Correcting Entries

What Are Correcting Entries?

Correcting entries are used to correct an error.

How it Works

The whole aim of the double entry accounting system is to ensure your record of transactions is correct.

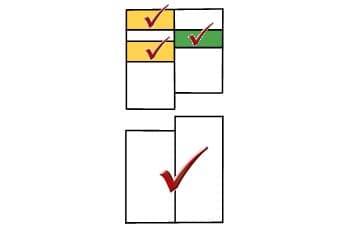

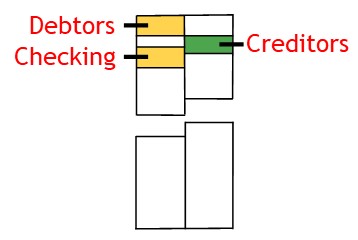

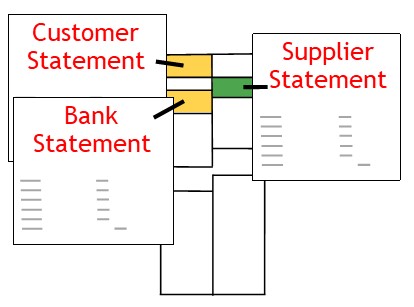

For example, you check one side of your record of transactions by checking the control accounts.

You do this by comparing them to the records of other businesses.

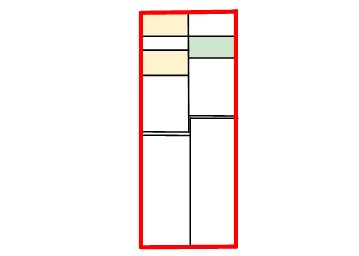

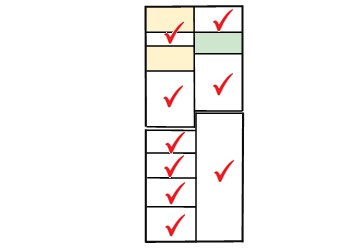

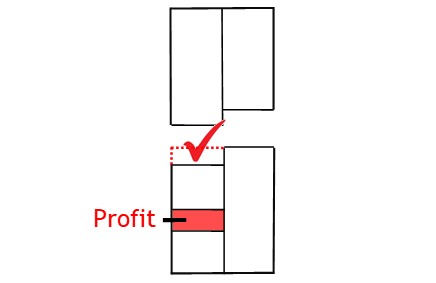

After this, you prepared a trial balance.

If it balanced, then it proved the other side of your transactions was also correct.

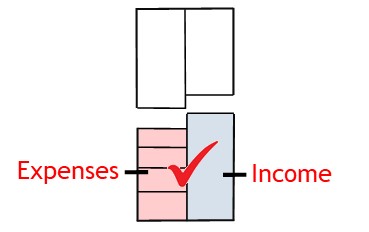

With all these checks, your record of income and expenses should be correct.

Even so, mistakes are still possible.

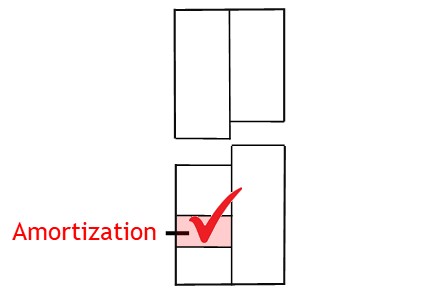

For example, the business may have an intangible asset, such as a license.

This will lose value over time.

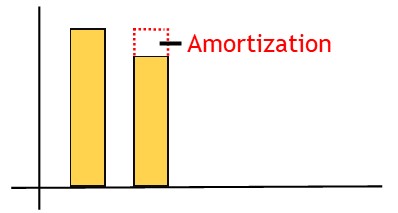

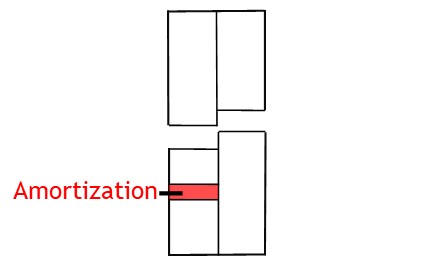

With intangible assets, the loss of value is known as amortization.

Amortization needs to be recorded as an expense.

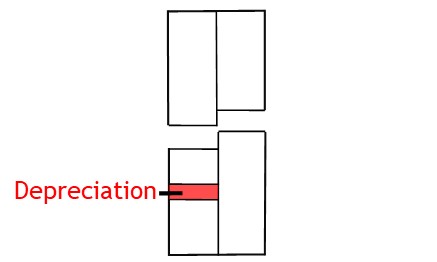

However, an expense such as this may be mistakenly allocated to the depreciation account.

Depreciation is the wrong expense account to use.

Depreciation relates to the value lost by tangible assets, such as equipment.

Finding the Error

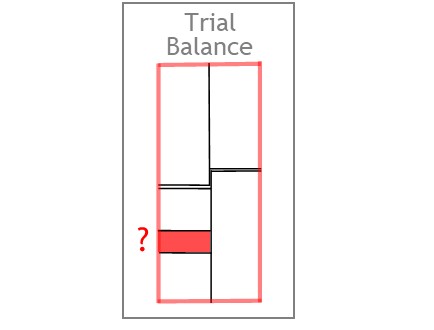

Normal checks won’t find this error.

Allocating an expense to the wrong expense account won’t throw the system out of balance.

Nor will it affect profit.

The only way to find this error is to run your eye over the trial balance.

Once found, you need to correct any errors.

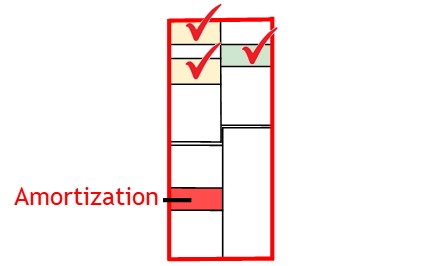

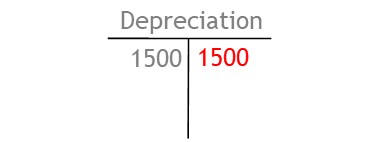

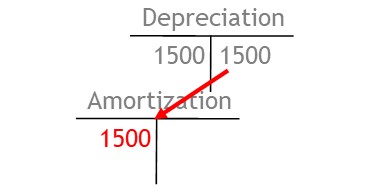

Here, you need to take the value out of the depreciation account.

And you move it to the correct account.

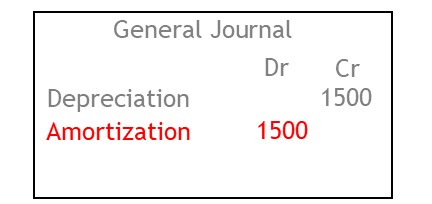

To do this, you use the general journal.

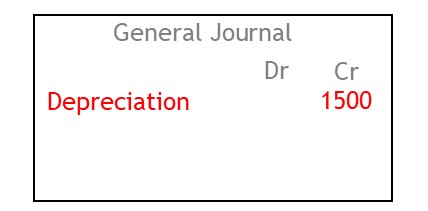

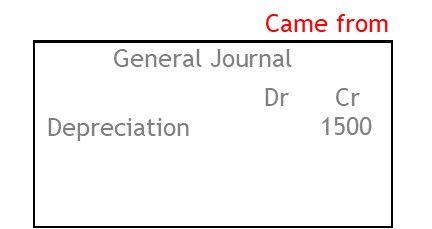

You credit the depreciation account.

This shows you have taken value from the depreciation account.

After this, you debit the amortization account.

This shows you moved the expense value to the amortization account.

© R.J. Hickman 2020