Control Account - Debtors

Recording Customer Sales in the Control Account

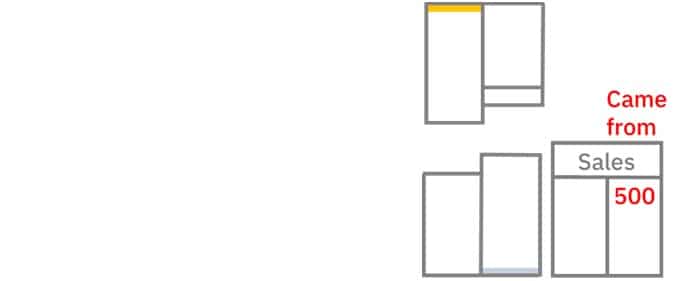

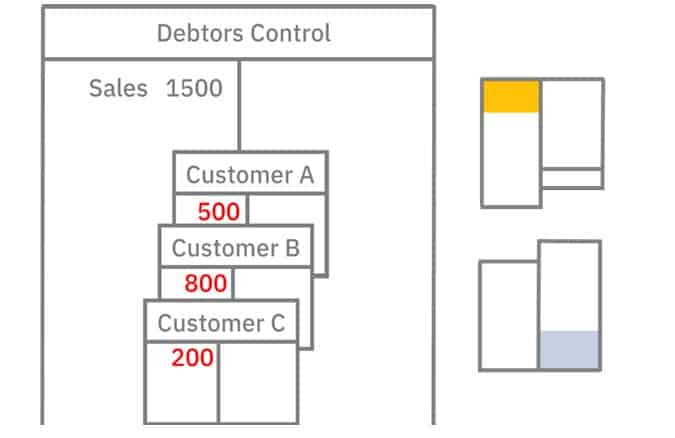

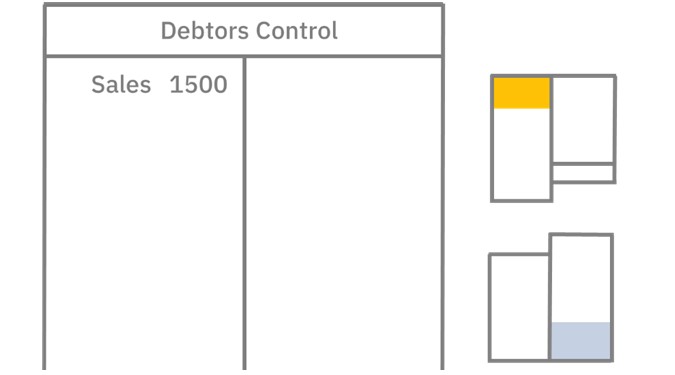

Suppose a business started up, and on day 1, it made sales on credit to a customer.

This means the customer buys now but pays later

When this happens, a value of goods or services comes from sales and those goods or services go to that particular customer

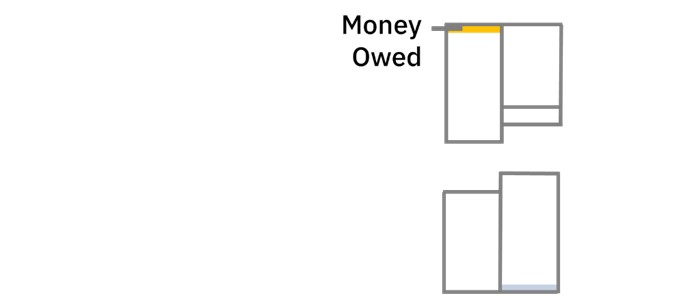

The customer will owe money to the business meaning they will be in debt to the business

For this reason, they are called a debtor

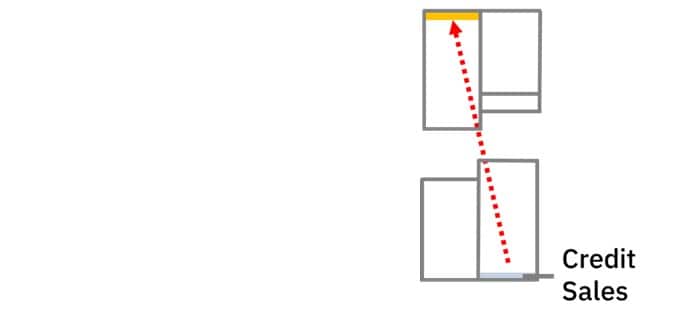

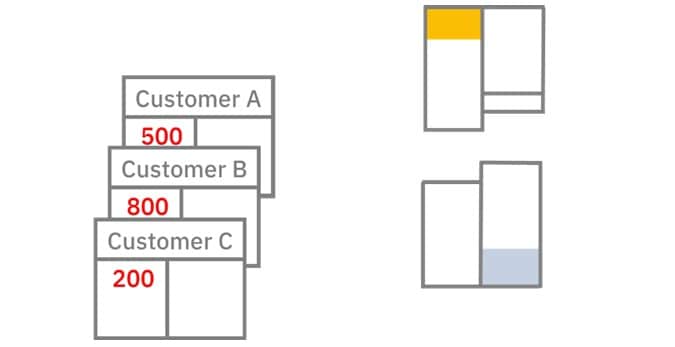

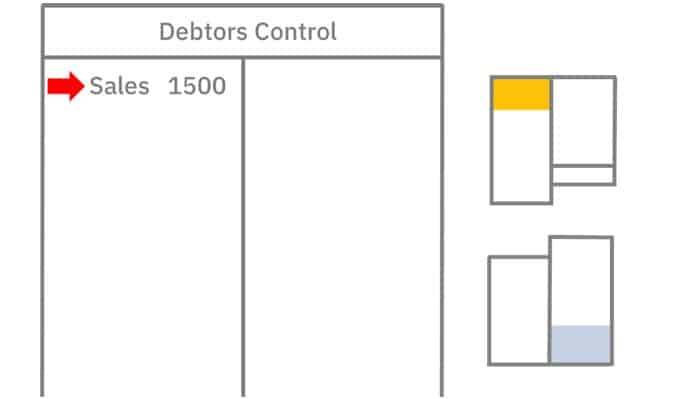

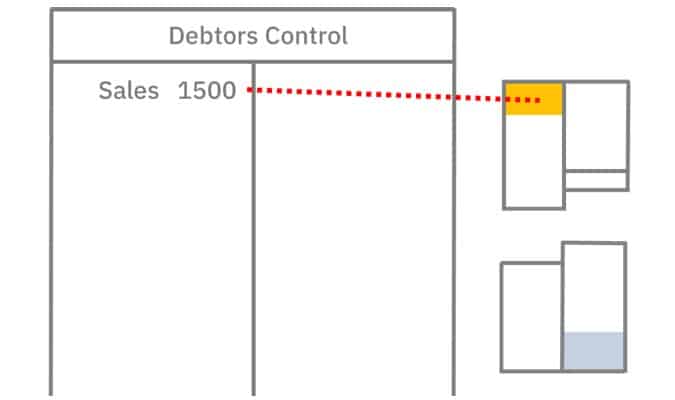

To record the transaction, you credit the sales account to show a value of goods or services came from sales

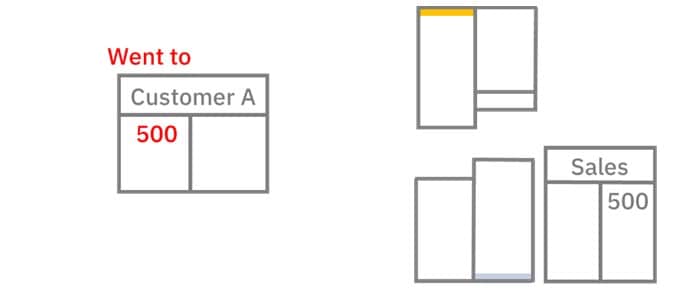

Then you debit the individual customer’s account to show a value of goods or services went to that particular customer

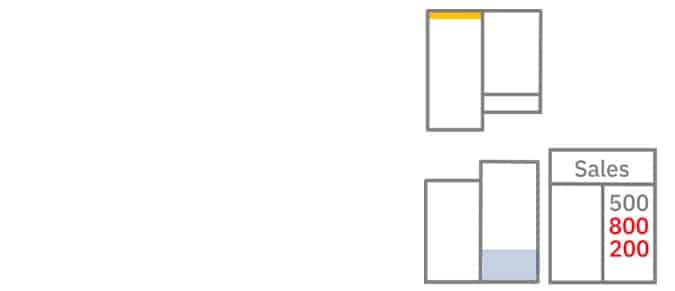

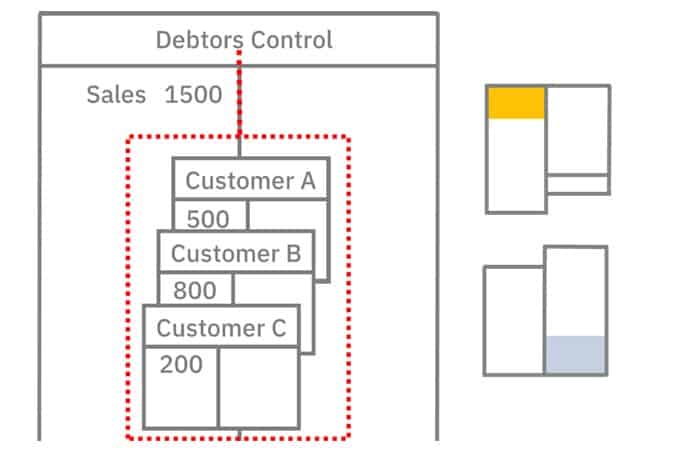

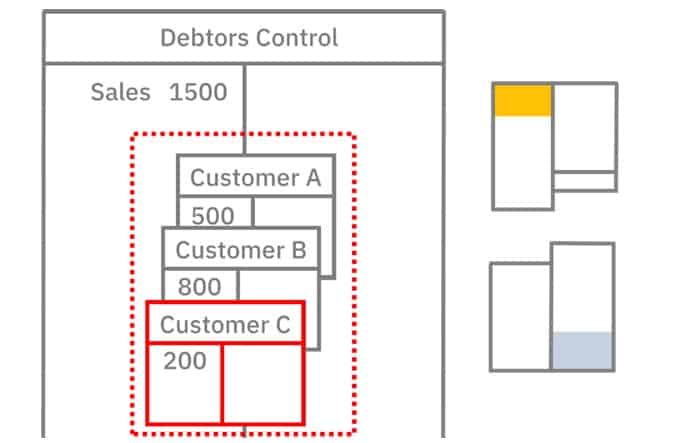

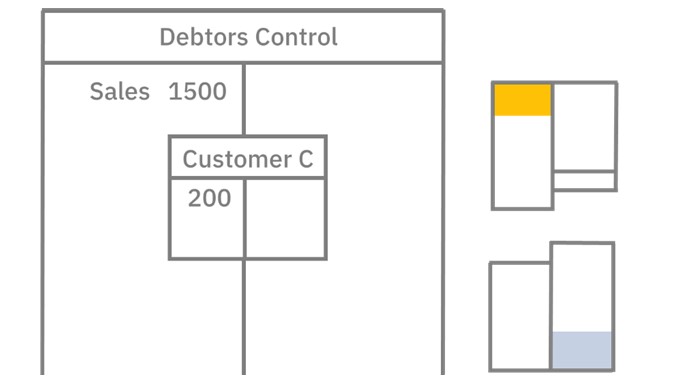

The business may have made more credit sales during day 1

You record these transactions in individual customer accounts, as well

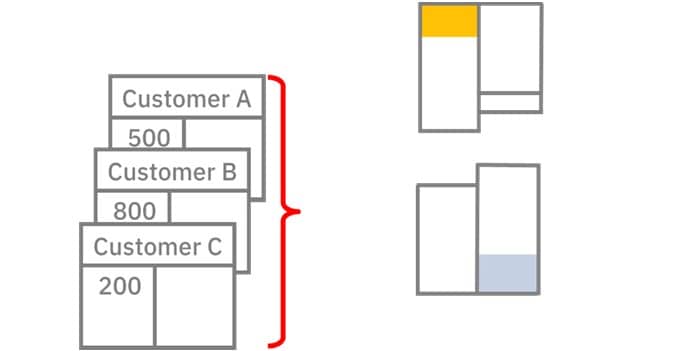

If all you had were these individual accounts, it would be difficult to keep track of how much money all customers owe in total

To find this, you would need to add together all the balances of all the individual accounts

This may be all right if the business only has a few accounts, but a business may have hundreds or even thousands of customer accounts making this task extremely difficult

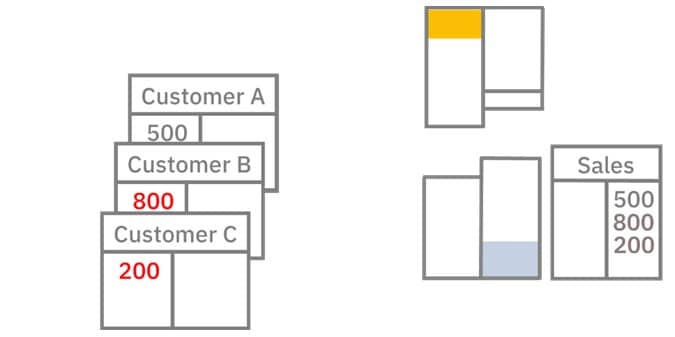

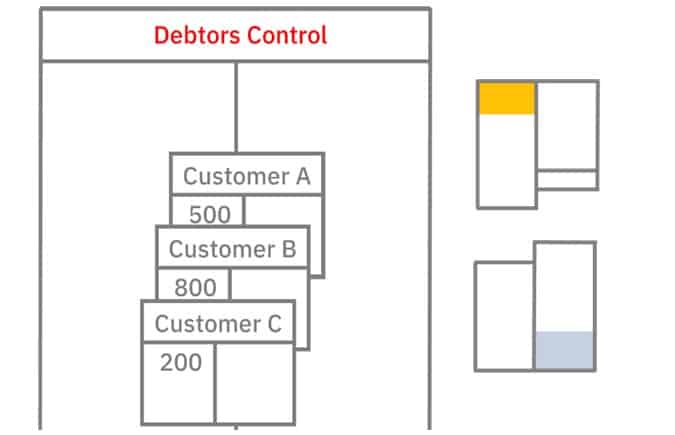

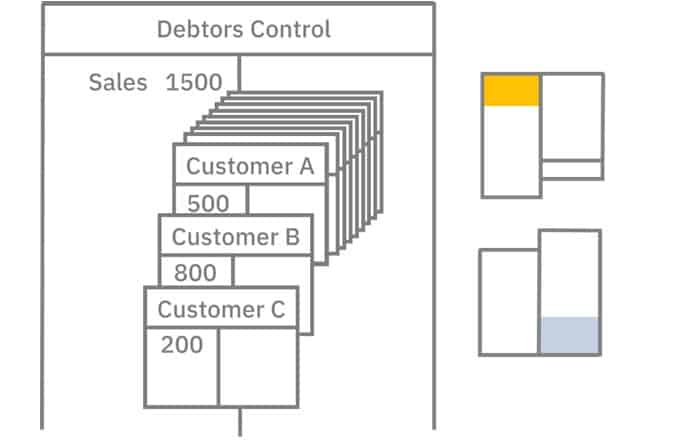

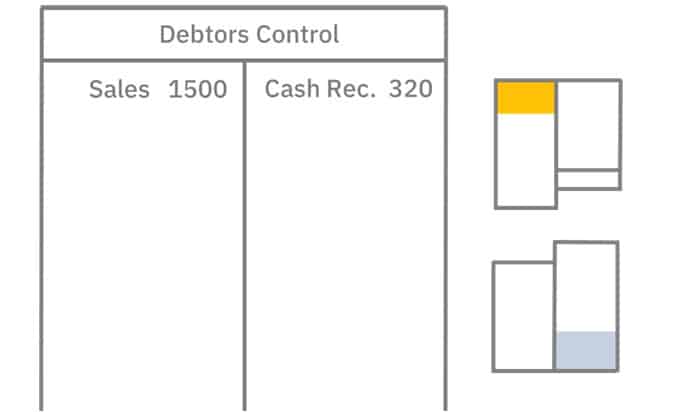

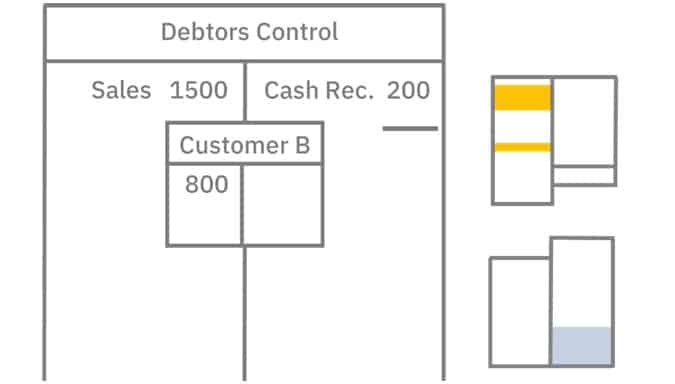

To overcome this problem, once you’ve updated the individual accounts, you also update an account known as a sales ledger control account, otherwise known as a debtors control account.

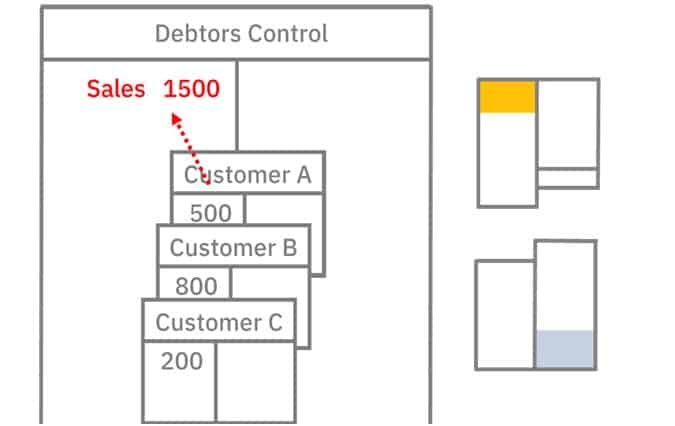

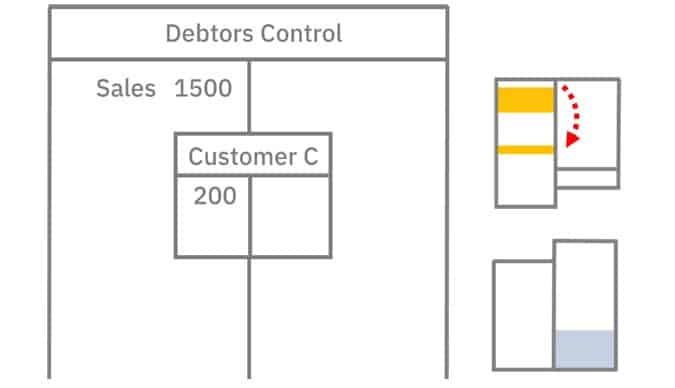

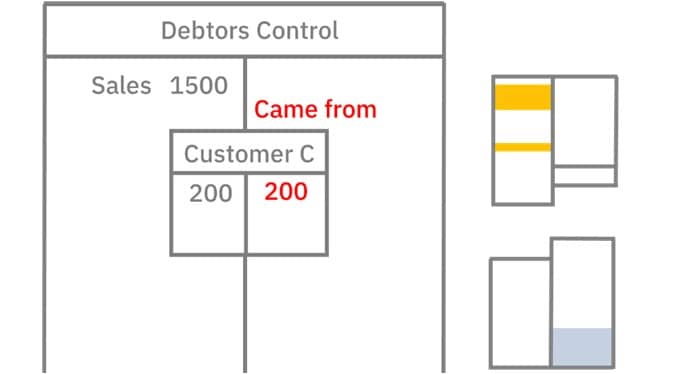

When you update the control account, you update it with a summary of the customer transactions

In this example, it is a total of the day’s sales as shown in the sales ledger

Ledger is a term used to describe a collection of accounts.

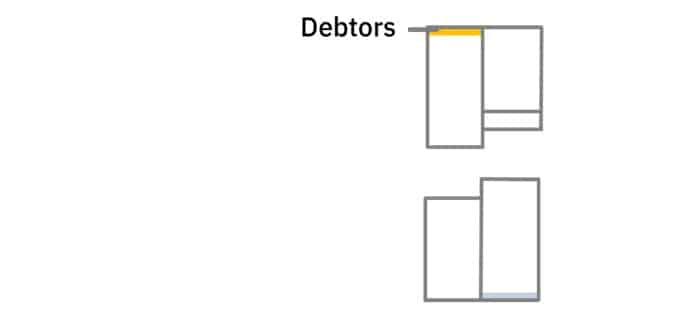

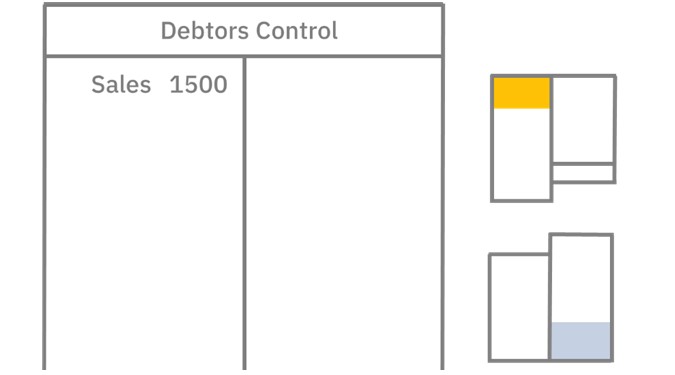

Once updated, the control account gives you more control over your records

Now, to find out how much is owed to the business by all of its customers, all you need to do is refer to the control account’s balance.

The control account is the account contained in the general ledger, and it is the control account’s balance that is shown on this diagram

For their part, the individual customer accounts form something known as a subsidiary ledger or a sales ledger

Each account within this ledger is referred to as a sub account

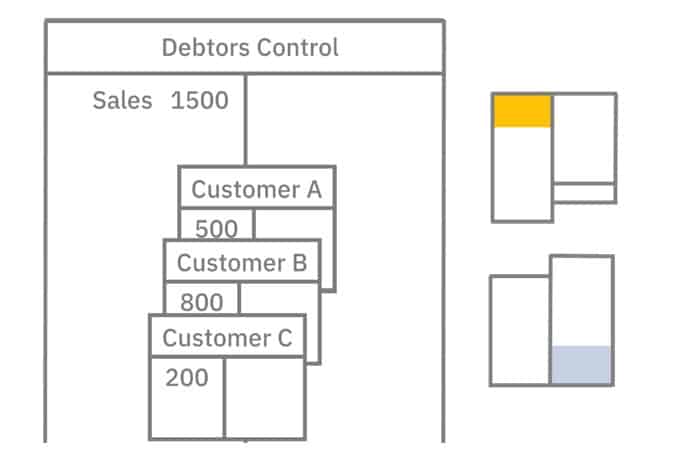

Without a control account, it would be hard enough to keep track of money owed from sales alone, but the amount of money owed to the business by customers is influenced by many factors—not just sales’

For example, each day customers will make payments, thereby reducing the amount owed.

Discounts for early payment will further reduce the amount owed.

If customer checks are dishonored, this will increase the amount owed again.

And if the business writes off debt, this will reduce the amount owed.

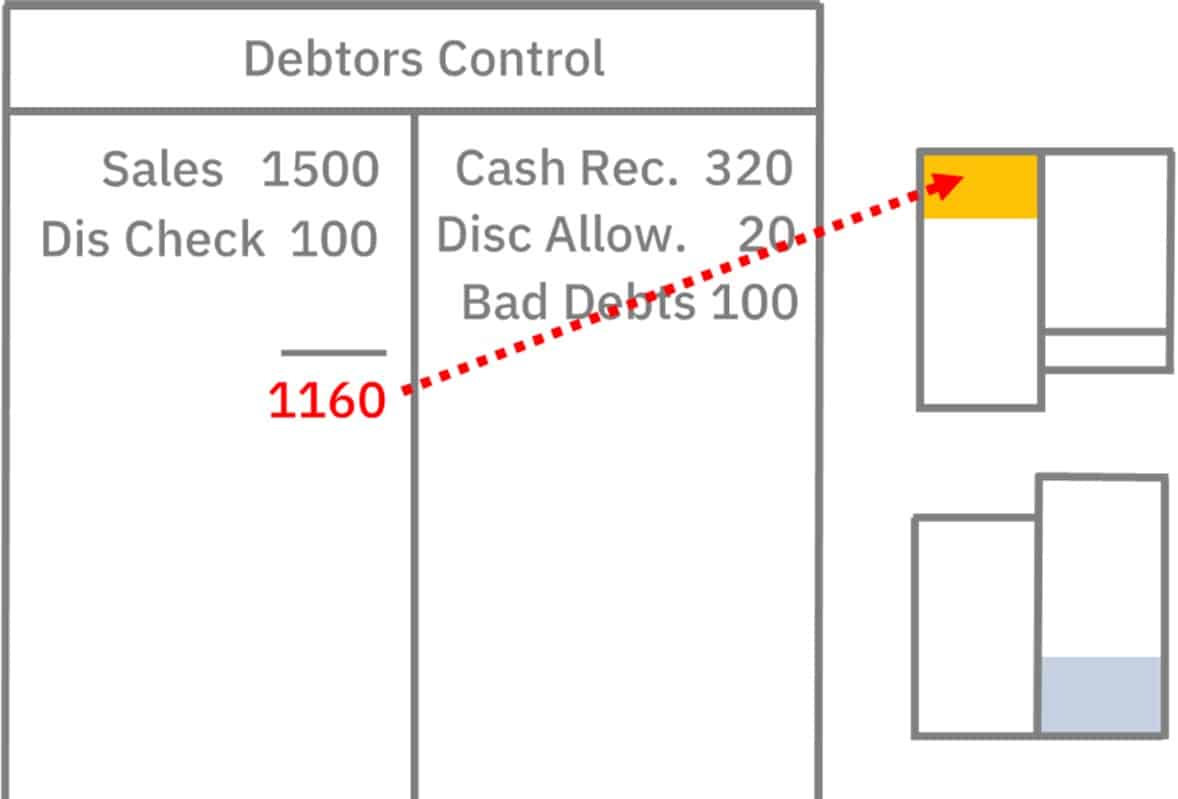

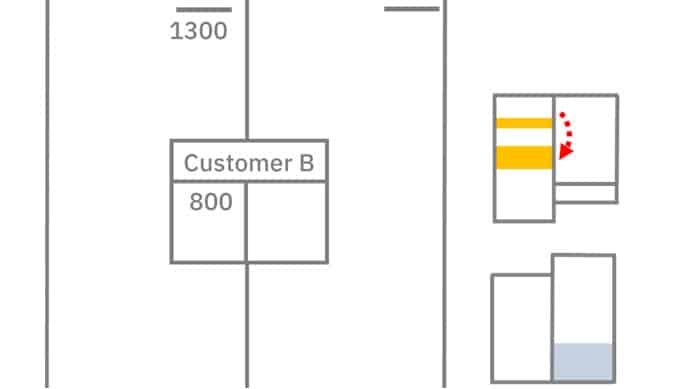

After updating the control account with totals of the day’s transactions, you find its balance, and this balance will show much customers now owe in total

Typically, a control account contains summarized totals of hundreds of transactions, but in each of the following explanations, it is assumed only one transaction occurred each day.

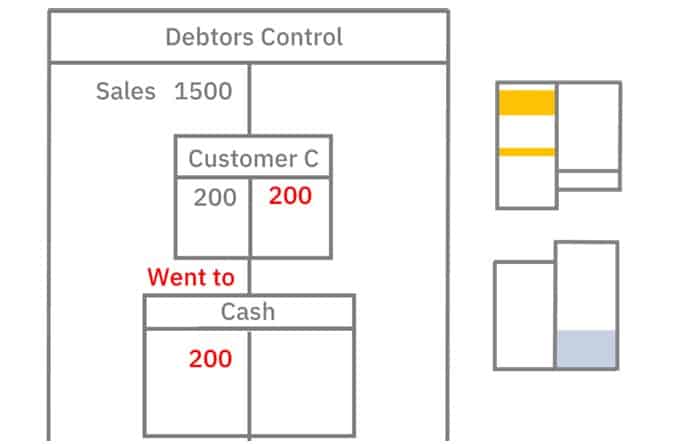

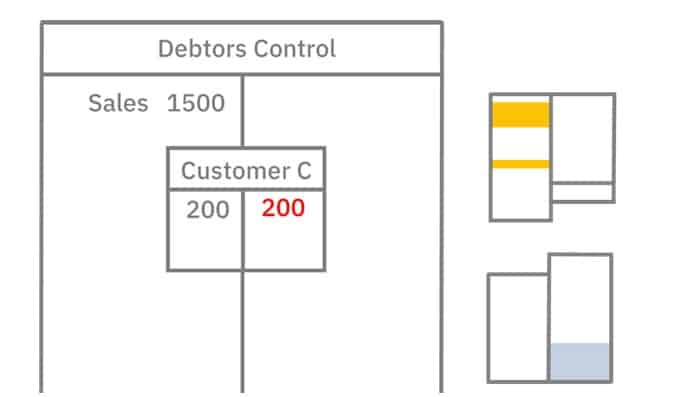

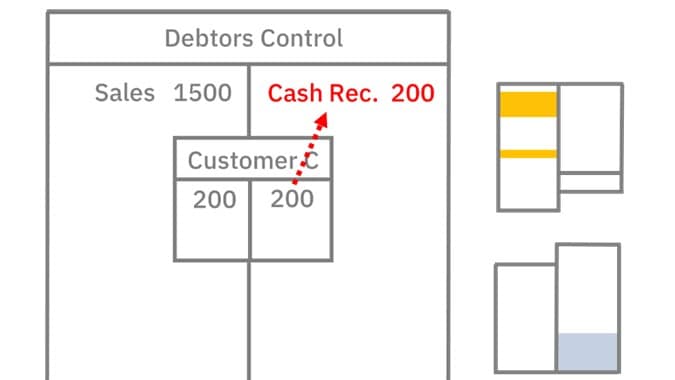

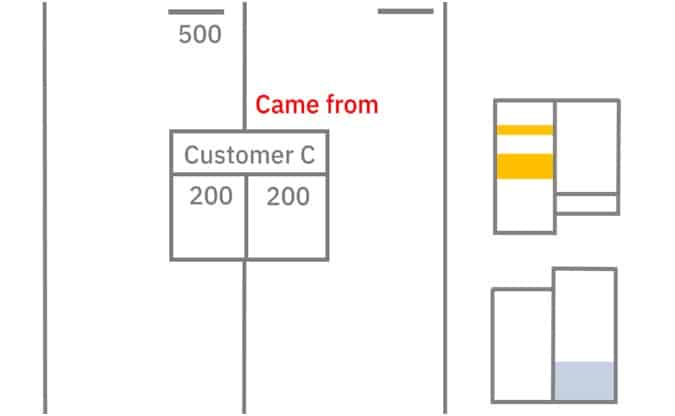

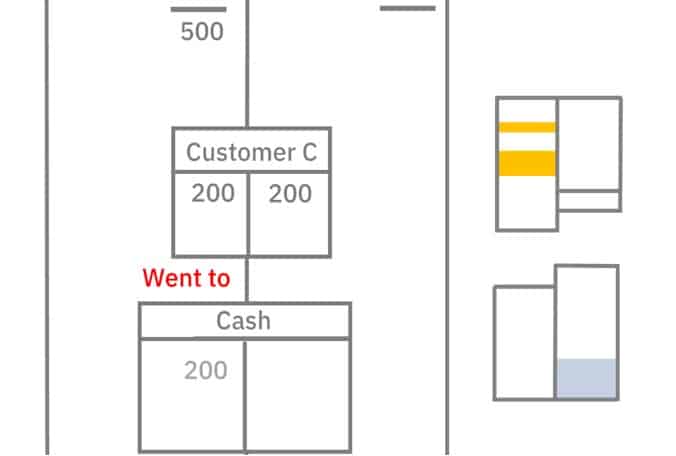

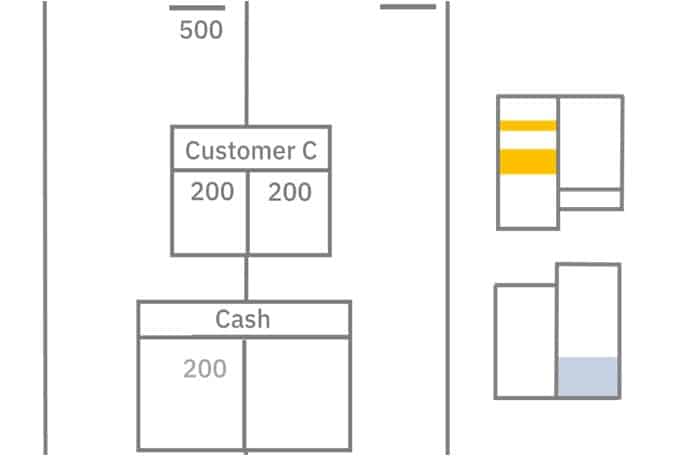

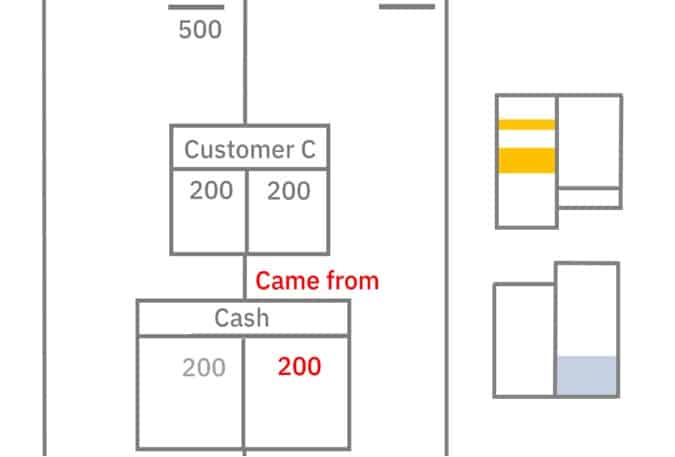

Recording Customer Payments in the Control Account

Customers will make payments to pay some or all of what they owe.

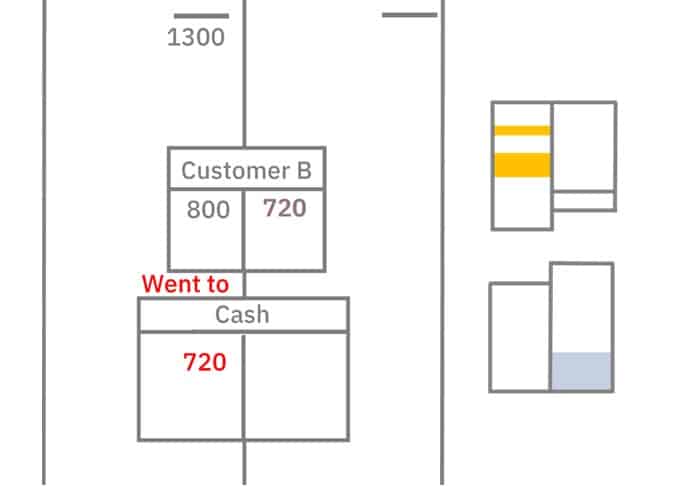

Here, money comes from the customer and the business deposits the money in the bank

To record the transaction, you credit the customer’s account to show money came from them

Then you debit the cash account to show the money was deposited in the bank

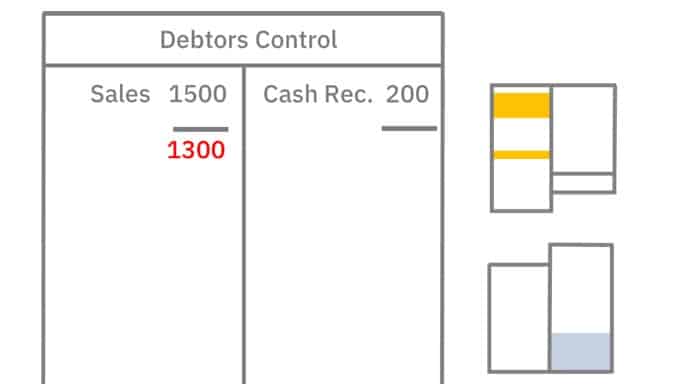

Once updated, you would update the control account with a summary of the day’s customer transactions

Assuming the payment was the only customer transaction made on the day, you would record it in the control account

After this, you can balance the control account to find out how much is still owed by all customers

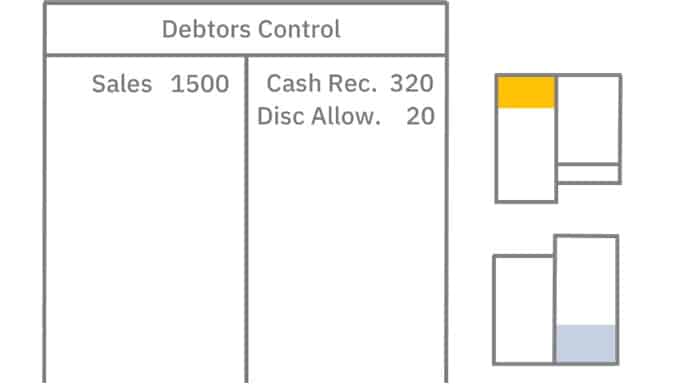

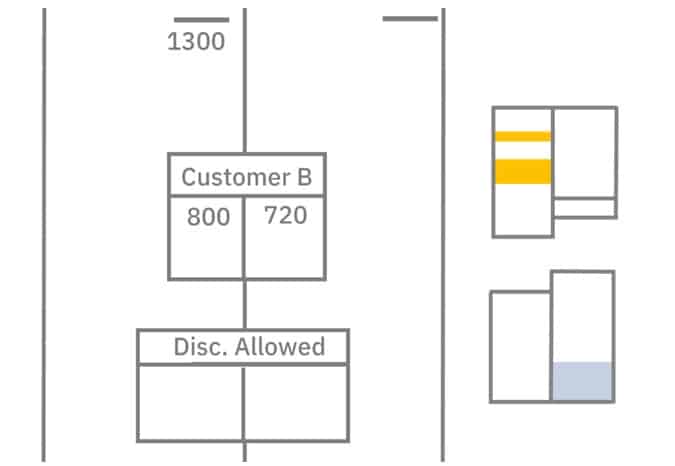

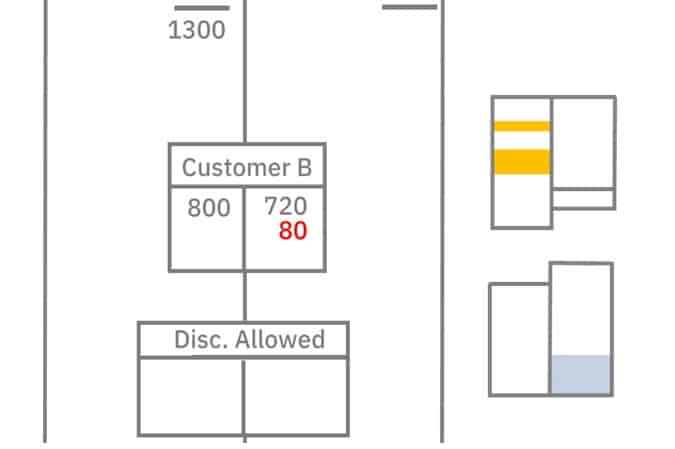

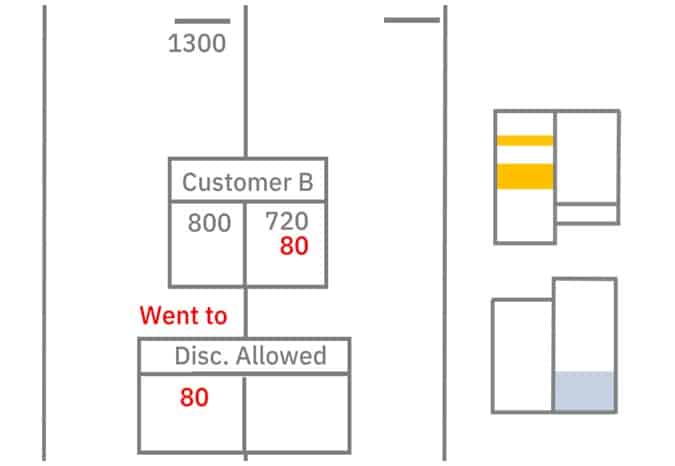

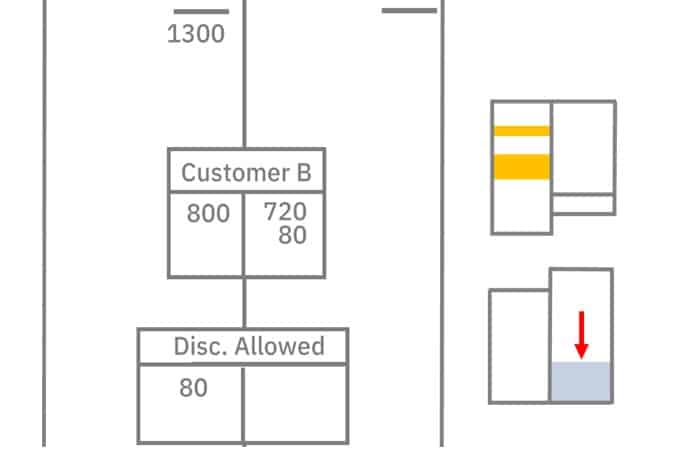

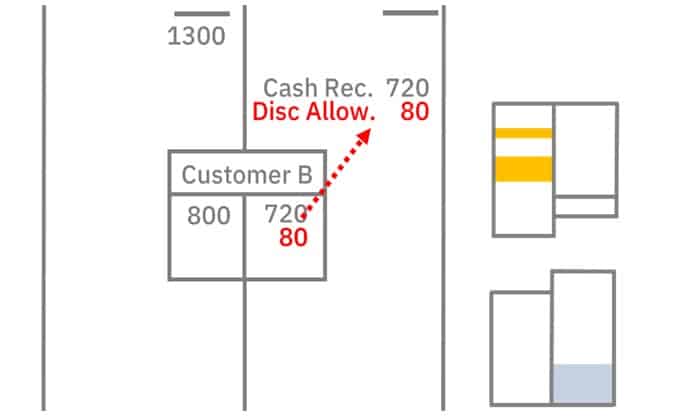

Recording Discount Allowed in the Control Account

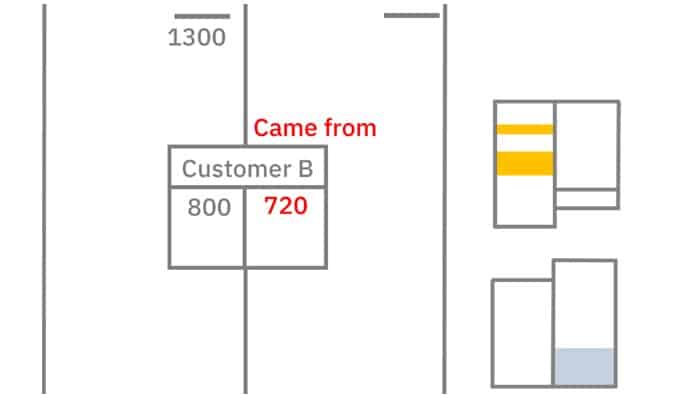

Typically, a business will offer a discount to customers to encourage early payment

If a customer takes up the offer, they will send a payment – less the discount

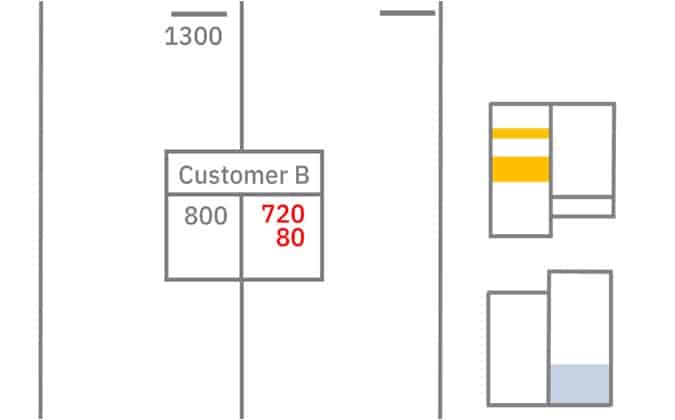

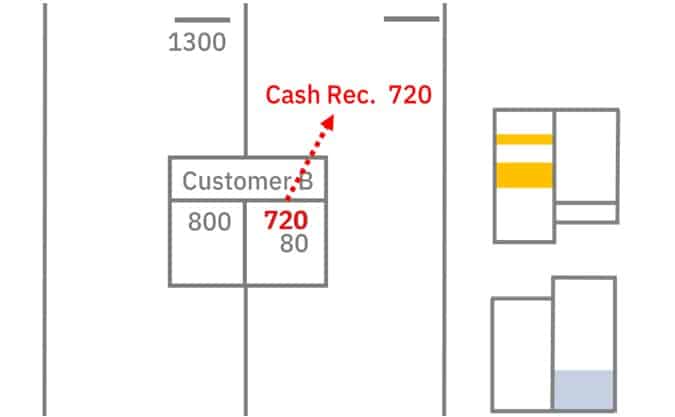

To record the transaction, you credit the customer’s account with the amount they actually paid – to show that money came from them

Then you debit the cash account to show that the business deposited the money in bank

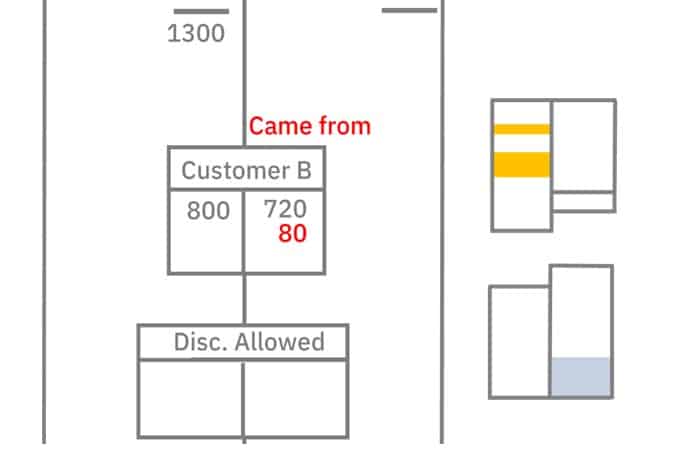

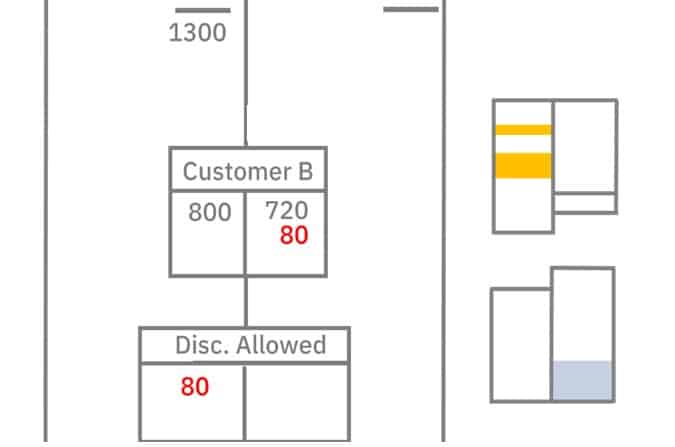

At the same time, you need to record the discount in the discount allowed account

This is a revenue account – but it balances on the debit side, making it a contra account

To record the discount, you credit the customer’s account

This shows you are taking value from that account

Then you debit discount allowed

This shows you have assigned the value as discount allowed

Putting it another way, you are using a contra revenue account to show the discount has reduced revenue

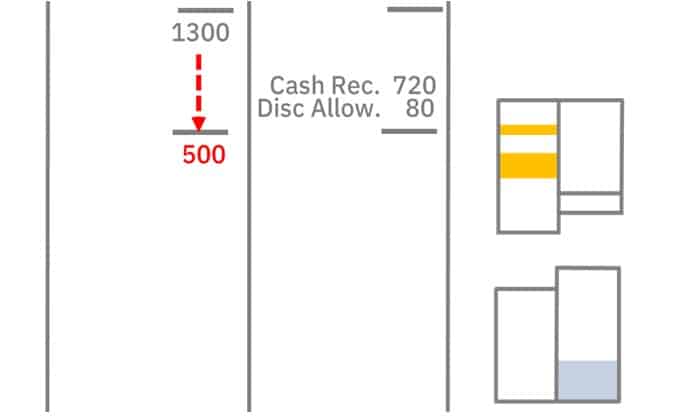

You need to update the control account with any discounted payment, as well

To do this, you record the amount actually paid in the control account

Then you also record the discount allowed

When you balance the control account, you can see customers now owe even less

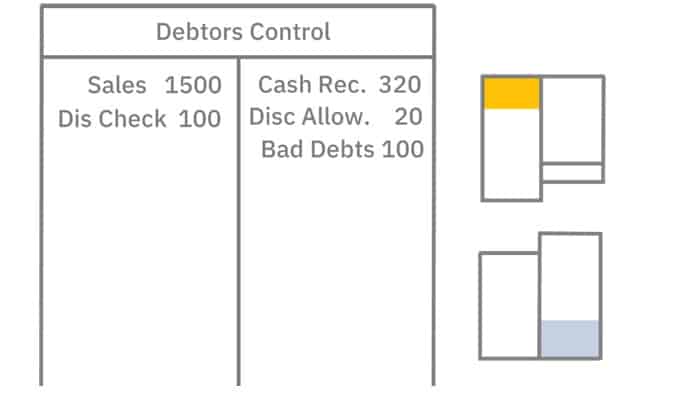

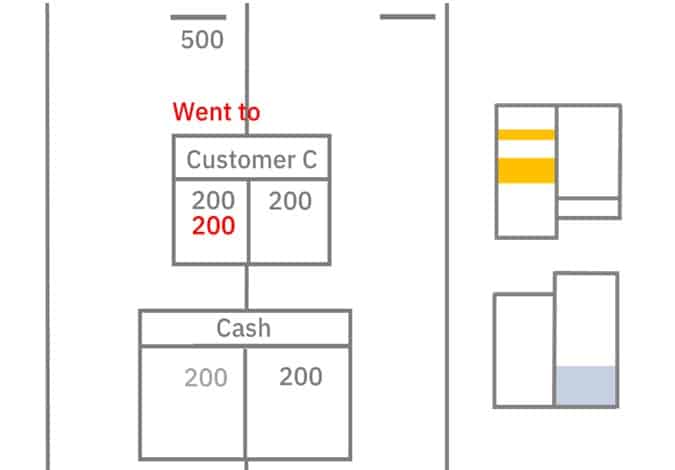

Recording Dishonored Checks in the Control Account

Sometimes, a customer’s check will be dishonored

This will happen if the customer does not have sufficient funds in their account to cover a payment they made

When the payment was made, you credited the customer’s account to show that money came from them

Then you debited the cash account to show the money was deposited in the bank

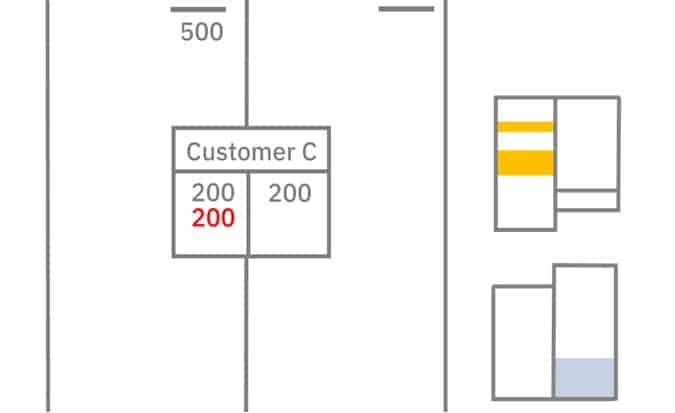

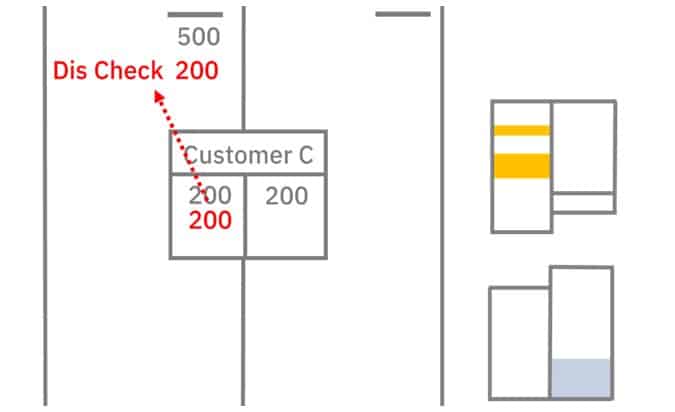

To record the dishonored check, you need to do the reverse

So you credit the bank account to show that you are taking value from it

Then you debit the customer account to show you are sending the value back to them

By doing this, the customer’s debit balance will show the customer once again owes money to the business for their purchase

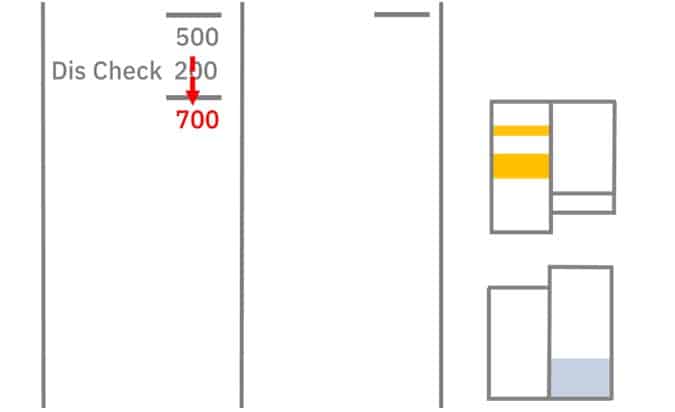

You need to record this in the control account, as well

When balanced, the control account will show the amount owed to the business by customers has increased again

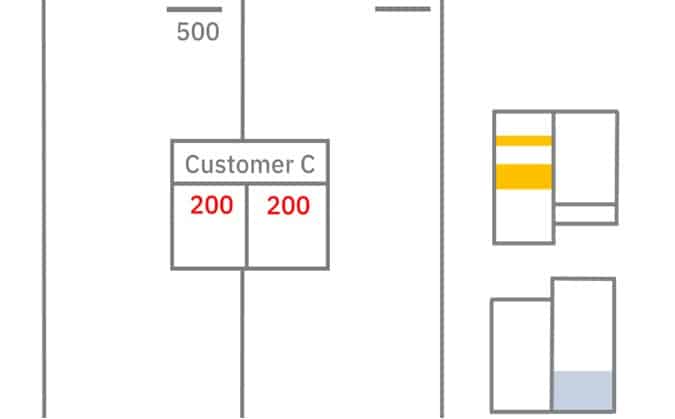

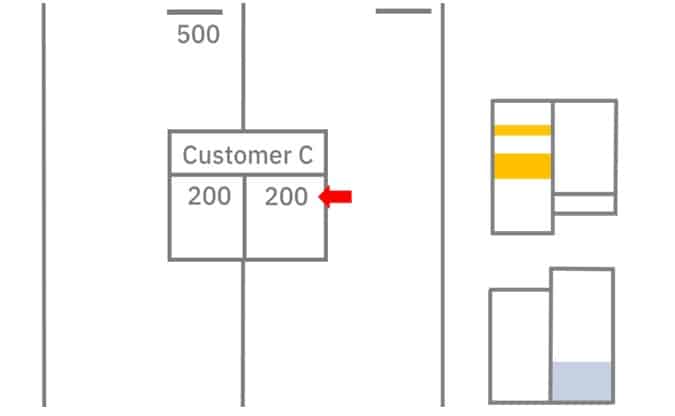

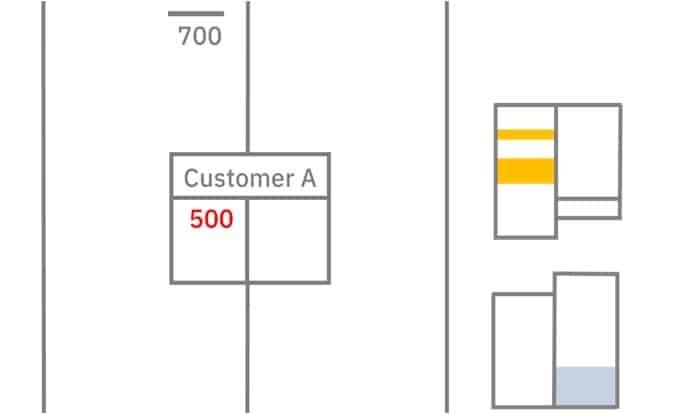

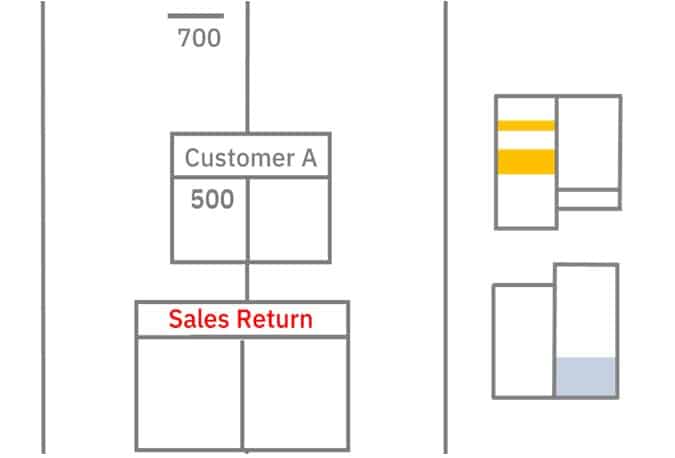

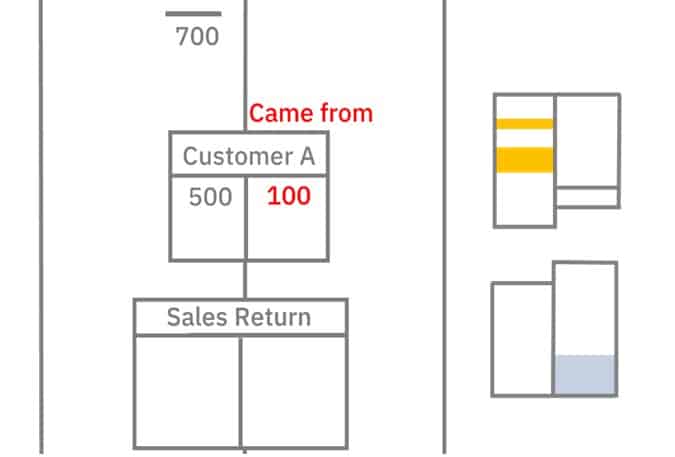

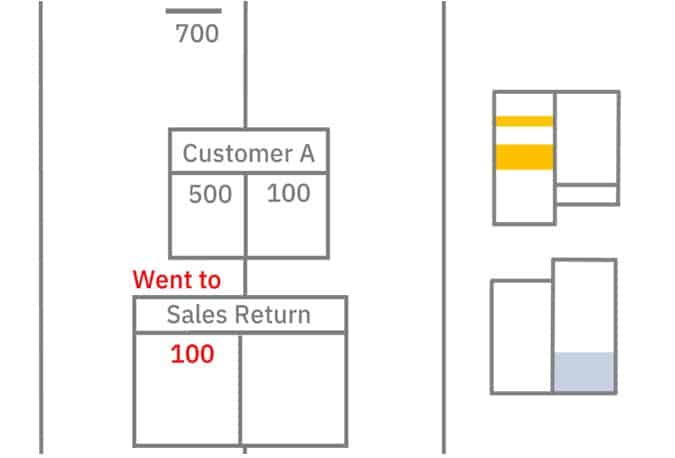

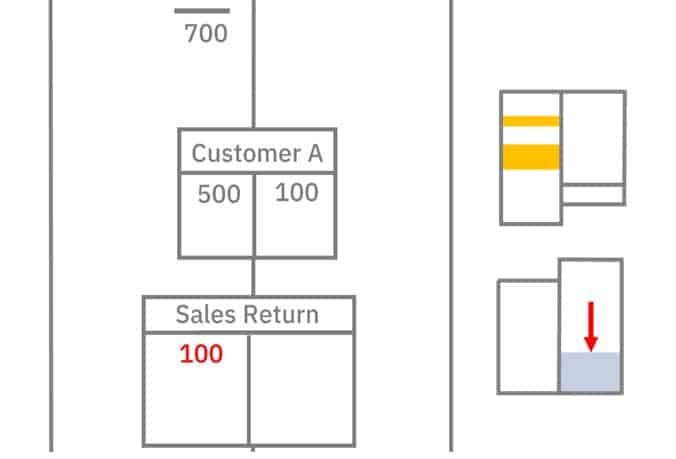

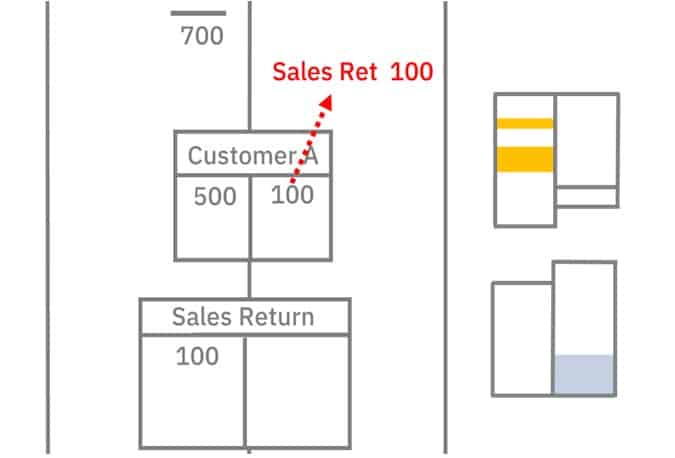

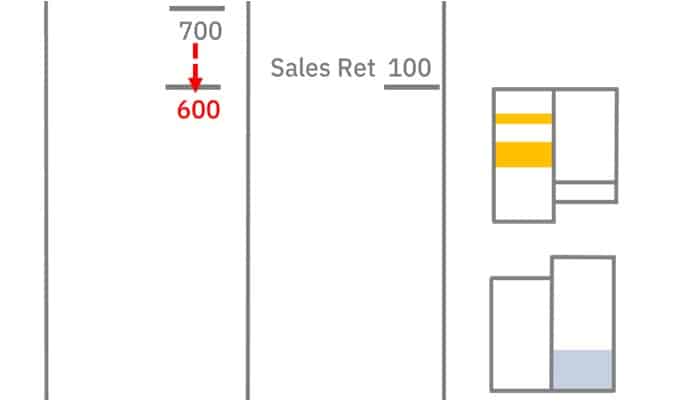

Recording Returns in the Control Account

A customer may also return some or all of the goods they purchased

In this case, you use the sales return account

You credit the customer account to show that a value of goods have come from them

Then you debit the sales return account to show where the goods went

The sales returns account is a contra revenue account meaning it balances on the debit side thereby offsetting the revenue accounts

You need to record this in the control account, as well

When balanced, the control account will show this has lowered the amount

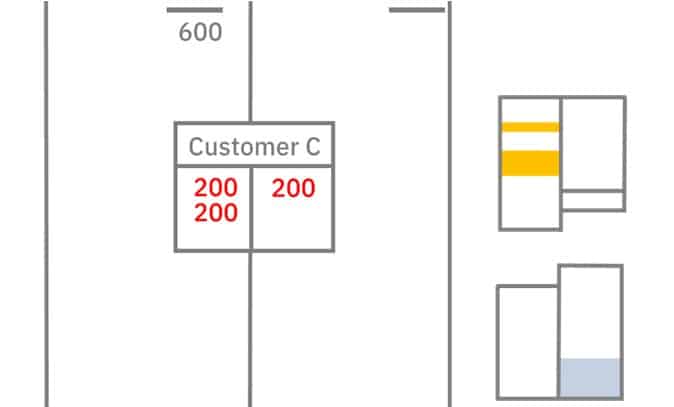

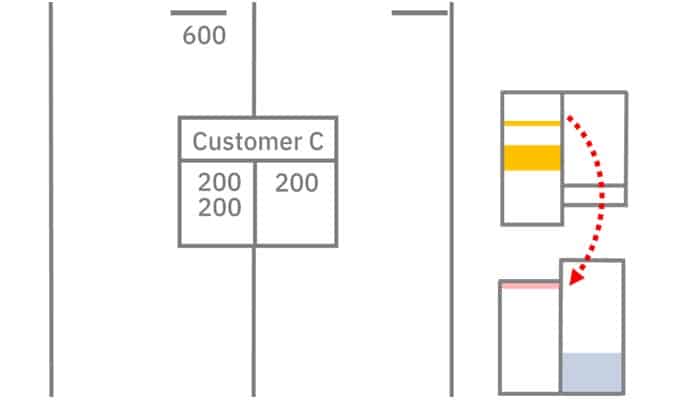

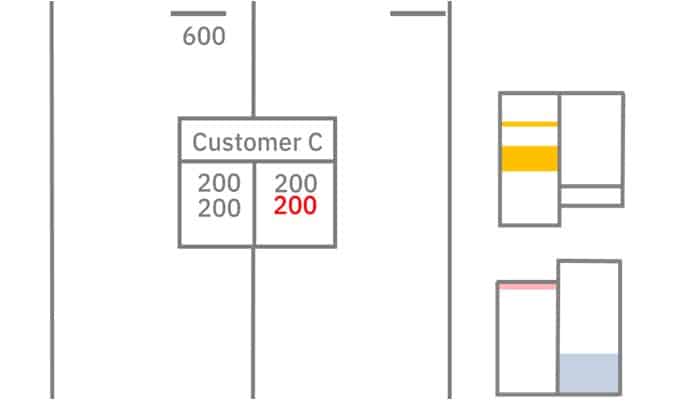

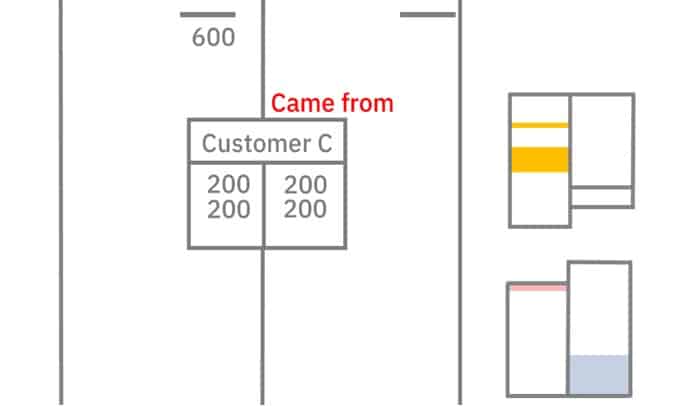

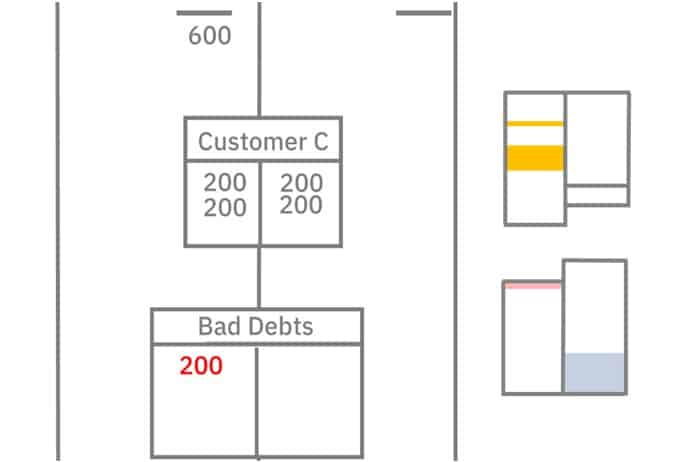

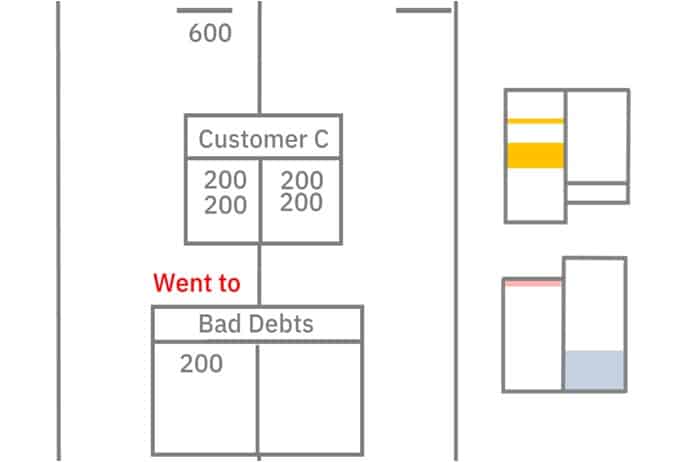

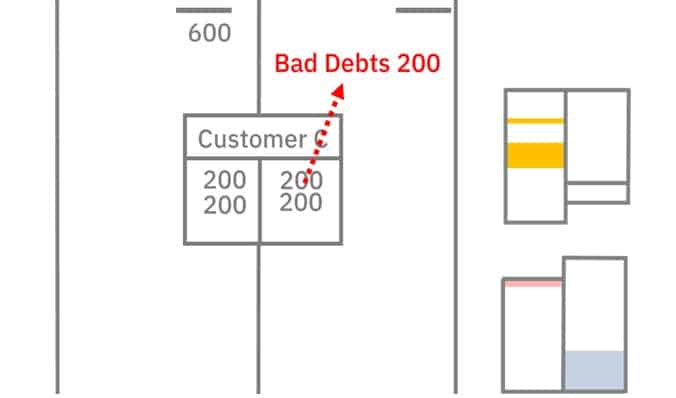

Recording Bad Debts in the Control Account

In time or under certain circumstances, a business may write off some debts

When doing this, you take value from the customer’s account and record it in the bad debts expense account

To record the bad debt, you credit the customer account

This shows you are taking value from the customer’s account

Then you debit the bad debts account

This shows you have assigned the value as an expense

You also update the control account

The bad deb will further reduce the amount customers owe to the business.