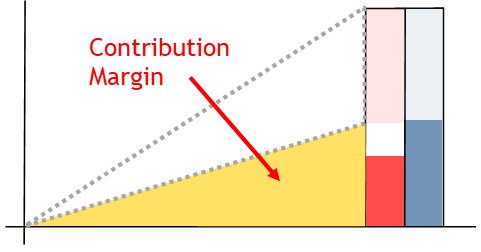

Contribution Margin

What is a Contribution Margin?

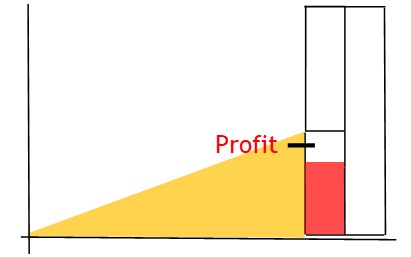

Contribution margin shows how much money variable costs are contributing to fixed costs and profit.

How it Works

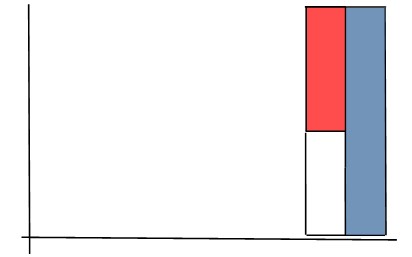

A business produces revenue.

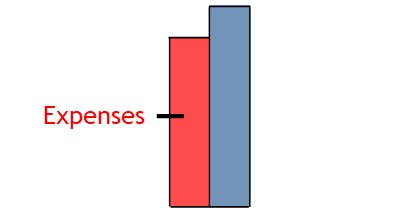

To produce that revenue, the business will incur costs.

These costs are made up of two parts.

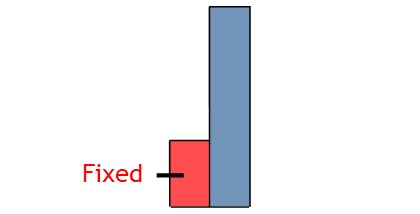

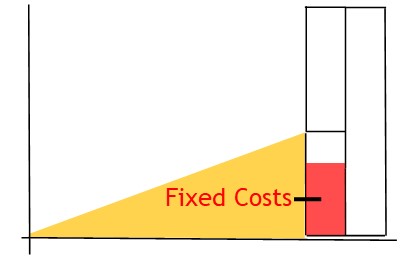

One part comprises fixed costs.

Fixed costs include things such as rent, admin salaries, insurance.

These costs need to be paid regardless of whether the business earns income or not.

Furthermore, they always remain at the same level no matter what happens to sales.

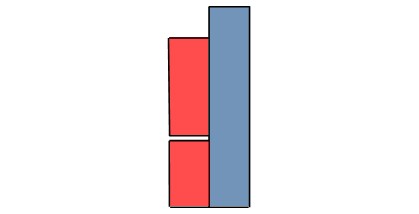

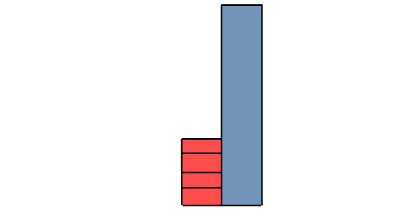

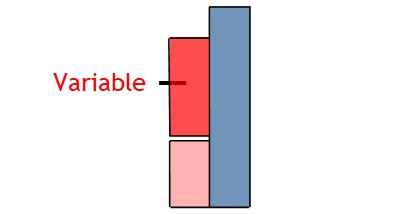

The other costs are variable costs.

Variable costs include things such as sales commissions, direct labor costs, and cost of materials used in production.

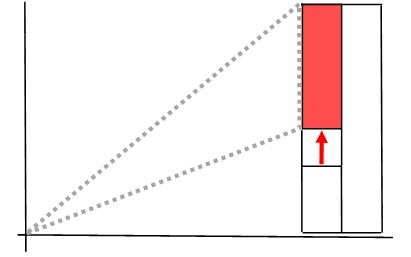

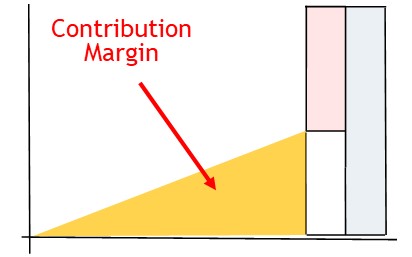

They are called variable costs because they vary dependent on revenue levels.

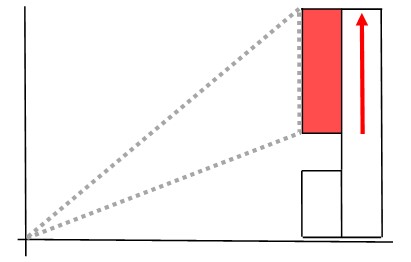

They are what drives revenue higher.

As a result, they drive profit higher, as well.

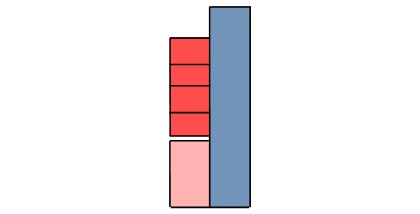

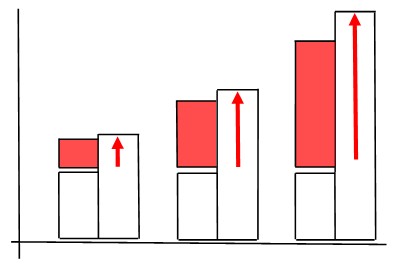

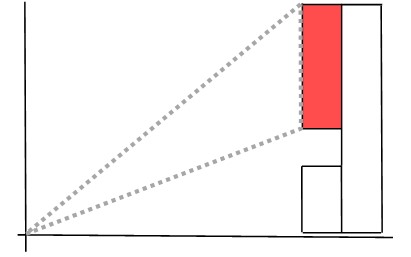

Variable costs are like a crane.

They lift revenue.

In the process—they also lift profit.

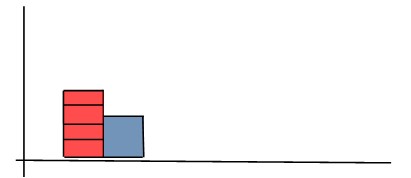

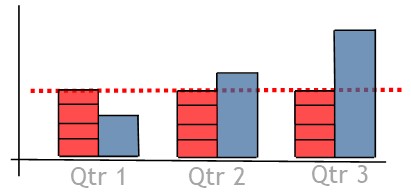

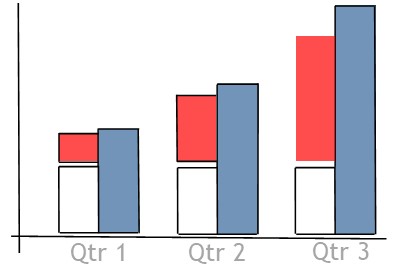

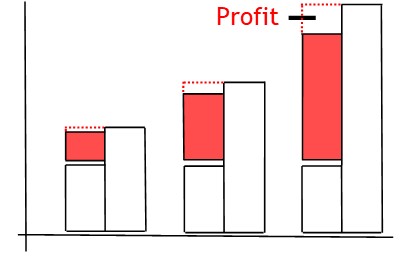

To calculate contribution margin, you deduct total variable costs from total revenue.

The difference shows how much variable costs are contributing to the business.

It will show you how much money variable costs are contributing to fixed costs.

And it will also show you how much they are contributing to profit.

© R.J. Hickman 2020