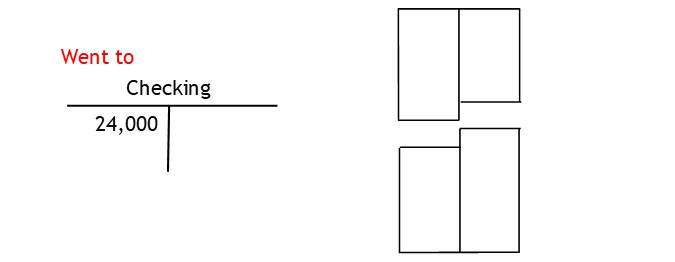

Next, you need to record money received from the consignee and deposited in the bank.

Here, you credit the consignee’s account.

This shows the money came from the consignee.

Then you debit the cash account.

This shows the money was deposited in the bank.

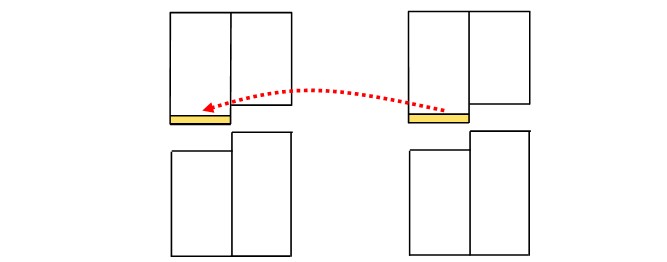

The final step in the process is to reverse the consignment inventory entry made earlier.

Consignment inventory will become opening stock in the coming.

So you need to reverse the closing inventory value back to the consignment account.

To reverse the entry, credit the consignment inventory account.

This shows you are taking value from the inventory account.

Then you debit the consignment account.

This shows you have assigned the value to the consignment account.