Control Account - Creditors

Recording Supplier Purchases in the Control Account

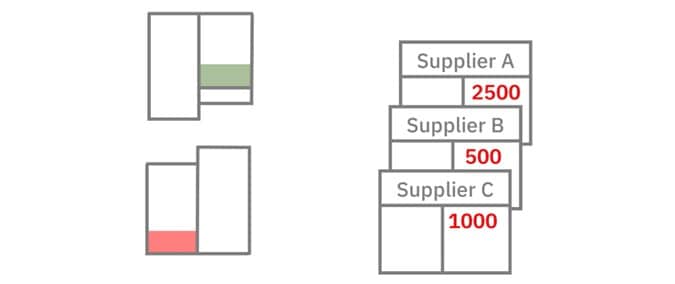

A business will buy goods & services on credit from wholesalers and so on

This means the business buys now but pays later.

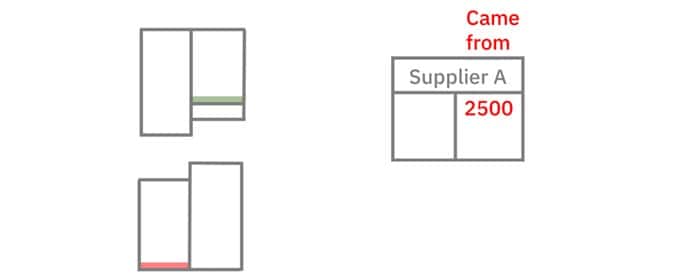

When this happens, a value of goods or services comes from a supplier, and those goods or services will become an expense of the business.

The business was able to buy the goods or services on credit because the supplier was prepared to extend credit to it.

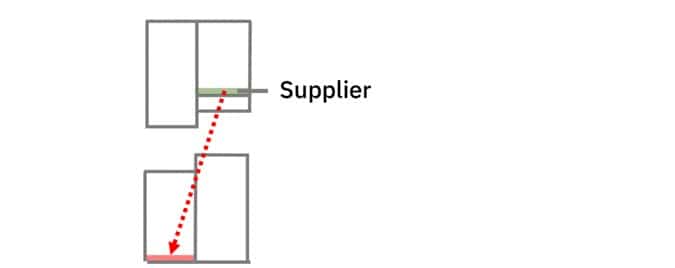

For this reason, the supplier is called a creditor.

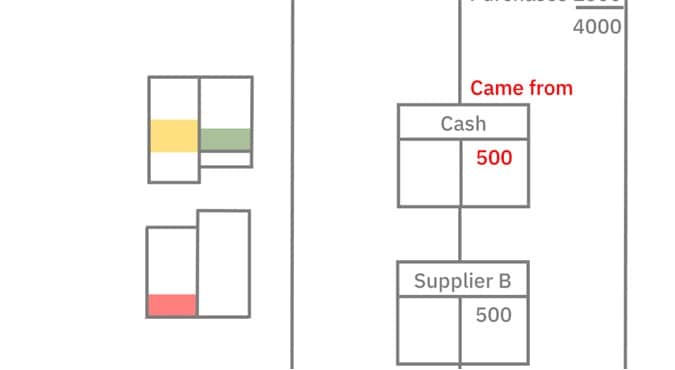

To record the transaction, you credit the supplier’s account to show a value of goods or services came from the supplier.

Then you debit the expense or purchases account to show where the goods or services were used.

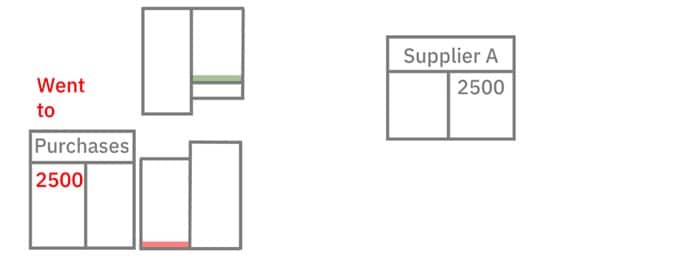

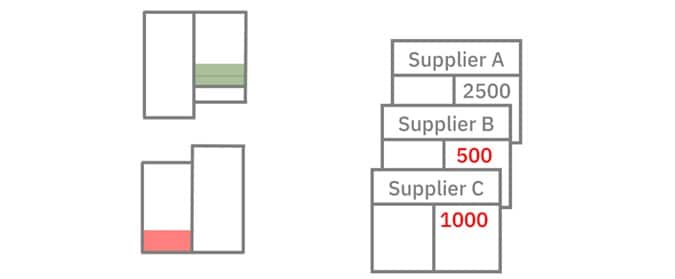

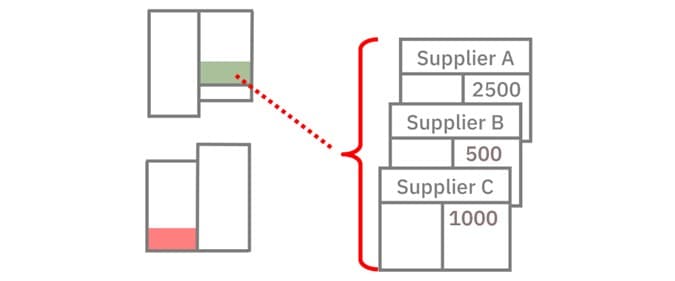

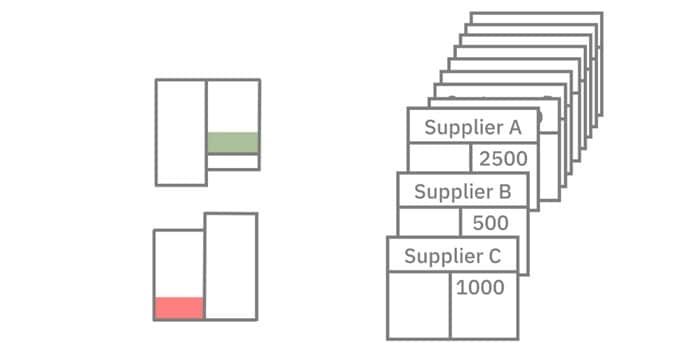

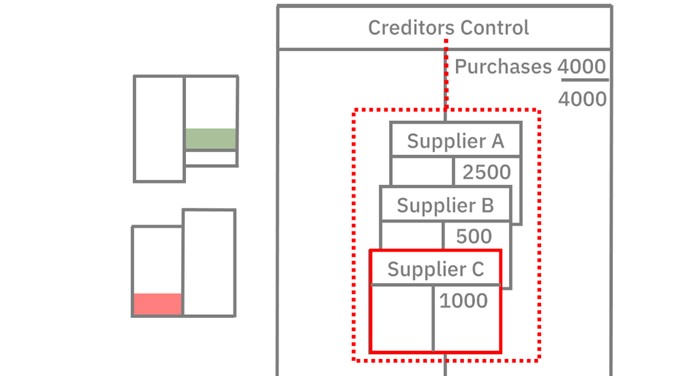

A business may buy goods & services from several suppliers, each day.

If these individual supplier accounts were contained in the general ledger it would be impossible to manage the business effectively.

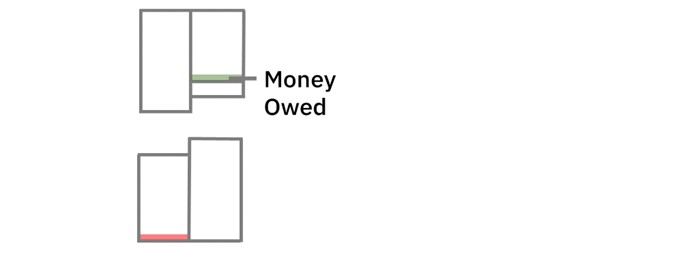

To find out how much money the business owed suppliers, you would need to add together all the balances of all the individual supplier accounts.

This may be all right if the business only has a few supplier accounts, but a business may have many suppliers making this task extremely difficult.

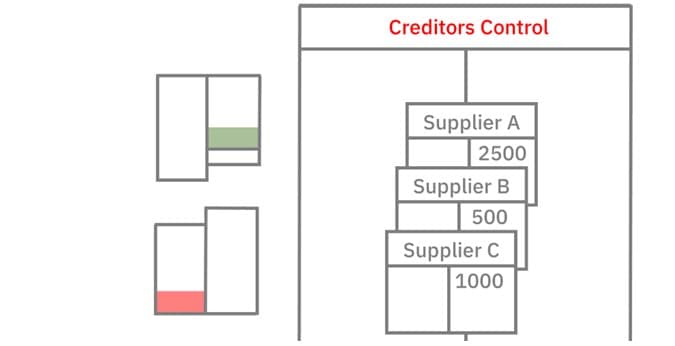

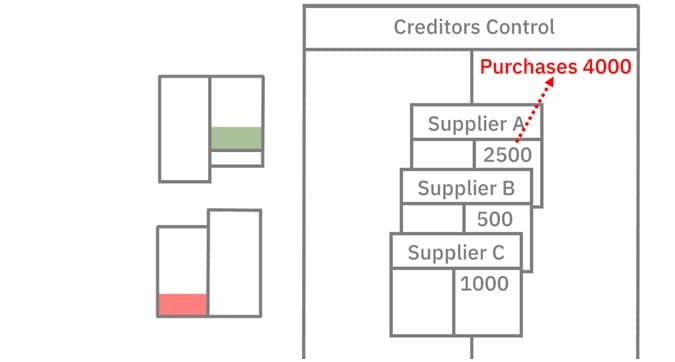

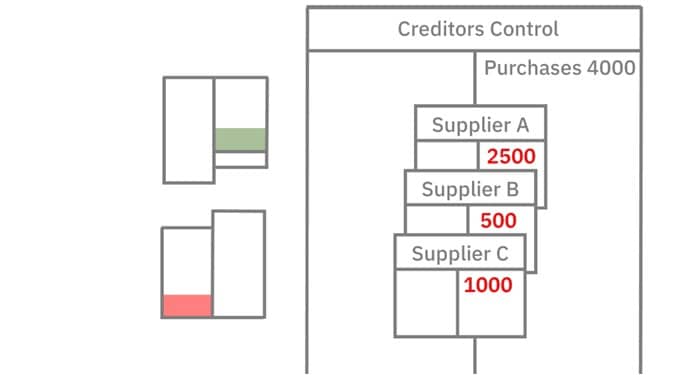

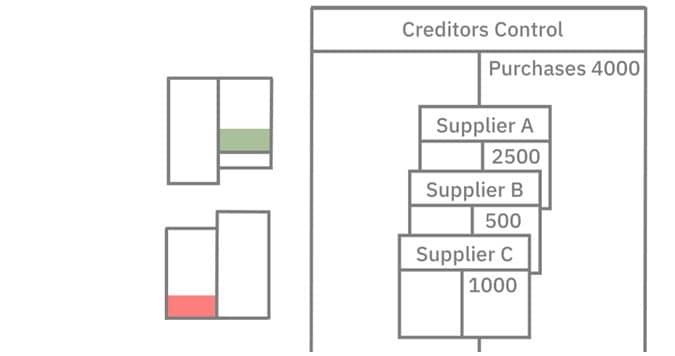

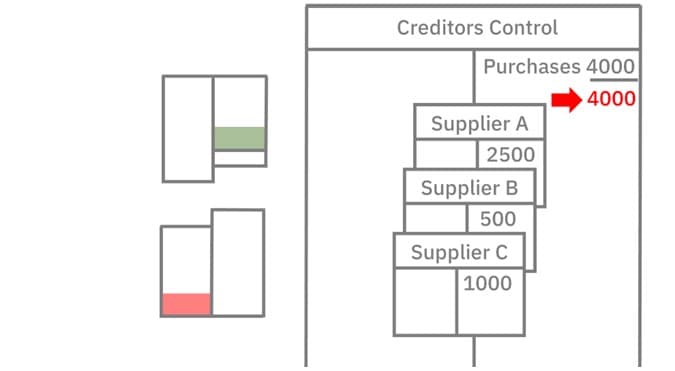

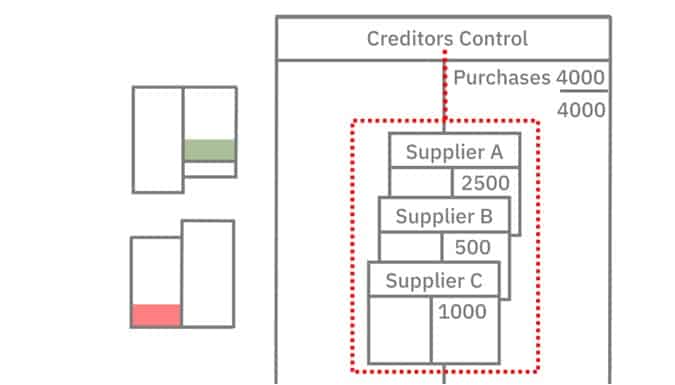

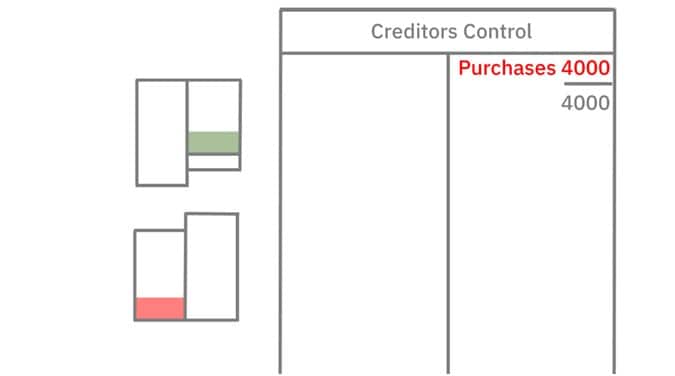

To overcome this problem, once you’ve updated the individual supplier accounts. you also update an account known as a purchases ledger control account or creditors control account.

When you update the control account, you update it with a summary of the supplier transactions.

In this example, it’s a total of the day’s purchases shown in the purchases ledger.

Doing this gives you more control over your records.

Now, to find out how much the business owes to all of its suppliers all you need to do is refer to the control account’s balance.

The control account is the account contained in the general ledger, and it is the control account’s balance that is shown on this diagram

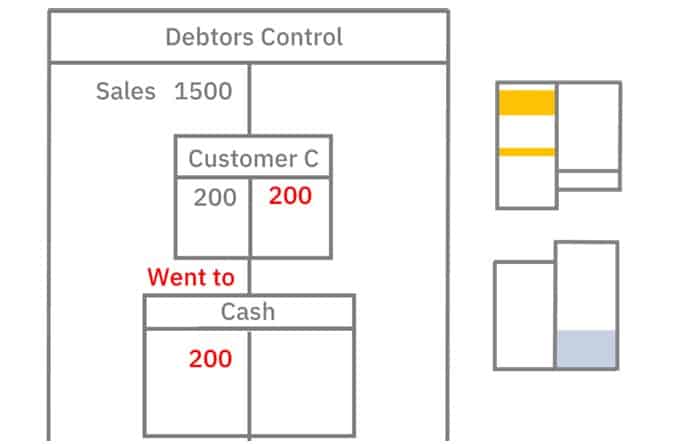

For their part, the individual customer accounts form something known as a subsidiary ledger or a sales ledger

Each account within this ledger is referred to as a sub account

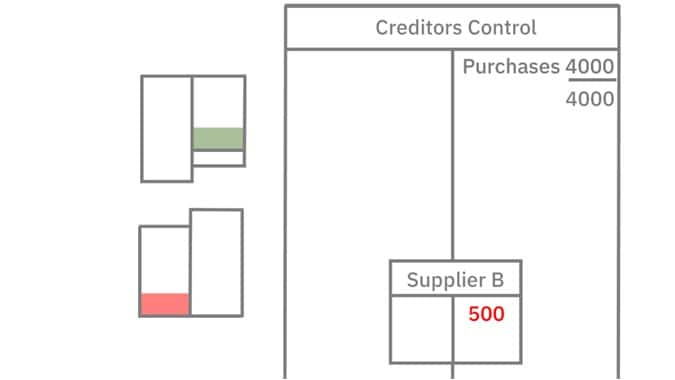

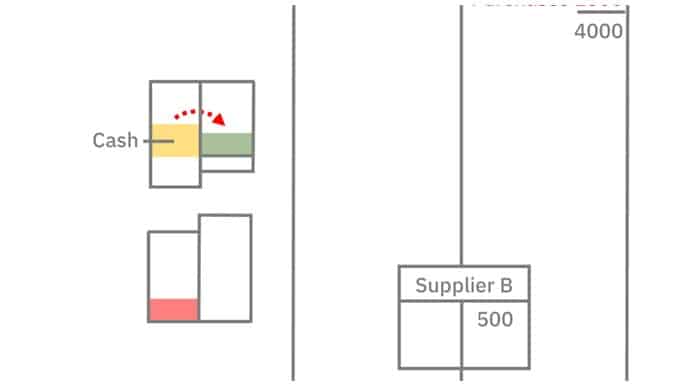

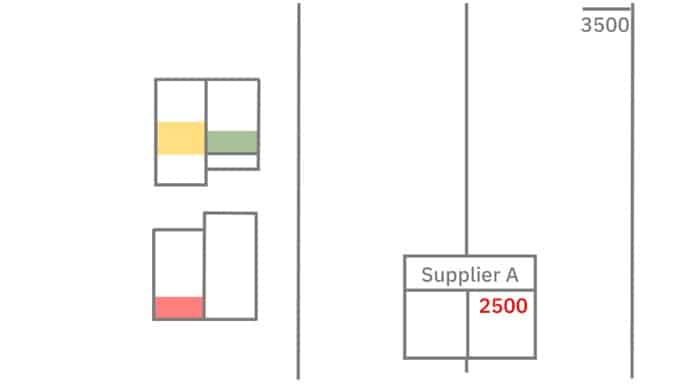

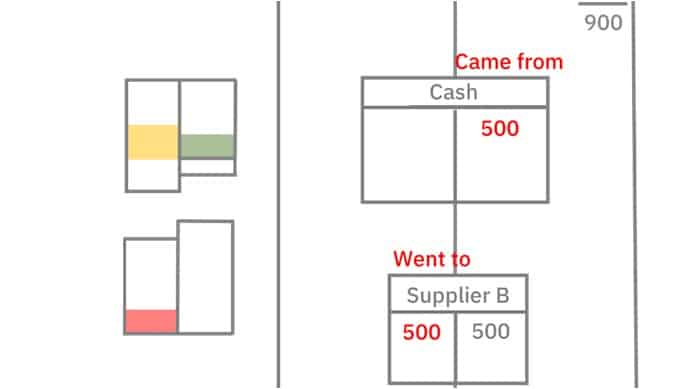

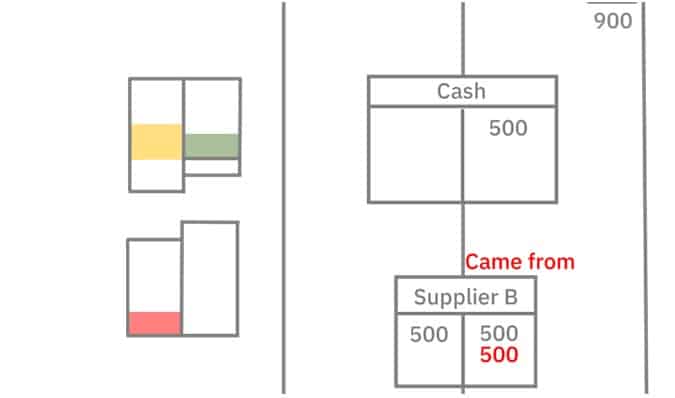

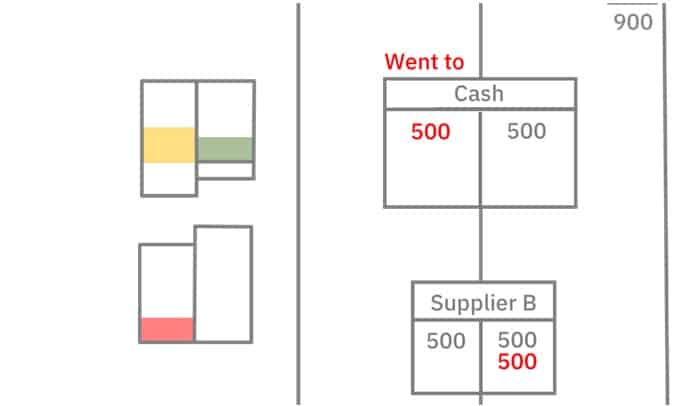

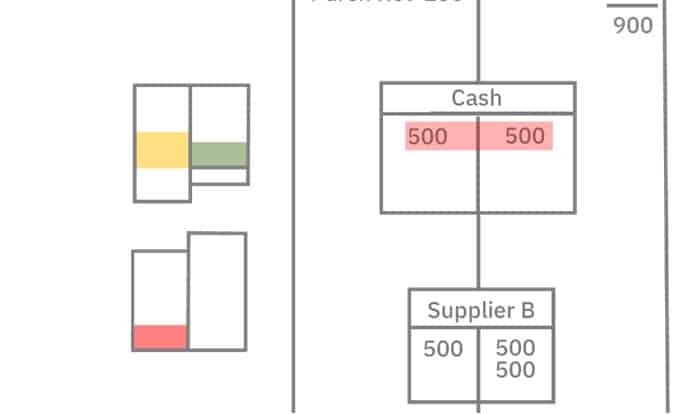

Recording Supplier Payments in the Control Account

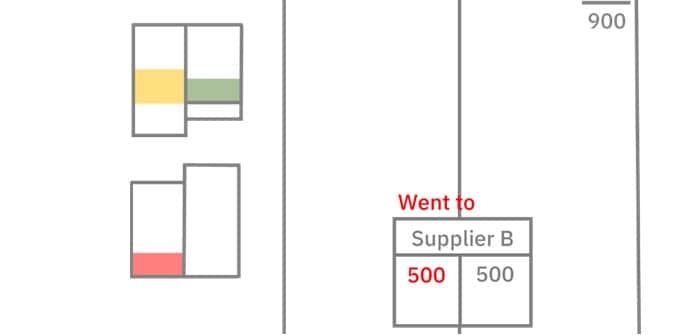

The control account contains a summary of all supplier transactions, not just purchases

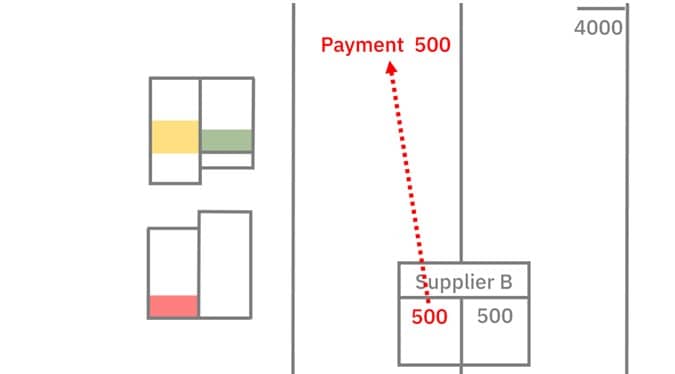

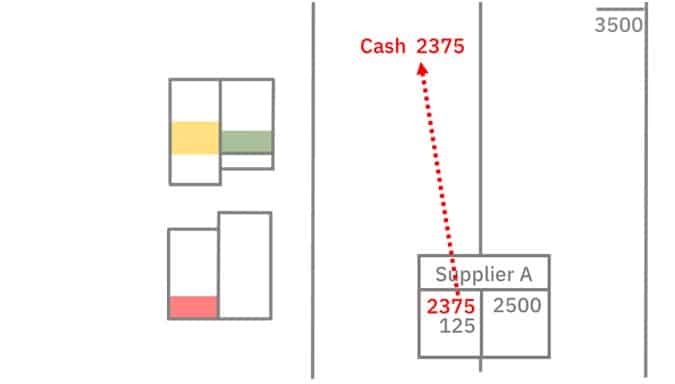

For example, the business will make payments to suppliers.

Here, money comes from the business’s bank account and the business sends this money to the suppler

To record the transaction, you credit the cash account to show that money came from the bank.

Then you debit the supplier’s account to show the money went to the supplier.

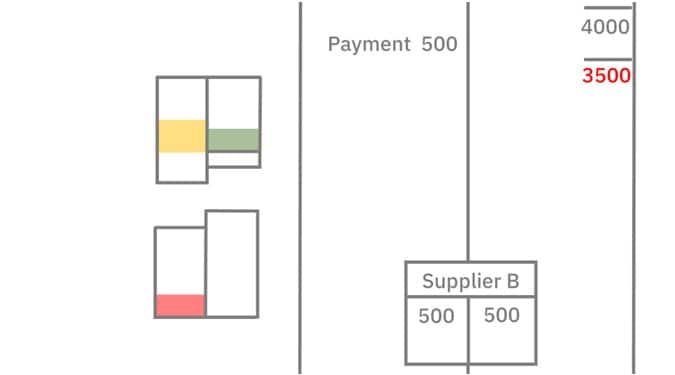

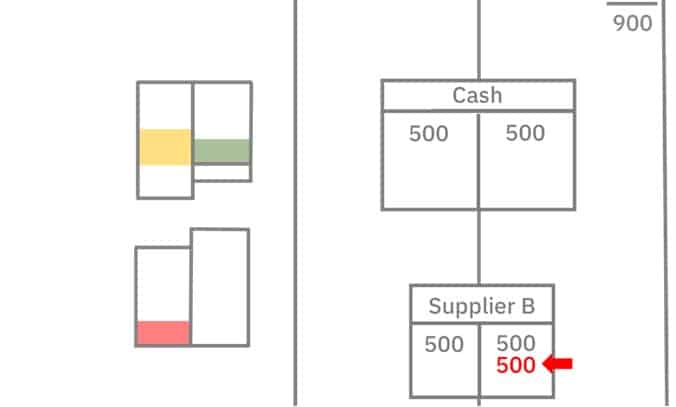

Once updated, you update the control account with a summary of the day’s transactions.

After this, you can balance the control account to find out how much the business still owes to all suppliers.

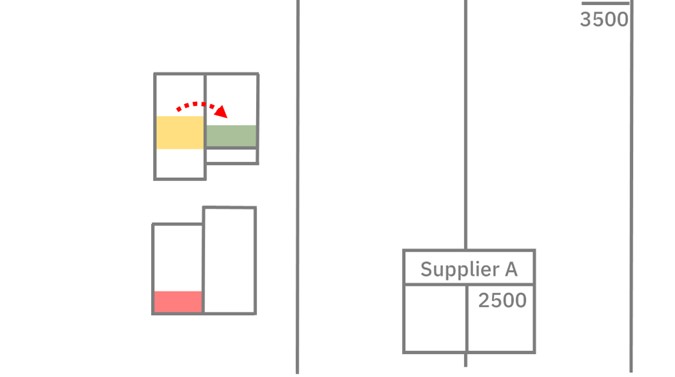

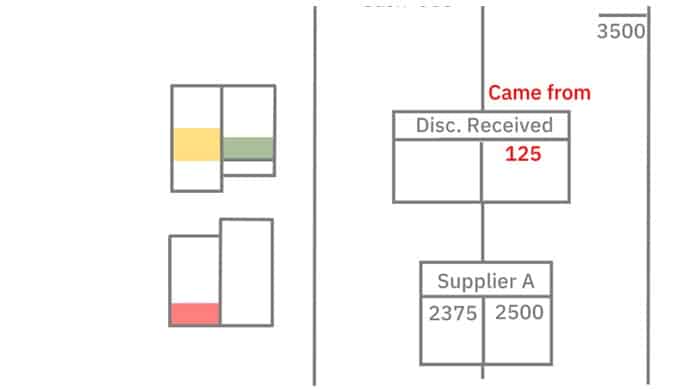

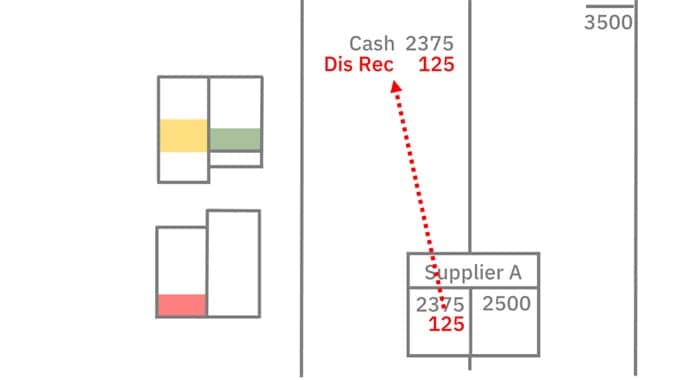

Recording Discount Received in the Control Account

Typically, suppliers will offer a discount to encourage early payment.

If the business takes up the offer, it will send a payment – less the discount.

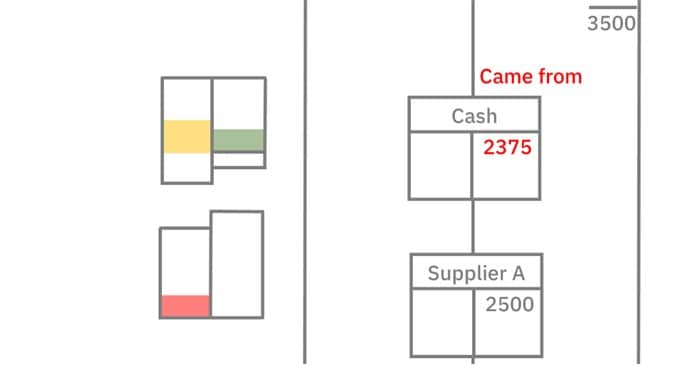

To record the transaction, you credit the cash account with the actual amount paid to show money came from the bank.

Then you debit the supplier’s to show the money went to the supplier.

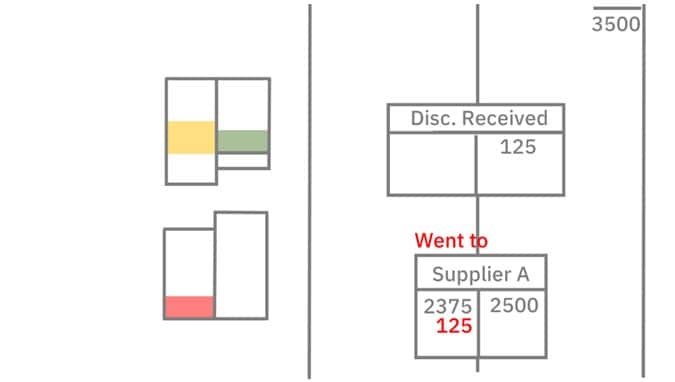

Part of the payment’s total value came from the discount, so you credit the discount received account to show that value came from it.

Then you debit the supplier’s account to show you have assigned the discount’s value to it.

When added together, the payment and the discount should equal the amount owed

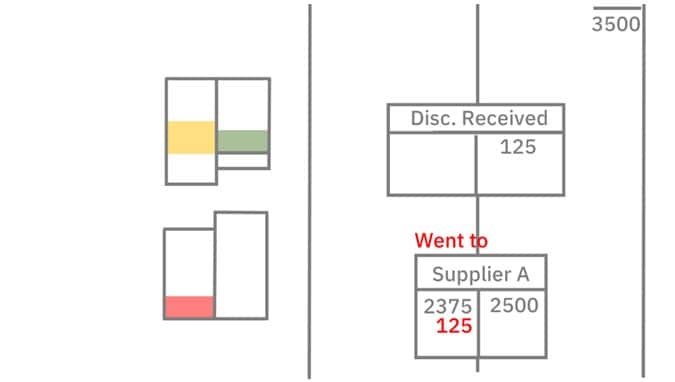

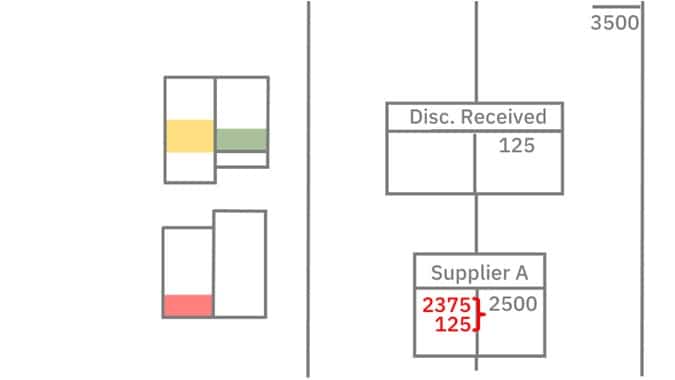

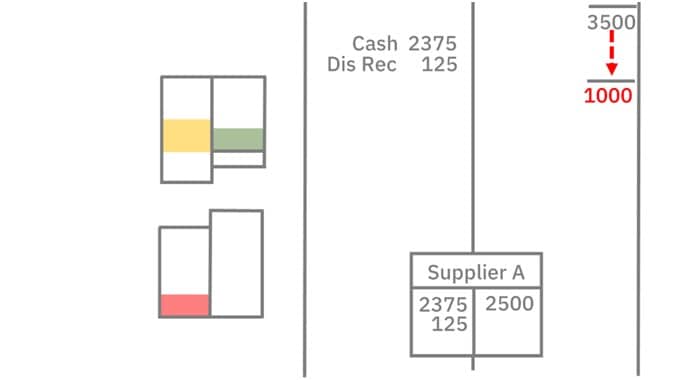

You need to record the discounted payment in the control, as well, beginning with the actual payment.

Then you record the discount received.

When balanced, the control account will show how much the business now owes to suppliers.

Recording

Returns in the Control Account

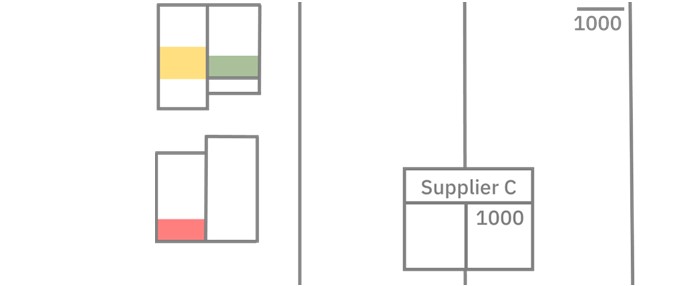

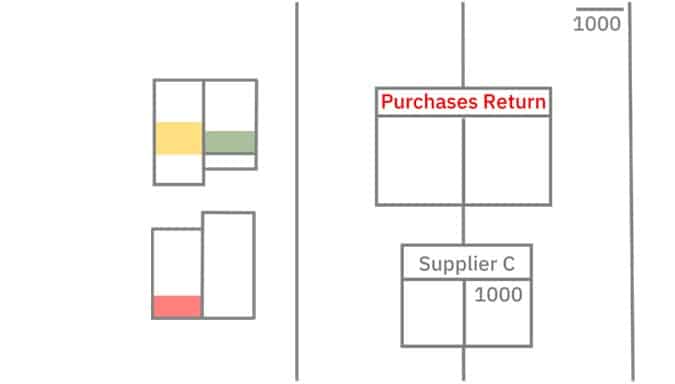

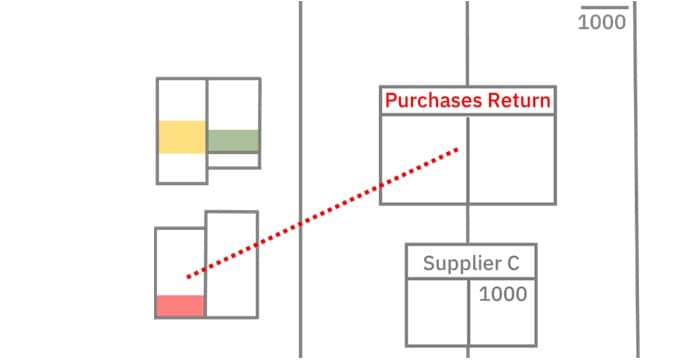

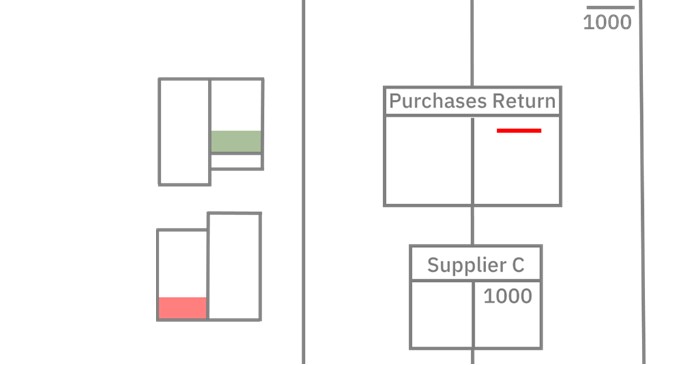

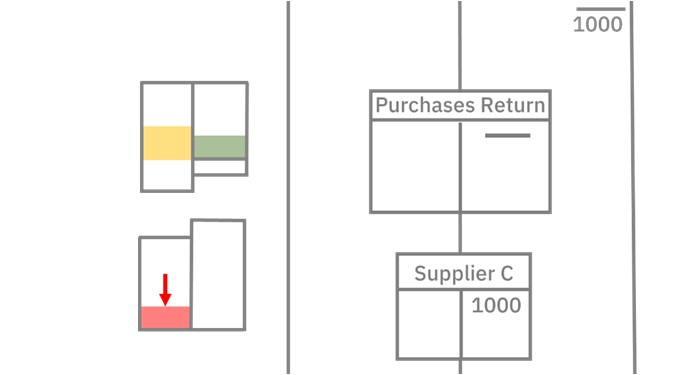

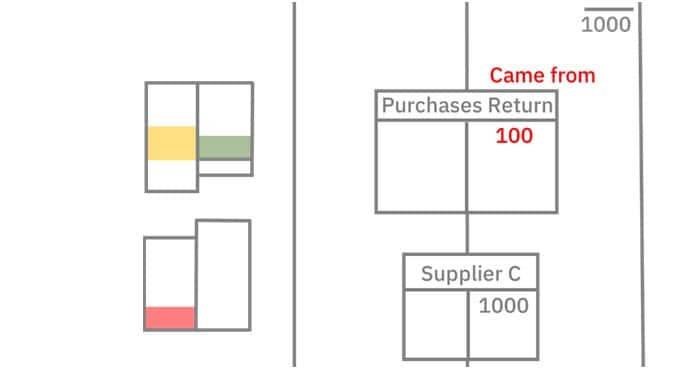

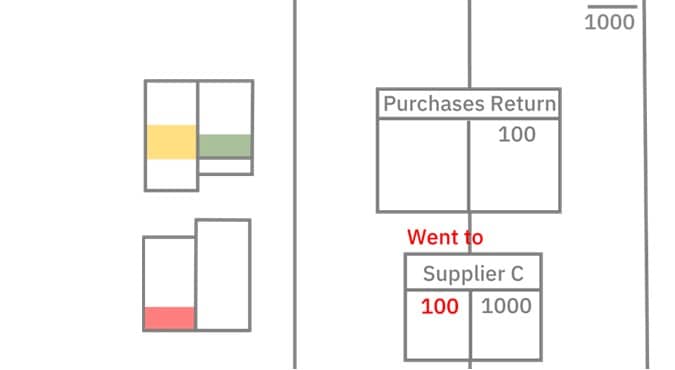

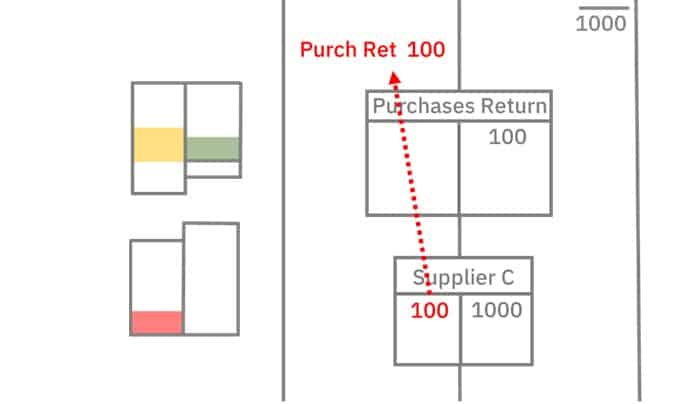

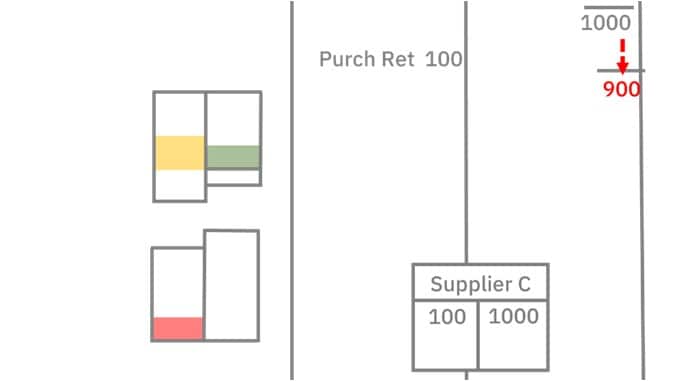

The business may also return goods to a supplier.

Here, you use the returns outwards or purchases return account.

This account is a contra expense account.

Unlike other expense accounts, it balances on the credit side.

This means it reduces the balance of expense accounts.

To record the return, you credit the returns account to show a value of goods came from the business.

Then you debit the supplier’s account to show that the goods were returned to the supplier.

You need to record this in the control account, as well

This will reduce the amount owed by the business to suppliers.

Recording

Dishonored Checks in the Control Account

It’s possible for a business to make a payment to a supplier, but due to there being insufficient funds in the business’s bank account, the check will be dishonored

To record a dishonored check, you do the opposite of what you did when recording the transaction in the first place.

You credit the supplier’s account to show you are taking value back from it.

Then you debit the cash account to show you are returning the value to it.

This way, the supplier’s account shows the business still owes money to the supplier

And the cash account entries offset one another—as if the payment was never made.

Doing this will increase the control account’s balance