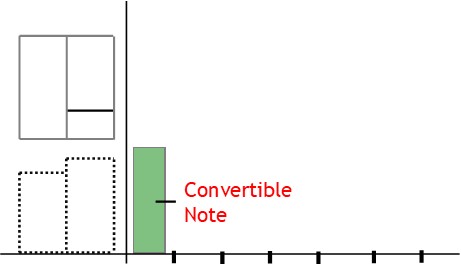

Convertible Note

What is a Convertible Note?

A convertible note is a loan that converts into equity at the end of the note term.

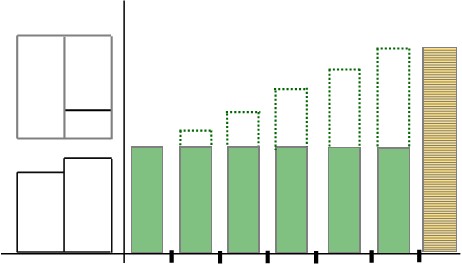

How it Works

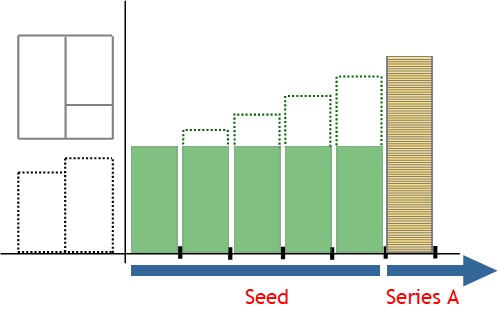

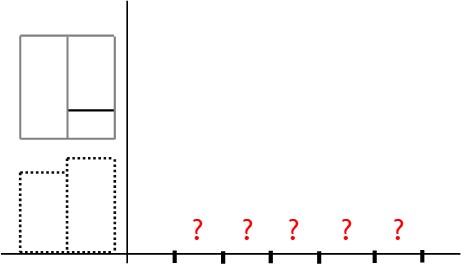

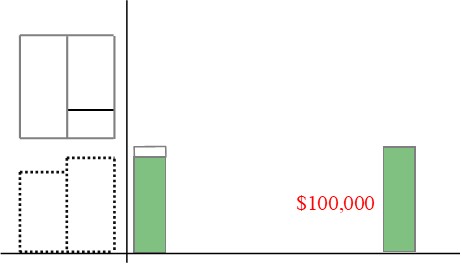

To grow and expand, a start-up company will need to raise money.

The start-up can do this by borrowing money via a short term note (less than 10 years maturity)

Or it can do so by selling stock in the company to investors.

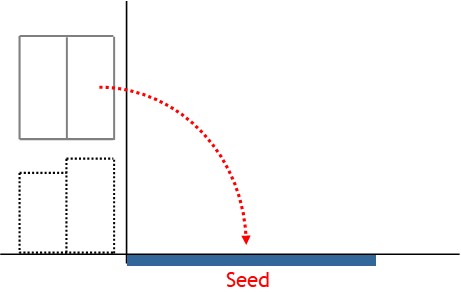

The problem facing a start-up company is they have no trading history.

This adds uncertainty to the start-up’s prospects, going forward.

All of this makes finding a value for the start-up company difficult.

A convertible note can overcome this problem.

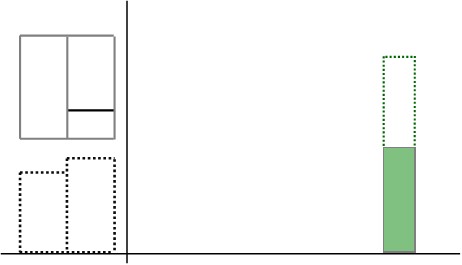

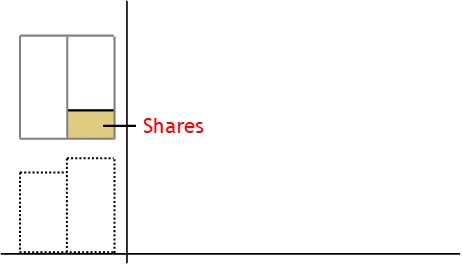

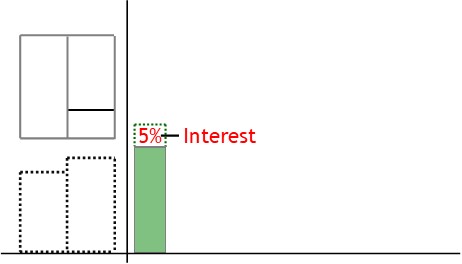

A convertible note starts off as a loan with interest due.

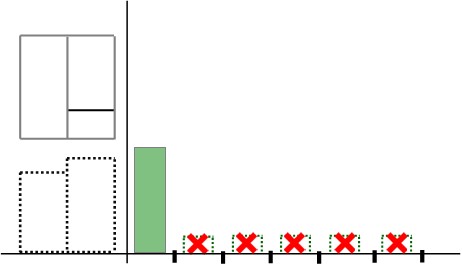

However, unlike regular notes and bonds, interest is not paid each year.

Instead, it accumulates over the note term.

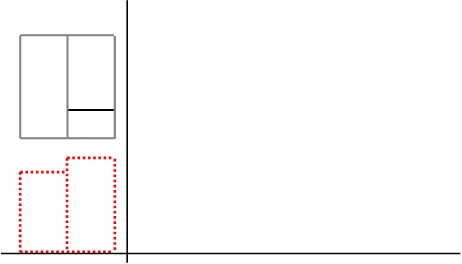

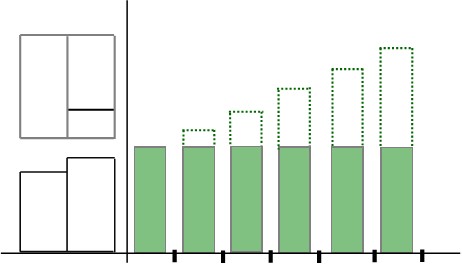

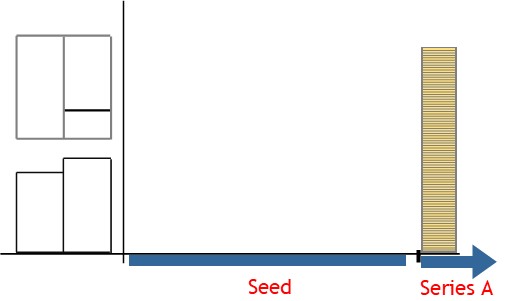

Then, at the end of the note term, the note is converted into equity.

Typically, this conversion occurs as part of the next financing round.

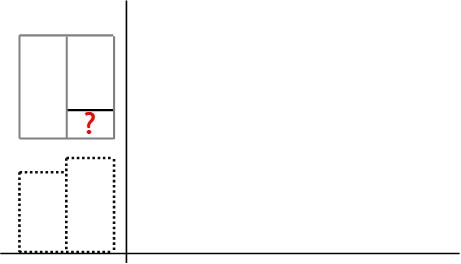

Some start-ups can appear riskier than others.

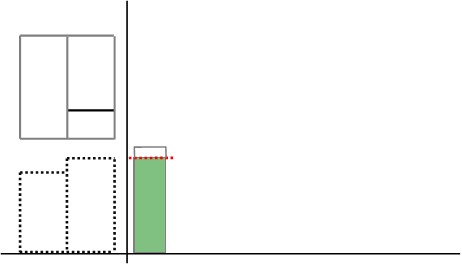

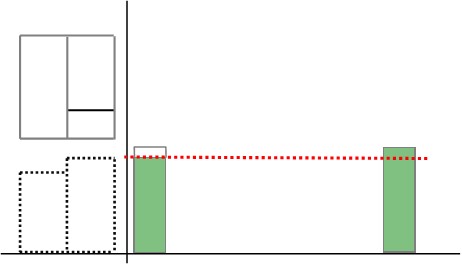

To compensate for the increased risk, the issuer may discount the convertible note.

In other words, the investor pays less than face value.

However, upon redemption, they are paid full face value.

This way, the investor makes a gain on the bond price.

On top of that, they earn interest income.