Call Premium

What is a Call Premium?

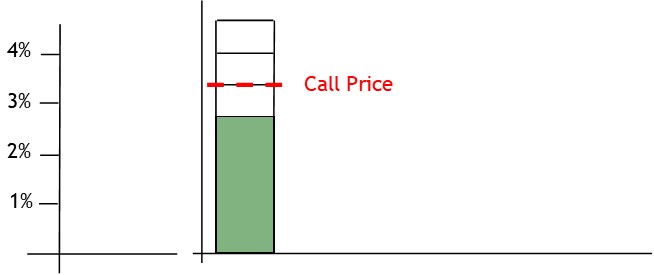

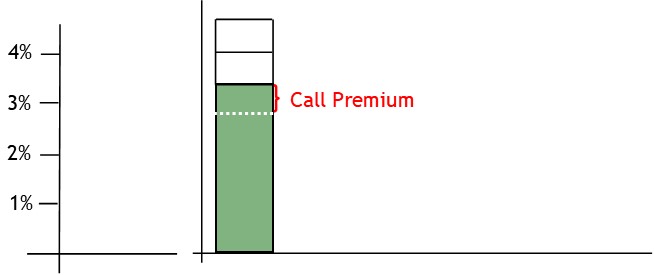

Call premium is the difference between a bond’s par value and call price.

How it Works

When a corporation issues a bond, it issues the bond around current interest rates.

This means it will pay the current rate of interest each year—over the bond term.

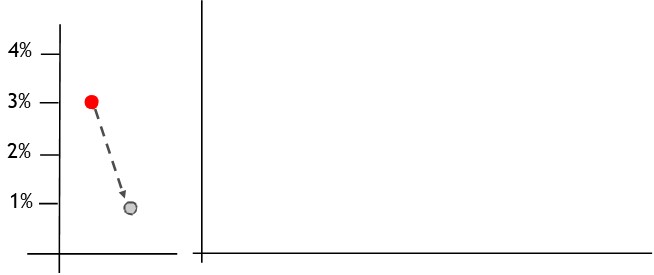

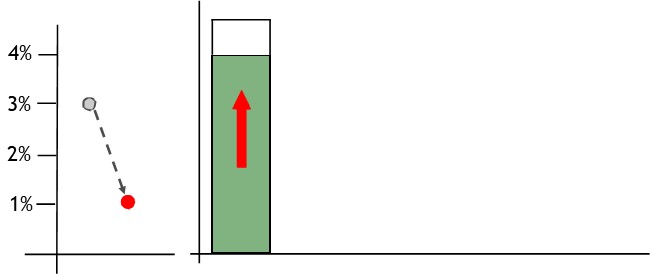

However, when issuing the bond, the corporation may be concerned there is a chance interest rates will fall in the next year or so.

Should this happen, the corporation will be locked into paying a higher rate of interest than prevailing interest rates.

To guard against such an event, the corporation may issue their bond with an embedded call price option.

If interest rates do fall, the bond’s price will rise.

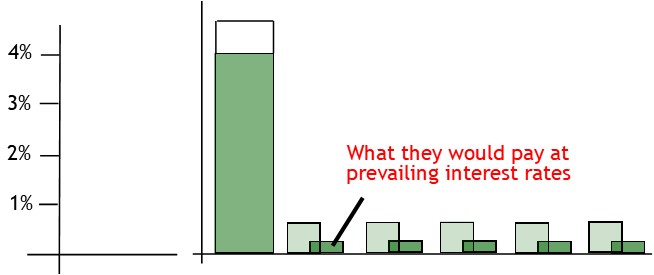

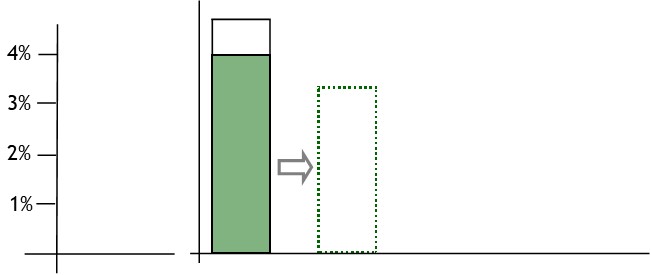

In this event, the corporation can exercise the call option.

This is like buying the bond back at the strike price.

After this, they can re-issue the bond.

Now, though, they pay a lower interest rate.

Call Premium

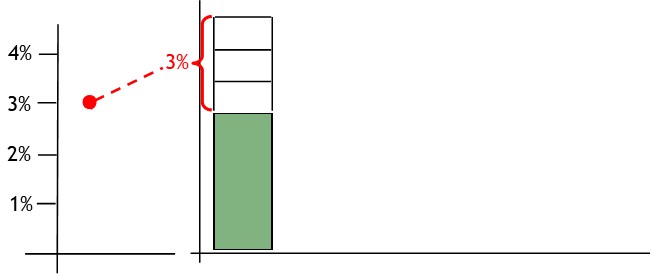

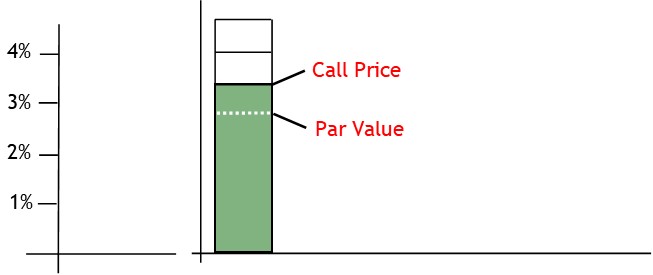

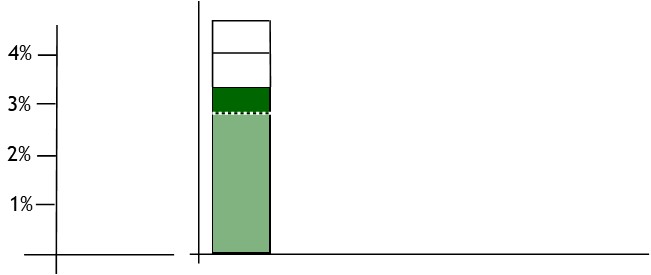

The call premium is the difference between par value and the call price.

It is how much over and above par value the issuer must pay to redeem the bond in the event they call it.

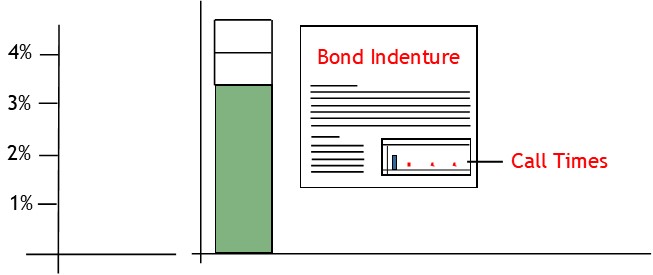

How and when the bond may be called is set out in the indenture, which is a legal contract between the borrower and the lender.

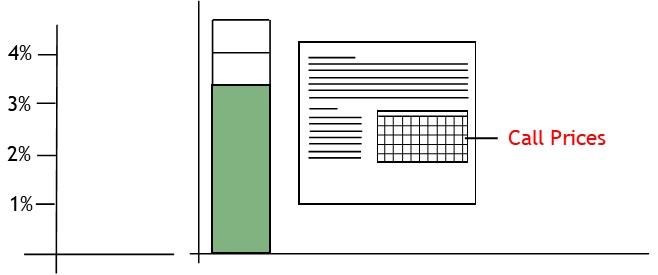

The indenture will also stipulate how much the issuer must pay the investor, should they wish to redeem the bond before maturity.

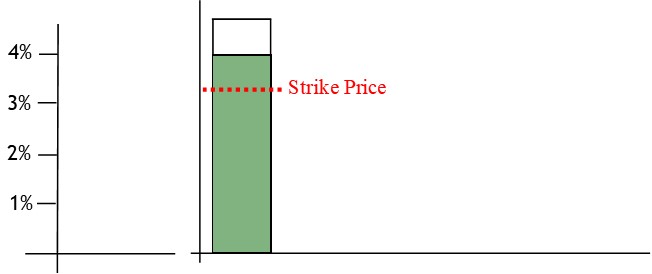

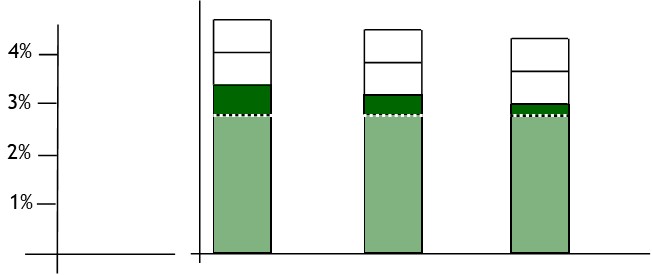

Typically, the call price starts off at par plus a year’s interest.

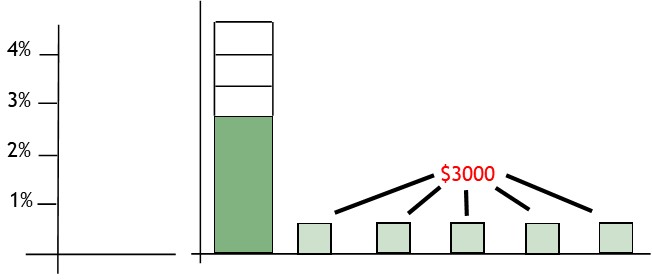

Then the premium gradually decreases as the bond approaches maturity.

© R.J. Hickman 2020